Trading Week Ahead: Gold Breaks Momentum After a Parabolic Run

After the Fed kept rates unchanged at 3.75%, markets are turning their focus to JOLTS, ISM Services, and Nonfarm Payrolls, which will provide new insight into labour demand and economic momentum. Last week’s sharp pullback on gold after its parabolic rally shows how fragile sentiment remains, and this week’s reports could quickly reshape rate expectations and market direction.

👉 JOLTS Job Openings

December job openings are forecast to rise slightly to 7.23 million from 7.146 million. The Fed monitors this closely since elevated openings suggest wage pressure and inflation risk. A weaker print could support dovish expectations and weigh on the dollar.

👉 ISM Services PMI

The index is expected to slip to 53.5 from the previous 54.4. With services making up over 77% of the US economy, a strong print may signal sticky inflation. A miss could boost equities and pressure the dollar.

👉 Nonfarm Payrolls

January NFP is forecast at 60,000 after a weak 50,000 print in December. A strong report would reinforce the Fed’s hawkish stance. A downside surprise may lift risk assets unless it is too soft and sparks recession fears.

*All times in the table are in GMT+1

Technical Analysis with FVG Strategy

This technical analysis uses the EMA 20 and EMA 50 to determine market trends, alongside the Fair Value Gap (FVG), which refers to price imbalances caused by aggressive movements, signalling key entry and exit points. This strategy applies to EURUSD, GBPJPY, US30, and XAUUSD, providing insights into both last week’s market opportunities and the current one.

Opportunities to Watch This Week

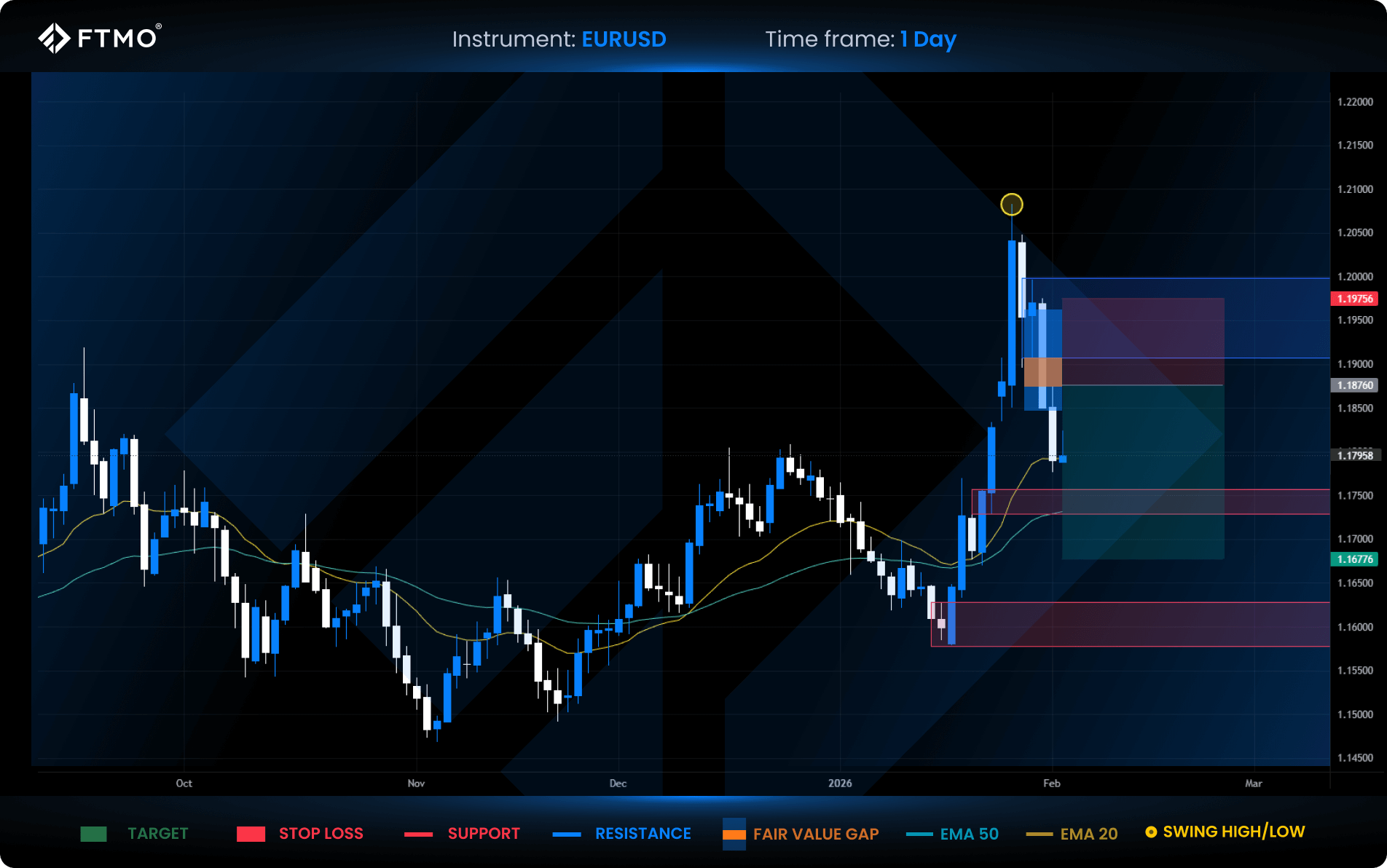

EURUSD

Market Context: After a sharp bullish rally, EURUSD has shifted into bearish momentum, supported by a valid short FVG. The move aligns with February’s typically negative seasonality.

Bearish Scenario (Preferred): A continued move lower with a pullback into the short FVG, targeting either the first support zone at 1.20 RRR or the fixed 2 RRR level marked on the chart.

Bullish Scenario (Alternative): A direct reaction from support without a pullback could trigger a bounce toward resistance.

FVG Setup: A short FVG has formed and remains active, supported by seasonal bias.

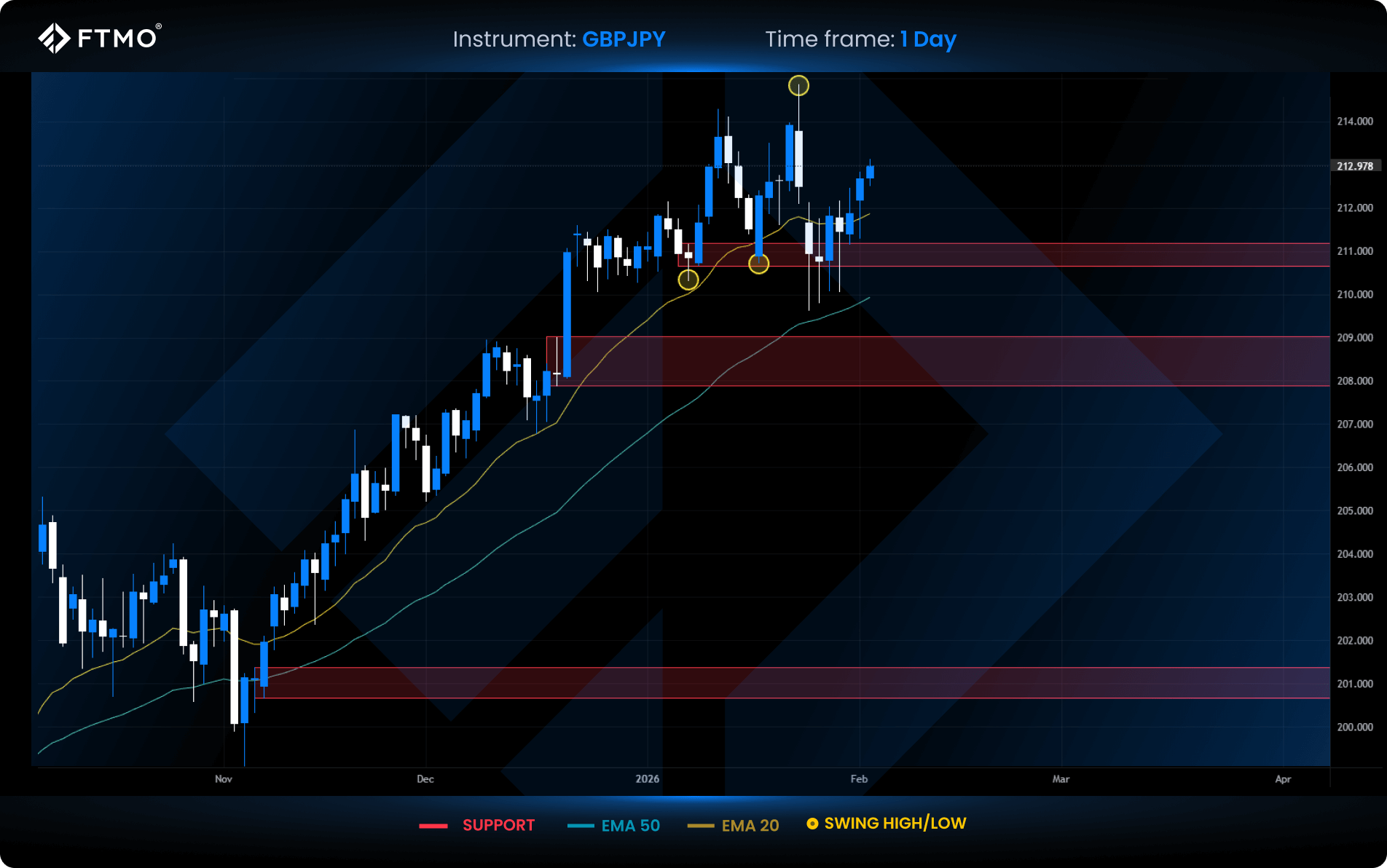

GBPJPY

Market Context: Last Monday, GBPJPY swept a two-month liquidity level and held support, indicating strong defence from buyers.

Bullish Scenario (Preferred): A continuation toward the yearly high, which acts as a strong upside magnet.

Bearish Scenario (Alternative): A return to support, where the market would reassess and determine the next direction.

FVG Setup: No FVG formed this week due to less aggressive market movement.

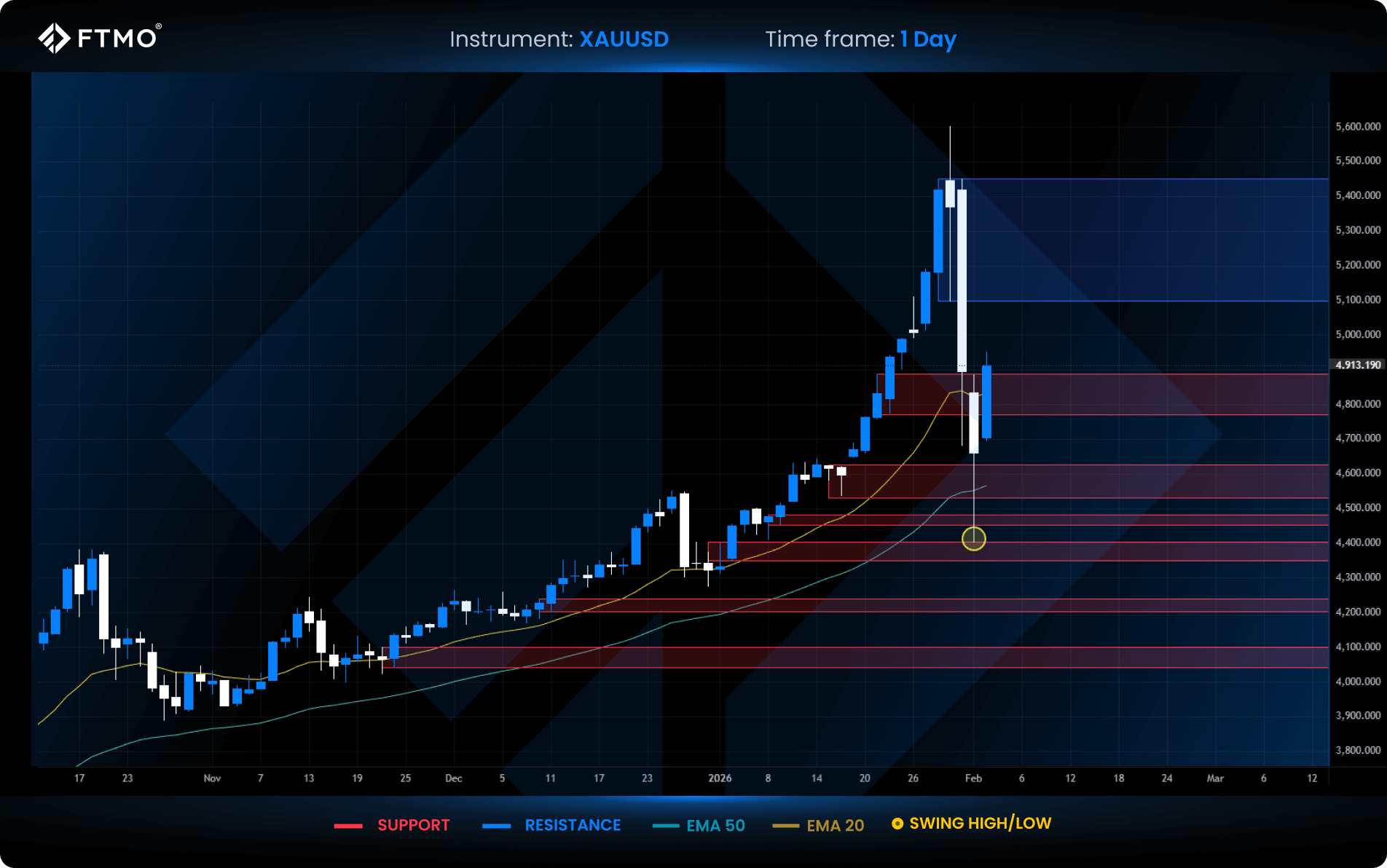

XAUUSD

Market Context: After a nearly 25% selloff that began on Friday, gold is showing signs of renewed bullish momentum. The recent candle held above support, avoiding a full close below the zone.

Bullish Scenario (Preferred): A continuation to the upside, especially if the price closes the gap and targets the resistance zone, where the next key decision may take place.

Bearish Scenario (Alternative): If the downtrend resumes, gold may revisit Monday’s low and extend the correction.

FVG Setup: A short FVG has formed, but traders should be cautious. After such a massive drop, setups often require more confirmation, and this particular FVG does not fully align with broader market context.

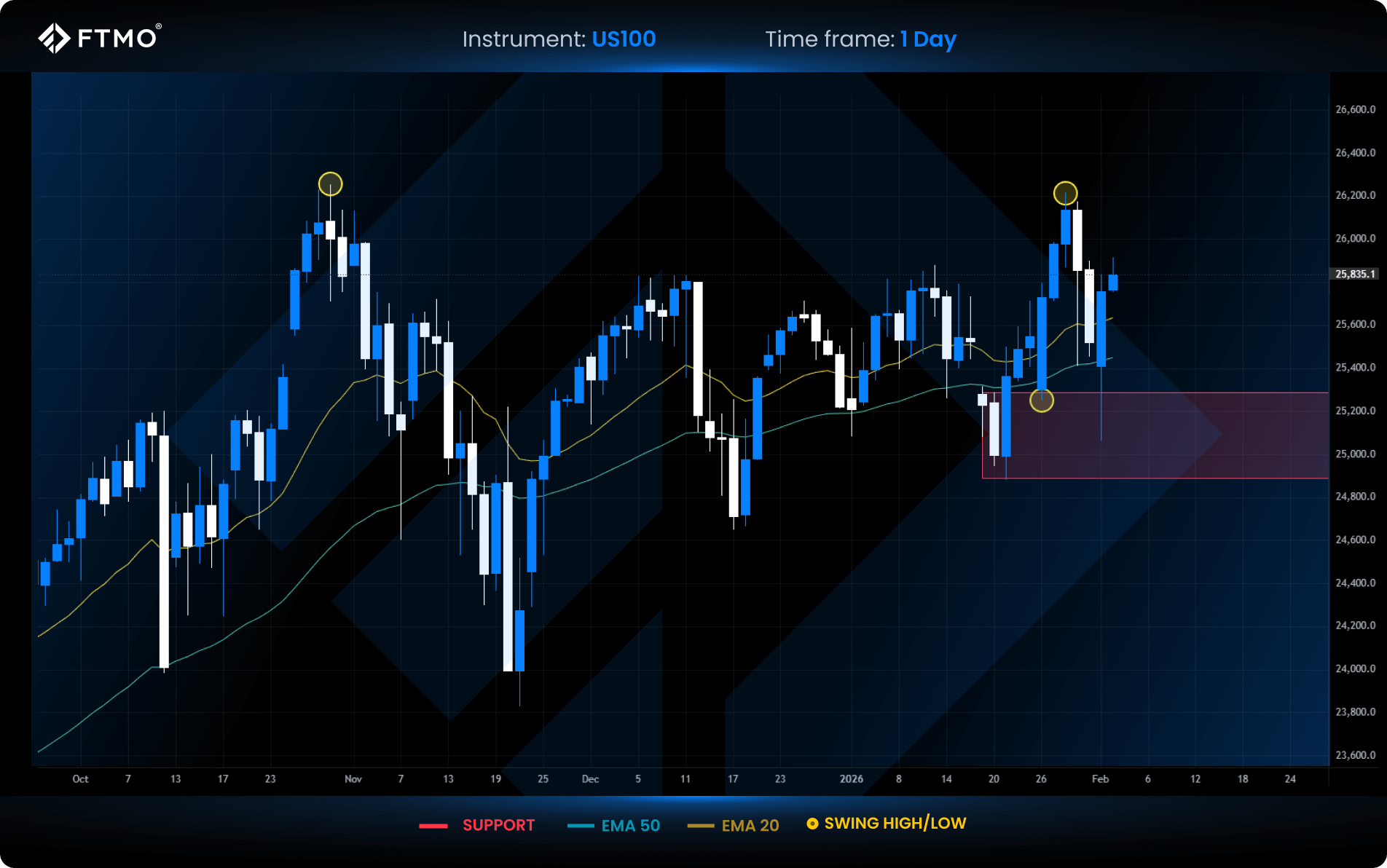

US100

Market Context: Following a support test and a sweep of the previous swing low, the US100 regained momentum and is now heading toward a swing high.

Bullish Scenario (Preferred): A continuation toward the swing high, which serves as the immediate upside target.

Bearish Scenario (Alternative): A retest of the support zone if bullish momentum stalls.

FVG Setup: No FVG formed this week.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?