Scalping Gold to a $25,198 Profit: Mastering One Instrument in Both Directions

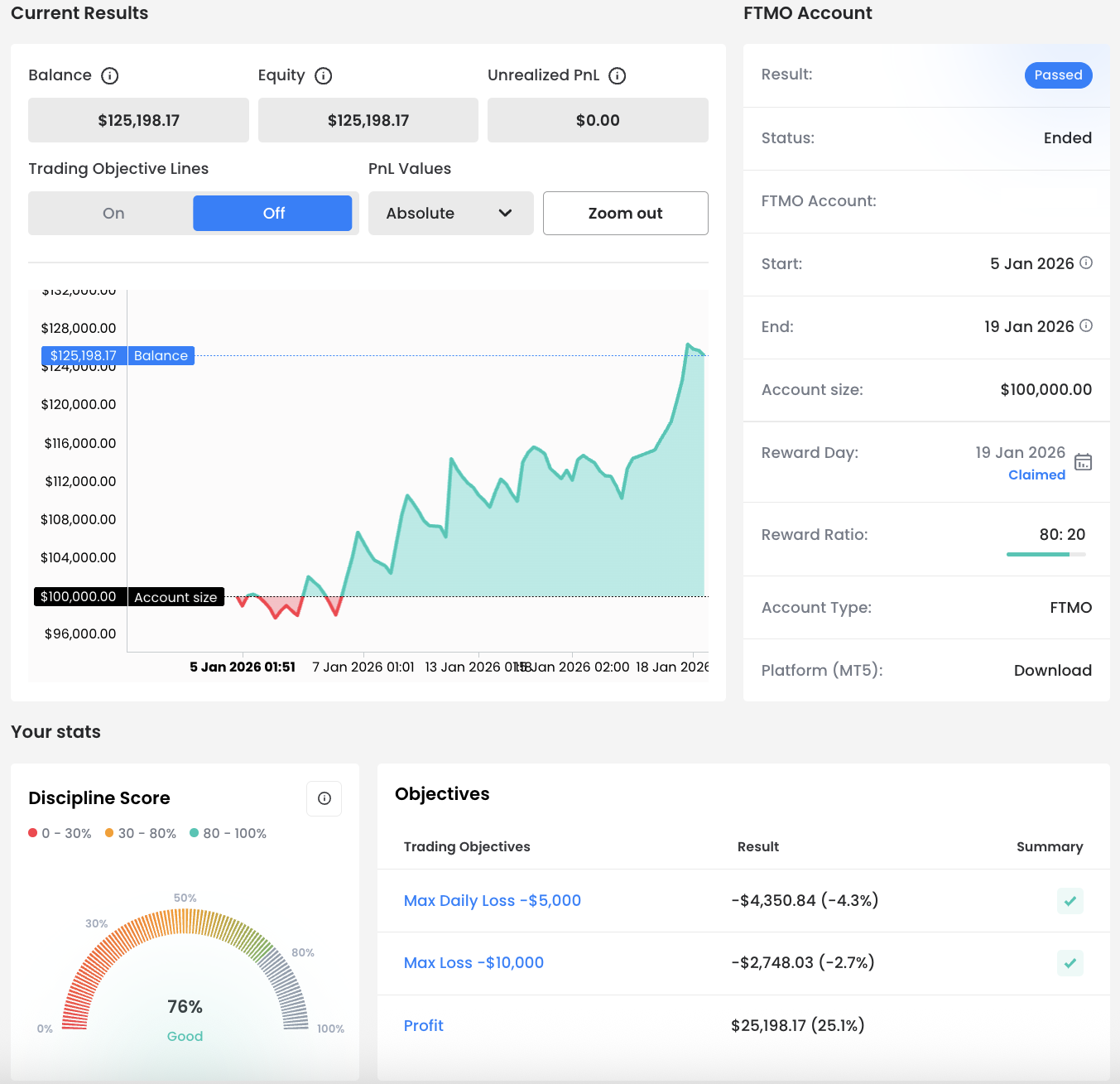

In this part of the Successful Trader Story, we look at a trader who built a $25,198 profit (+25.1%) on a $100,000 FTMO Account by focusing primarily on scalping gold, while staying flexible enough to hold the strongest trades for hours when momentum clearly confirmed.

Controlled Growth Without Extreme Swings

The Balance curve shows a performance built gradually rather than explosively. After a brief period of early consolidation near the starting balance, equity began to rise steadily and finished near the highs at $125,198.17.

Despite several pullbacks along the way, risk remained under control throughout the entire period. The trader respected both the Max Daily Loss and Max Loss limits, and the final Discipline Score of 76% confirms that the growth was driven by structure and repeatable execution.

Learning to Stop Before the Damage Is Done

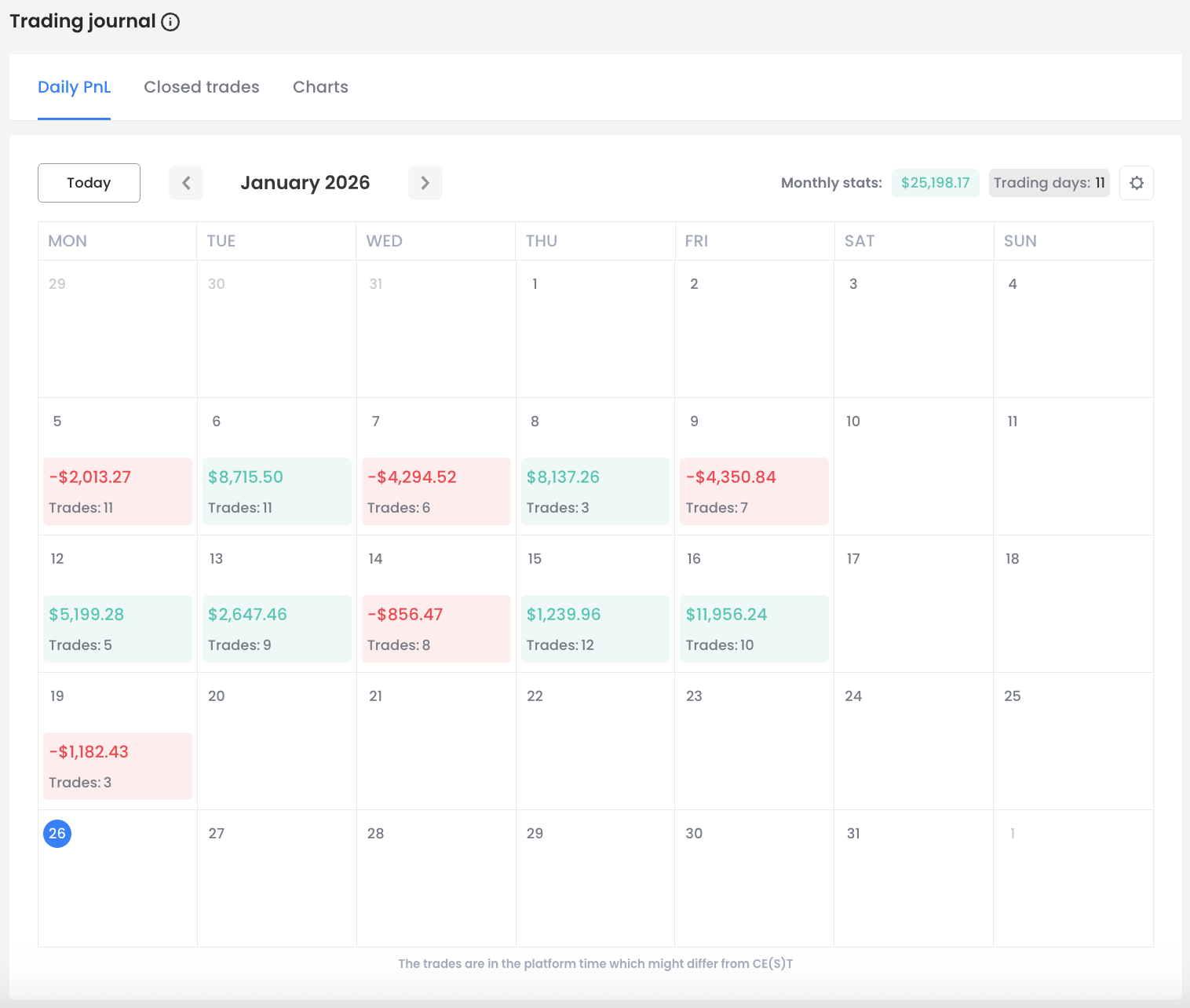

The PnL Calendar adds important context to the overall performance. During the first week, particularly on Wednesday and Friday, the trader came close to breaching the Max Daily Loss, signaling moments of increased pressure and more challenging conditions.

However, these difficult sessions were managed without breaking Trading Objectives. Rather than spiraling into overtrading, the trader absorbed the losses and preserved capital.

This discipline paid off later. On Friday, 16 January, the account recorded its strongest day of the period, with a series of successful short positions on gold producing a total daily profit of $11,956.24. The contrast between these sessions highlights the trader’s ability to reset and adapt.

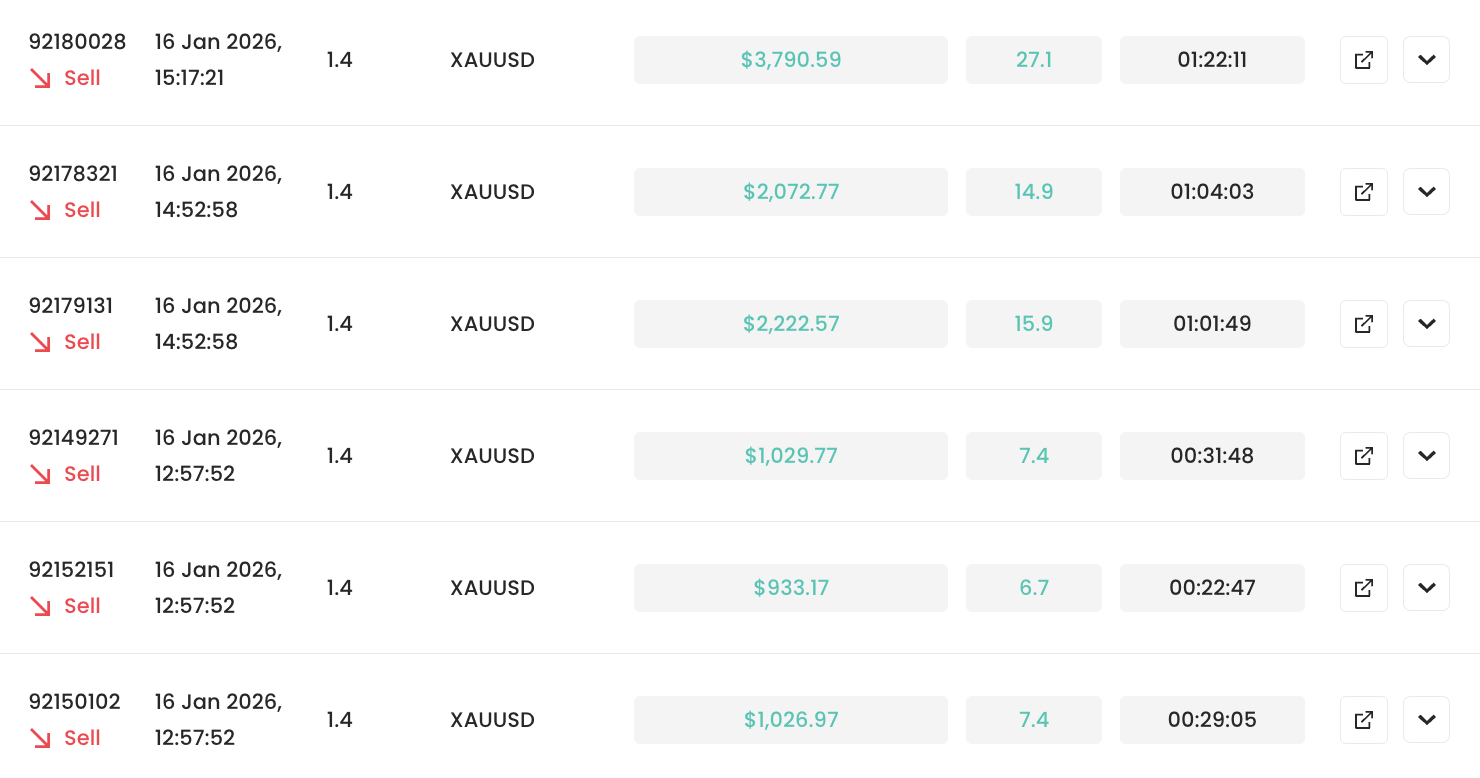

A closer look at individual trades reveals a scalp-oriented intraday style. While the majority of losing trades were closed within seconds or minutes, strongly suggesting tight Stop Loss placement and immediate invalidation when price action did not confirm the setup, the most profitable trades lasted significantly longer, often extending into hours.

This contrast indicates that while risk was cut aggressively, winning positions were given room to develop once momentum aligned.

Statistics in Context

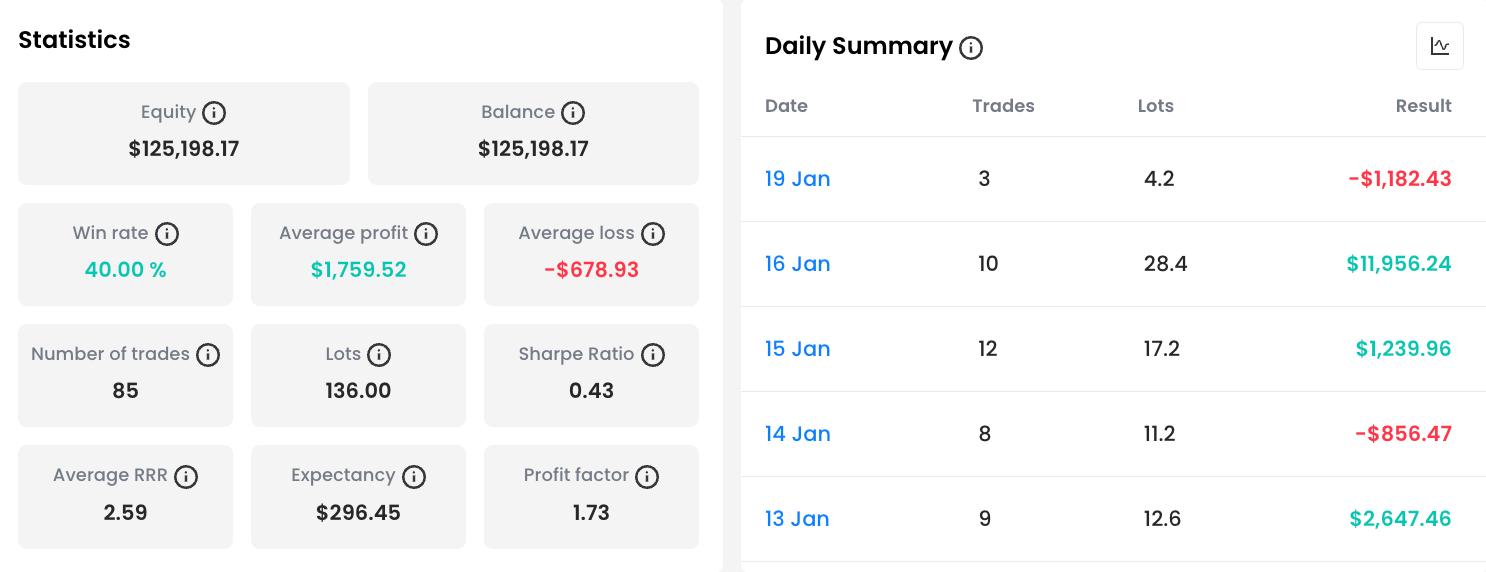

While the Win Rate of 40% may appear modest at first glance, it is a natural outcome of cutting losses quickly while allowing winners more room. The real edge becomes clear when viewed alongside the Average RRR of 2.59, showing that successful trades were, on average, significantly larger than losing ones.

With 85 trades executed, the trader followed an active intraday approach where protecting capital on invalid setups and extracting maximum value from confirmed moves mattered far more than achieving a high hit rate.

One Market, Both Directions

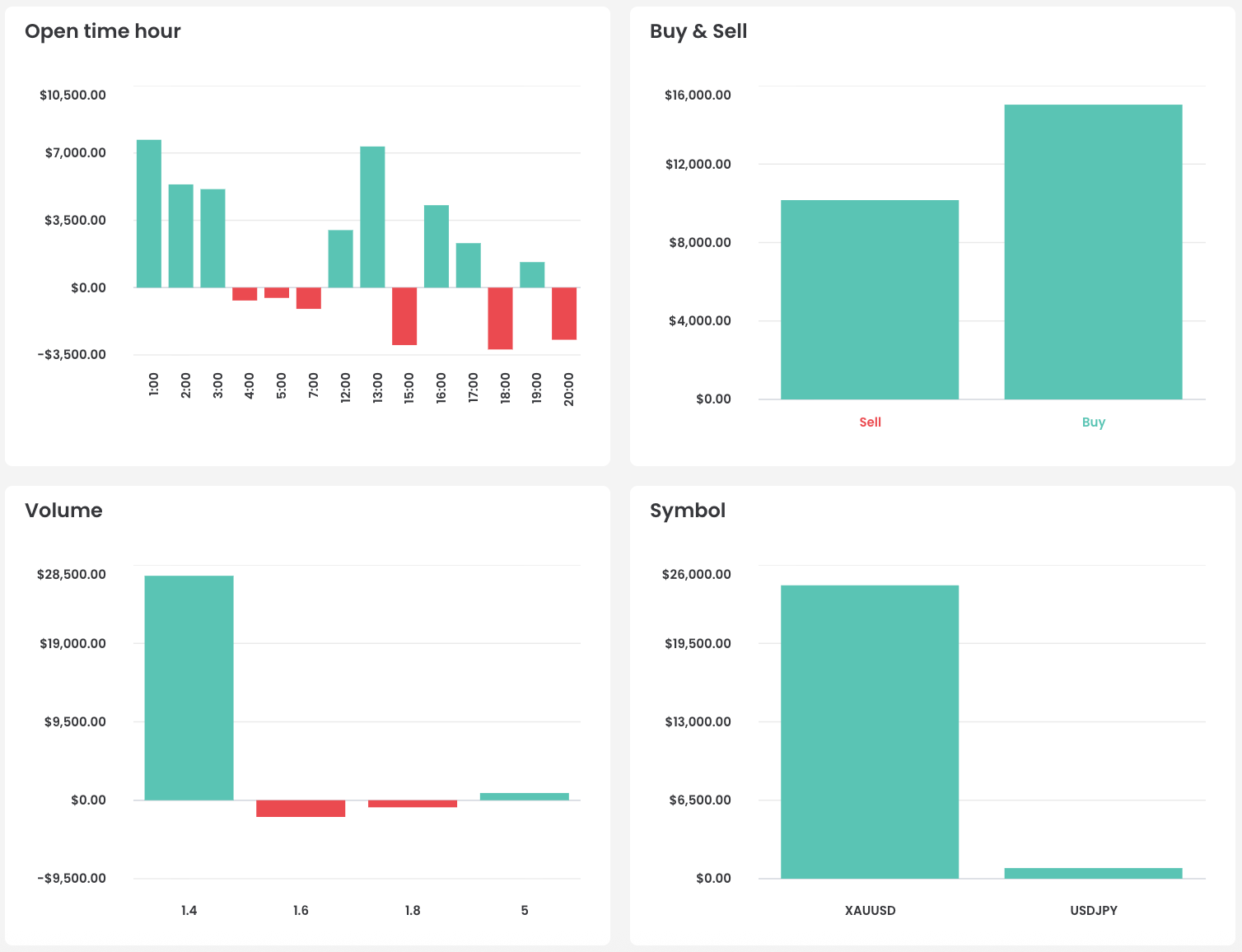

The Charts section reveals several defining traits of the trader’s approach. Almost all trading activity was concentrated on XAUUSD, confirming a clear focus on mastering a single instrument rather than diversifying across many markets.

The Buy & Sell breakdown shows a relatively balanced contribution from long and short positions, indicating that trades were driven by setup quality rather than directional bias. The trader was comfortable trading gold in both directions, depending on market conditions.

The Open Time Hour chart suggests that trading activity clustered around periods when gold typically shows higher intraday volatility, supporting quick moves and momentum-driven setups.

Scalping Is Not About Speed Alone

This trading period shows that a scalp-oriented intraday approach does not have to rely on constant high accuracy. By combining fast loss-cutting, selective patience on winners and a deep understanding of XAUUSD, the trader turned controlled execution into a $25,198 profit.

Once again, this Successful Traders Story highlights that long-term results come from aligning strategy, psychology and risk management – and executing them with consistency.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?