Trading Week Ahead: Will the Fed Blink?

Markets are entering a critical week to close out January. With fresh data on consumer confidence, producer inflation, and the Fed’s latest rate decision, investors have plenty to digest. These events could steer sentiment into February and set the tone for Forex, crypto, and indices.

👉 CB Consumer Confidence

Sentiment is forecast to rise slightly to 90.1 from 89.1. A stronger print may boost the dollar and weigh on equities. A miss could raise concerns about consumer resilience and support dovish expectations.

👉 Federal Funds Rate

The Fed is expected to keep rates steady at 3.75%. Powell’s tone and forward guidance will be in focus. Any signal of policy shifts or inflation concerns could trigger sharp market reactions.

👉 US PPI

Producer prices are expected to increase 0.2%, matching the previous month. A hotter reading may lift yields and strengthen the dollar. A softer print would support risk appetite and reinforce disinflation trends.

*All times in the table are in GMT+1

Technical Analysis with FVG Strategy

This technical analysis uses the EMA 20 and EMA 50 to determine market trends, alongside the Fair Value Gap (FVG), which refers to price imbalances caused by aggressive movements, signalling key entry and exit points. This strategy applies to EURUSD, GBPJPY, US30, and XAUUSD, providing insights into both last week’s market opportunities and the current one.

Opportunities to Watch This Week

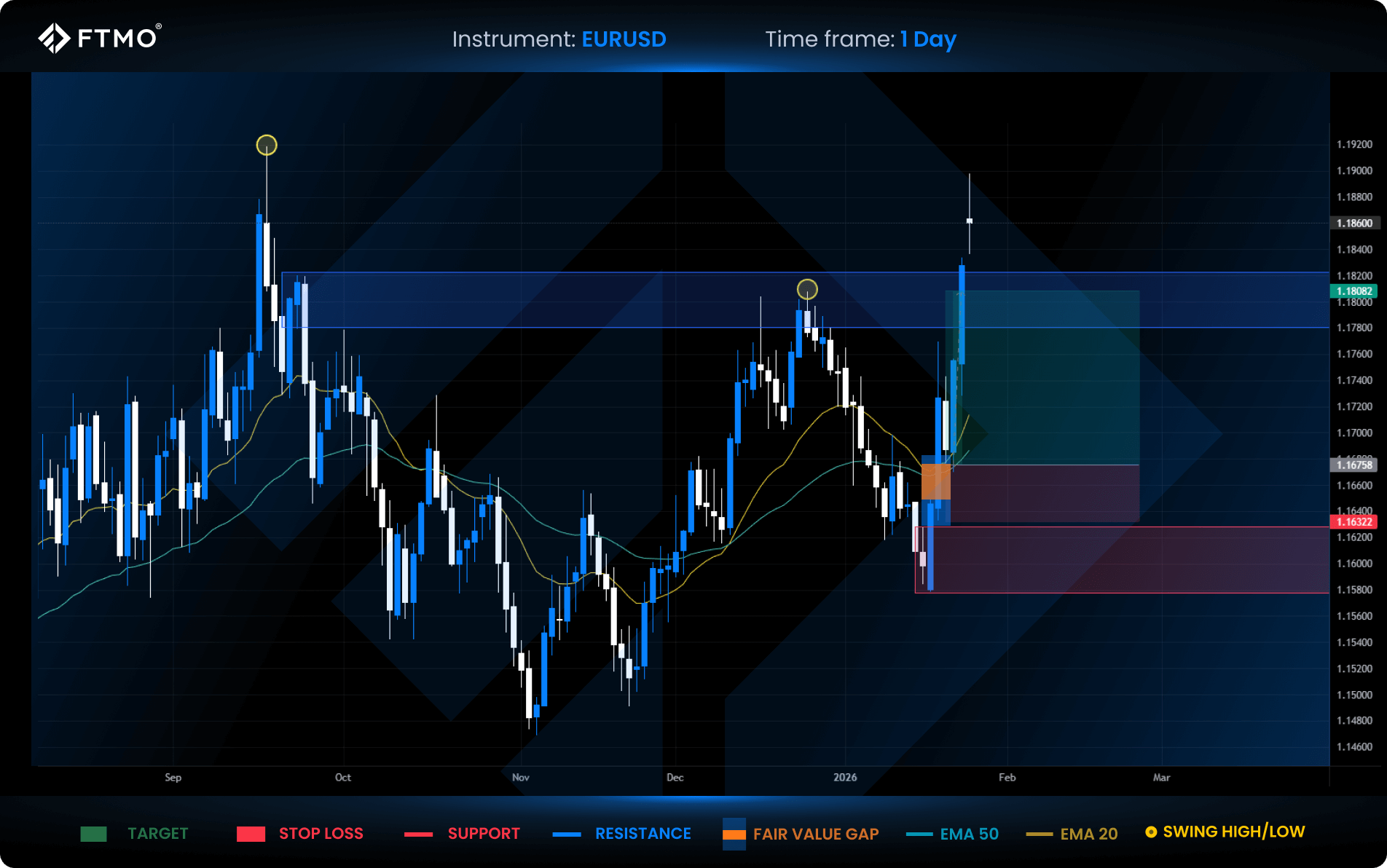

EURUSD

Market Context: EURUSD broke through resistance and cleared a two-month swing high. Price is now trading above the breakout zone and appears to be targeting the yearly high, where significant liquidity could be positioned.

Bullish Scenario (Preferred): Continuation of the aggressive uptrend, aiming for a sweep of the yearly high.

Bearish Scenario (Alternative): A daily close back below resistance could trigger a short-term pullback and trend cooldown.

FVG Setup: No new FVG formed this week. However, last Wednesday’s bullish FVG provided a clean entry and reached a 3:1 RRR, targeting the recent swing high.

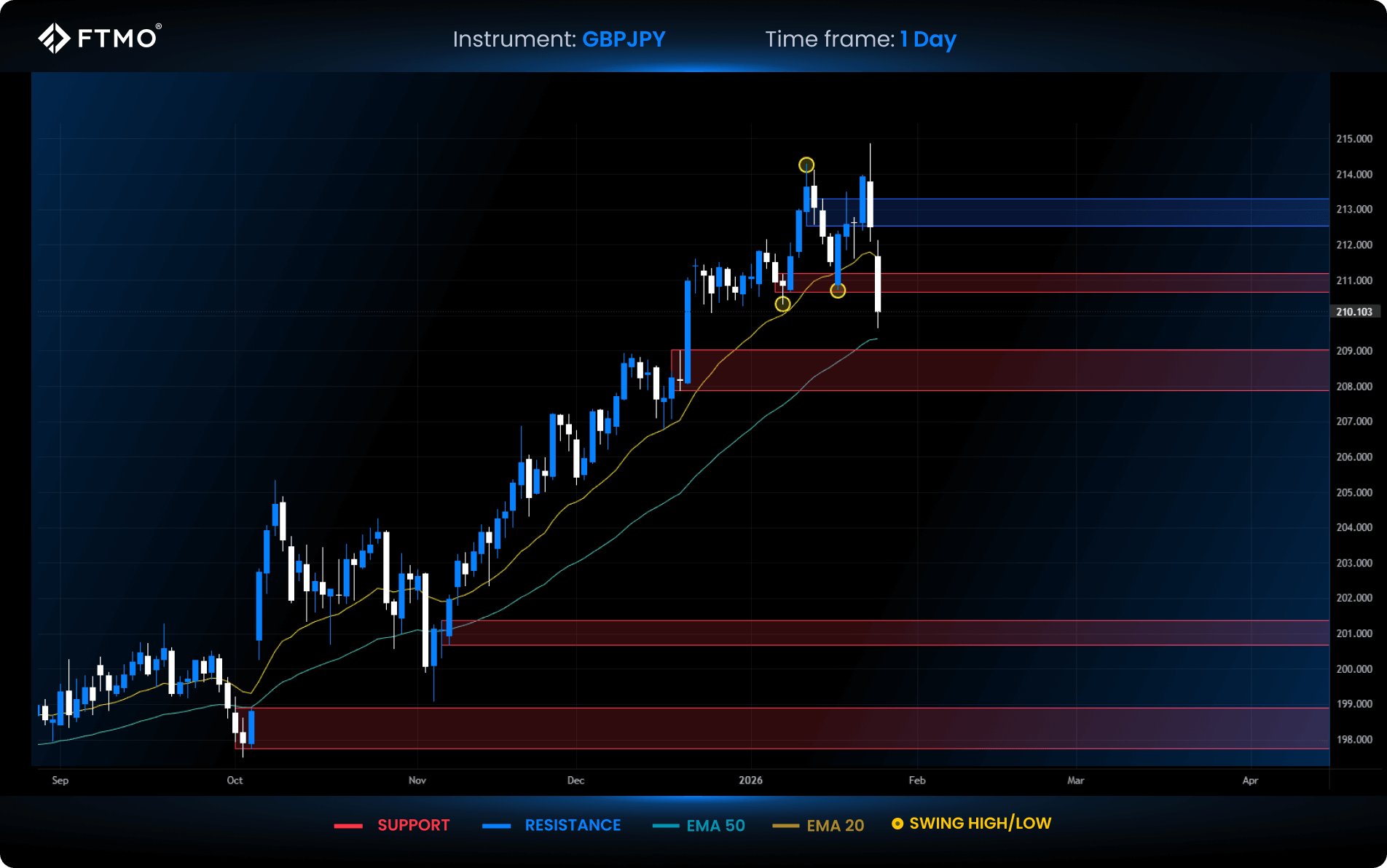

GBPJPY

Market Context: On Friday, GBPJPY swept a swing high and rejected resistance, followed by a sharp sell-off. Price is now below both the 20 EMA and the resistance zone, having taken liquidity below the range low.

Bearish Scenario (Preferred): A continuation lower into the next support zone, where buyer interest could reemerge.

Bullish Scenario (Alternative): If the support holds and the candle does not close below it, the bullish trend may resume.

FVG Setup: No FVG formed this week, but potential setups may appear on lower timeframes in line with the preferred direction.

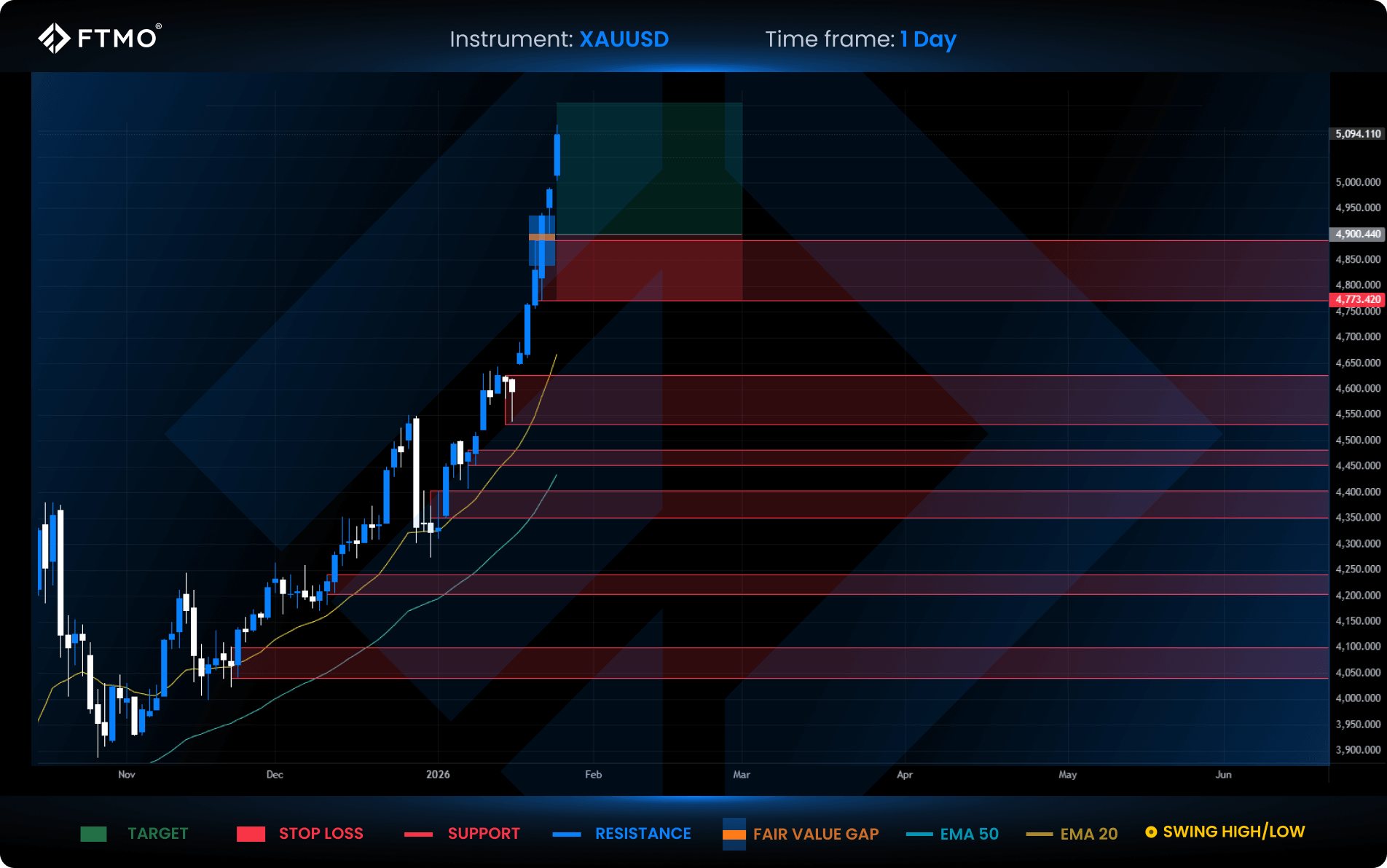

XAUUSD

Market Context: Gold continues its parabolic rally, breaking through the major psychological level of $5,000 per ounce. While momentum remains strong, caution is warranted, as sharp moves often precede equally aggressive reversals.

Bullish Scenario (Preferred): Trend continuation with an ideal pullback into the most recent FVG, targeting a 2:1 RRR.

Bearish Scenario (Alternative): A breakdown below support would temporarily shift structure bearish and open the door for a corrective move.

FVG Setup: A valid long FVG setup remains tradable unless a new FVG forms. The target remains at 2:1 RRR with stop placement based on standard FVG methodology.

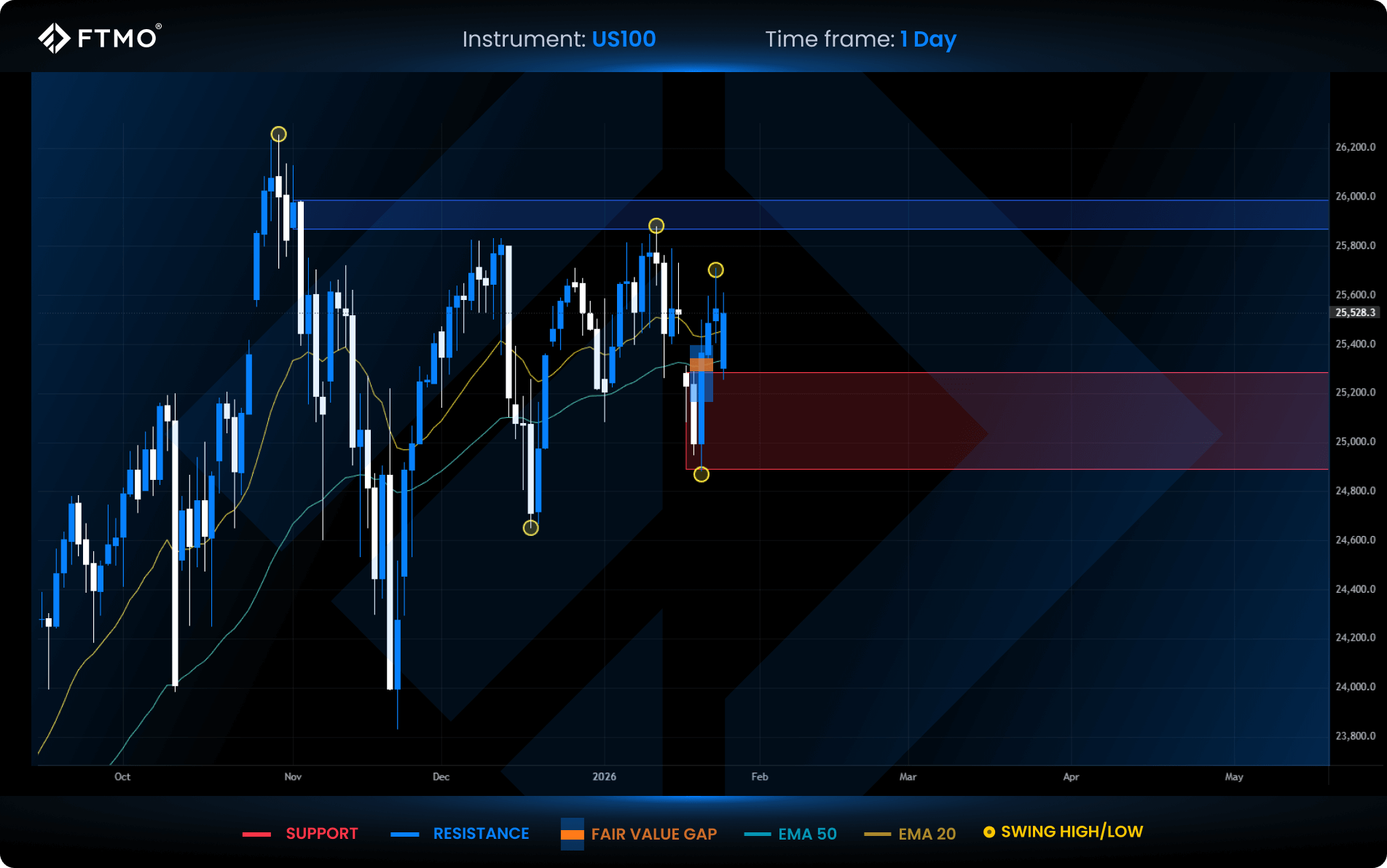

US100

Market Context: The US100 is currently reacting from support, where today's positive open triggered a bullish response.

Bullish Scenario (Preferred): A move higher following the long FVG setup, with targets at the next swing high or the resistance zone.

Bearish Scenario (Alternative): A retest of support and potential sweep of the swing low could occur if buying momentum fails.

FVG Setup: A long FVG has formed and remains active.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?