“To get what you want you always need to take a risk or give something away”

Trading is a risky business, but it is a risk that a trader must be aware of and work with. It's not about mindless risk and betting everything on one card or gambling, but about proper risk management and money management. And our new traders Ozan Celal, Adrian, Roman and Daniel are also aware of this.

Trader Ozan Celal: “In my opinion, luck doesn't play much of a role in trading.”

How did you manage your emotions when you were in a losing trade?

I think I managed my emotions well when I was in a losing trade, because I know that I'm risking maximum 1% of my capital. I also know and keep telling myself when I'm in a losing trade that I did everything right, that was my point to entry and that what my strategy "said". In my opinion this is one of the most important things in trading that you have to follow your plan and of course everyting has to be planned.

What do you think is the key for long term success in trading?

As I said one of the most important things is to have a plan and follow it. This, combined with psychology, which is also the most important thing in trading, is the key for succes in my opinion. Of course you have to learn a lot of things "in the game", I mean the strategies, then you have to learn what is happening and why is this happening and these type of things. But all in all I think there is not a single key to success in trading, because you have to learn so many things and so many keys for long term success in trading but what I mentioned in the beginning these things the keys for success for me.

What was easier than expected during the FTMO Challenge or Verification?

I expected the criteria to be harder and harder to meet. But that is just my opinion, and I'm sure that they are difficult for most traders.

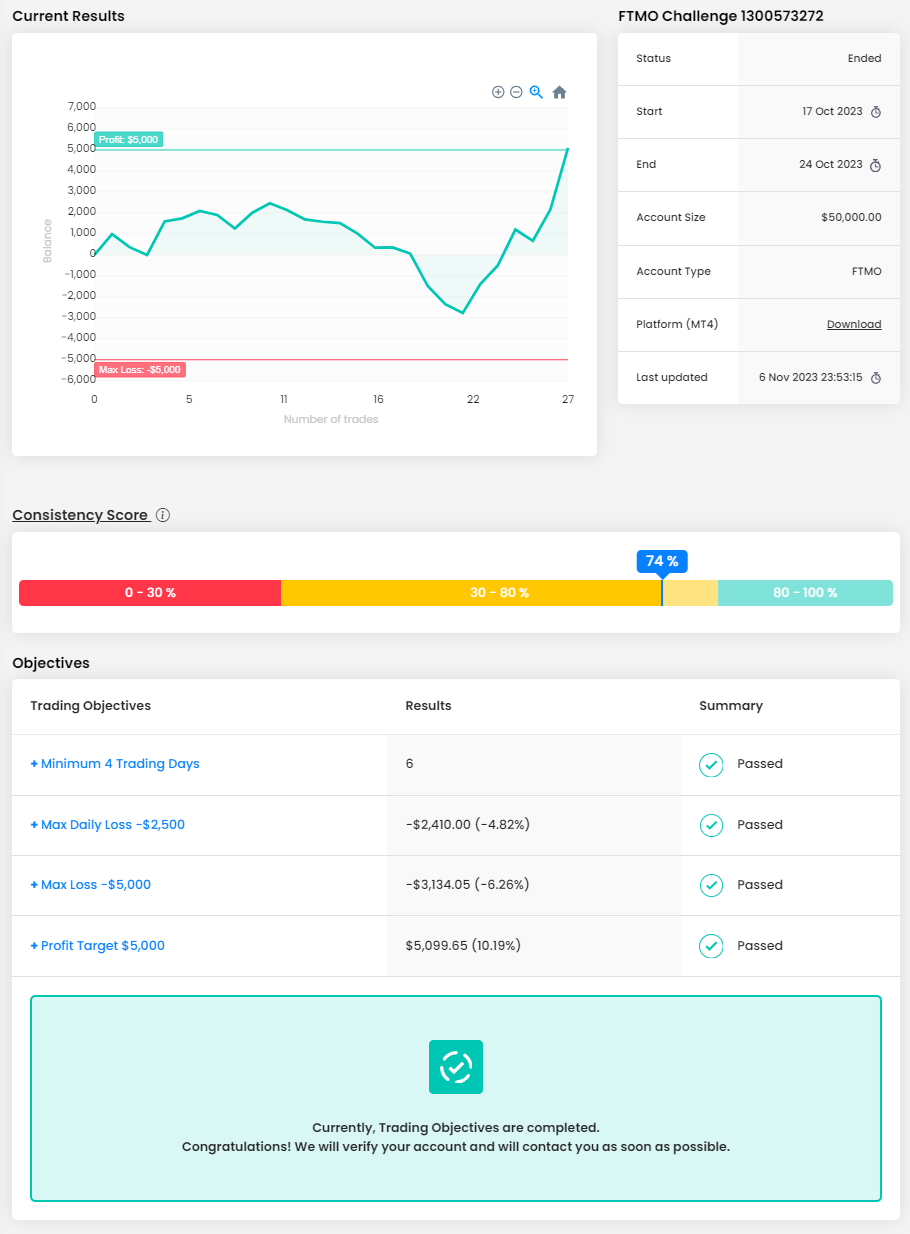

What was the most challenging aspect of your FTMO Challenge or Verification, and how did you overcome it?

The hardest part for me was knowing that I could only lose 5% of my capital per day, 10% overall, and obviously I have never lost 5% in a single day and I never will more than 5% per day, but in your own account you don't have to worry about these types of things, and so it was more difficult, but I tried to ignore this information when I was in a position or about to trade. But apparently I bought it overall and paid attention to it.

How did you eliminate the factor of luck in your trading?

In my opinion, luck doesn't play much of a role in trading, especially if we don't want to trade under news. Considering that I manage every one of my trades, I couldn't even say that I was lucky that I took out a trade here and there because I manage my trades properly. So luck didn't play much of a role in my trades, they were all pre-planned and I didn't trade before or during news.

One piece of advice for people starting the FTMO Challenge now.

Be committed, be patient and never give up! If you work hard, you can do everything. And my favourite quote: Most people overestimate what they can achieve in the short term and almost everyone underestimates what they can achieve in the long term.

Trader Adrian: “The FTMO loss limits are like guide rails which steer me clear of taking on too much risk.”

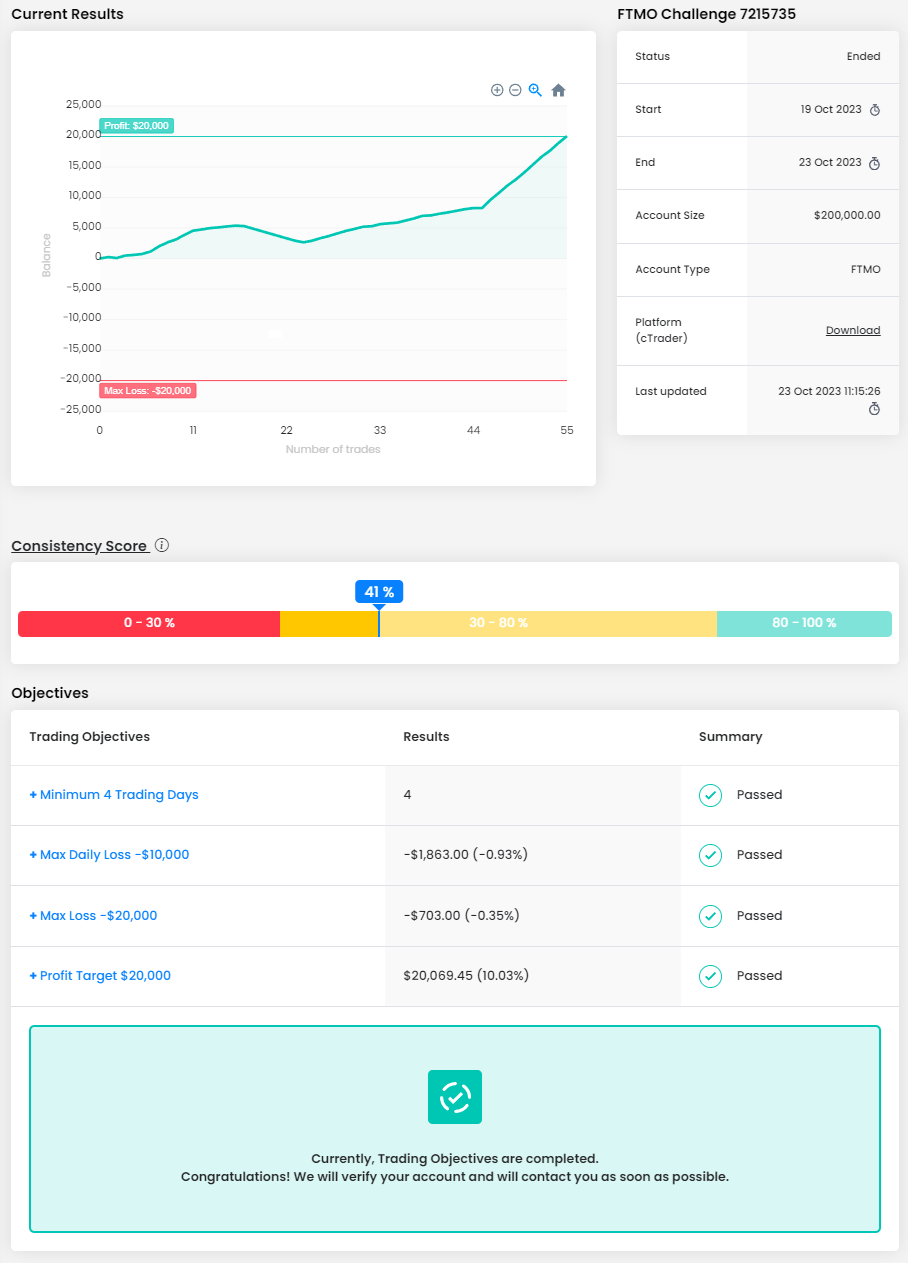

How did passing the FTMO Challenge and Verification change your life?

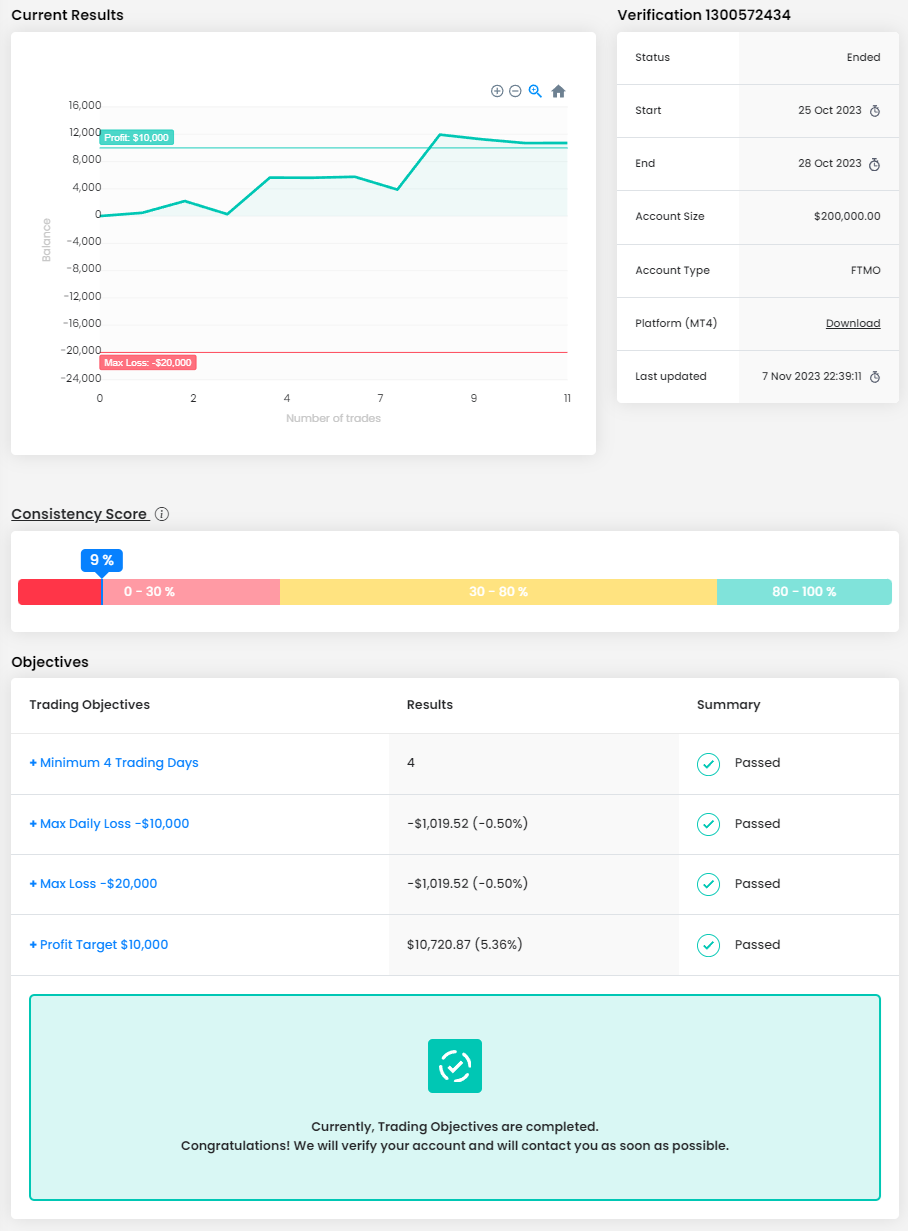

Having a large amount of capital to trade with is a total game changer in terms of being able to generate income outside of my normal day job and particularly with a $200k USD account, one can make a decent income whilst only risking a small % per trade! If I can keep this account and be consistent I plan on reducing my hours worked in my job down to part time.

Do you have a trading plan in place, and do you follow it strictly?

I definitely have a trading plan in place which I follow 90% of the time. To increase this to 100% I am in the process of making checklists for each of my strategies to make sure that I no longer make any silly mistakes which are outside of my plan which can be very costly.

How did loss limits affect your trading style?

With my personal trading account there are no loss limits which is a double edged sword which has actually caused me more harm than good in terms of overleveraging. The FTMO loss limits are like guide rails which steer me clear of taking on too much risk and in particular the daily loss limit helps me to walk away on a bad trading day instead of being prone to revenge trading.

What inspires you to pursue trading?

The possibility of having financial freedom and more free time to pursue my hobbies and passions.

What do you think is the key for long term success in trading?

Having a trading plan with proven, backtested strategies combined with knowing your psychological weaknesses and then practicing techniques to prevent those weaknesses from holding you back from your true potential as a trader.

What is the number one advice you would give to a new trader?

Manually back test your strategies so that each time your setup happens you know the probability of it being a profitable trade. The more data the better (5 years + is ideal). With this back tested data in your arsenal, it makes a world of difference in eliminating emotions while trading!

Trader Roman: “The simplest and at the same time the hardest thing was to accept your fear and follow the plan.”

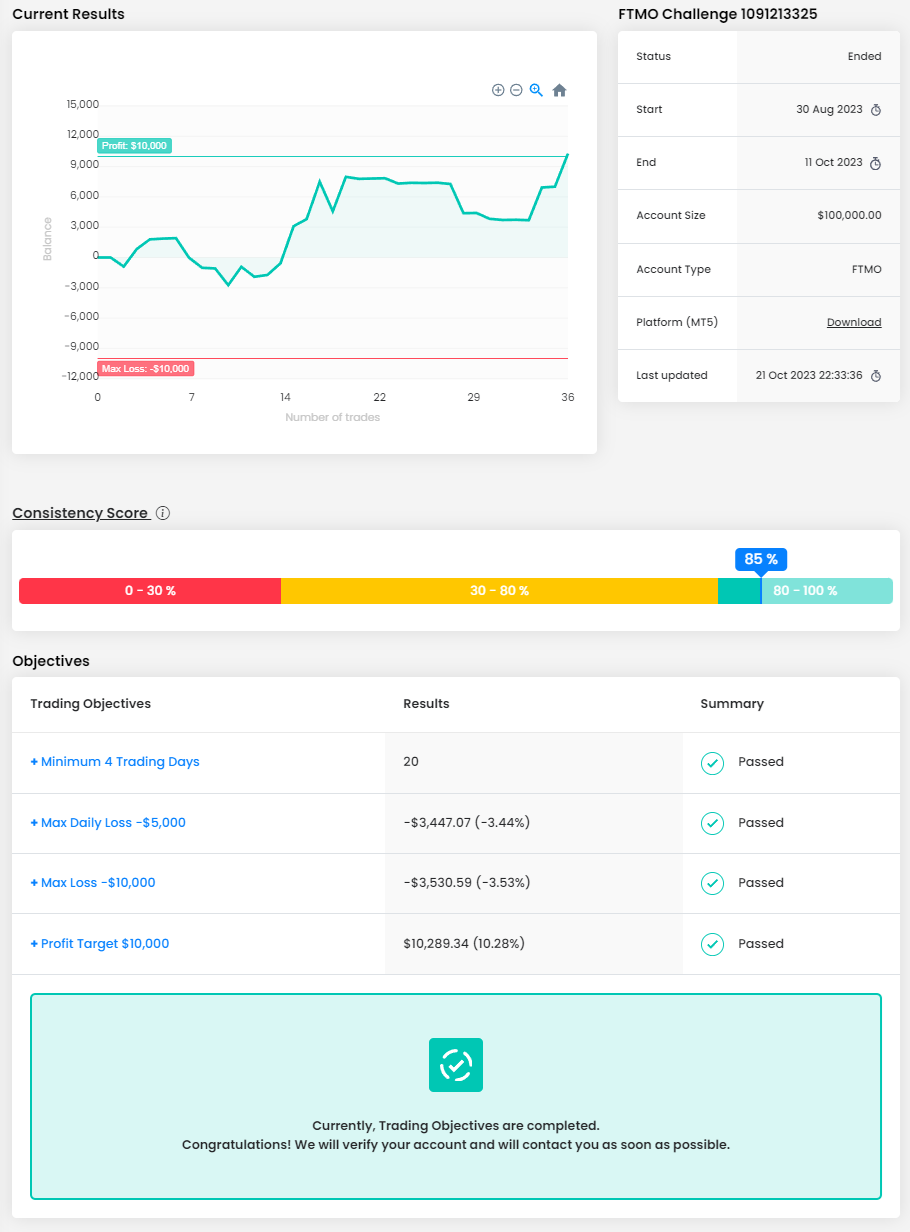

What does your risk management plan look like?

I have rules regarding risk management that I always try to adhere to and follow my trading strategy. My risk per trade does not exceed 2%. Also, after one unsuccessful trade a day, I usually stop my trading day, the exception is only in those cases when I understand that I was in a hurry with my entry and my narrative for the day will work out and I am sure of it, I can afford to enter into the transaction again but with less risk.

What was easier than expected during the FTMO Challenge or Verification?

As a trader, I am constantly faced with emotions of doubt as to whether I made the right choice by entering this or that trade. The simplest and at the same time the hardest thing was to accept your fear and follow the plan. To get what you want you always need to take a risk or give something away.

Has your psychology ever affected your trading plan?

At the beginning of my journey of becoming a trader, psychology played a key role, as it often pushed me to illogical and unreasonable actions. Long and careful work on myself helped me cope with negative emotions. YES, they are still present, but I don't let them take over my actions.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I would like to increase my trading deposit with FTMO, but it’s only a matter of time, I’ll do it when I realize that I’m ready. Small steps to big victories.

What do you think is the most important characteristic/attribute to become a profitable trader?

Often, I hear from other famous and strong traders that the key aspect is psychology. In fact, I believe that first and foremost, every successful trader should have a trading strategy that suits his personality type and that is based on statistics - statistics are the key to success. In addition to all this, the ability to manage risks, risk management and then the psychological aspect, I think so.

What is the number one advice you would give to a new trader?

Don't try to make quick and easy money. Don't expect that trading is the key to getting rich in a short period of time. Study, backtest, statistics, work on your discipline. Never exceed the risk and do not chase large deposits at the beginning of your journey.

Trader Daniel: “Be patient. Only take the best trades.”

How did you manage your emotions when you were in a losing trade?

It was a process to get to the point where I could manage the emotions. Practice was key. I do believe that one of the biggest lessons I learned is to be grateful for everything I learn when I lose a trade. We will progress faster if our emotions remain positive, but I'm still working on that. Also, creating the right risk management strategy helps you to know that even when you have a loss, your strategy (and with God's help) you are more likely to have higher profits and continue to move forward. Know that you will be patient and wait until you have all the confirmations for the next trade.

What was more difficult than expected during your FTMO Challenge or Verification?

Honestly, I'm grateful for how well things went during the Challenge. I did have an initial downswing during the beginning phase, which got me nervous, but overall, things went very well. I'm grateful for that. The most difficult thing leading up to being able to take the Challenge was creating a good risk-management strategy, staying patient and waiting for the right time to enter the trades.

Describe your best trade.

One of the best trades I had was the one that I took when I passed the first phase of the Challenge. It was based off Fibonacci and the market was trending and went to where I expected. Those are generally my best trades and they usually happen after waiting through the consolidation phase, which is the most tricky and very tempting to trade, but when the consolidation phase ends, there is often a pretty clear path for me on where the market will go. That was the case with this trade.

How did loss limits affect your trading style?

I really do appreciate the maximum loss limits. They actually helped me to create a solid risk management strategy. My first goal is to get profitable and stay profitable. I want to be far away from the overall maximum loss. As for the daily loss, I have determined that if I ever lose more than $5,000 in a day, I have to stop. That means that my profitable days are at least $10,000. So not only do I have risk management on my individual trades, but I also have a daily risk management strategy. It has helped a lot because when you're struggling enough to lose $5,000 (based off of a $200,000 account) you're most likely not understanding the market the way you thought you were and it's good to take a break. There is one very important thing I would recommend, and that is to base the daily loss off of the total account balance of the previous day, and not off of the initial account balance. This would allow me to scale my account the way that I would like to, based off of my risk-management strategy.

How would you rate your experience with FTMO?

5 Stars. I truly appreciate being able to take as many practice tests as I needed to in order to feel comfortable enough to take the real trial. That helped a ton. Customer service has also been great. The way you have adapted and changed the rules according to what makes the most sense has been great as well. I only have 1 strong recommendation and that is to make the daily maximum limit based on the total account size of the previous day, and not on the initial account size.

One piece of advice for people starting the FTMO Challenge now.

I would only take the real Challenge after having taken the Free Trials enough to feel comfortable. So far, the things that have helped me the most are the following... Be patient. Only take the best trades, and wait until I am locked in. Being locked in means that based on all of my indicators, I truly feel where the market is going and taking the trade at the right time. Basically, instead of fear of loss and greed, it's based off faith and knowledge... A feeling of calmness. It's the same type of emotion as when I'm driving a car... I calmly watch the road and take the turns at the time I need to, doing my best to stay safe as I go. I love that there is no time limit. It truly helps to keep this mentality.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.