Trading Week Ahead: EURUSD Reacts Bullish at Key Support

A politically charged and data-driven week lies ahead, as markets brace for remarks from President Trump, a US GDP, and early PMI signals. With macro momentum heating up, traders should prepare for elevated volatility and fast shifts in sentiment.

👉 President Trump Speaks

Markets will be on edge as Trump takes the stage Wednesday. Unexpected comments on the economy, interest rates, or foreign policy could spark immediate volatility across USD, equities, and yields.

👉 US GDP

Thursday’s Q4 GDP release is forecast at 4.3%, following a blockbuster 3.8% print in Q3. A strong surprise may challenge dovish market positioning. A miss could support risk sentiment and pressure the dollar.

👉 US Flash PMIs

January’s flash PMIs are expected to rise modestly, with services seen at 51.7 (previous 51.4) and manufacturing at 51.9 (previous 51.8). Gains would suggest steady growth, supporting USD strength. Weaker readings may revive growth concerns.

Technical Analysis with FVG Strategy

This technical analysis uses the EMA 20 and EMA 50 to determine market trends, alongside the Fair Value Gap (FVG), which refers to price imbalances caused by aggressive movements, signalling key entry and exit points. This strategy applies to EURUSD, GBPJPY, US30, and XAUUSD, providing insights into both last week’s market opportunities and the current one.

Opportunities to Watch This Week

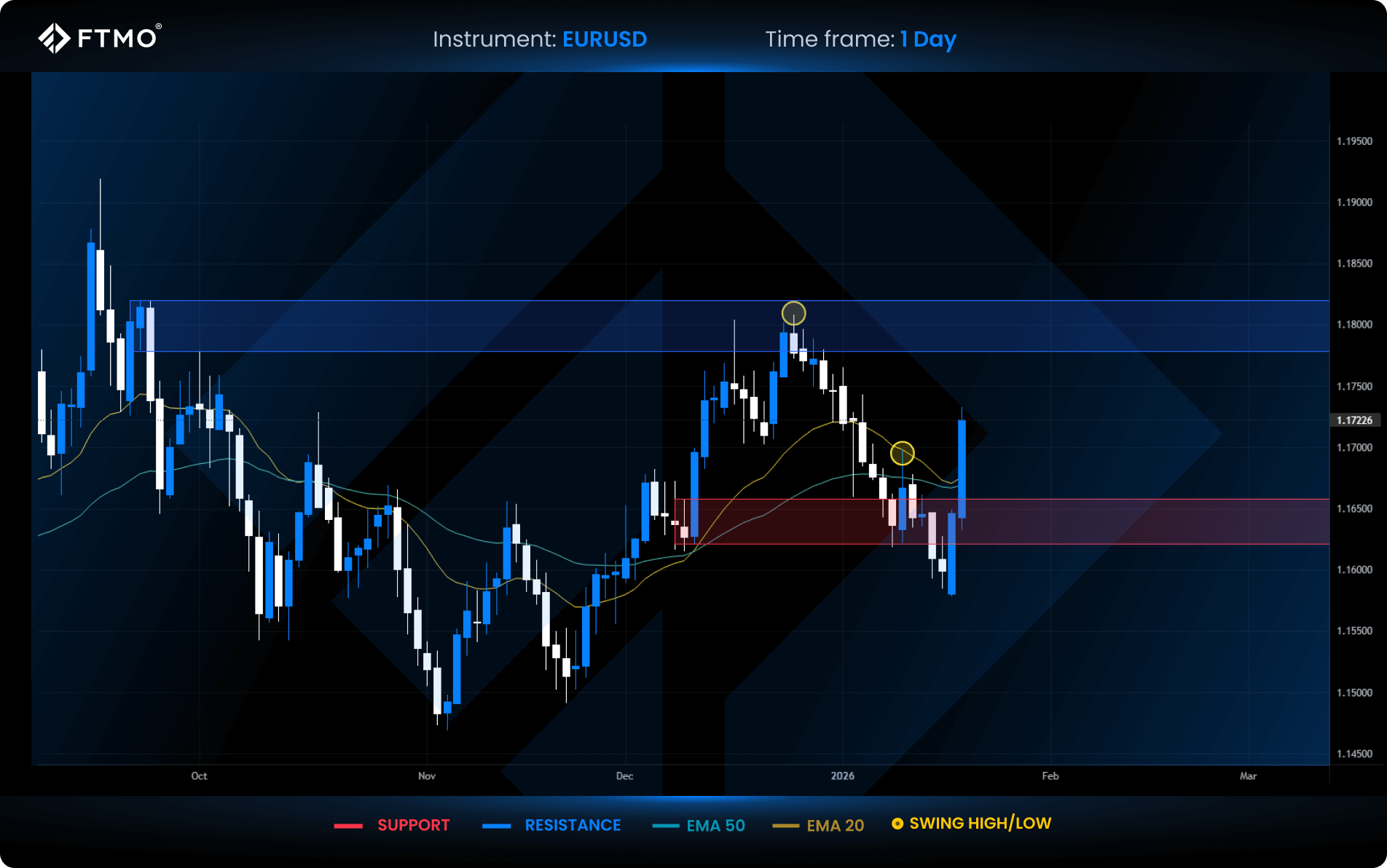

EURUSD

Market Context: EURUSD held last week’s support as the full candle failed to close below the level, triggering a strong bullish move. Along the way, price cleared a swing high and is now pushing toward resistance, targeting the previous month’s high where liquidity may be positioned.

Bullish Scenario (Preferred): Continuation toward resistance and a potential sweep of the previous month's high.

Bearish Scenario (Alternative): A pullback into the support zone before any further upside continuation.

FVG Setup: No fair value gap formed this week.

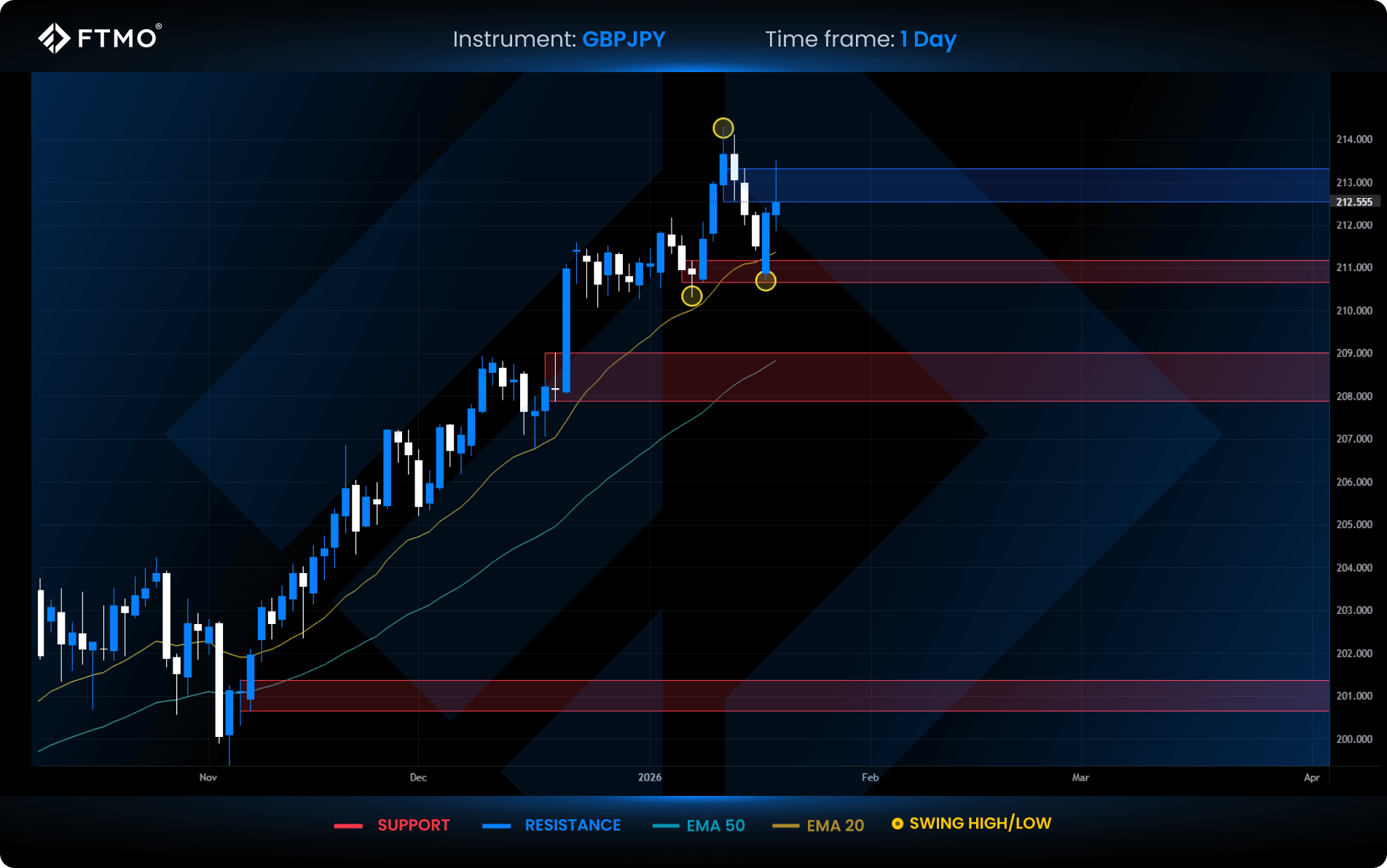

GBPJPY

Market Context: Following last week’s breakout from the range and rally, GBPJPY pulled back into support where buyers stepped in again, sending price higher. It is currently trading between support and resistance.

Bullish Scenario (Preferred): A break above resistance in line with the prevailing uptrend, with a potential target at the marked swing high.

Bearish Scenario (Alternative): Rejection from resistance and a pullback into Monday’s low.

FVG Setup: No FVG was formed this week.

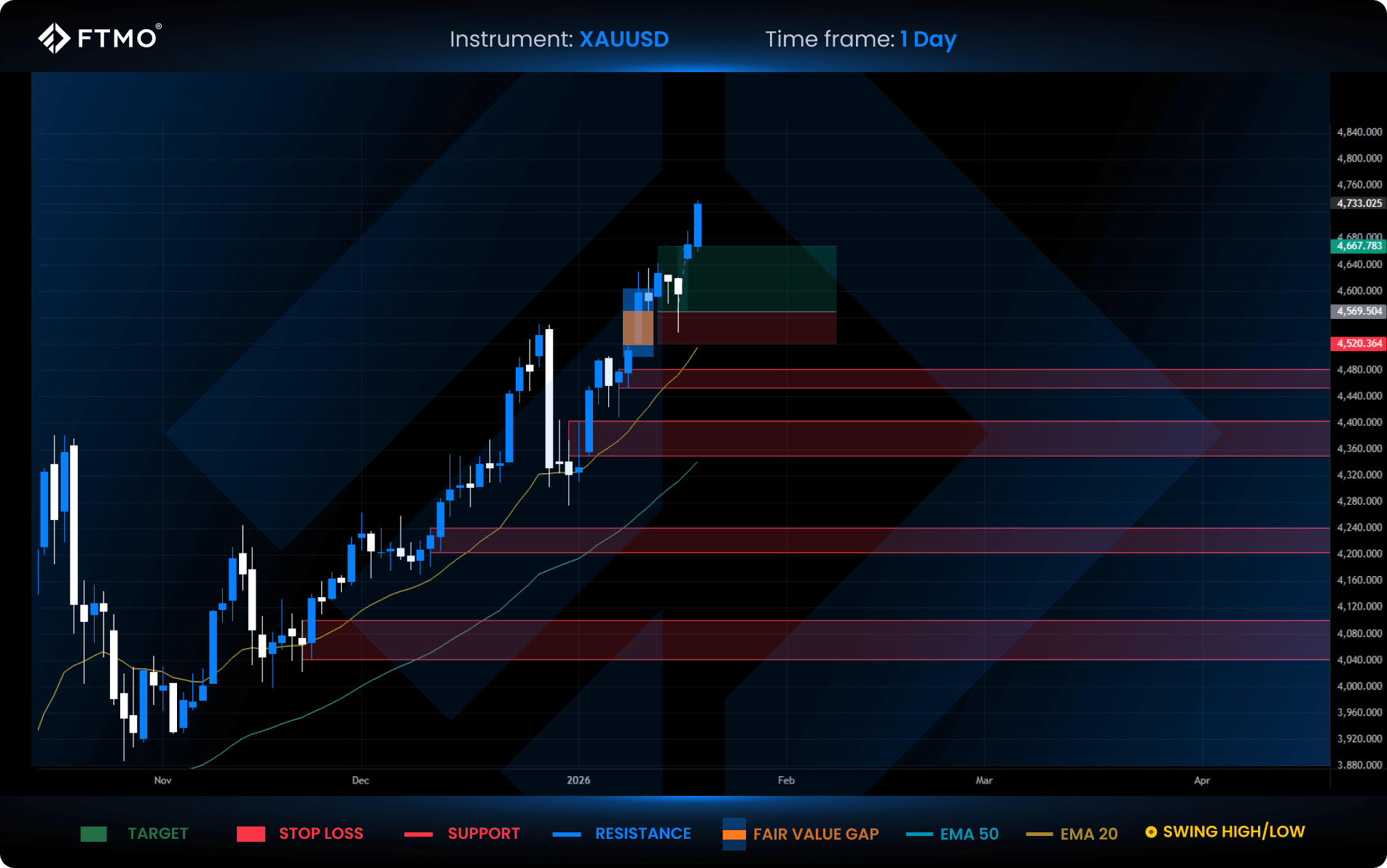

XAUUSD

Market Context: Gold continues its strong uptrend, reaching new all-time highs and maintaining a clean bullish structure.

Bullish Scenario (Preferred): Trend continuation remains the primary view, supported by strong price action.

Bearish Scenario (Alternative): A pullback to fill imbalances left by recent aggressive moves.

FVG Setup: Last week's FVG was tested and successfully reached a 2:1 RRR.

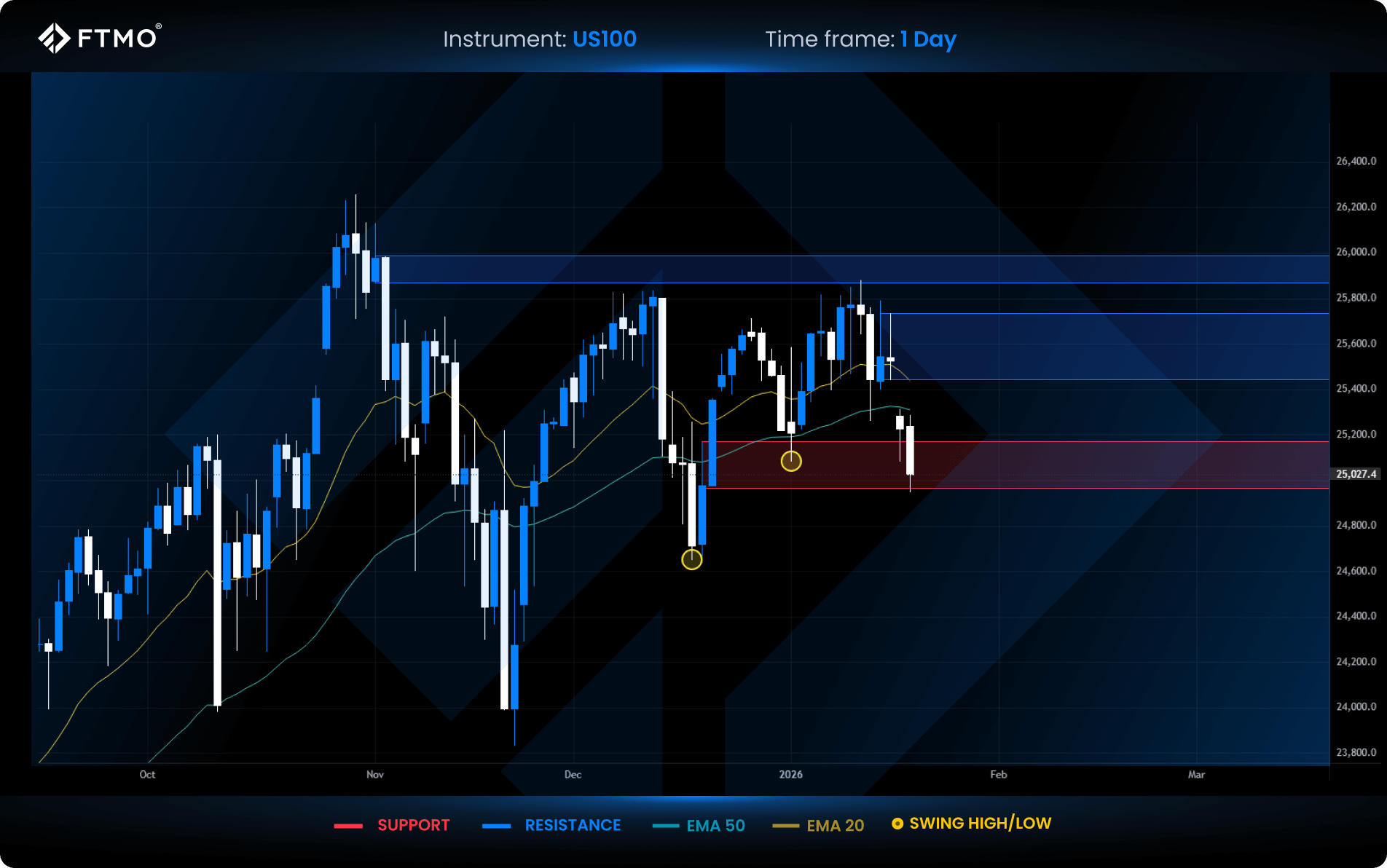

US100

Market Context: After last week’s liquidity sweep and resistance test, the Nasdaq weakened and is now back at support, where another swing low has been taken out.

Bullish Scenario (Preferred): Buyer reaction from support, with a potential move to fill the overnight gap created by the prior sell-off.

Bearish Scenario (Alternative): A daily close below support could extend the move lower toward the next marked swing low.

FVG Setup: No FVG was formed this week or last, due to a lack of strong directional aggression.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?