Consistency is very important for success in trading

The path of a trader is not an easy one, it is usually a bumpy ride with more or less successes and failures on the way. Sometimes everything goes smoothly and one successful trade is followed by another, while other times it is just pain and suffering from watching a series of losing trades and the account being blown up.

Every strategy has periods when it works almost flawlessly and generates profits, as well as periods when the trader has to deal with a series of losses. In general, however, it can be argued that when profitable trades outweigh losing trades (either in number or volume), the strategy is profitable in the long run.

Quick profits provide no guarantee of success

The profitability of a strategy is therefore not only determined by the size of the profit it generates, but also by its performance during good and bad times. In other words, consistency of results is an important aspect for any strategy. This can be defined in different ways. One can check the last 100 trades, or assess the results for each quarter and from there determine whether the strategy is profitable or not over the long term.

Having consistency is very important, as we can see in the examples of the following two strategies.

Strategy A:

- A trader executes 1 trade a day using the same position size for 5 consecutive days.

- Account size: 100 000 USD

- 5 trades

- Profit 50 000 USD (50%)

- Drawdown 50 000 USD (50%)

Strategy B:

- A trader executes 1 trade a day using the same position size for 100 consecutive days.

- 100 trades

- Profit 30 000 USD (30%)

- Drawdown 10 000 USD (10%)

Although Strategy A makes much larger profits per trade, Strategy B performs better over a longer period of time with a lower drawdown, making the strategy less risky and more consistent.

Every trader should realise as soon as possible that the pursuit of quick profits increases the risk of a strategy and is not the path to long-term sustainable trading. In Strategy A, it can be clearly seen that it experienced a drawdown of 50% in just one week, which may sooner or later lead to an account reset.

New Consistency Score in Account MetriX

FTMO has launched a new metric within the Account MetriX app called the “Consistency Score”, to enable traders to track their consistency. This indicator measures the trading consistency of each trader, with a higher value indicating a higher consistency of trades, which could help our traders to achieve better results, which should be the goal for anyone who wants to stay in the trading business for a longer period of time.

The formula for calculation of the Consistency Score is simple: (1 – (absolute value of the most profitable or losing day / absolute result of all trading days)) x 100%.

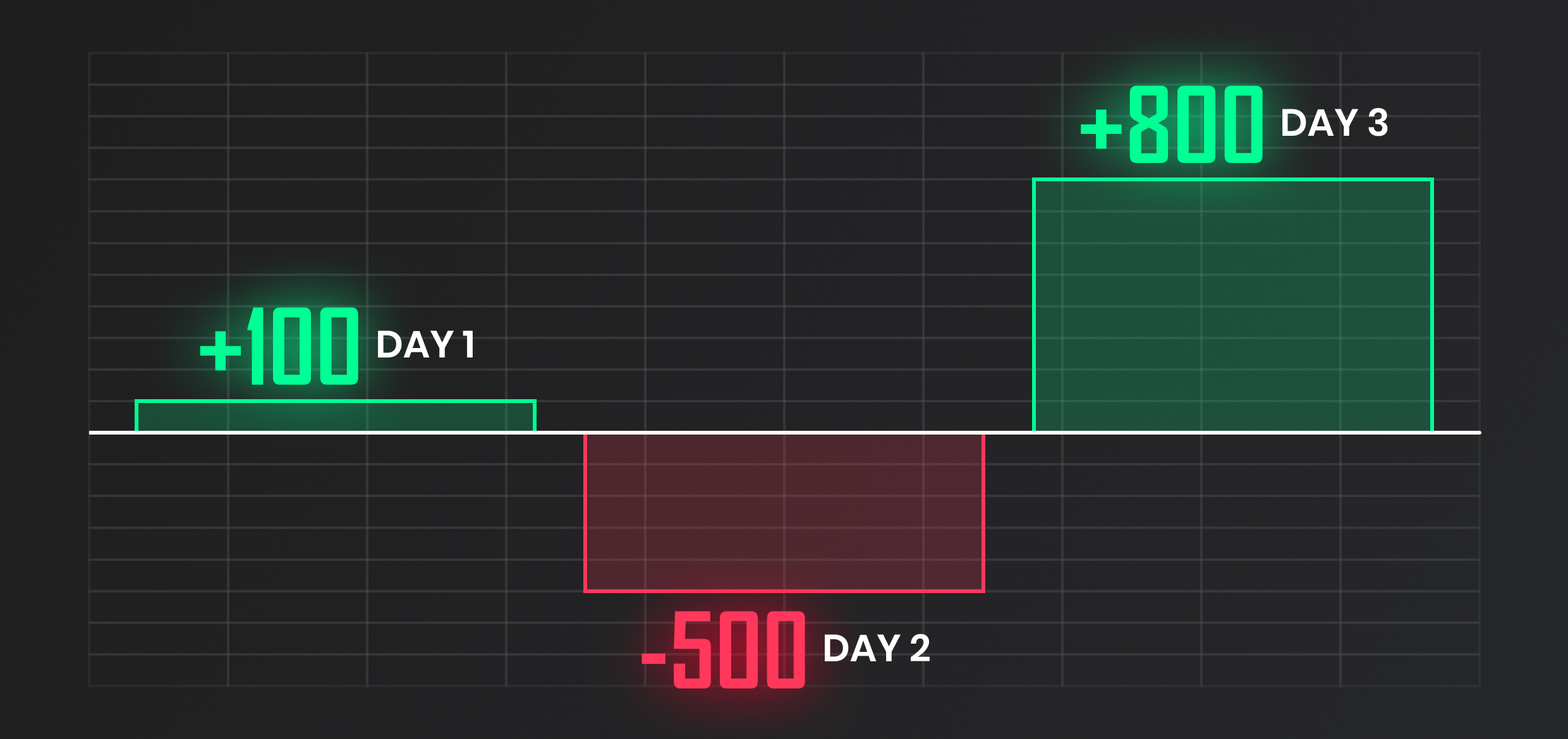

Example:

Trader's results:

- Day 1: +100

- Day 2: -500

- Day 3: +800

The biggest daily profit was 800.

The absolute sum of all trading days is 100 + 500 + 800 = 1400.

Consistency Score =(1-(800/1400))x100 = 43%.

How the Consistency Score works

If a trader’s Consistency Score is 0%, it means that all of his profit was made on a single day. Therefore, it is very difficult to evaluate the consistency and profitability of a strategy based on the results based on only one day of trading.

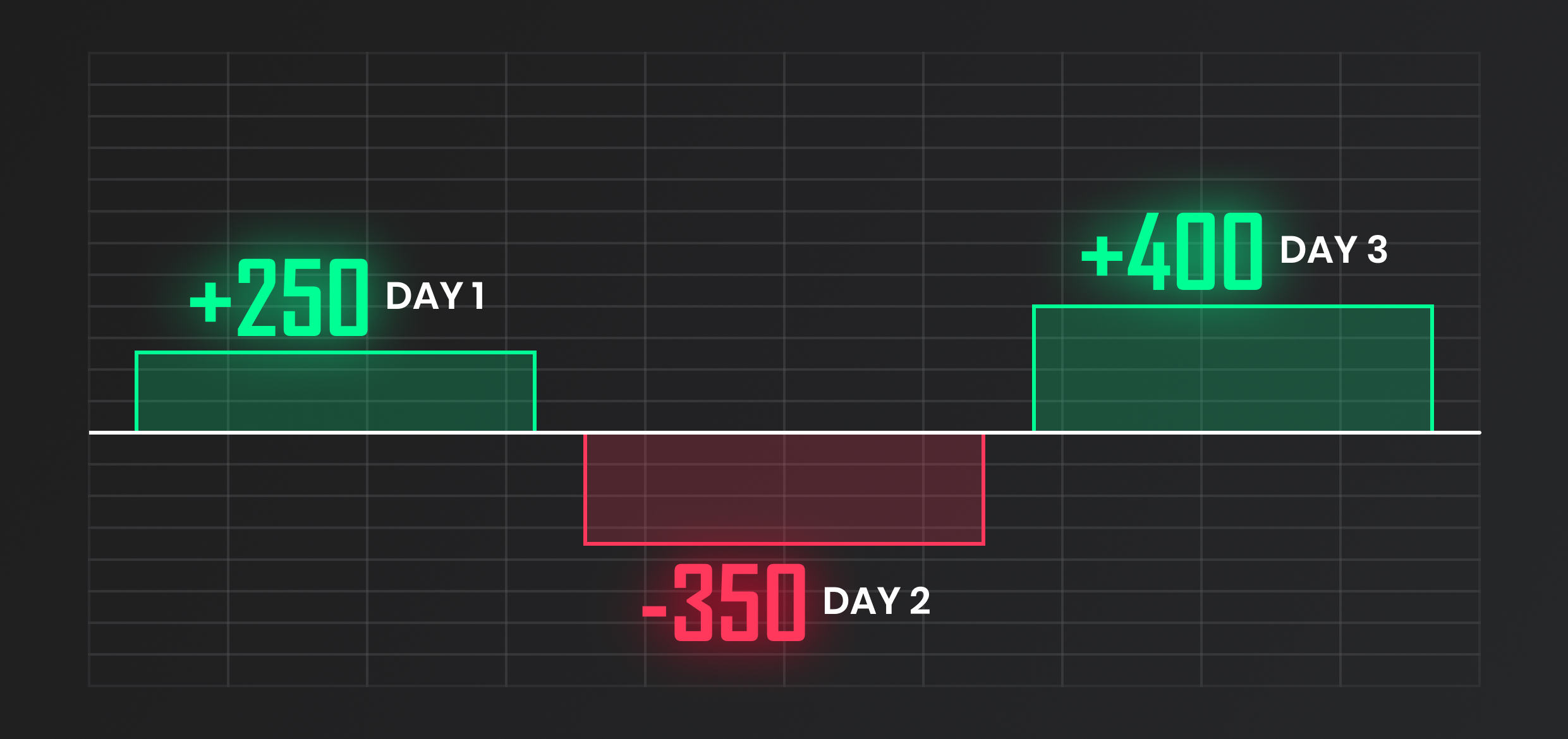

If the Consistency Score is 60%, it means that the trader’s most successful trading day accounts for 40% of his total profit.

Example:

Trader's results:

- Day 1: +250

- Day 2: -350

- Day 3: +400

The biggest daily gain was 400.

The absolute sum of all trading days is 250 + 350 + 400 = 1000.

Consistency score =(1-(400/1000))x100 = 60%.

According to the long-term analysis of our traders, we have arrived at the following distribution of results. A value above 80% is considered to be very good because this value indicates that the strategy is likely to be successful in the long term. FTMO values traders who can maintain a consistent approach in addition to profits. A great benefit for consistent traders is our Scaling plan as well as the adjustment of the profit sharing ratio to 90% in favour of the trader.

However, traders do not have to worry about their success or whether meeting the requirements to pass the Evaluation Process will depend on their Consistency Score. A successful completion of the Evaluation Process is based on completing the basic Trading Objectives of FTMO and the Consistency Score is for informational purposes only.

Some traders may feel that the Consistency Score may limit or discriminate against certain strategies, but this is certainly not its purpose. Striving for consistent results does not limit any trader from achieving above average returns. Yes, sometimes a trader may have an exceptionally successful trade in which he realises an above-average return, which may harm his Consistency Score. However, trading is not about one gain, and maintaining consistent results over a long period of time may not have a negative effect on the overall result.

When a trader trades successfully over a long period of time with an RRR of 2:1, for example, he may have an exceptional trade where he holds a profitable trade longer and reaches an RRR of 4:1. Since his strategy is set at an RRR of 2:1 (we assume he has tested it for a long time and knows what he is doing), this may be a lucky accident that may not be repeated and further attempts at such super trades may end in a series of unnecessary losses. It is not uncommon for unnecessary interventions in a working strategy in the pursuit of faster profits to lead to losses and, in the worst case, an account wipeout.

A consistent approach, on the other hand, can save a trader’s account if he experiences a prolonged period of losses. When a trader decides to “take revenge on the market” and starts opening unnecessarily large positions in pursuit of higher profits, he may face an account deletion, in the case of an FTMO Challenge or an FTMO Account.

This is best illustrated by an example. Below we can see the results of an FTMO Account with a Consistency Score of 80.61%, and after a period when the trader did not do well, he almost reached the Maximum Loss limit. If he had traded larger positions, or started opening these larger positions after a series of losses, he would have certainly violated this important condition.

But thanks to his consistent approach, he managed to get out of the drawdown and eventually made a great profit of $17,000. It is also clear from the above example that a trader does not have to have a completely smoothed yield curve with minimal fluctuations at all times to achieve a high Consistency Score.

Conclusion

FTMO is looking for serious traders who are able to manage risk responsibly and achieve consistent results over a long period of time. From our years of experience, we know that a consistent approach differentiates traders who follow a trading plan from those traders who only make profits through luck. We hope this new feature will help all traders to achieve their long-term goals.

Frequently asked questions and answers

- What is FTMO trying to achieve with the Consistency Score?

At FTMO, we appreciate traders who take trading seriously. Not only do we like to see profits, but we also like to see them made consistently over a period of time and based on a significant number of trades. The Consistency metric is only informative and does not affect the outcome of the trading account results.

- How is the Consistency Score calculated?

The Consistency Metric is calculated using the following formula:

(1 - (Highest Profit or Loss Day / Absolute Sum of all Trading Days)) x 100%.

- Does the Consistency Score affect the outcome of my FTMO Challenge / FTMO Account?

No, it does not. You only have to follow the Trading Objectives and avoid forbidden trading practices.

- Are you planning to implement a rule based on the Consistency Score in the future?

Currently, the Consistency Score is only informative.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.