Trading Week Ahead: Crucial Week for the Fed and USD

The upcoming week will be critical for the markets, with the focus squarely on the US macroeconomic landscape. Traders will closely watch a trio of key events that could shift expectations around the timing and pace of the Federal Reserve’s next policy moves. Here's what you need to know:

• FOMC Meeting Minutes

The minutes from the latest Fed meeting will offer deeper insight into the central bank's internal discussions. Following mixed inflation and consumer data, markets are eager to detect any dovish shift in tone. If the Fed shows more openness to easing later this year, it could weaken the US dollar and support both equities and Treasuries.

• US GDP

The second estimate of Q1 GDP growth typically brings only minor revisions to the advance print, but even small surprises can move markets. A downward revision would strengthen the case for rate cuts, weighing on the dollar and yields. On the other hand, a stronger reading could boost confidence in US resilience, supporting the USD and potentially pressuring equities.

• US Core PCE Price Index

The Fed’s preferred inflation gauge, the core PCE, is the marquee event of the week. With markets hypersensitive to inflation trends, any upside surprise would likely push rate cut expectations further out, boosting the dollar and Treasury yields. A softer reading would be a clear risk-on trigger for equities and risk assets.

*All times in the table are in GMT+2

Technical Analysis with FVG Strategy

This trading method combines the EMA 20 and EMA 50 to assess market trends, along with the Fair Value Gap (FVG) to detect areas where price moved too quickly, leaving behind imbalances. These gaps often signal high-probability entry and exit points. The approach is applied to pairs like EURUSD, GBPJPY, US30, and XAUUSD, offering a review of recent price behaviour and highlighting ongoing trade opportunities.

Last Week’s Opportunities

EURUSD

Market Context: EURUSD regained bullish momentum after a strong bounce from the 50 EMA, now trading above both the 20 and 50 EMAs. The pair is approaching a key resistance level, which confirms the continuation of the upward trend.

Bullish Scenario (Preferred): A continued rally into resistance remains the primary outlook. A confirmed close above this level could trigger a liquidity sweep of the previous swing high.

Bearish Scenario (Alternative): A rejection at resistance could initiate a pullback targeting recent swing lows.

Setup: No FVG setup formed last week or this week. Market structure remains clean with a bullish bias.

XAUUSD

Market Context: After a bearish correction, gold has regained bullish traction, now approaching resistance and previous swing highs. Momentum suggests a continuation of the move higher.

Bullish Scenario (Preferred): The base case remains a push into resistance and a potential sweep of swing highs, where reactive selling may occur.

Bearish Scenario (Alternative): If price reacts to resistance and a valid short FVG setup confirms, a decline toward the next support zone becomes likely.

Setup: A bullish FVG setup formed last week, aligning with current market structure. No new setup has emerged this week.

GBPJPY

Market Context: Following a sweep of swing high liquidity, GBPJPY shifted into a bearish correction. Price is currently consolidating near the 20 and 50 EMAs.

Bearish Scenario (Preferred): Breakdown from this consolidation could lead to a continuation lower into the nearest support zone.

Bullish Scenario (Alternative): A break above resistance would mark a structural shift and reintroduce a longer-term bullish bias.

Setup: Two short FVG setups were identified last week. The first failed to trigger and the second reached its 1:2 RRR target.

Opportunities to Watch This Week

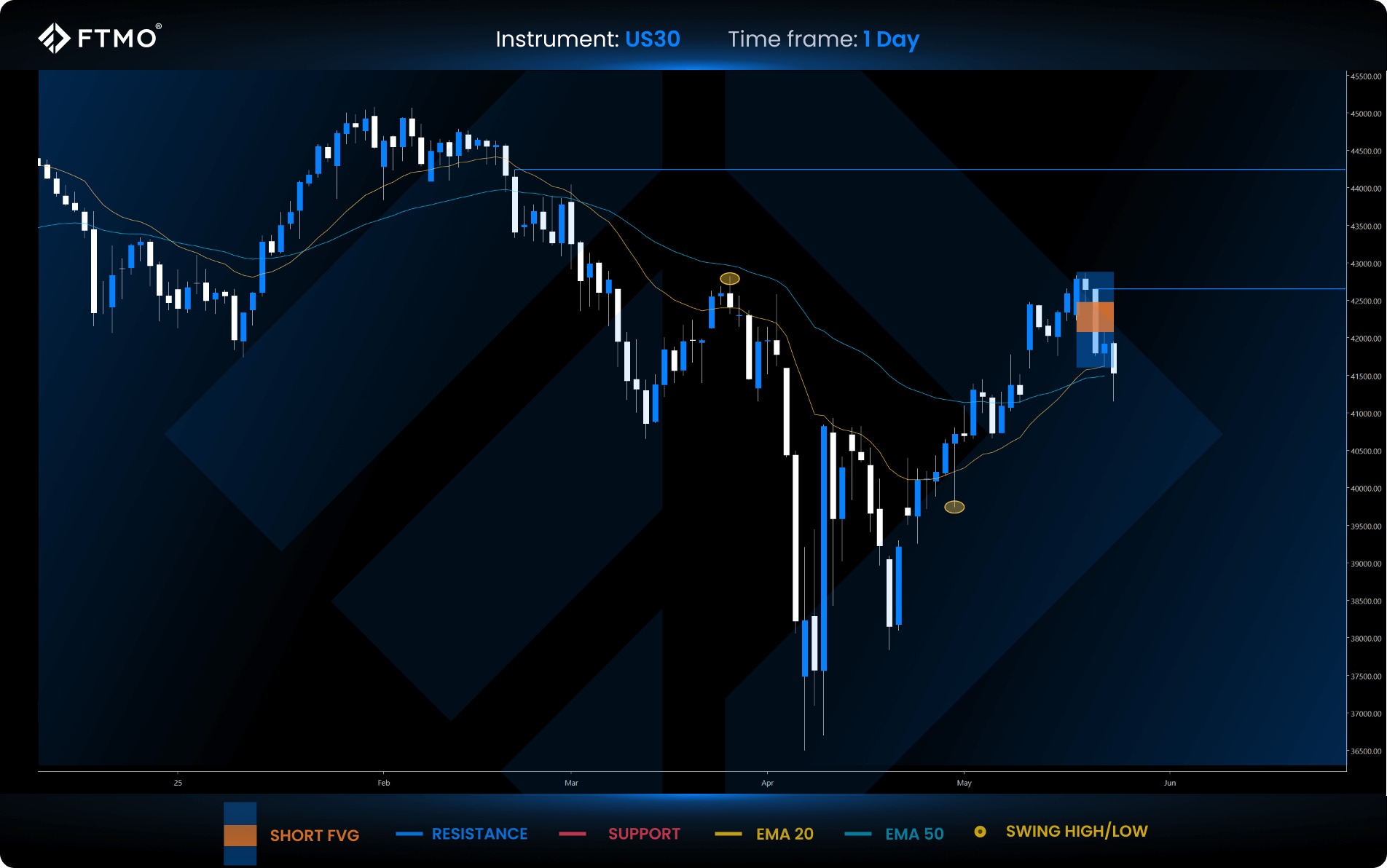

US30

Market Context: After a strong bullish run, the index is showing its first signs of exhaustion. The market has entered a corrective phase, during which a fresh short FVG setup has emerged, a potential early signal of a sentiment shift.

Bearish Scenario (Preferred): The active short setup opens up for a pullback with a potential target of a 1:2 RRR trade or a more aggressive sweep of swing low liquidity.

Bullish Scenario (Alternative): However, if price finds support at the EMAs and bulls regain control, a continuation of the long-term uptrend could follow.

Setup: A short FVG setup is currently active and tradable, aligning with the ongoing retracement. Watch key levels closely – momentum may shift rapidly

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations. FTMO companies do not act as a broker and do not accept any deposits. The offered technical solution for the FTMO platforms and data feed is powered by liquidity providers.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?