Trading Week Ahead: Can EURUSD Extend Its Bullish Run?

Big moves could be ahead as the Fed prepares to cut rates, US retail sales lose steam and the Bank of England faces pressure to shift tone. Traders should stay alert, as key decisions this week could shake the dollar, move yields and spark fresh volatility.

👉Looking to position ahead of the key moves? Here’s what you need to know.

• US Retail Sales

Retail sales are forecast to rise by 0.2% in August, down from a 0.5% increase in July, pointing to a potential loss of consumer momentum. While the expected figure aligns with a soft-landing scenario, any downside surprise could strengthen the case for future Fed rate cuts and weigh on the dollar. Conversely, a stronger print may dampen dovish expectations and lift yields.

• Fed Interest Rate Decision

The highlight of the week comes Wednesday with the Fed’s rate decision. Markets widely expect a 25 bps rate cut, though a surprise 50 bps move isn’t entirely off the table. A standard cut may trigger a “sell the news” reaction, as much of it is already priced in. However, if Chair Powell signals openness to further easing, the dollar could weaken while risk assets rally. Conversely, a hawkish tone suggesting a one-and-done cut may lift the USD and weigh on equities and bonds.

• BoE Interest Rate Decision

The Bank of England is expected to keep rates steady at 4.00% on Thursday, maintaining its cautious stance amid persistent inflation concerns. While no change is the consensus, traders will focus on any dovish shift in tone or vote split that could signal a cut later this year. Sterling could see sharp moves if policymakers hint at softening their policy stance, particularly amid recent weak UK data.

*All times in the table are in GMT+2

Technical Analysis with FVG Strategy

This strategy combines the use of the 20- and 50-period EMA to assess market direction alongside the Fair Value Gap (FVG) to pinpoint zones of price inefficiency. These gaps, which emerge during sharp market moves, often highlight strong potential areas for trade entries and exits. The method is suitable for instruments like EURUSD, GBPJPY, US30, and XAUUSD, offering insights into recent market behaviour and identifying possible trading setups.

Last Week’s Opportunities

EURUSD

Market Context: The euro maintains a bullish structure, trading above the 20 and 50 EMA and reacting positively to support. Liquidity above remains an attractive target together with Monday’s FVG long.

Bullish Scenario (Preferred): Continuation into the marked liquidity zone with the FVG target in play.

Bearish Scenario (Alternative): A daily close below the support zone would signal a shift to bearish structure with the next support visible on the chart.

FVG Setup: Monday’s bullish FVG remains active.

XAUUSD

Market Context: Gold is rotating near all-time highs, suggesting temporary consolidation without clear signs of trend reversal.

Bullish Scenario (Preferred): A continuation higher with potential for a new all-time high.

Bearish Scenario (Alternative): A daily close below support would confirm a trend shift with the potential to fill long gaps.

FVG Setup: Last Tuesday’s FVG setup remains in play.

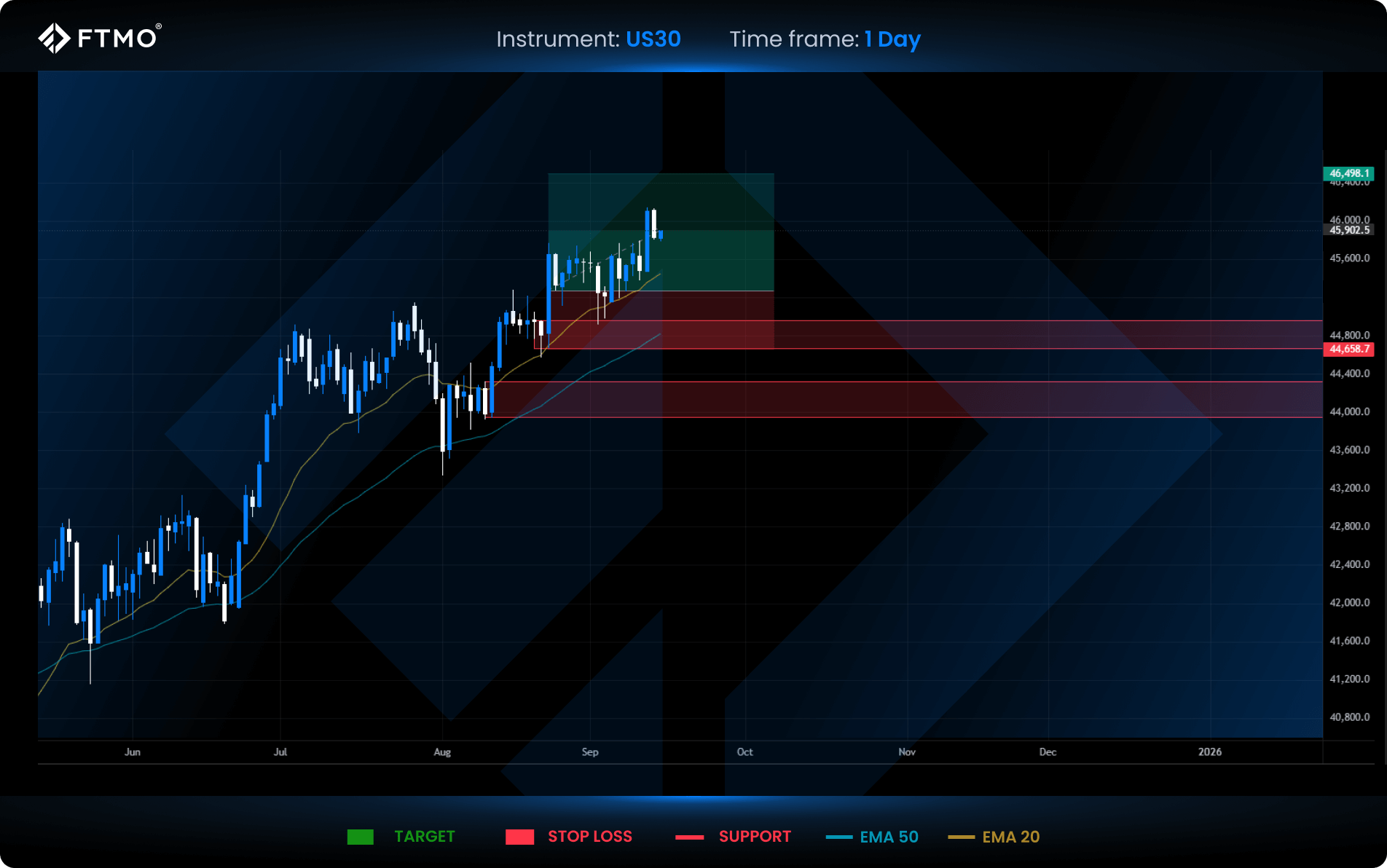

US30

Market Context: After consolidating in a range last week, price broke to a new all-time high on Thursday, followed by a bearish inside bar on Friday.

Bullish Scenario (Preferred): Long continuation remains favoured, with the FVG pointing to a 2:1 RRR target.

Bearish Scenario (Alternative): A return to support is possible if the Friday inside bar triggers follow-through selling.

FVG Setup: No valid FVG formed this week.

Weekly Market Outlook

GBPJPY

Market Context: GBPJPY holds a bullish bias but momentum has been muted, with price still above both EMAs.

Bullish Scenario (Preferred): A breakout of the range to the upside remains the main scenario.

Bearish Scenario (Alternative): A move below the range could target two swing lows and extend toward support where buyers may step in again.

FVG Setup: No valid FVG formed this week, highlighting the lack of aggressive moves.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis, or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?