Trading Week Ahead: Bullish FVG Setup on US30 as Index Hits a New All-Time High

Three key US macro events are set to drive market sentiment this week: Fed Chair Jerome Powell’s speech, Flash PMI data, and the final estimate of Q2 US GDP. Each event could significantly influence interest rate expectations, move Treasury yields, and spark volatility across equities and the US dollar. Here’s what traders need to watch.

• Fed Chair Powell Speaks

The Fed delivered its first rate cut last week, and markets expect two more by early 2026. Powell’s Tuesday speech will be key for clues on timing. A dovish tone could weaken the dollar and lift equities, while a cautious message may support yields and weigh on risk sentiment.

• US Flash Manufacturing and Services PMI

Flash PMIs, due Tuesday, will offer a timely snapshot of economic activity. Manufacturing PMI is expected to fall to 51.8 from 53.0, while Services PMI is forecast to dip to 53.8 from 54.5. Both remain in expansion territory, but weaker-than-expected results may fuel concerns about a slowdown and strengthen the case for Fed easing. Stronger data would likely support the dollar and risk sentiment.

• US Final GDP

The final GDP figure for the second quarter is due Thursday, with the forecast holding steady at 3.3%, matching the previous estimate. While no change is expected, any revision could shift the market’s view of the US economy. A stronger number would likely boost Treasury yields and the dollar. A weaker result could increase expectations for policy easing later this year.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Tuesday, Sep. 23 | 9:15 AM |  EUR EUR |

Flash Manufacturing, Services PMI |

| 3:45 PM |  USD USD |

Flash Manufacturing, Services PMI | |

| 6:35 PM |  USD USD |

Fed Chair Powell Speaks | |

| Wednesday, Sep. 24 | 4:00 PM |  USD USD |

New Home Sales |

| Thursday, Sep. 25 | 9:30 AM |  CHF CHF |

SNB Policy Rate |

| 2:30 PM |  USD USD |

GDP | |

| 4:00 PM |  USD USD |

Existing Home Sales | |

| Friday, Sep. 26 | 2:30 PM |  CAD CAD |

GDP |

USD USD |

Core PCE Price Index |

Technical Analysis with FVG Strategy

This technical method combines the 20- and 50-period EMAs to identify market direction, paired with the Fair Value Gap (FVG) concept – price imbalances caused by strong market momentum that highlight potential entry and exit zones. The strategy is applicable to instruments like EURUSD, GBPJPY, US30, and XAUUSD, offering a perspective on trading opportunities from both the previous and current weeks.

Opportunities to Watch This Week

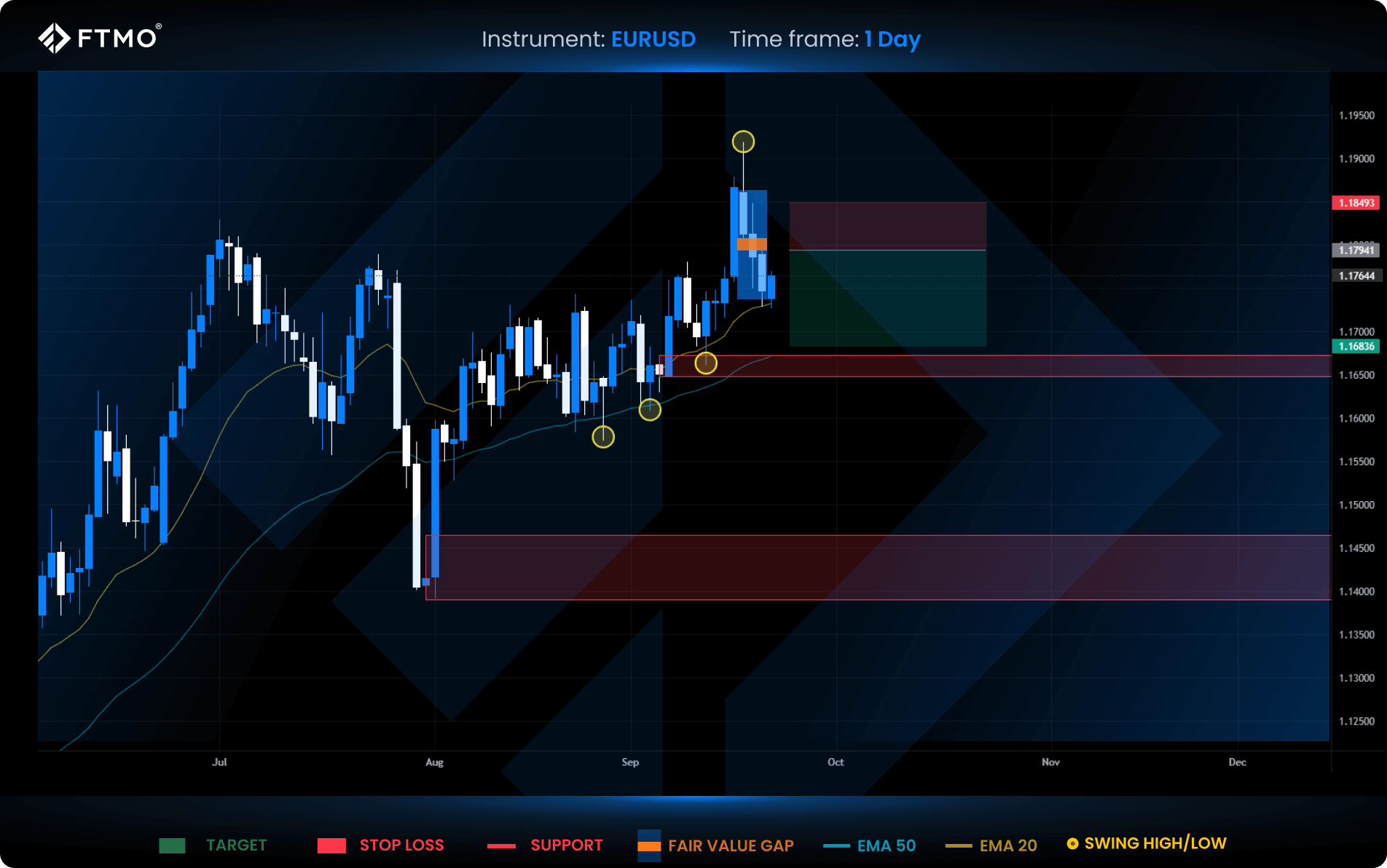

EURUSD

Market Context: Euro sweeps multi-month liquidity and is currently in a corrective phase. Price still holds above the 20 and 50 EMA, though a sharp rejection has printed a bearish FVG this week.

Bearish Scenario (Preferred): Short from the FVG zone with a 2:1 RRR target or a deeper move toward the support zone and marked swing lows.

Bullish Scenario (Alternative): A bounce from EMA levels could trigger continuation toward the recent swing high in line with the broader bullish structure.

FVG Setup: This week’s bearish FVG remains in play.

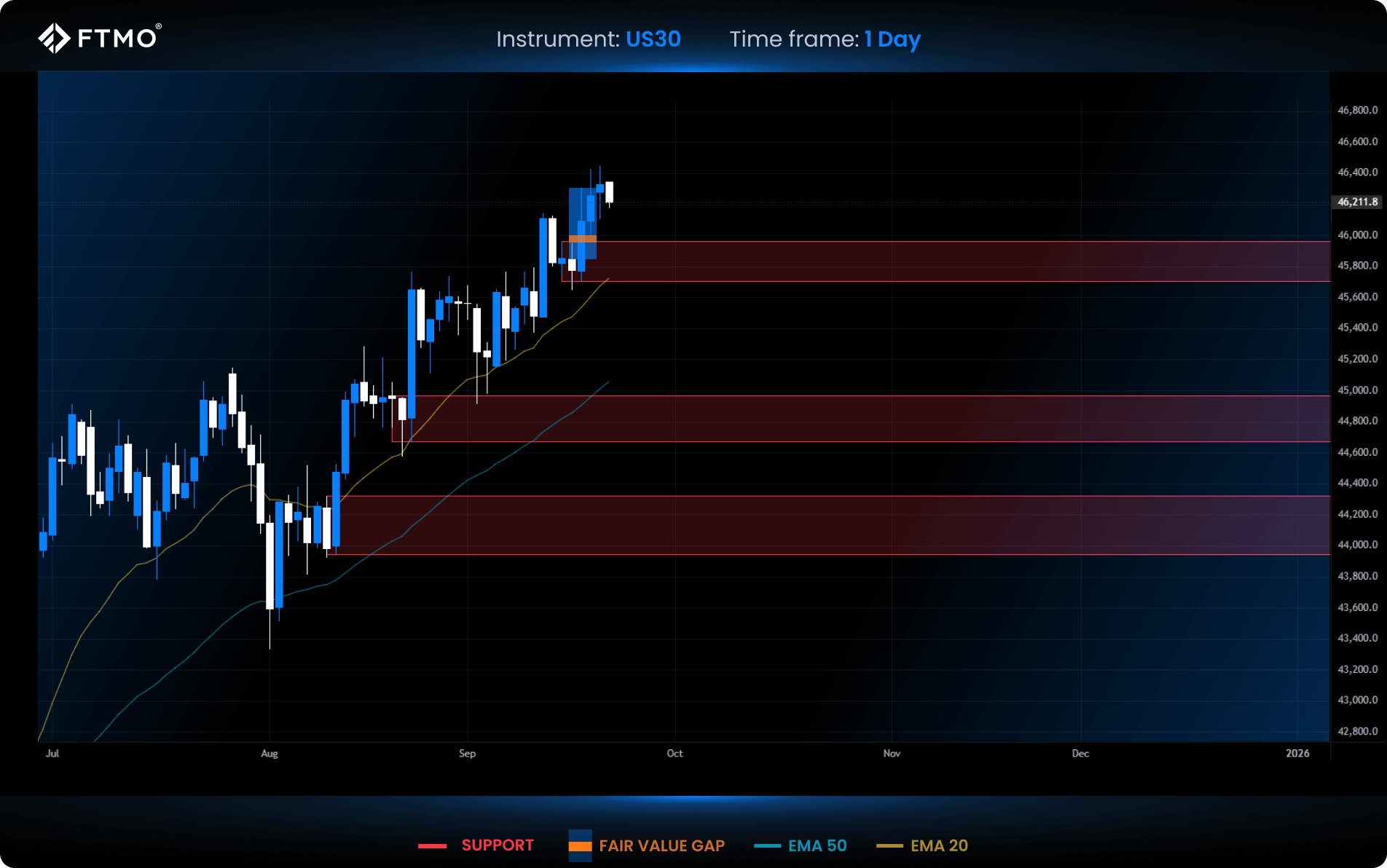

US30

Market Context: US30 remains in a strong bullish structure, consistently printing new highs. The index is positioned for a potential corrective pullback into support.

Bullish Scenario (Preferred): A retracement into the support zone followed by renewed buying interest aligns with the active bullish FVG.

Bearish Scenario (Alternative): A close below support may indicate a structural shift and potential reversal into short bias.

FVG Setup: A bullish FVG was confirmed this week and remains active.

Last Week’s Opportunities

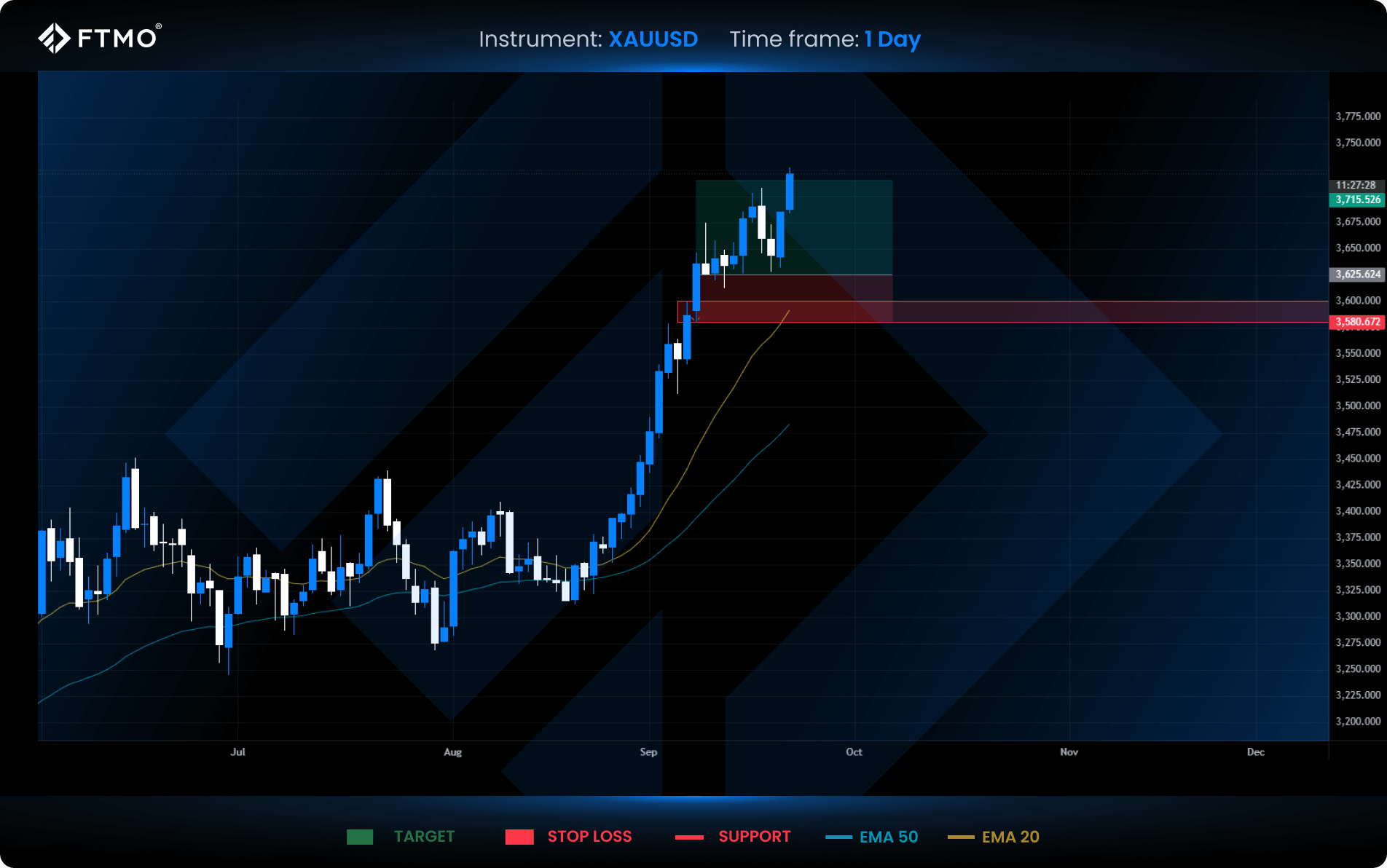

XAUUSD

Market Context: Gold continues to print fresh highs, showing no signs of trend fatigue. Last week’s bullish FVG successfully hit its target.

Bullish Scenario (Preferred): Further continuation toward new highs in line with the prevailing uptrend.

Bearish Scenario (Alternative): A short-term correction back into the nearest support zone could offer a dip-buying opportunity.

FVG Setup: No new FVG setup was formed this week.

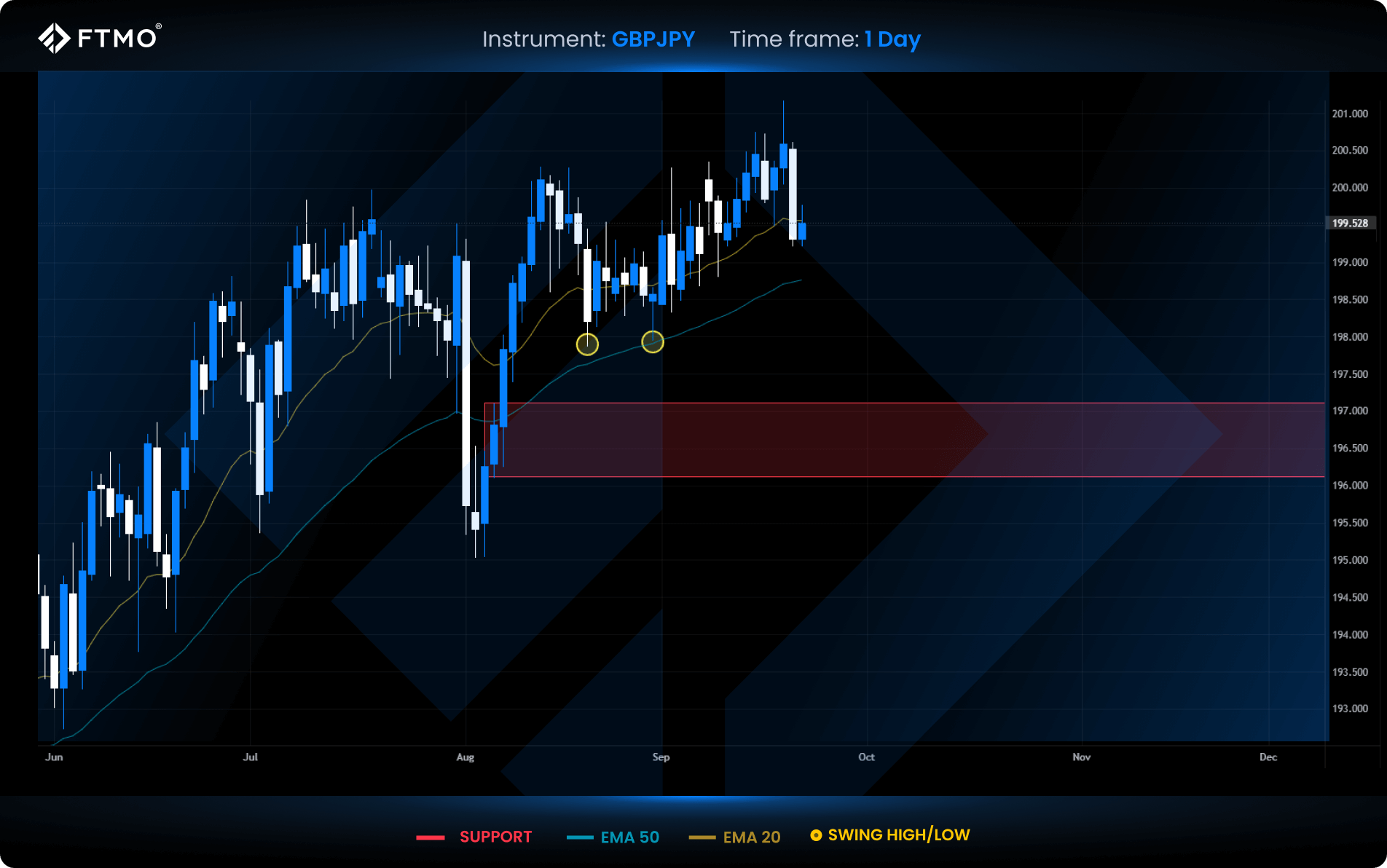

GBPJPY

Market Context: Price held a rising channel last week before breaking to the downside on Friday. Currently, the pair trades near the 20 EMA, acting as dynamic support.

Bullish Scenario (Preferred): Rebound from the EMA and continuation of the bullish momentum remain the primary expectations.

Bearish Scenario (Alternative): A drop below the 20 EMA could target swing lows and test the key support zone, likely attracting strong buyer interest.

FVG Setup: No valid FVG setup formed due to relatively stable price action.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis, or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.