“Discipline ensures consistent risk management.”

For these FTMO Traders, success came from structure, patience, and treating the FTMO Challenge as a professional evaluation. In this Q&A, Luis, Zsolt, and Samuel share how disciplined risk management, emotional control, and process-driven thinking helped them navigate the FTMO Challenge and Verification.

Trader Luis Alejandro: “Trade less, but trade better.”

What does your risk management plan look like?

My risk management plan is based on capital preservation and consistency. I risk a small and fixed percentage per trade, typically between 0.25% and 0.5%, depending on market conditions. I always define my Stop Loss before entering a trade and calculate position size accordingly. I avoid overtrading, limit the number of trades per session, and stop trading for the day if market conditions are not aligned with my strategy. My focus is on maintaining a favourable reward-to-risk ratio and protecting the account from unnecessary drawdowns.

How has passing the FTMO Challenge and Verification changed your life?

Passing the FTMO Challenge and Verification confirmed that my trading approach is consistent and disciplined. It gave me confidence in my process and reinforced the importance of patience and risk control. More than a financial milestone, it represents a professional validation of my trading skills and motivates me to continue trading with responsibility and a long-term focus.

What was more difficult than expected during your FTMO Challenge or Verification?

What was more difficult than expected was maintaining emotional discipline during periods of low volatility or slow market conditions. Avoiding unnecessary trades and waiting for high-quality setups required patience and strict adherence to my rules, especially knowing that the objectives were already within reach.

What was the hardest obstacle on your trading journey?

Developing trust in my strategy, accepting losses as part of the process, and focusing on long-term consistency instead of short-term results was the biggest challenge.

What was easier than expected during the FTMO Challenge or Verification?

Once I committed fully to my trading plan and risk rules, execution became easier than expected. Sticking to predefined setups, managing risk properly, and letting profitable trades develop without interference made the process smoother and more controlled.

What would you like to say to other traders that are attempting the FTMO Challenge?

Focus on risk management and consistency rather than chasing profits. Trade less, but trade better. Respect your rules, accept losses calmly, and treat the FTMO Challenge as a professional evaluation rather than a race. If your process is solid, the results will follow naturally.

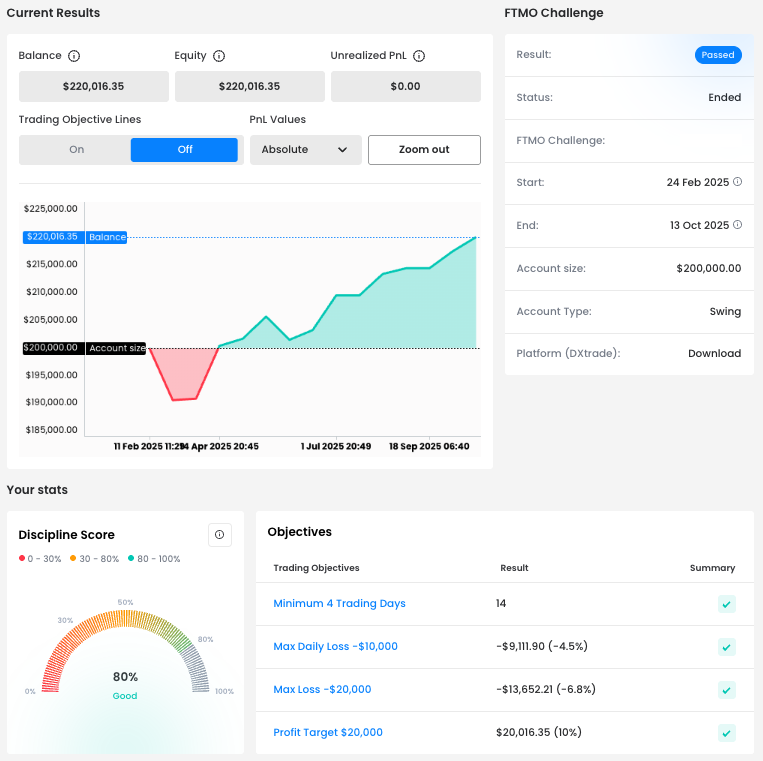

Trader Zsolt Robert: “The human mind is your only enemy.”

How did you manage your emotions when you were in a losing trade?

I didn’t feel anything, because my strategy is backed by stable data. I knew I would succeed; it was only a matter of time.

Where have you learnt about FTMO?

I heard about it on YouTube, then I read reviews on Trustpilot and Propmatch. The reviews were the most important factor in my decision.

What was easier than expected during the FTMO Challenge or Verification?

The identity creation process after completing the Verification phase. DXTrader is also a great choice because I’m not a huge fan of MetaTrader. The FTMO app is also immaculate. I love it.

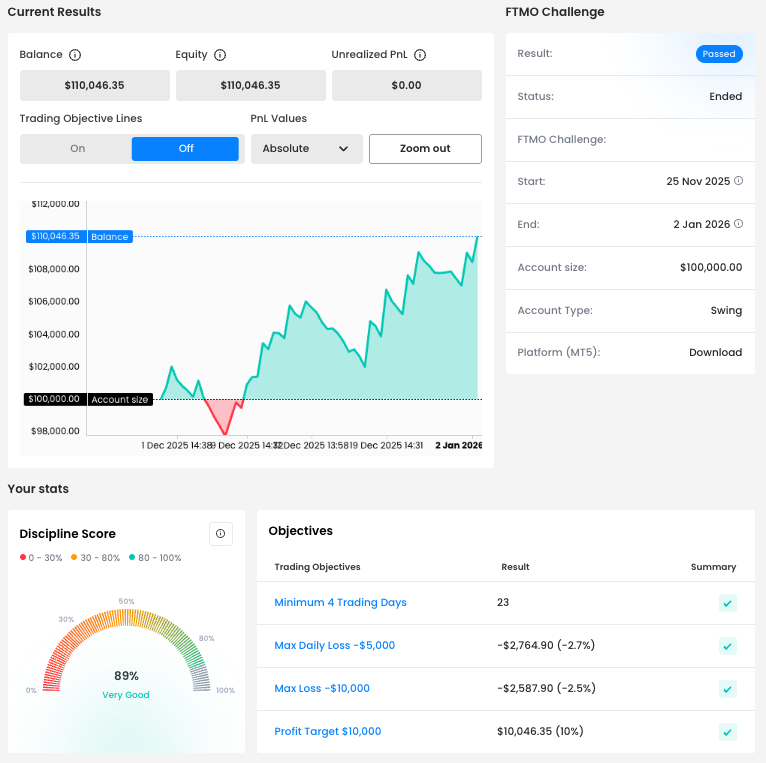

Do you plan to take another FTMO Challenge to manage even bigger capital?

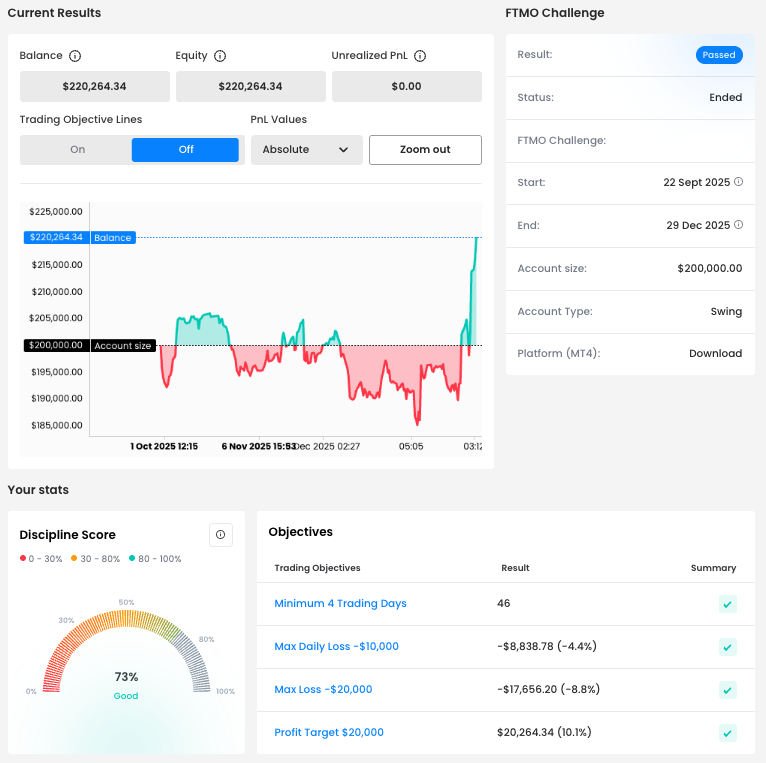

Yes, as soon as I can finance another 200,000$ account from the profit I receive from my first withdrawal.

What inspires you to pursue trading?

I am passionate about this whole world.

What is the number one advice you would give to a new trader?

Be patient and learn to deal with your emotions. The human mind is your only enemy.

Trader Samuel: “Focus on process, not profits.”

What do you think is the most important characteristic or attribute to become a profitable trader?

The most important attribute of a profitable trader is discipline. Discipline ensures consistent risk management, strict respect of the trading plan, and the ability to stay objective regardless of market conditions.

Where have you learnt about FTMO?

Instagram.

How did you manage your emotions when you were in a losing trade?

When I am in a losing position, I rely on predefined rules rather than emotions. My risk is always determined before entering the trade, and I accept the loss as part of the statistical process. I do not adjust positions emotionally or interfere with the trade. Once the trade is closed, I review it objectively and move on without attempting to recover the loss.

What was the hardest obstacle on your trading journey?

The most difficult obstacle was achieving consistency in execution and risk management. Overcoming this allowed my results to become more stable and repeatable.

How would you rate your experience with FTMO?

My experience with FTMO has been very positive. The rules are clear, the trading environment is professional, and the structure encourages disciplined risk management and consistency. FTMO’s framework aligns well with a process-driven trading approach.

One piece of advice for people starting the FTMO Challenge now.

Focus on process, not profits. Respect risk management rules, trade selectively, and aim for consistency rather than speed. Treat the FTMO Challenge as a professional evaluation, not a race.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?