Trading Week Ahead: FOMC and PCE in Focus

With US markets closed on Monday for a holiday, attention turns to a packed week of economic data and earnings. A cooler-than-expected inflation reading has revived hopes for a Fed rate cut as early as June, while AI-related concerns continue to weigh on tech. This week’s PCE inflation and GDP figures could provide a crucial update for policymakers and markets alike, alongside key corporate results from Walmart, Palo Alto Networks, and others.

👉 FOMC Meeting Minutes

On Wednesday evening, the minutes will offer a deeper look into the Fed’s January decision. Any signs of disagreement or concern around the inflation outlook could move yields and shift dollar sentiment.

👉 US GDP

Q4 growth is forecast to be revised down to 2.8% from the initial 4.4%. A downgrade may weigh on the soft-landing narrative and support risk assets. A stronger revision would likely boost the dollar.

👉 Core PCE Price Index

The Fed’s preferred inflation gauge is expected to rise 0.3%, up from 0.2% previously. A hotter print could challenge dovish expectations and lift the dollar. A soft number would support equities and cut pricing.

*All times in the table are in GMT+1

Technical Analysis with FVG Strategy

This technical analysis uses the EMA 20 and EMA 50 to determine market trends, alongside the Fair Value Gap (FVG), which refers to price imbalances caused by aggressive movements, signalling key entry and exit points. This strategy applies to EURUSD, GBPJPY, US30, and XAUUSD, providing insights into both last week’s market opportunities and the current one.

Opportunities to Watch This Week

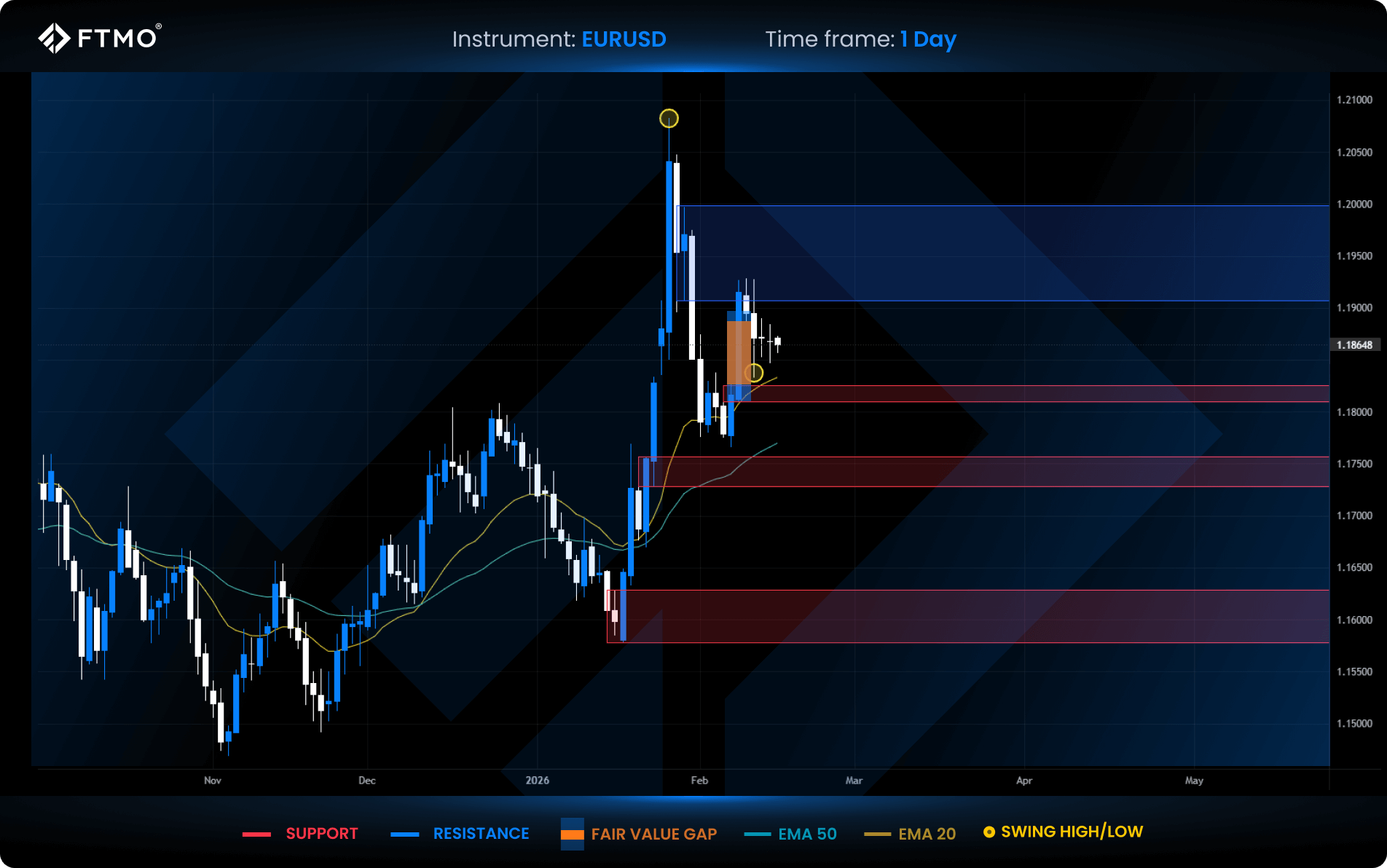

EURUSD

Market Context: Last Monday, EURUSD tested resistance, which led to a short-term bearish reaction. However, price remains above the 20 EMA, maintaining the short-term bullish trend bias.

Bearish Scenario (Preferred): Despite the overall trend still being bullish, further downside remains likely, with a potential move into support and a sweep of Wednesday’s low. A bullish reaction may follow from this area to resume the broader trend.

Bullish Scenario (Alternative): If the price reverses sooner and moves back toward resistance, the next directional move will depend on how the market reacts at that key zone.

FVG Setup: A short FVG formed last Tuesday, but since it was created just below resistance, it is considered invalid.

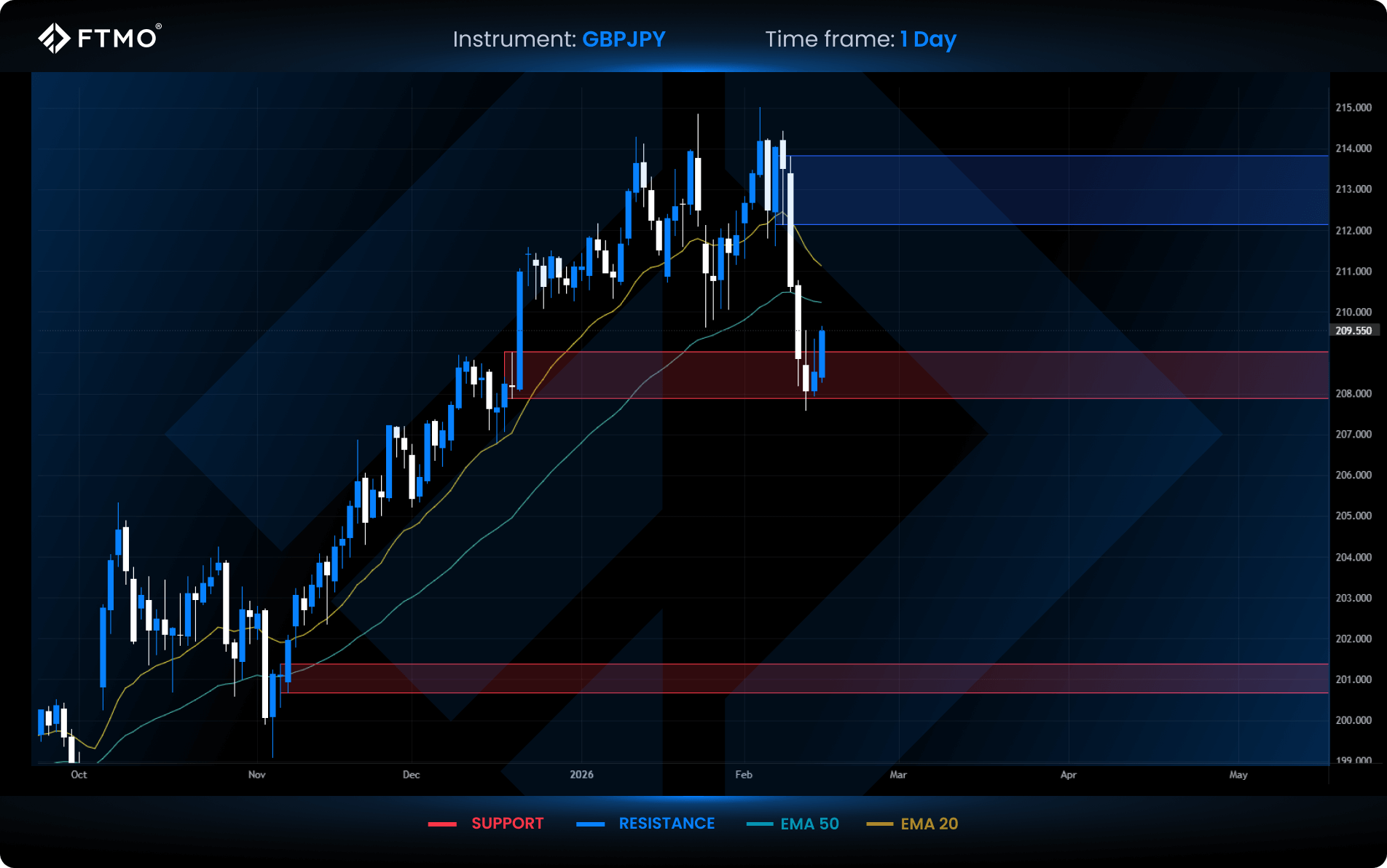

GBPJPY

Market Context: Starting Tuesday, GBPJPY saw a sharp selloff that swept liquidity before reaching the first support level. Friday’s close and today’s open suggest early signs of buying interest at this zone.

Bullish Scenario (Preferred): A bounce from current levels with a move toward resistance is the favoured outlook.

Bearish Scenario (Alternative): If price fails to hold support and closes below it, this could trigger a deeper move into the next lower support zone.

FVG Setup: No FVG has formed, but potential setups may emerge on lower timeframes in the direction of the preferred scenario.

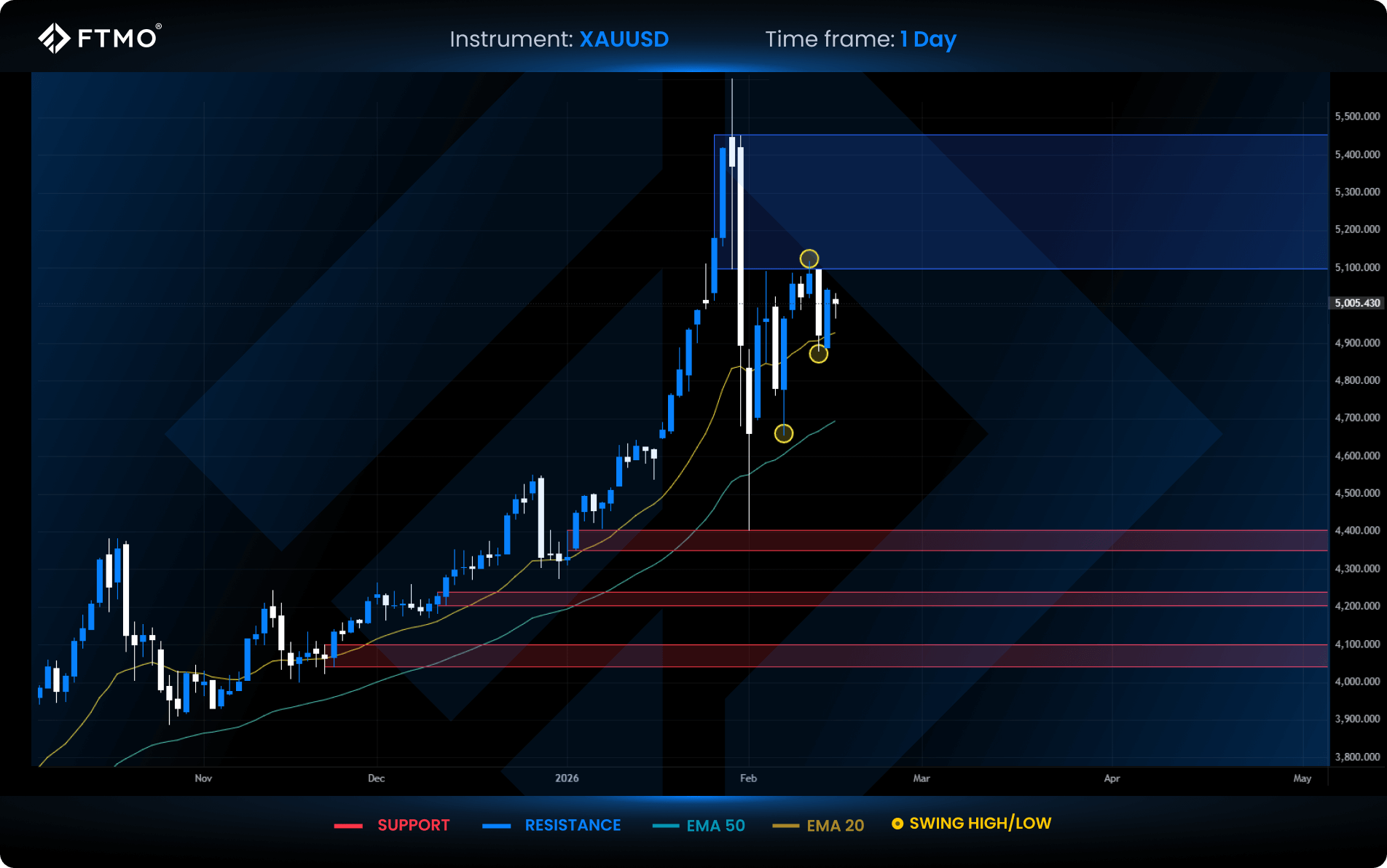

XAUUSD

Market Context: Gold pulled back from resistance and returned to the 20 EMA, which continues to hold as dynamic support in the ongoing bullish trend.

Bullish Scenario (Preferred): A continuation higher toward the swing high and back into resistance is expected.

Bearish Scenario (Alternative): A short-term drop below the 20 EMA may occur to collect liquidity before a bullish reversal resumes.

FVG Setup: No valid FVG setups were formed this or last week due to indecisive market conditions.

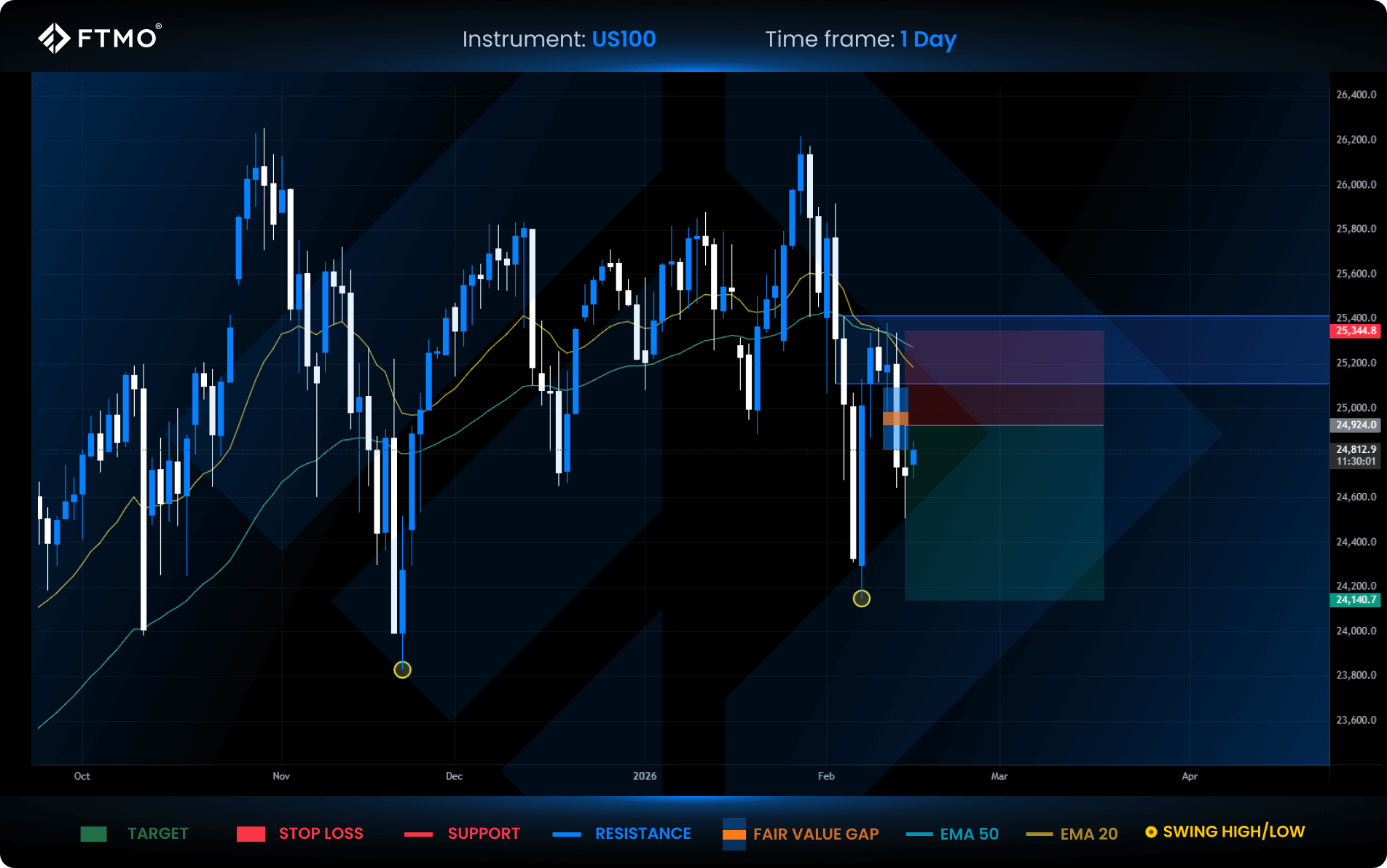

US100

Market Context: Following last week’s valid FVG setup, the Nasdaq continues to trend lower and remains below both the 20 and 50 EMAs. A new short FVG has formed in line with the prevailing downtrend.

Bearish Scenario (Preferred): Continued downside movement in line with the active short FVG, targeting the marked swing low.

Bullish Scenario (Alternative): Invalidation of the FVG with a close above resistance would signal a shift in structure and a possible return of buyers.

FVG Setup: A new short FVG formed this week and is active, with a potential target at the marked swing low.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?