“Every successful trader is a losing trader who never gave up.”

For these FTMO Traders, success didn’t come from avoiding losses, but from persistence, discipline, and respecting the process. In this Q&A, Mohmmad, Razvan-Andrei, and Ramon share how risk management, emotional control, and consistency helped them navigate losses and progress through the FTMO Challenge and Verification.

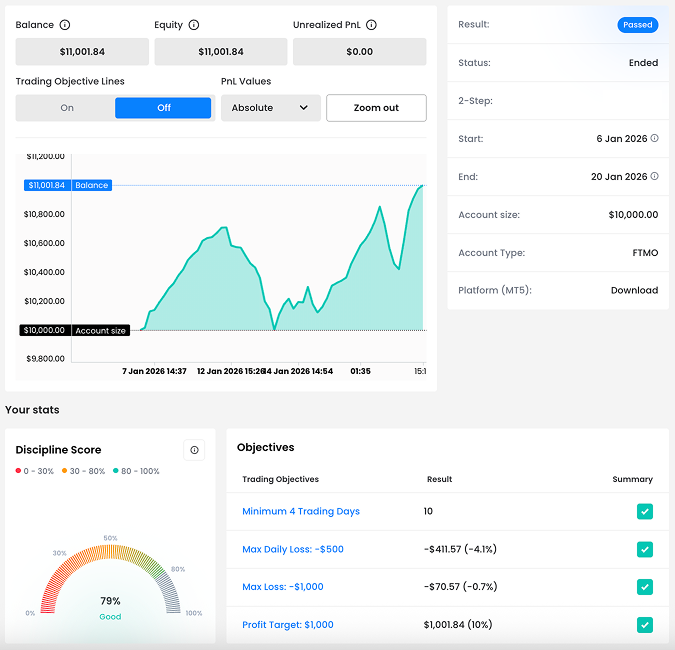

Trader Mohmmad Asif: “Protecting capital and following a plan are more important than chasing quick gains.”

How did Max Loss limits affect your trading style?

Max Loss limits made me more disciplined and risk-focused. I reduced position sizes, avoided overtrading, and became more selective with entries. They helped me protect capital and maintain consistency by stopping trading once predefined risk limits were reached.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a clear trading plan that defines risk management and entry and exit rules. I follow it strictly and avoid impulsive trades outside my plan, which helps maintain consistency and control emotions.

What was easier than expected during the FTMO Challenge or Verification?

Following the rules and managing risk was easier than expected. Having clear Trading Objectives and limits helped me stay disciplined and focused throughout the Challenge.

What inspires you to pursue trading?

I am inspired by the combination of analytical thinking, discipline, and continuous self-improvement that trading requires. It offers long-term growth opportunities and rewards consistency and patience.

Describe your best trade.

My best trade was one where I strictly followed my plan, entered at a high-probability setup, managed risk properly, and let the trade reach its target without emotional interference. The process mattered more than the profit.

What is the number one piece of advice you would give to a new trader?

Focus on risk management and consistency before profits. Protecting capital and following a plan are more important than chasing quick gains.

Trader Razvan-Andrei: “Calmness, discipline, and risk management are the key factors in trading.”

Do you have a trading plan in place, and do you follow it strictly?

Yes, this is exactly how I became a consistent trader and successfully passed the FTMO Challenge.

How did you manage your emotions when you were in a losing trade?

By respecting my trading plan and risk management, I avoid being emotionally affected. Losses happen to everyone and should be treated as such.

How did you eliminate the factor of luck in your trading?

Luck in trading is not an option if you want to become a consistent trader in the long term, and it can lead to a complete loss of capital when that luck runs out.

What was the hardest obstacle on your trading journey?

Respecting the trading plan, risk management, and emotional control.

What would you like to say to other traders who are attempting the FTMO Challenge?

Calmness, discipline, and risk management are the key factors in trading. Every successful trader is a losing trader who never gave up.

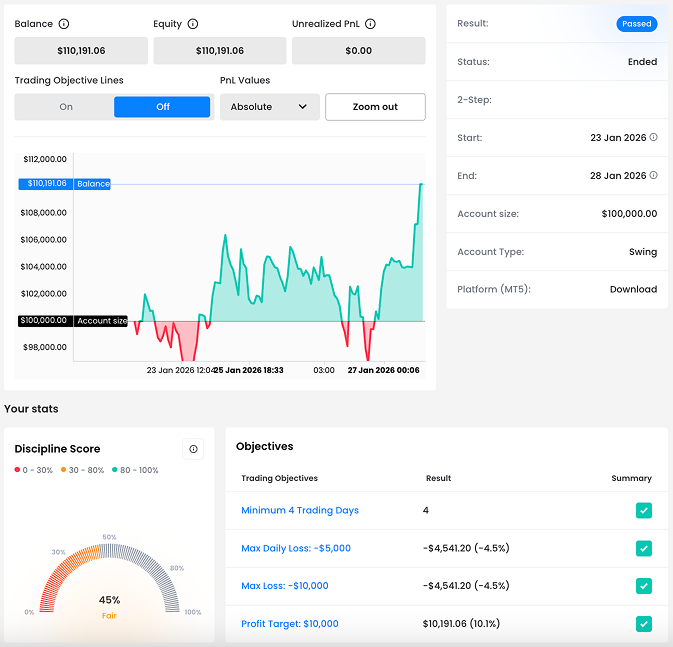

Trader Ramon: “Long-term consistency matters more than short-term results.”

How did you eliminate the factor of luck in your trading?

I eliminated luck by focusing on consistency and risk management rather than individual outcomes. I trade the same setup repeatedly, risk a fixed percentage per trade, and only execute when my conditions are met. This way, performance is driven by probabilities over time, not random wins or losses.

Describe your best trade.

My best trade wasn’t about profit size, but execution. It was a setup that fully matched my plan, entered at a key level with confirmation, and managed with patience. I followed my rules perfectly, didn’t interfere emotionally, and let the trade reach its target without hesitation.

Where have you learnt about FTMO?

I learned about FTMO through other funded traders and online trading communities, where I saw real examples of traders passing the FTMO Challenge and managing funded FTMO Accounts professionally.

What was more difficult than expected during your FTMO Challenge or Verification?

The most difficult part was managing patience and avoiding overtrading. Knowing when not to trade, especially on slow or unclear market days, was harder than expected but crucial to staying within the rules.

What do you think is the most important characteristic or attribute to become a profitable trader?

Discipline. A profitable trader follows his plan consistently, controls emotions, accepts losses calmly, and understands that long-term consistency matters more than short-term results.

One piece of advice for people starting the FTMO Challenge now.

Trade smaller than you think you should. Focus on consistency and rule-following, not on hitting the profit target quickly. If your process is correct, the results will take care of themselves.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?