Trading Week Ahead: Massive Crypto Liquidations Hit the Market Amid Tariff Uncertainty

Markets ended last week on the back foot after Donald Trump’s renewed tariff against China triggered a sharp risk-off move, sparking a broad selloff and reigniting trade war fears. As sentiment remains fragile, the week ahead brings a high-stakes lineup of US data, including CPI, Retail Sales and PPI, all poised to influence Fed rate expectations and inject fresh volatility into the market.

• CPI

All eyes will be on the September CPI data. Headline inflation is forecast to slow from 0.4% to 0.3% month-over-month, but any upside surprise could disrupt dovish expectations. Core inflation remains the key focus, and a stubbornly high reading may push Treasury yields higher and weigh on equities, particularly rate-sensitive sectors like tech.

• Retail Sales

Retail Sales for September are set to drop from 0.6% to 0.4%, signalling a potential cooling in consumer momentum. However, if spending holds up better than expected, markets may interpret this as another sign of economic resilience, reducing the urgency for rate cuts. FX and equity traders should watch for any divergence from the forecast to reposition ahead of Q4.

• PPI

After a surprise contraction in August (-0.1%), September’s PPI is expected to rebound to 0.3%. This sharp turnaround may renew concerns about input cost inflation flowing into CPI data down the line. A stronger-than-expected print would reinforce hawkish pricing in rates markets and likely pressure equities and support the dollar.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Tuesday, Oct. 14 | 8:00 AM |  EUR EUR |

German CPI |

| 6:20 PM |  USD USD |

Fed Chair Powell Speaks | |

| Wednesday, Oct. 15 | 2:30 PM |  USD USD |

CPI |

| Thursday, Oct. 16 | 2:30 AM |  AUD AUD |

Employment Change |

| 8:00 AM |  GBP GBP |

GDP | |

| 2:30 PM |  USD USD |

Retail Sales | |

USD USD |

PPI |

*All times in the table are in GMT+2

Technical Analysis with FVG Strategy

This trading approach leverages the 20- and 50-period Exponential Moving Averages (EMAs) to assess the prevailing market trend, while the Fair Value Gap (FVG) is used to pinpoint zones of price inefficiency. These gaps, formed during sharp price movements, often highlight optimal entry or exit levels. The strategy is suitable for instruments like EURUSD, GBPJPY, US30, and XAUUSD and provides insights into both last week’s market opportunities and the current one.

Weekly Market Outlook

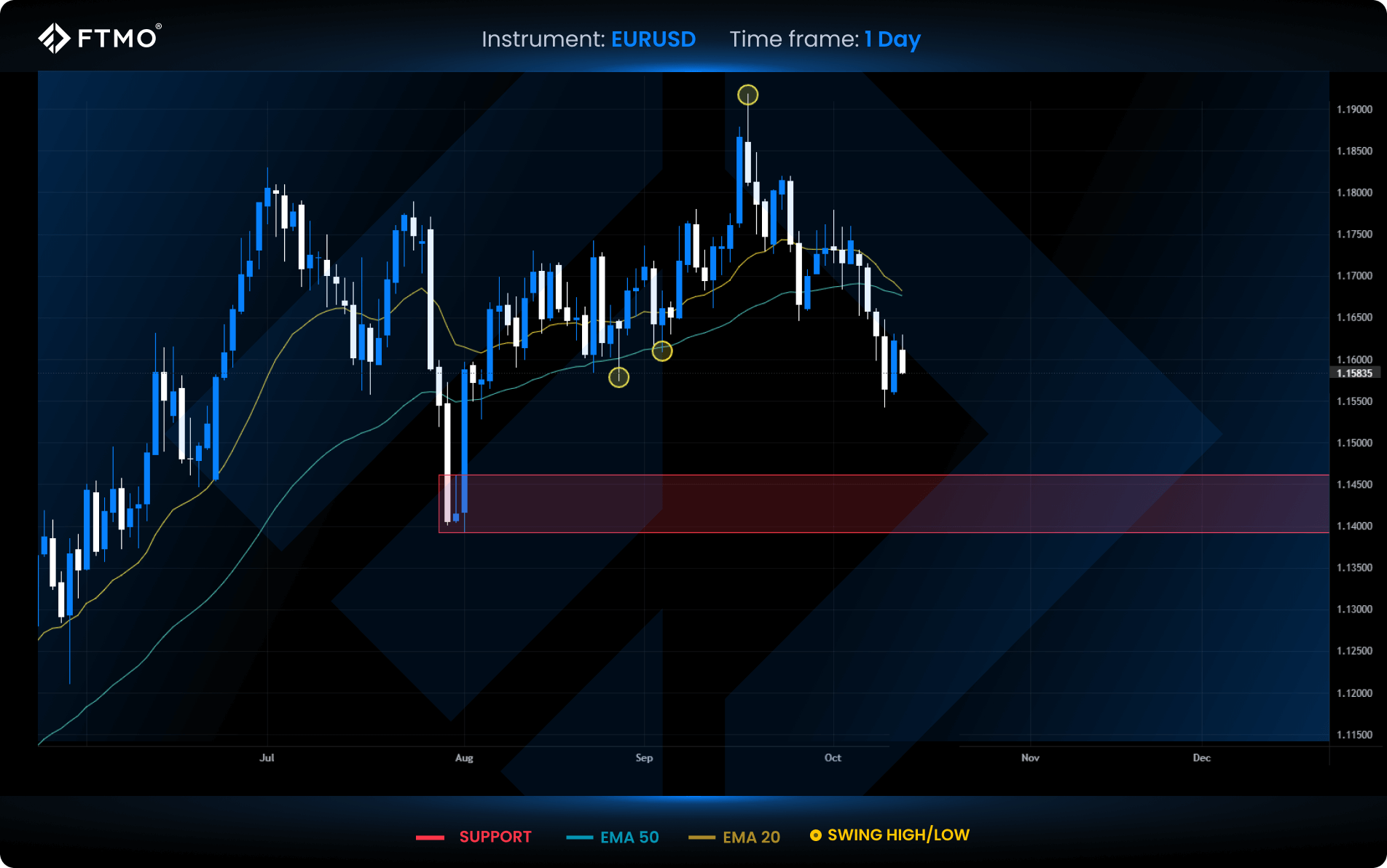

EURUSD

Market Context: EURUSD remains in a downtrend, trading below both the 20 and 50 EMAs. The pair recently swept two-month liquidity and is now approaching a key support zone, which could act as a potential target if a bearish FVG forms.

Bearish Scenario (Preferred): Price could continue lower into the support zone. This area may act as a reaction point, where the market reveals its next directional bias.

Bullish Scenario (Alternative): A reversal could occur if the price closes back above the 20 and 50 EMAs or if a bullish FVG setup forms. Such a move would signal a potential trend shift.

FVG Setup: No new FVG has formed this week.

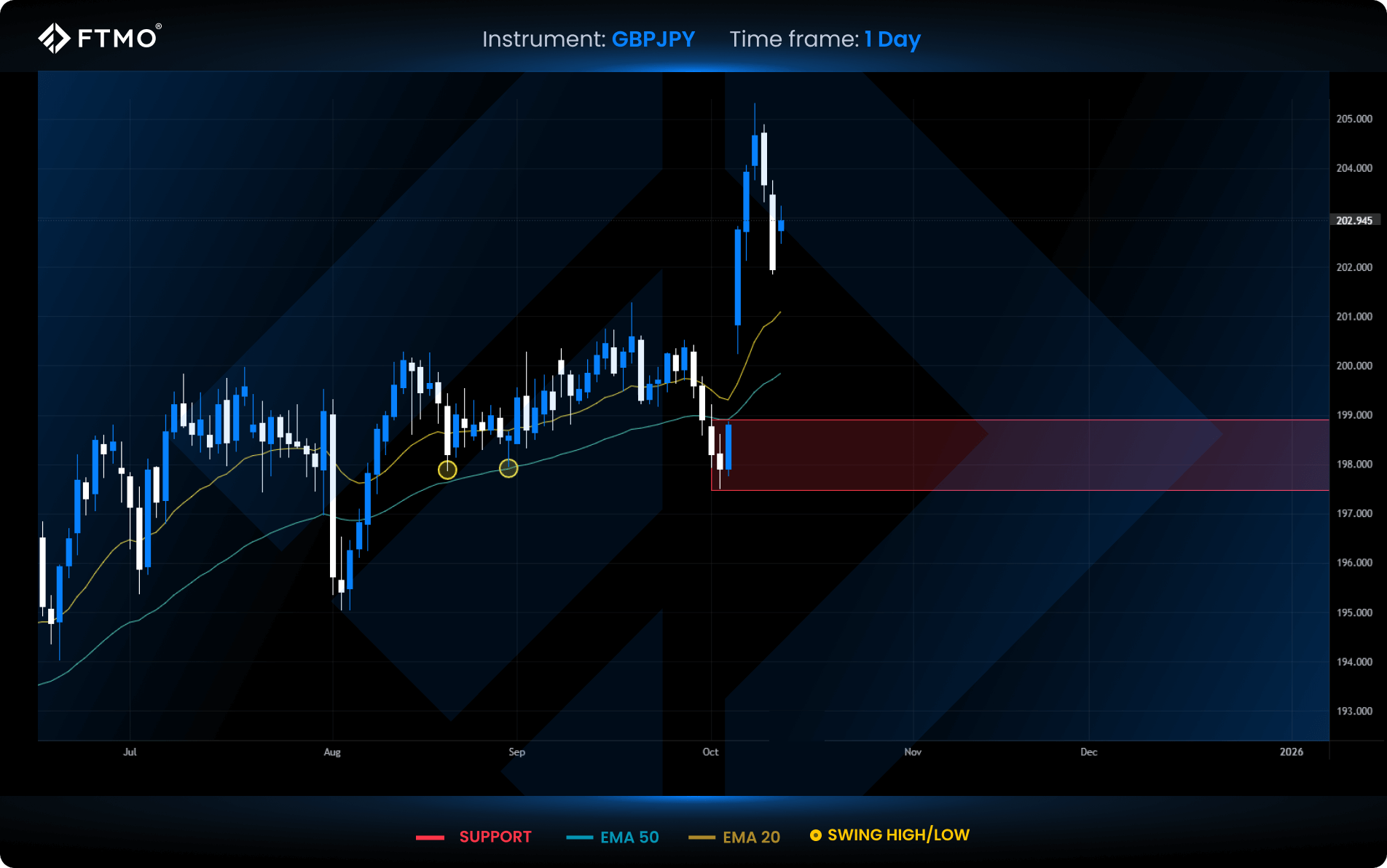

GBPJPY

Market Context: GBPJPY is still reacting to the recent liquidity spike following last week’s overnight gap. Since the end of last week, price has been heading lower, creating an opportunity for a gap fill.

Bearish Scenario (Preferred): The expected move is a continued drop to fill the overnight gap, with the gap zone acting as the primary liquidity target.

Bullish Scenario (Alternative): A bullish reversal may occur if momentum shifts, potentially sending the pair back into a continuation of the uptrend.

FVG Setup: No new FVG has formed this week.

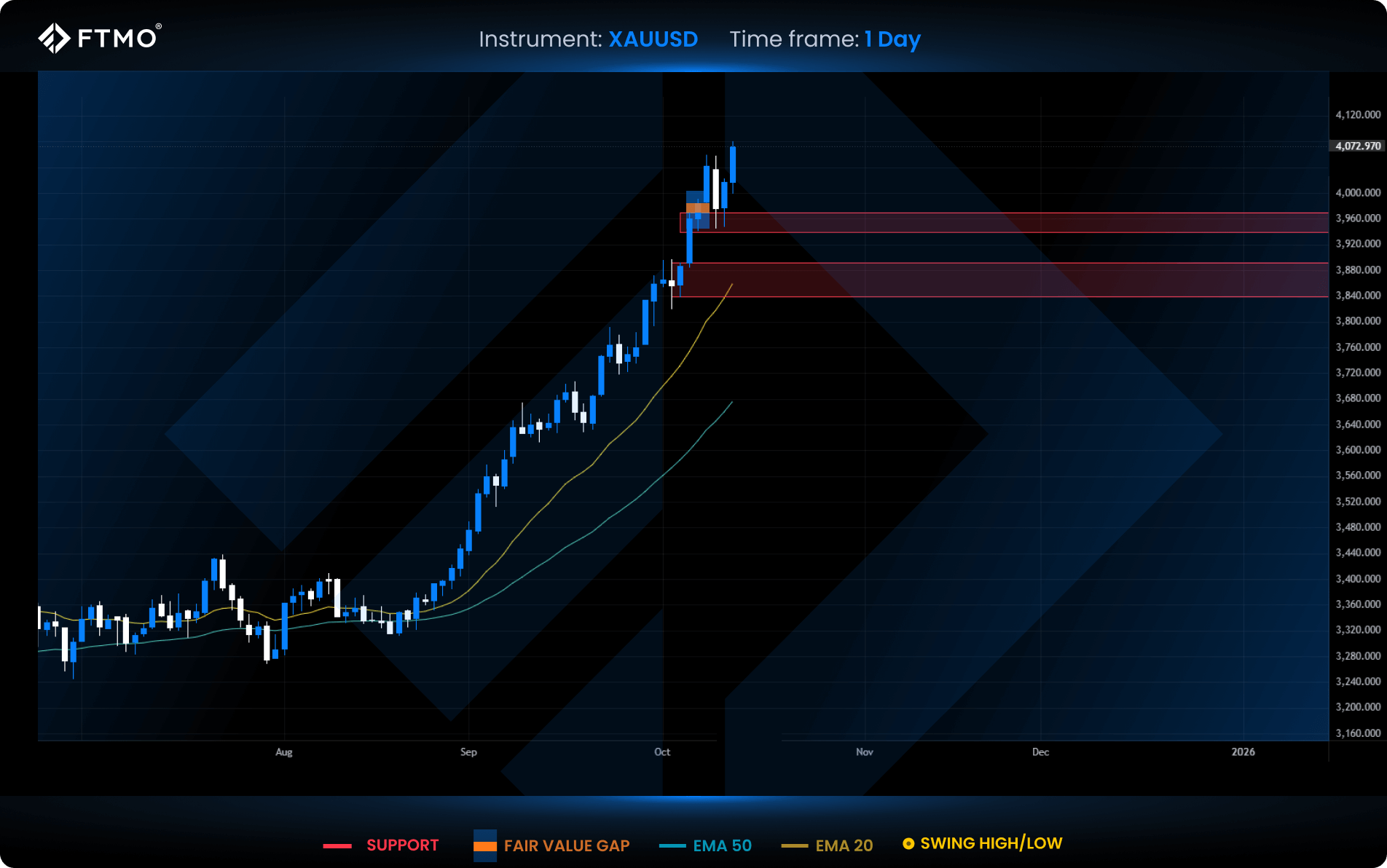

XAUUSD

Market Context: Gold has printed yet another all-time high, continuing its extraordinary bullish run. Friday’s dip was a reaction to comments by former President Trump regarding tariffs, but the market quickly recovered, reaffirming bullish strength.

Bullish Scenario (Preferred): The uptrend looks set to continue, supported by a swift recovery after Friday’s correction. Price action remains strong, and sentiment favours further upside.

Bearish Scenario (Alternative): While trend reversal is not evident yet, strong trends often end with sharp corrections. Caution is warranted, especially near extremes.

FVG Setup: No new FVG formed this week. Last week’s setup reached its 2:1 RRR target.

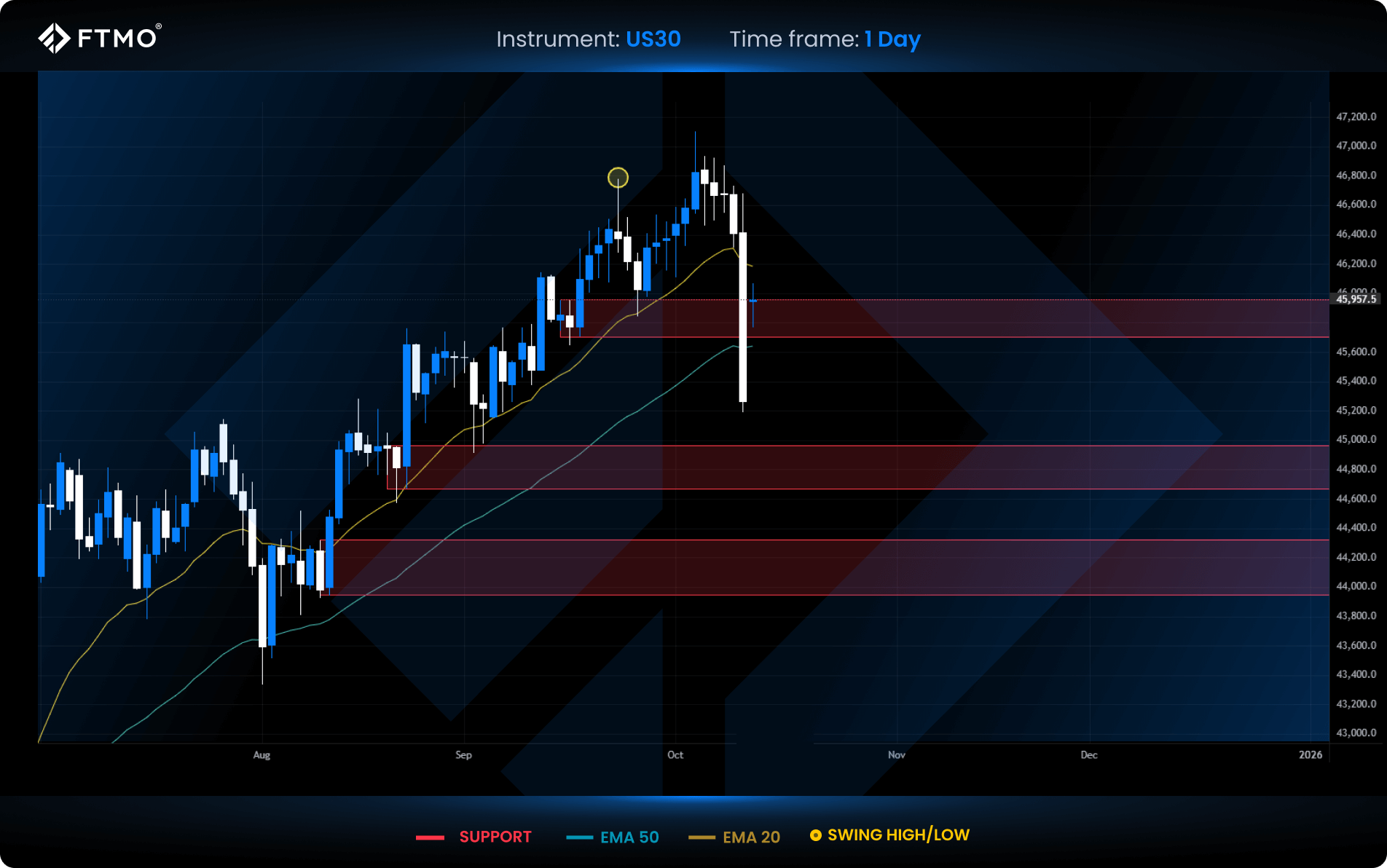

US30

Market Context: US30 saw a sharp reaction to remarks from President Trump. Today’s open suggests signs of recovery, but the next few sessions will be critical in confirming whether the move was just a liquidity sweep or the start of a broader correction.

Bullish Scenario (Preferred): If recovery continues, the index could return to its previous bullish trend. The structure remains intact unless confirmed otherwise.

Bearish Scenario (Alternative): A bearish scenario would gain validity if a new short FVG forms and the index fails to recover recent losses.

FVG Setup: No FVG has formed this or last week.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.