Mastering One Market: Win rate 61% on Gold Delivered a $30,007 Profit

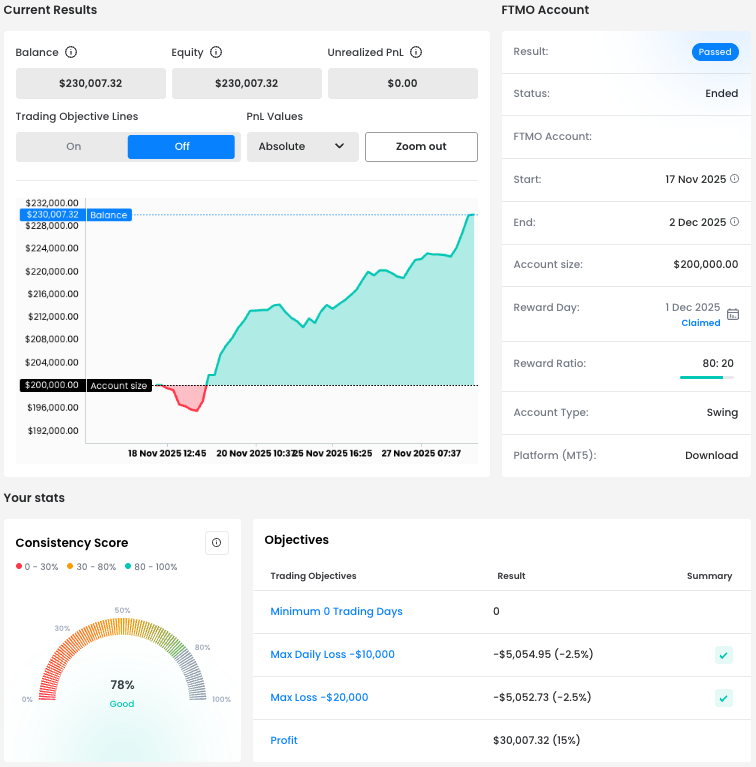

In this edition of Successful Trader Stories, we spotlight a swing trader who turned a rough first day into a remarkably stable run. Trading exclusively XAUUSD, he finished 9 of 10 trading days in profit and closed the period with a clean +15% gain on his $200,000 FTMO Account. A clear example of what focused, controlled trading can achieve.

From Early Red to Steady Green

The Balance curve shows a trader who needed a little time to find his rhythm. The first days dipped below the initial $200,000 level, but the drawdown stayed well within the FTMO Trading Objectives.

Max Daily Loss and Max Loss were both kept under control, with the worst day limited to around -2.5 % of the account. Once he found his groove, the equity line turned into a steady climb that ended close to the highs at $230,007.32. The Consistency Score of 78 % confirms that this was not luck, but a repeatable process.

The PnL Calendar makes this even clearer. Out of 10 trading days, 9 finished in profit, including strong sessions on 18, 19, 21, 25 and 28 November. That hit rate on days, not just on individual trades, shows a very good feel for when to step in and when to step back.

Numbers That Confirm The Edge

The Win Rate of 61.11 % means that roughly 6 out of 10 trades closed in profit. On its own, that is already solid. Combined with his reward-to-risk profile, it becomes a clear edge. His average profit per trade was $1,288.88, while the average loss was limited to -$596.46. In other words, winners were more than twice as large as losers.

In total he executed 54 trades and almost 49 lots. The position sizing stayed reasonable for a 200K swing FTMO Account, which helped keep emotions in check and allowed his statistics to play out.

Specialist In One Market

The most striking detail in his trading journal is the focus. The Symbol chart shows that he traded only XAUUSD. No indices, no FX pairs, no crypto, just gold. That kind of specialisation often helps traders read one market much better than many.

The Buy & Sell breakdown leans to the long side, which matches the dominant moves on gold in his trading window. Even so, he kept losses on losing longs under control and allowed the best trades to stretch, which is exactly what a swing approach on a volatile instrument like XAUUSD requires.

The Open time hour chart highlights when he found most of his opportunities. Profits cluster mainly during the European afternoon and into the US session, from around 14:00 to 18:00 platform time, when gold usually sees strong volume and impulsive moves.

Case Study: Letting A Gold Long Breathe

A good example of his style is the long on XAUUSD from 18 November. He opened a 1.5 lot buy after price had formed a clear intraday low, then held the position for just under two hours (01:56:21). The trade closed with a profit of $3,631.98, worth 24.3 pips.

The structure of this trade shows an interesting and well-controlled approach. As the price moved higher and formed a series of higher lows, he gradually adjusted the Stop Loss upward – locking in more of the open profit while still giving the trend room to breathe.

The position was eventually closed by the Stop Loss, but at a positive level. By that point, the move had already played out, and the trailing Stop Loss effectively acted as a dynamic Take Profit based on price action rather than a fixed target.

This is a textbook example of using a dynamic Stop Loss not only for protection but also as a way to follow positive signals. Once the market stopped making new highs and momentum started to fade, the adjusted Stop Loss was triggered and secured the gain automatically, without the need to overthink the exit.

What This Two Week Stretch Teaches

This two week performance shows how powerful a simple, focused playbook can be. By concentrating exclusively on XAUUSD, trading in his best hours, keeping losses around half the size of his winners and letting the statistics work over time, this trader turned a 200K swing FTMO Account into $230,007.32.

Once again, this Successful Trader Story underlines that long term results are built on process: clear rules, consistent execution and respect for risk.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?