Opening Range Breakout Strategy: How to Master the 15:30 US Session

Many traders hunt for the "holy grail" in complex indicators, yet the most profitable strategies are often built on a single factor: time. The Opening Range Breakout (ORB) strategy is designed to capture the day's first major impulse. For most traders, the "golden hour" begins exactly at 15:30 CET.

In this article, we’ll explore how to adapt this strategy for the US markets and what to watch out for to avoid falling into "fakeout" traps.

Why 15:30? The Power of the US Open

While the forex market operates 24 hours a day, equity indices such as the US500 or US100 experience a sharp surge in liquidity at 15:30 CET, which corresponds to 9:30 EST. This is when major institutional players on Wall Street begin their trading activity.

This brief yet highly volatile period, known as the Opening Range, often sets the tone for the rest of the US session.

How to Define the Opening Range (OR)

There is no single rule for how long the opening interval should be. However, three timeframes are most commonly used:

- 5-minute OR: Suitable for aggressive traders and scalpers.

- 15-minute OR: The balanced approach for day trading.

- 30-minute OR: A more conservative method that filters out excessive market noise.

Strategy Mechanics

- High: The upper boundary of the range, acting as resistance.

- Low: The lower boundary of the range, acting as support.

- Breakout: A valid breakout occurs only when a full candle closes above or below the range. A wick alone is not valid confirmation.

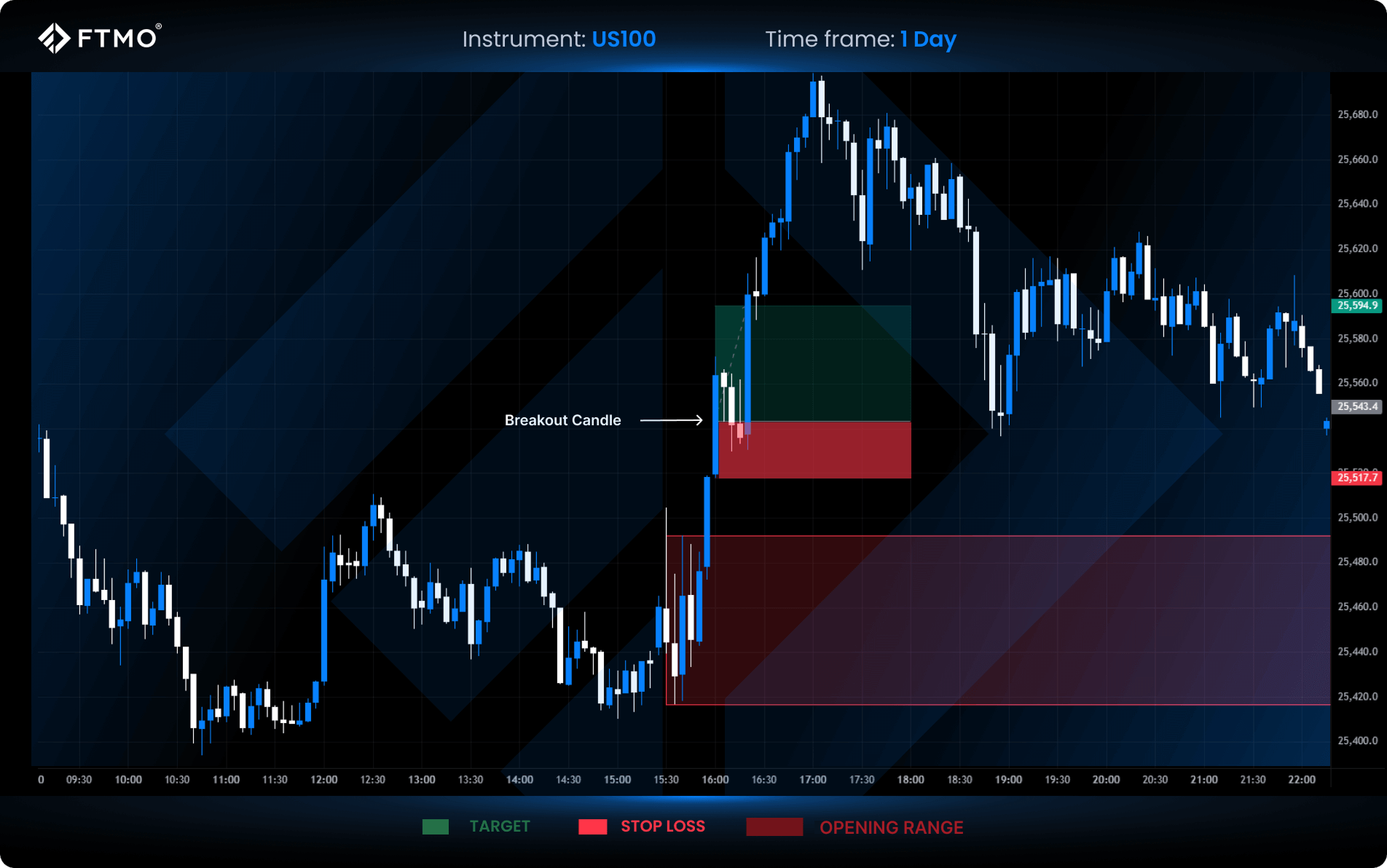

Practical Trade Setup on the US100

To illustrate the approach, let’s look at a practical example on the US100 (Nasdaq). Rather than trading a blind breakout, this method incorporates Fair Value Gap (FVG) confirmation to increase the probability.

1. Define the Range (15:30–15:45 CET)

During the first 15 minutes after the Wall Street opens, allow price to develop naturally. Your only task is to mark the high and low of the first 15-minute candle. These two levels define the Opening Range.

2. Monitor the Breakout on the 5-Minute Chart

Once the range is established, switch to the 5-minute timeframe. Wait for a 5-minute candle to close decisively above or below the range.

3. Entry via Fair Value Gap (FVG)

It is generally advisable not to enter immediately after the breakout, as the market is often temporarily overheated. Instead, identify the most recent Fair Value Gap created by the impulsive move that triggered the breakout.

- Entry: Place a limit order at the nearest edge of the FVG.

- Stop Loss: Position it safely above or below the middle candle that formed the FVG.

- Take Profit: Apply a fixed Reward-to-Risk Ratio of 2:1.

Advanced Filters: How to Avoid False Breakouts

False breakouts are the main weakness of the ORB strategy. To improve your win rate and reduce low-quality signals, consider adding confirmation factors:

- Volume: A valid breakout should be supported by rising volume. If price moves higher while volume declines, it may indicate a bull trap.

- Previous Day Levels: Is the breakout occurring above the previous day’s high? If so, trend strength is typically greater.

- VWAP (Volume Weighted Average Price): If price is trading above VWAP and simultaneously breaks the range to the upside, the long setup carries higher probability.

- Excessively Wide Opening Range: If the first 15 minutes are extremely volatile and the range is unusually large, it may signal a choppy, non-trending session. In such cases, skipping the trade can be the more disciplined decision.

Conclusion

The Opening Range Breakout during the US session remains one of the most robust approaches for intraday traders. It does not require monitoring charts all day. Often, 30 to 60 minutes of focused attention is sufficient.

The key to consistency lies in discipline. Do not chase every move. Wait for a confirmed breakout supported by Fair Value Gap structure and proper risk management.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?