Strict risk management can be the path to success

In the next part of the series on successful FTMO Traders, we will have a look at a trader who followed strict risk management and money management rules during his trading period, thanks to which he had no problem achieving consistent results.

A proper approach to trading, where the trader risks the same amount on every trade under any circumstances, shows that he understands the importance of risk management. When a trader is experienced enough and has sufficiently tested this method of opening positions on his strategy, it greatly increases the likelihood that he will be consistently profitable over the long term.

We value this approach in our traders, and the setting of our Trading Objectives should guide them in the right direction. Today's trader is an example of how this approach can actually work.

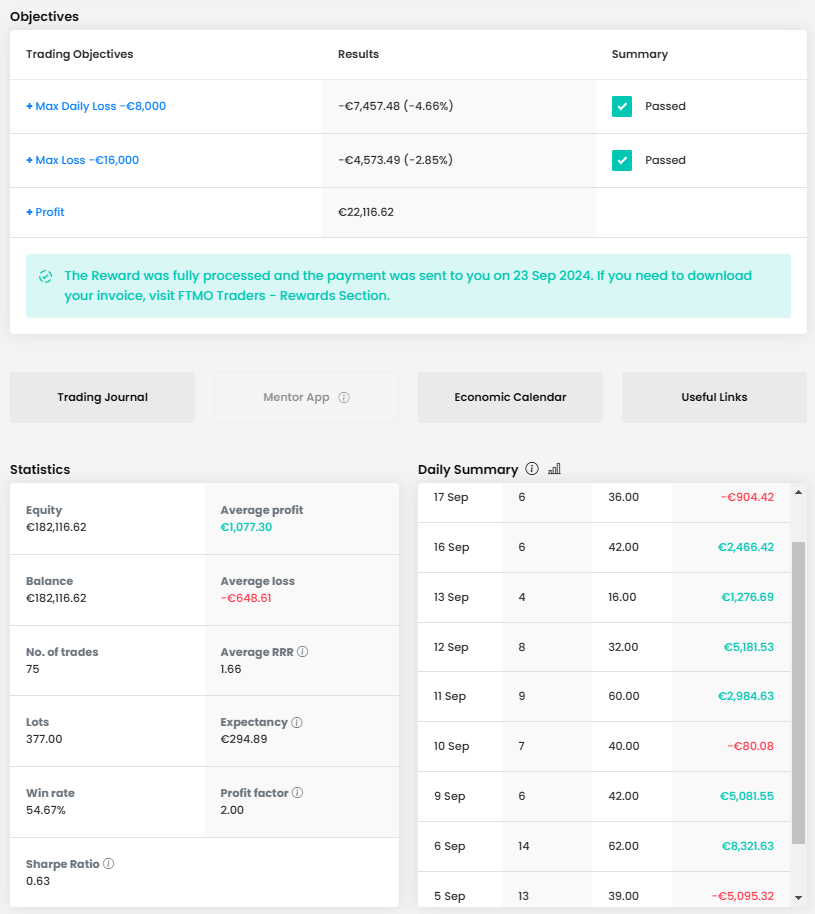

Thanks to his consistent approach, the trader managed to achieve a very interesting return, even though it is clear from the balance curve that it was not as easy as it might look from the final result. The trader had quite a challenging start, as he went into the negative on the second trading day, thanks to a series of losing trades, with a loss of over €4,500. Fortunately, however, he was able to recover from this streak and limit the risk of higher losses by reducing his position size, which may have provided some psychological relief.

After he managed to get back into profit, his curve was already on an upward trend most of the time and eventually the trader ended up with a profit of over €22,000, which is a great result for an account size of €160,000. This was also due to his consistent approach and strict approach to risk management and money management, where he opened equally sized positions depending on the instrument.

Considering that the trader started the second day in the black and ended it with the mentioned loss, he came quite close to exceeding the Maximum Daily Loss limit, but in the end he made it through just fine. He had no problem with the Maximum Loss limit at all.

The trader opened a total of 75 positions with a total size of 377 lots, which is an average of around 5 lots per position. However, he actually opened positions of 10 lots on currency pairs and 4 lots on other instruments, which is still okay. Similarly, an average RRR of 1.66 is fine, which combined with a win rate of over 50% (54.67%) should lead to long-term profitability.

In the trader's trading journal we see that he is a typical intraday trader who does not keep positions open overnight but closes them the same day. In most cases, he keeps trades open for several hours, but if necessary, he will close a trade after a few minutes. The trader does not open multiple positions at the same time on one instrument, but often opens a new position immediately after closing the original one, which can be a sign of impatience and we do not like to see that.

On the other hand, we appreciate that the trader has set both Stop Loss and Take Profit on open positions. This is practically a necessity in fast markets such as Bitcoin, because without Stop Loss there is a risk of relatively high and unnecessary losses. Moreover, the trader very often proceeded to move the SL when his trade was in profit, thus locking in profits.

The trader's trade opening times varied quite a bit, but clearly the most successful time of the day for him was between 17:00 and 20:00 (MT4 platform time). Perhaps the trader would have benefited from focusing more on this time and, for example, eliminating trading during the midday period.

The most popular trader's instrument was gold (XAUUSD), which has long been one of the most popular instruments among FTMO Traders. The trader then split the rest of the positions between three currency pairs and the largest cryptocurrency Bitcoin (BTCUSD).

In the first picture we see just a case where the trader opened the first trade after the price bounced off the support, but due to the shifted SL it blew him out on a much smaller profit he expected from the trade. So after a few minutes he opened a second position, which has already ended better, although here again it looks a bit too early to exit the trade. The total return on both trades was €3,382, which is not bad.

In the second picture we see a similar situation. This is a slightly riskier trade, where the entry was again made after a bounce from a local support and the trader fired on the SL. However, he opened another position immediately afterwards, which he closed probably manually with a much higher profit. Here, the exit ultimately appears to be quite well timed and the total profit on both trades is 4,291 euros, which is not bad either.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?