When will bitcoin be at $200,000?

It is an unwritten rule that as soon as an investment asset crosses an important psychological level, investors in the markets start speculating about when the next level will be hit. Such speculation cannot always be taken entirely seriously, but on the other hand it is not unreasonable to follow it.

Predictions by the son of US President-elect Donald Trump that he loves bitcoin and that its price will rise to $1 million thanks to the election of the most 'pro-crypto' president in US history, or that the US will become the world capital of the cryptocurrency market as a result, cannot, of course, be taken seriously. This is despite the fact that the election of Donald Trump as president was one of the strongest drivers in the price rise to $100,000 and above.

Cautious investors might take news like this more as a warning that the price may fall in the near future, which is common in the investment world. Whenever a self-proclaimed expert on an asset comes along and starts talking about a rise in its price, you need to be vigilant.

Bitcoin at 100K. What next?

Anyway, the price of bitcoin surpassed the $100,000 level in early December 2024, which for quite a long time was considered such a holy grail and a difficult milestone for many pessimists to reach. Of course, there were plenty of optimists who did not doubt that the 100,000 mark would be crossed, and there were plenty who tried to prove it by various more or less sophisticated methods.

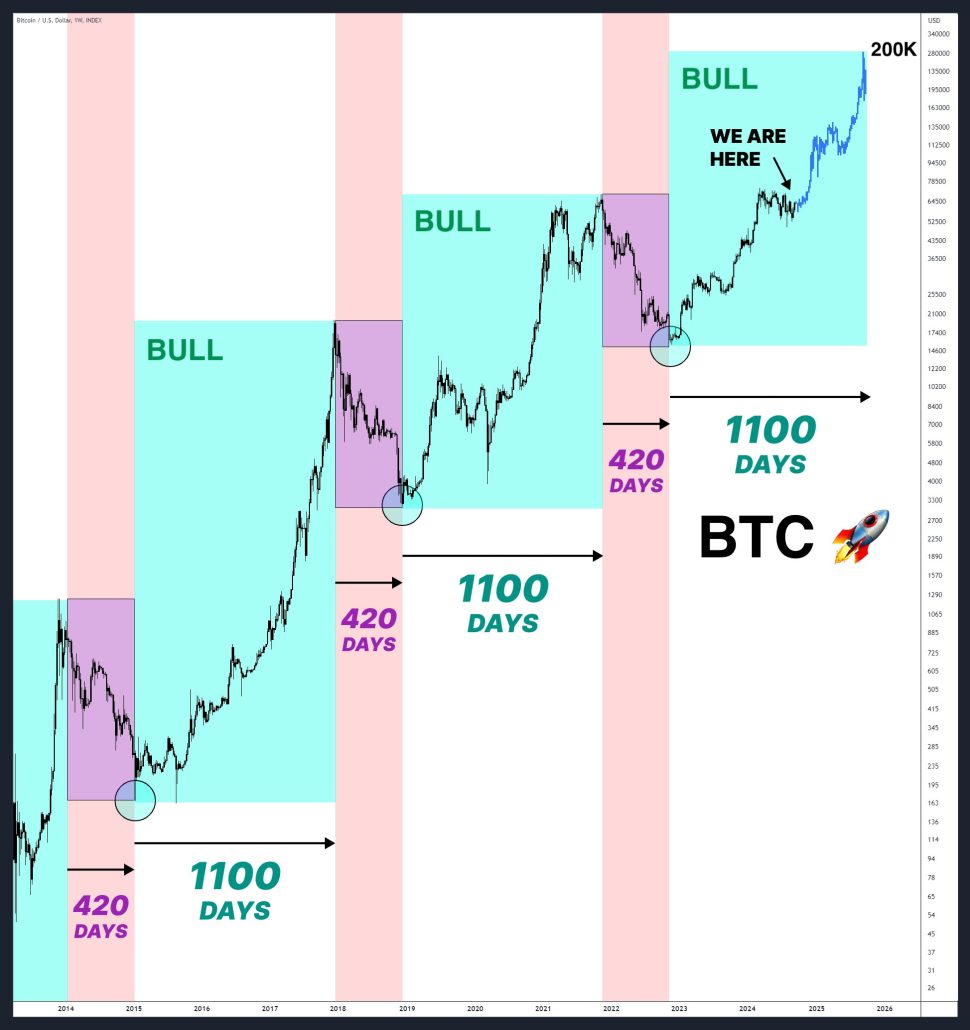

For example, a chart from user OxNobler looks interesting, who is even convinced that $200,000 per bitcoin is a realistic target, which he predicts the price should reach sometime in late 2025 (and he is far from being alone). Since he came up with this chart back in late October 2024, when the price was below $70,000, we can congratulate him in the meantime.

Source: Twitter

The problem with this chart, however, is that the user has modified it in a rather strange way. It's not so much that he used a logarithmic scale, but the scale of the graph is very strange. If we look at the second chart that Investopedia used, the dips in particular look much more ominous than the first chart.

Source: Investopedia, TradingView

It will be interesting to see what happens if bitcoin actually hits that $200,000 in a year. In the past, bitcoin has already experienced a few dips, which by the way is nicely visible on the chart, so we can look forward to that. In the meantime, we can speculate what will happen at a price around $100,000.

Bitcoin still remains a fairly volatile asset, so after hitting a record price of over $103,600 the very next day it dropped to a price of around $92,000. However, this drop has so far shown typical signs of profit-taking and the price is back above $100,000 after a few days, with some of the largest institutional investors such as BlackRock (which owns around $50 billion worth of bitcoins) and MARA Holdings, one of the largest bitcoin miners, taking advantage of the drop to buy.

Why will the price of bitcoin rise?

Once more we mention Donald Trump, who has helped bitcoin for the second time by wanting to name Paul Atkins, CEO of Patomak Global Partners, who is considered to be a fan of cryptocurrencies, as the next head of the US Securities and Exchange Commission (SEC). In addition, Trump is proposing that bitcoin becomes part of the US strategic reserves and Senator Cynthia Lummins even envisions buying 200,000 bitcoins a year for the next five years.

This shows a trend that is unlikely to be the preserve of the US alone, that cryptocurrencies, and bitcoin in particular, will be increasingly and significantly integrated into traditional financial systems. Reducing regulation, which has been one of the main constraints on bitcoin's widespread adoption, would only help bitcoin slowly shed its label as a speculative asset.

The first such step was the introduction this year of bitcoin spot ETFs, which are now booming (this week they saw a cumulative net gain of 500,000 bitcoins), with more to follow. Bitcoin is becoming a financial asset that is increasingly being used for investment by large institutional investors, hedge funds, banks and even pension funds. And the more such investors invest in bitcoin, the more stable its price growth can be.

Growth is not guaranteed

Bitcoin may have been created years ago as an alternative currency, but with the current price rise, hardly anyone can actively use it for regular payments except true enthusiasts. On the face of it, it doesn't make sense to buy something with a currency that could be worth ten percent more in a few days. For people who have not yet found common ground with Bitcoin, it is at best a high-risk asset with no fundamentals, whose growth is driven by strong "hype" in short periods when almost everyone wants to own it.

These periods are then followed by periods of declines and consolidations, followed by periods of stagnation, which can last for quite a long time, as can be seen in the second figure. Those who jumped into bitcoin when it was worth, say, $40,000 can congratulate themselves today, but those who bought at around $100,000 should be cautious in their expectations. Despite all the positive hype, there are factors that could slow or even reverse the price rise, although that may seem like an impossible scenario in December 2024.

For example, although the head of the Fed has recently been talking about bitcoin as a competitor to gold, unlike this traditional store of value, bitcoin may be hurt by the current political instability and escalation of the already tense situation in Ukraine or the Middle East.

In uncertain times, investors are turning away from risky assets, which bitcoin still remains, and turning to safe havens, which still include, for example, gold. Such a risk-off environment could limit bitcoin's price growth or even mean a sell-off.

Interestingly, some investors also see the slower rollout of pro-crypto measures by the new US president as a risk. Thus, today's enthusiasm could easily turn into disappointment, which could again lead to a correction in the bitcoin price.

There have also been reports in the bitcoin community in recent days that quantum computers could be a threat to bitcoin. In fact, Google has announced the launch of a new quantum computer chip, Willow, which is capable of performing calculations in minutes that can take years for today's supercomputers. The encryption capabilities of computers based on such chips could be a threat to the security of cryptocurrencies. But some experts consider these concerns premature, because even the very high speed of the Willow processor is still not enough for the encryption used by bitcoin. So it's more like music of the distant future. Trade safely!

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?