The road to profits is never a straight path

A perfect example that the road to success isn't always smooth and filled with profitable trades is today's featured trader from the series on successful FTMO Traders.

Unlike the previous case, where the trader had a near perfect balance curve and was a little short of 100% successful trades, today's trader is a slightly different case. The trader we will look at today has been struggling with losing trades since the beginning of his trading period and his trade success rate is far from 100%.

While a high success rate is a psychological factor for many traders that helps them achieve long-term profits, it is not the most important aspect of trading. If a trader is confident in the success of his strategy, is able to accept a relatively large number of losing trades and adjusts his RRR accordingly, he can be profitable in the long run even with a success rate of around 50%.

The balance curve of today's trader is far from perfect and was briefly in the red at the beginning of the trading period. However, it was nothing dramatic and the trader was able to work his way to a very attractive result with gradual steps and a consistent approach.

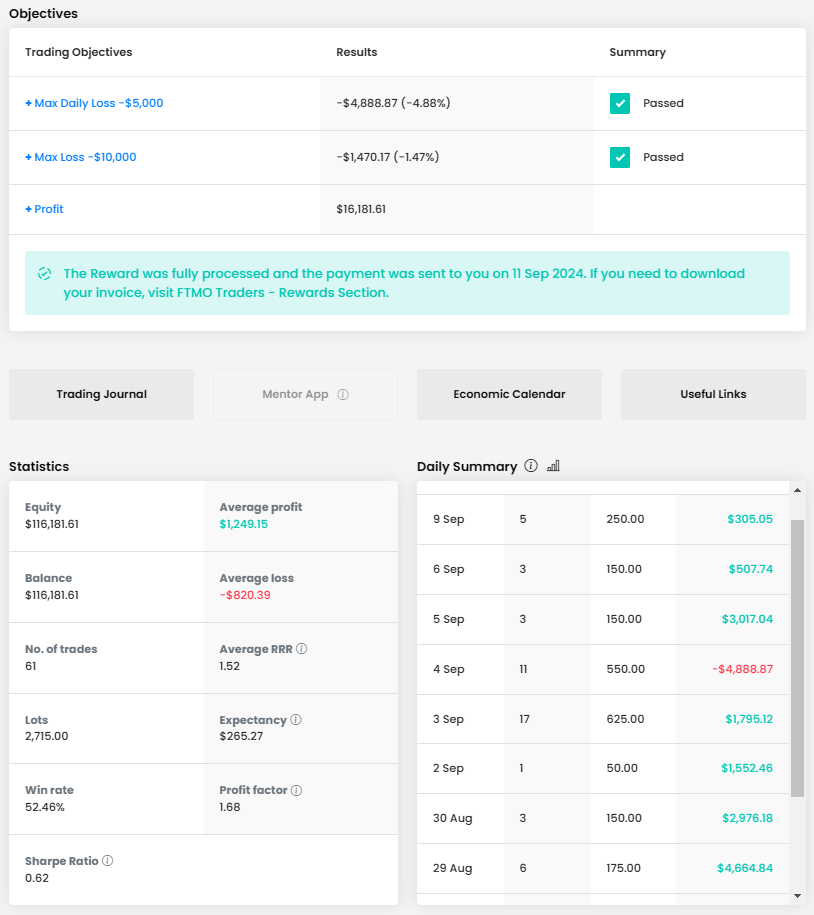

A profit of almost $40,000 is again a great result, which at an account size of $200,000 is almost 20%. Despite the "bumpy" road to this result, the trader had no problem with the Maximum Daily Loss limit or the Maximum Loss limit, which he came nowhere near. The aforementioned trade success rate was just shy of 55%, but combined with an RRR of 1.71, even with such a relatively low success rate, a very high profit can be made.

To achieve this impressive result, the trader needed 11 trading days and 137 trades with a total size of 629.8 lots, which is an average of around 4.6 lots per trade. However, the trader opened different sized positions and often opened additional orders, so the total size of some of his trades may have been 25 lots. However, given the size of the account (he opened such large positions on the indices), this is not a problem.

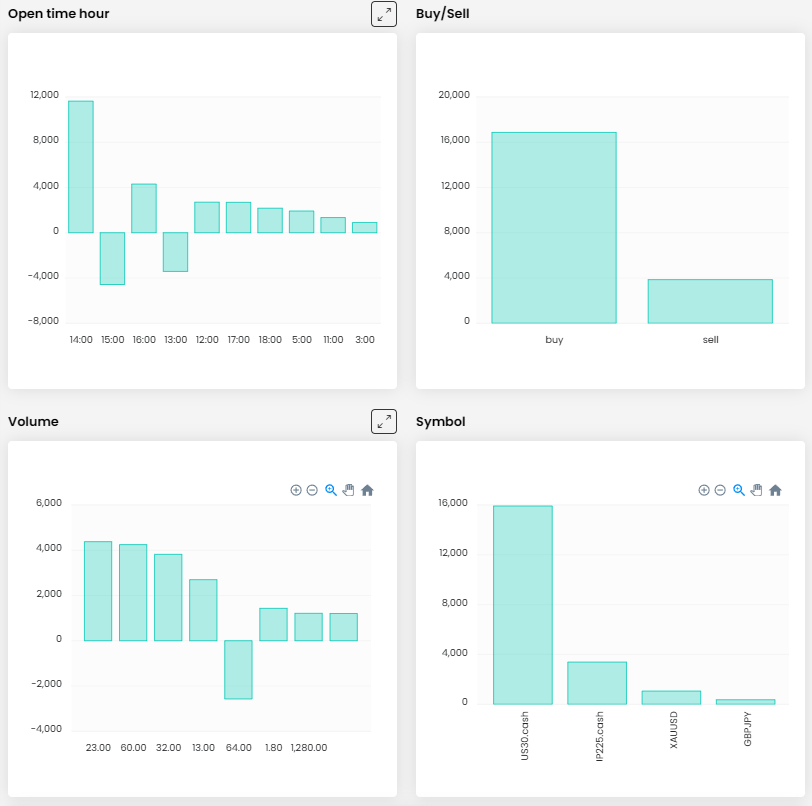

The journal shows that he is a typical intraday trader who holds positions open from a few minutes to several hours, and only rarely does he hold a position open overnight (in this case for only five trades at the beginning of the trading period).

We appreciate that the trader entered both a Stop Loss and a Take Profit on every order, and it is also a great credit to the trader that in only three cases did the losing trades end up more than $2,000 in the red. Thus, the trader risked less than 1% of the account on most trades, which is a very good approach from a risk management perspective. With such a large account, there's no need to risk an excessive amount of money on a single trade.

The trader had no problem making money on both long and short positions, which we are happy to see. He split his trades into five instruments, two of which are precious metals (gold XAUUSD and silver XAGUSD), two are indices (US30 and US100) and he also made a couple of trades on the EURJPY currency pair. However, it is already evident from the journal that most of his focus was on gold. The results for the individual instruments look accordingly. Interestingly, he achieved a positive result on all instruments, which is not the norm.

The trader was one of the more active traders and his appetite for trading grew as he did well. On the first trading days he made only a few trades, on the last one it was already 24, unfortunately he did not do very well on this day.

We mentioned in the journal section that the trader entered SL and TP on all positions, which is positive. On the other hand, the trader, due to his strategy (and probably slight impatience), set the TP so far that he almost never reached it. It's a pity, and it shows that the trader should work a bit on how he handles his exits. The right way to exit, or in this case adjusting the exit strategy, might be what leads to even better results.

In the image below, we see an example of one of the trader's best trades, which was preceded by a trade that, while not ending in a loss, was exited perhaps a bit unnecessarily early. Here, the trader was entering a position in gold at a time when it had risen to an all-time high and was in consolidation. This period can be quite difficult for swing and position traders with longer investment horizons, but for short-term speculators it is perfect.

The trader entered the position at a time when it looked like a change in the direction of the short-term uptrend. The first trade was executed after a bounce off short-term resistance, including a good Stop Loss above the recent top. Unfortunately, the trader didn't hold his nerve and closed the trade after it looked like a possible break of the mentioned resistance (it could easily have been just a stop loss hunting of big traders). He closed the position manually and did not move the SL.

The second trade, which ended with a profit of over $8,500, saved the situation in the end. After forming a local double top and breaking the lower "neckline", he re-entered the short position, which he closed with a nice profit thanks to the fast price movement. Once again, he didn't hit the set take-profit (TP) target. However, considering the realised profit and the shift in price direction, there was no need for regret in this case.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?