“Treat trading as a business, not a gamble”

Most traders see trading as a way to make a quick buck and do not approach it as a serious business. This is why there are so many gamblers among traders who bet everything on a single trade, hoping to make a large profit. However, as our new FTMO Traders have already discovered, such an approach can never be successful in the long run.

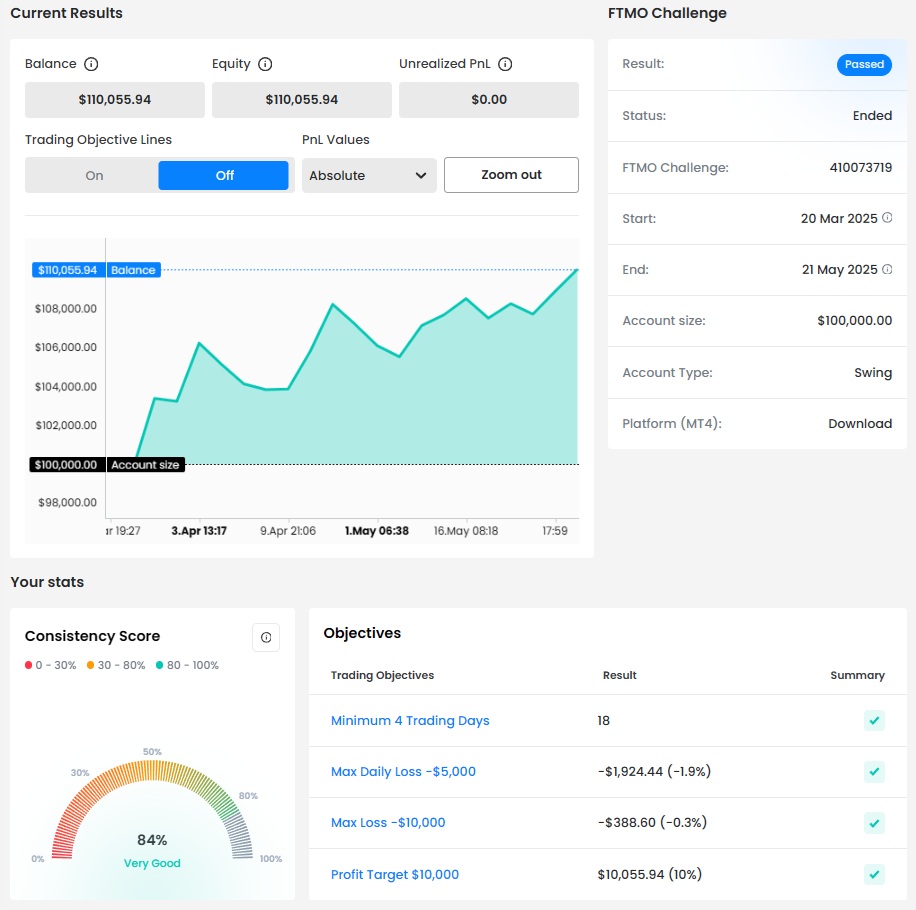

Trader Tim Christopher: “You have to be able to learn from your mistakes.”

How did you eliminate the factor of luck in your trading?

By using fundamental data in my Analysis and combining it with technical data for the entry (here mostly support and resistance sometimes trendlines) also going to higher timeframes made a huge difference.

What does your risk management plan look like?

I risk 1 percent on every trade and close early if the trade, for example, breaks resistance zone.

What do you think is the key for long term success in trading?

First: Keep it simple (don’t try to make a fancy strategy that doesn’t work in the end).

Second: Only technical data never worked for me, so I think fundamentals are must have to get the general direction.

Third: You have to be able to learn from your mistakes as long as needed and keep going until you fix enough mistakes to be profitable and then continue to become more profitable.

What do you think is the most important characteristic/attribute to become a profitable trader?

Two have passion and the consistency to keep going when it’s hard and not to quit when you have a losing streak sets the profitable ones apart from the rest.

Where have you learnt about FTMO?

It’s one of the biggest prop firms out there but I believe it was from a friend.

One piece of advice for people starting the FTMO Challenge now.

Don’t take too much risk in the challenge and try to be able to get some consistency first. I understand that you want to finish the challenge fast but, in the end, you’re not going to make money on the live account even if you pass if you can’t do it in a challenge. And since there is more pressure you should see it adds a learning opportunity.

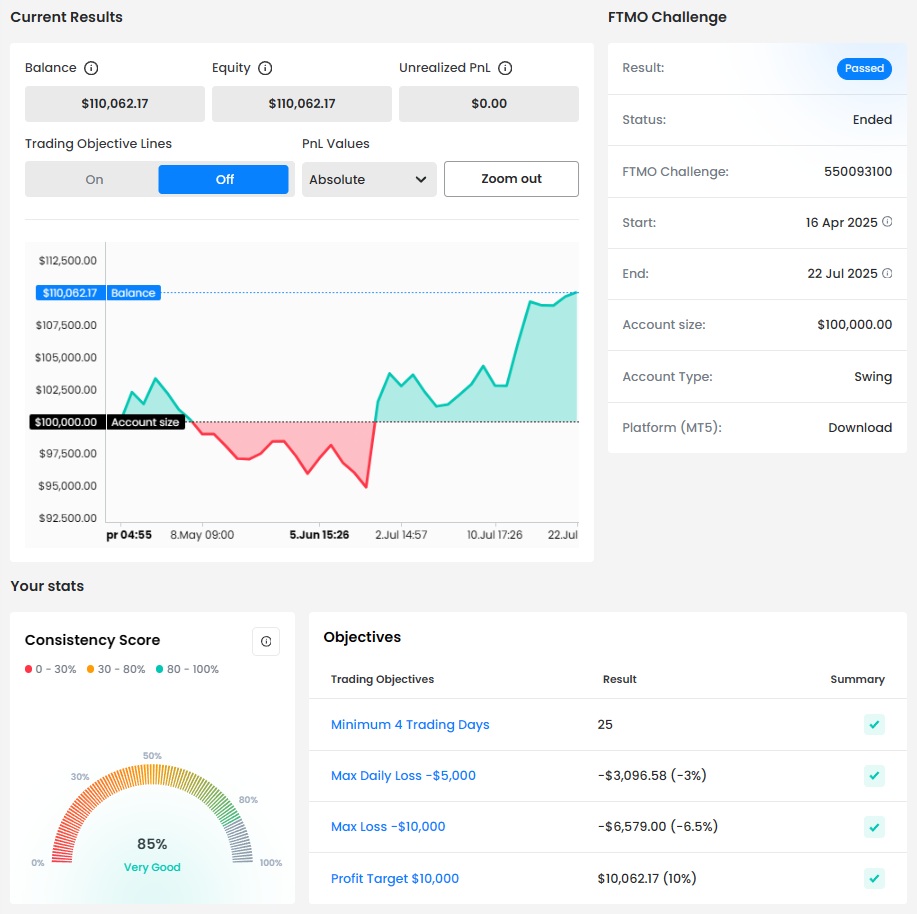

Trader Abdulsamad Olaposi: “A profitable trader needs to stick to his trading plan.”

What do you think is the most important characteristic/attribute to become a profitable trader?

Discipline and emotional control. A profitable trader needs to stick to his trading plan, even when facing losses or temptations to deviate. This includes setting and following strict risk management rules, not over-leveraging, and not letting fear or greed dictate decisions.

How did you manage your emotions when you were in a losing trade?

I accept the loss, review my decision to ensure it followed my strategy, and move on. I never chase losses or try to make back the money immediately, as this leads to further emotional and irrational decisions.

Where have you learnt about FTMO?

I learned about FTMO through my research on proprietary trading firms. I saw many positive reviews and testimonials from other traders who have successfully passed the challenge. FTMO’s reputation for providing a fair and supportive environment for traders is what caught my attention.

How would you rate your experience with FTMO?

I’ve had a great and hitch free experience so far.

What was easier than expected during the FTMO Challenge or Verification?

Verification.

What would you like to say to other traders that are attempting the FTMO Challenge?

Stay disciplined, patient, and focused on your trading plan. The FTMO Challenge is as much a test of your psychology as it is of your strategy. Don't rush to hit the profit target; instead, aim for consistent, small gains. Always prioritize risk management and never risk more than you're comfortable losing on a single trade. Remember that losing trade is not a failure, but an opportunity to learn and improve. Trust your process and believe in your ability to succeed.

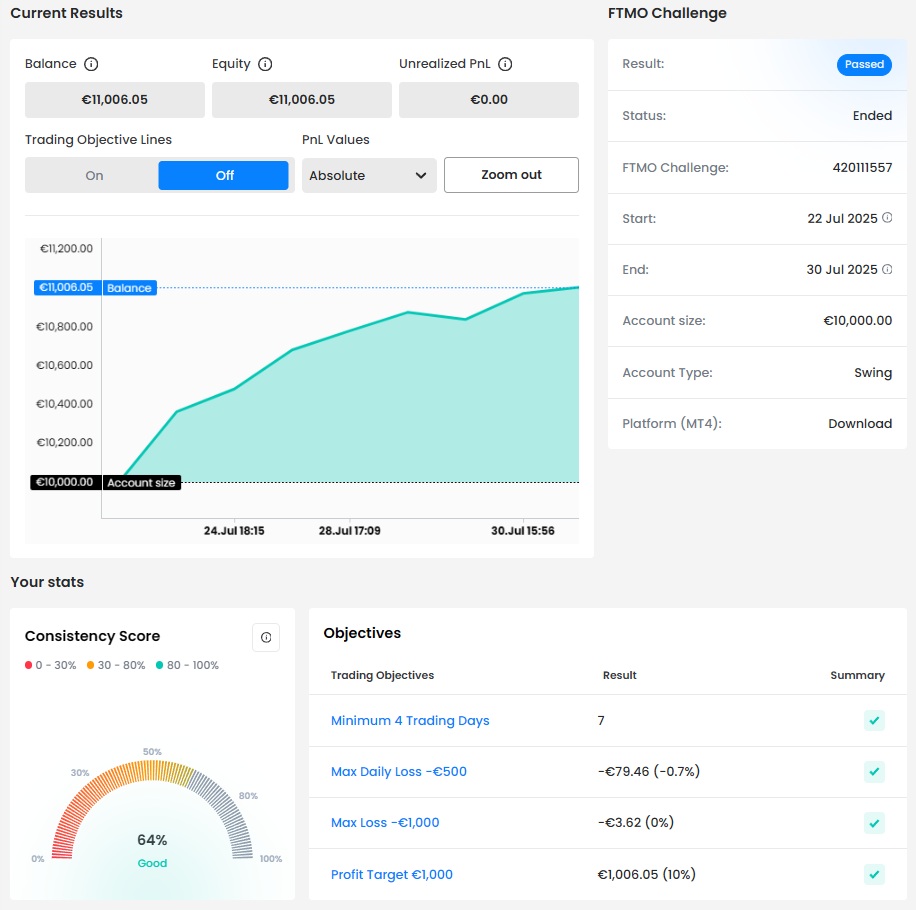

Trader Ruslana: “Consistent success comes from discipline and emotional balance.”

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult thing for me, I guess, was daily stop limit amount. But by reducing the lot size I was able to overcome it. And second difficulty was limitation of trading days, because of the fact that I’m more a swing trader.

What does your risk management plan look like?

My risk management is based on strict loss control and capital preservation:

- I limit risk per trade to no more than 1% of the account balance.

- I use mental Stop Losses based on market structure to protect every position.

- I have a daily loss limit of 2–3%, after which I stop trading for the day.

- I’m avoiding overtrading and making emotional decisions.

- I focus on high-probability setups and only strong high timeframe levels and prices, that are part of a backtested strategy.

- My minimum reward-to-risk ratio is 2:1, and I don’t flip positions without a clear setup.

Do you have a trading plan in place, and do you follow it strictly?

I’m always following strictly my trading plan and always waiting for clear setup.

What was more difficult than expected during your FTMO Challenge or Verification?

I had no difficulties this time with challenge and verification phases.

Describe your best trade.

My best trade wasn’t about the size of the profit — it was about the quality of my mindset. I followed my trading plan with full discipline, entered without hesitation, and managed the position calmly, without emotional interference. I wasn’t chasing the market or reacting impulsively — I was fully present, patient, and confident in my setup. That trade reminded me that consistent success comes from discipline and emotional balance, not just strategy.

What is the number one advice you would give to a new trader?

Focusing on protecting your capital and mastering your mindset — profits will follow. Many beginners chase quick gains, but real progress comes from building discipline, following a clear plan, and learning from every trade — win or lose. Treat trading as a business, not a gamble. Less is more.

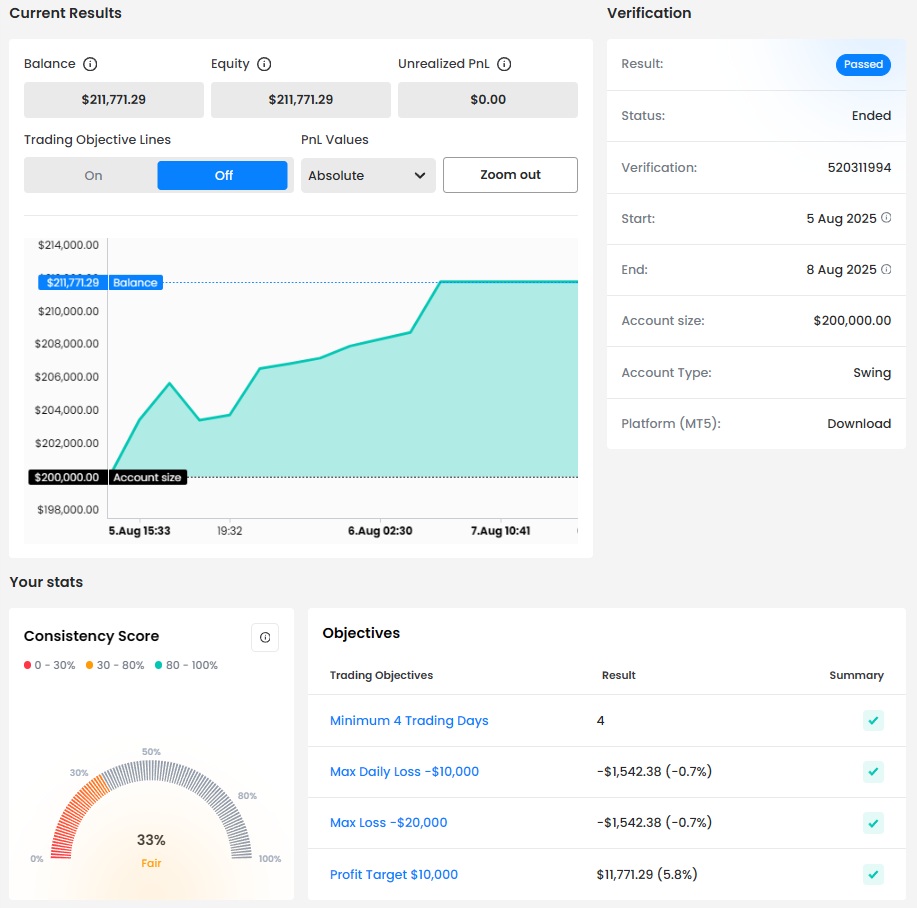

Trader Idris Owasina Akanni: “Profit is just the natural consequence of doing things right.”

What was easier than expected during the FTMO Challenge or Verification?

Once I started, I realized that sticking to my trading plan was easier than I expected. I had already built strong habits, so following my rules felt natural and gave me confidence throughout the process.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, without hesitation. This is just the beginning for me my aim is to scale up step by step, managing larger capital with the same discipline and precision that brought me here.

What was more difficult than expected during your FTMO Challenge or Verification?

The most challenging part was staying patient during days when the market was slow. It’s easy to get tempted to jump in, but I learned that sometimes, the best trade is no trade at all.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

Avoiding overtrading in choppy markets was the hardest part. I overcame it by reminding myself that trading is a marathon, not a sprint. I limited myself to high-quality setups and trusted the process, even if it meant taking fewer trades.

How did you eliminate the factor of luck in your trading?

I eliminated luck by relying on a tested strategy and strict risk management. Every decision was backed by analysis, not emotion, so my results came from skill and consistency rather than chance.

What is the number one advice you would give to a new trader?

Master your discipline before chasing profits. The market rewards patience, preparation, and risk control, profit is just the natural consequence of doing things right.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.