How to Apply Seasonality to Your Trading Strategy

Many traders know that markets behave differently throughout the year, but few know how to use that information in practice. Seasonality is not a trading strategy on its own, but it can improve timing, decision-making, and discipline when used correctly.

In this article, we look at how to apply seasonality as a practical part of a trading strategy.

What Seasonality Really Means in Trading

In trading, seasonality refers to recurring price tendencies that tend to appear at similar times each year. These tendencies are based on historical data and long-term market behaviour rather than short-term price action.

Seasonal patterns often emerge due to factors such as:

- Economic and fiscal cycles

- Institutional portfolio rebalancing

- Corporate reporting periods

- Supply and demand cycles in commodities

Importantly, seasonality does not provide exact entry signals. It operates on a broader time horizon and is most relevant for swing and position traders, where timing and context play a critical role.

Combining Seasonality with Technical Analysis

One of the most practical applications of seasonality is defining market bias. Instead of asking whether a trade setup exists, traders can first ask:

- Is this market historically strong, weak, or neutral during this period?

- Does my directional bias align with long-term tendencies?

During historically stronger seasonal periods, traders may prioritise trend-following setups. During weaker or less consistent periods, they may become more selective or reduce risk per trade. After successfully answering this question, traders can move on to technical analysis.

A practical workflow for merging technical analysis and seasonality might look like this:

1. Define the Seasonal Bias

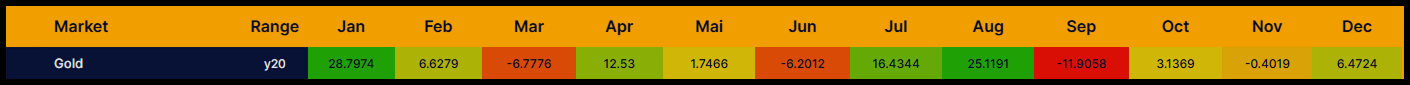

Ask yourself: Is this asset historically strong or weak this month? If you’re looking at gold (XAUUSD) in January, history tells you there’s a strong bullish tailwind. If you’re looking to short it, you need to be twice as careful with your confirmations.

2. The Execution Funnel

Don't just buy because it's January. Use this top-down approach:

1. Context: Check the seasonal average (e.g., gold tends to be strong in January).

Source: Market Bulls

2. Structure: Is the H4 or daily chart showing a bullish trend in alignment with that bias?

3. Entry: Execute based on your tested technical setup (order blocks, FVG, or breakouts).

Tip: If your technical signal aligns with the seasonal bias, you have "confluence". If they conflict, consider lowering your risk or skipping the trade entirely.

Adjusting Risk and Positioning Based on Seasonality

Seasonality serves as a primary guide for adjusting your trade management. It’s not just about where you enter, but how you manage the position once you’re in:

- High Confluence (Seasonality + Techs Align): You can aim for a standard Profit Target and be more patient with the trade.

- Low Confluence (Counter-seasonal): This is where you tighten your Stop Loss. If you are shorting the S&P 500 during a historically bullish window, you should be looking for quick scalps, not "moon bag" targets.

The Long-Term Edge

Seasonality is about trading smarter, not harder. It helps you filter out low-probability setups and gives you the confidence to hold winners when the historical data is on your side.

The key to long-term success at FTMO lies in your ability to align your strategy with high-probability environments. Seasonality allows you to move beyond basic chart patterns and transform your trading into a systematic process driven by data and professional foresight.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?