“Focus on patience, controlled risk, and consistent execution.”

For these FTMO Traders, progress didn’t come from rushing trades or chasing fast results. In this Q&A, Mehdi, Daniel, and Gabriel share how discipline, patience, and risk management helped them navigate the FTMO Challenge and Verification with a clear, rule-based approach.

Trader Mehdi: “This time my mindset was calmer and disciplined.”

What was easier than expected during the FTMO Challenge or Verification?

What felt easier than expected was following the FTMO Trading Objectives and adapting to the trading environment, as I was already familiar with the system from previous FTMO Challenges. This time, my mindset was calmer and disciplined — instead of rushing to pass the Challenge with one aggressive trade, I focused on patience, controlled risk, and consistent execution. That made the whole process smooth and stress-free.

Describe your best trade.

One of my best trades was a gold (XAUUSD) scalp where I waited for multiple confirmations before entry. I analysed price action, volume behaviour, liquidity sweep, large trade activity, and order flow alignment. I only entered once more than 80–85% of my trading factors were aligned. After a clear liquidity sweep and volume shift, I took the trade with a tight Stop Loss and disciplined position sizing. Price moved quickly into my target area and hit my Profit Target smoothly. This trade perfectly reflected my rule-based execution and patience.

What does your risk management plan look like?

My risk management is focused on capital protection and consistency. I risk a fixed percentage per trade (0.5–1%), always use a hard Stop Loss, and carefully control position size based on volatility. I respect all daily and overall drawdown limits. My strategy emphasises locking profits early to reduce exposure and maintain steady performance rather than holding trades for extended targets. Discipline and execution quality always come before profit size.

How did you eliminate the factor of luck in your trading?

I eliminated the factor of luck by trading only rule-based setups with strict confirmations. I enter trades only when multiple factors align, including price action structure, volume behaviour, liquidity sweep, and order flow signals. I rely on statistical consistency across a large number of trades, with disciplined execution, rather than on individual outcomes. This systematic approach removes randomness and ensures repeatable performance.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a clear and structured trading plan, and I follow it strictly. My primary analysis is based on trend trading and higher-timeframe price action to define the main market direction. I only trade in alignment with higher-timeframe bias and then refine my entries on lower timeframes, mainly the 1-minute chart. When price reaches predefined levels from my higher-timeframe analysis, I execute using precise entry setups with increased confirmation and volume alignment. This top-down approach keeps my trading consistent and rule-based.

One piece of advice for people starting the FTMO Challenge now.

Focus on consistency and full concentration. Trade only one account at a time, especially if you are scalping. Managing multiple accounts with different position sizes divides attention and negatively affects execution quality. A single, focused approach combined with strict risk management and disciplined trade execution is the key to passing the FTMO Challenge.

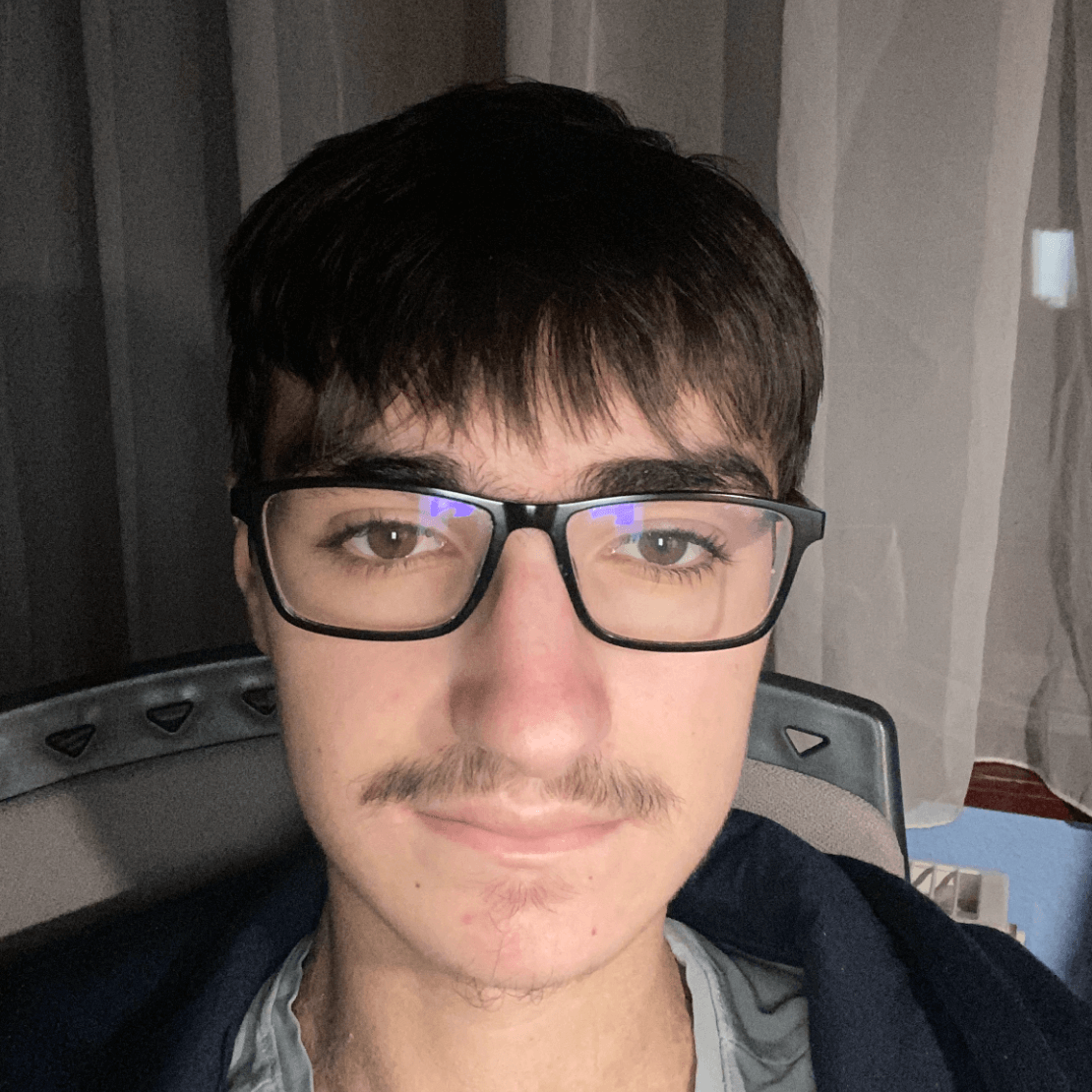

Trader Daniel: “Sometimes less is more.”

How did you manage your emotions when you were in a losing trade?

I managed them well, in my opinion. I never had the feeling that this wouldn’t work out because I have previous experience trading live accounts. Whenever I lost, I looked back at what I did wrong or what I shouldn’t have done and then moved on.

How has passing the FTMO Challenge and Verification changed your life?

It taught me to be more patient and more disciplined in trading and also in life. I sometimes kept trading whether I was in profit or loss during the day, and I started to cut this after a good trade, as sometimes less is more. Lastly, I also started trading less and just taking the best setups.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I do plan to buy a 50K or a 100K account in the future, but until then, I am trading with a 10K account so I can gain experience and hopefully some money.

What does your risk management plan look like?

I usually risk 0.5–1–1.5% (1.5% rarely appears). I set my risk based on my capital, then place my Stop Loss and Take Profit and turn on notifications, as I turn off my phone after placing the trade. I only get notifications when the price hits the Stop Loss or 50%, because I like to take partials to secure profits and set break-even levels.

What was the hardest obstacle on your trading journey?

Probably respecting the Max Daily Loss.

One piece of advice for people starting the FTMO Challenge now.

Don’t be afraid to try something new and trust them, because everybody was helpful, kind, and polite to me as well.

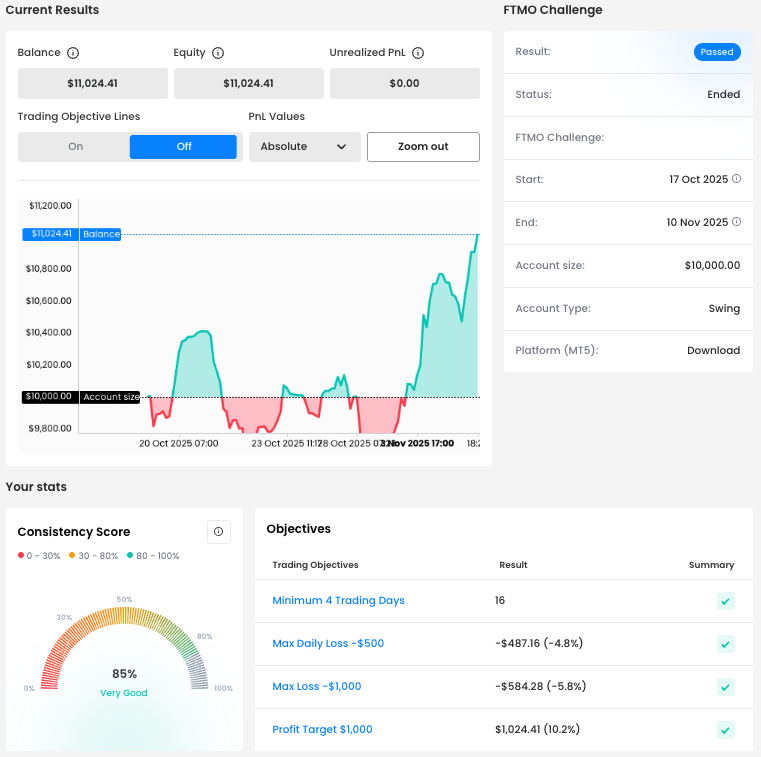

Trader Gabriel Benjamin: “Discipline, patience and risk management are key!”

What was more difficult than expected during your FTMO Challenge or Verification?

To meet Profit Target, and failing to make consecutive winning trades.

Describe your best trade.

The trade that played out as expected despite the wait. For example, my last two trades of the Verification phase. I waited all day for the perfect opportunity, only for it to take over 40 minutes and pass my Verification.

What was the most difficult part during your FTMO Challenge or Verification, and how did you overcome it?

I almost gave up on the Challenge phase. It took so long, and I changed strategies a lot. Finally, I went back to the strategy I started with and just needed to improve my discipline and patience to get back into the winning ways.

Where have you learnt about FTMO?

Back in 2022, through Twitter trading community spaces and Clubhouse.

How has passing the FTMO Challenge and Verification changed your life?

My life is full of hope because, from now on, any profits I earn will help improve it. I work a 9-to-5 job, which I wish to one day quit. This is the starting point.

What is the number one advice you would give to a new trader?

Discipline, patience, and risk management are key. Any strategy works under these three pillars.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?