“The hardest obstacle I faced was myself, if I’m being honest.”

Trading isn’t only about strategies and setups. In this Q&A, three FTMO Traders open up about emotions, discipline, and risk management on their journey through the Evaluation Process.

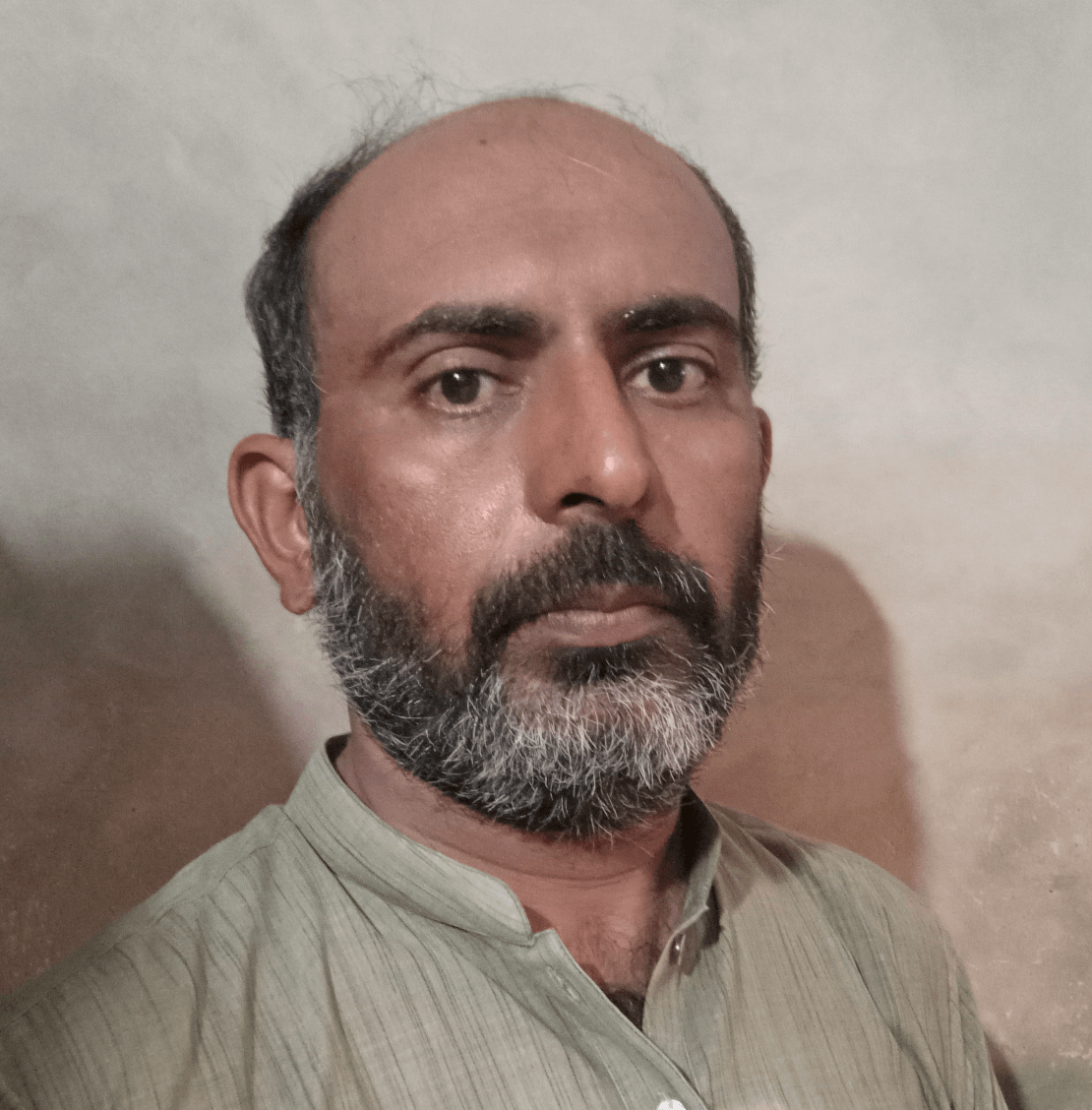

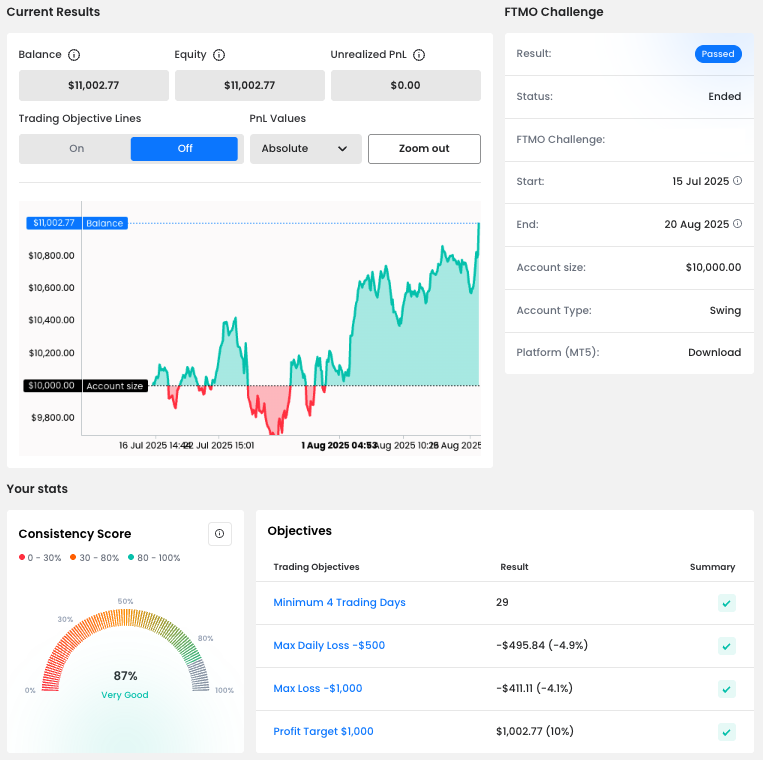

Trader Tanveer: “Focus on discipline and risk management instead of chasing profits.”

What was the hardest obstacle on your trading journey?

The hardest obstacle on my trading journey was managing emotions and maintaining discipline, especially during drawdowns. Learning to stick to my plan and focus on consistency rather than quick profits was the biggest challenge, but also the most valuable lesson.

How did you eliminate the factor of luck in your trading?

I eliminated the factor of luck by developing a structured trading plan based on backtested strategies, strict risk management, and clear rules for entries and exits. This helped me rely on data and probabilities instead of emotions or chance.

How would you rate your experience with FTMO?

My experience with FTMO has been excellent. The platform is professional, transparent, and provides a great opportunity to trade with discipline and proper risk management while growing as a trader.

Describe your best trade.

My best trade was when I patiently waited for my setup, entered with proper risk management, and followed my plan without emotions. The trade hit my target exactly as analyzed, reinforcing the importance of discipline and trust in my strategy.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, I plan to take another FTMO Challenge to manage even bigger capital as it will allow me to scale my trading, increase profitability, and further grow as a professional trader.

One piece of advice for people starting the FTMO Challenge now.

Focus on discipline and risk management instead of chasing profits — consistency is the key to passing the FTMO Challenge.

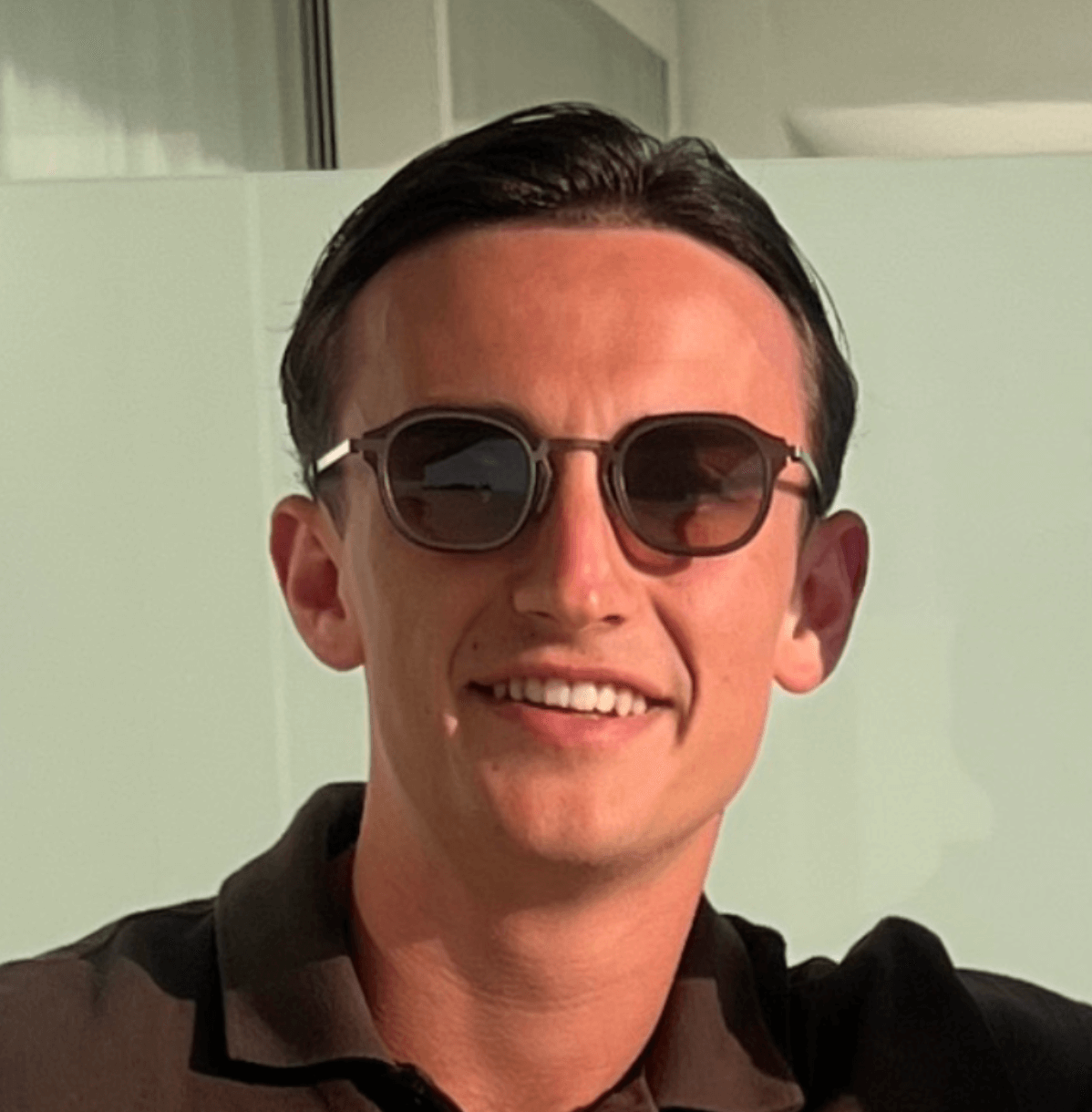

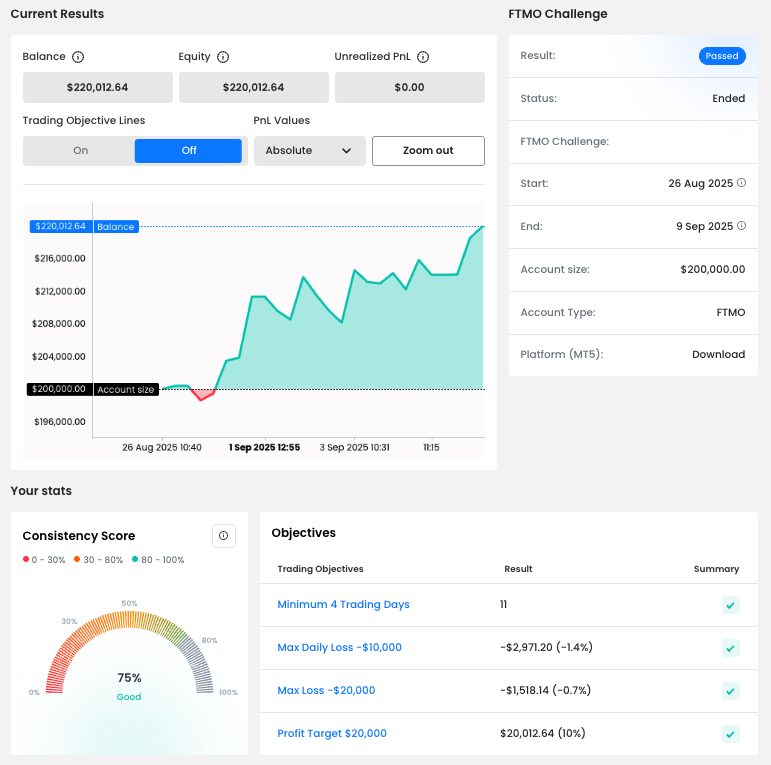

Trader Jack Daniel: “Emotions can skew your perspective of what’s true so easily.

What do you think is the most important characteristic/attribute to become a profitable trader?

I think there are many vital characteristics and attributes that create a consistently profitable trader. But in my personal experience it is emotional intelligence/emotional control. In an industry where we as traders read charts which present completely neutral information about itself, I started to understand that what deciphers my decision making, all stems from internally. Emotions can skew your perspective of what’s true so easily, and I think to have the skill to be able to process this in real time and understand what’s happening in each unique situation is so important.

Describe your best trade.

I wouldn’t think I have a “best trade” as such. I’ve had some trades which returned a high % but I’ve also had more “textbook” entries which fit my methodology perfectly and were so picture perfect of my strategy. I like to approach my trading with a systematic approach so most of my trades end up roughly the same % gain give or take, depending on the profit targets obviously.

What does your risk management plan look like?

My risk management plan is strict. All my trades are based on a minimum 3:1 reward-to-risk ratio (RRR). I’m not fixated on Win Rate, because we can’t actually control it — market conditions are unstable and fluctuate, so they don’t deliver a consistent outcome 100% of the time. This is where my minimum RRR of 3 comes in. Based on backtested data, my expected Maximum Losses are around 3–4 trades. With an RRR of 3, I can recover to positive with two winning trades. I only consider having two open positions if one is already risk-free, usually after moving 40% or more toward the TP target. I risk 1% per trade.”

What was the hardest obstacle on your trading journey?

The hardest obstacle I faced was myself, if I’m being honest. I kept relapsing into self-sabotaging behaviour, mostly driven by impatience, which ultimately made the journey longer and harder for me. That being said, I feel I wouldn’t be the trader I am now without making these errors, as they made me a more resilient person.

What was easier than expected during the FTMO Challenge or Verification?

I think once I applied the right set of mental habits and approached trading with the right perspective, everything changed. When trading comes from a place of chasing monetary gain rather than a systematic approach, it never ends well.

One piece of advice for people starting the FTMO Challenge now.

Trust yourself. Take a breath. Don’t stress. Step outside and put the phone down. Less is really more.

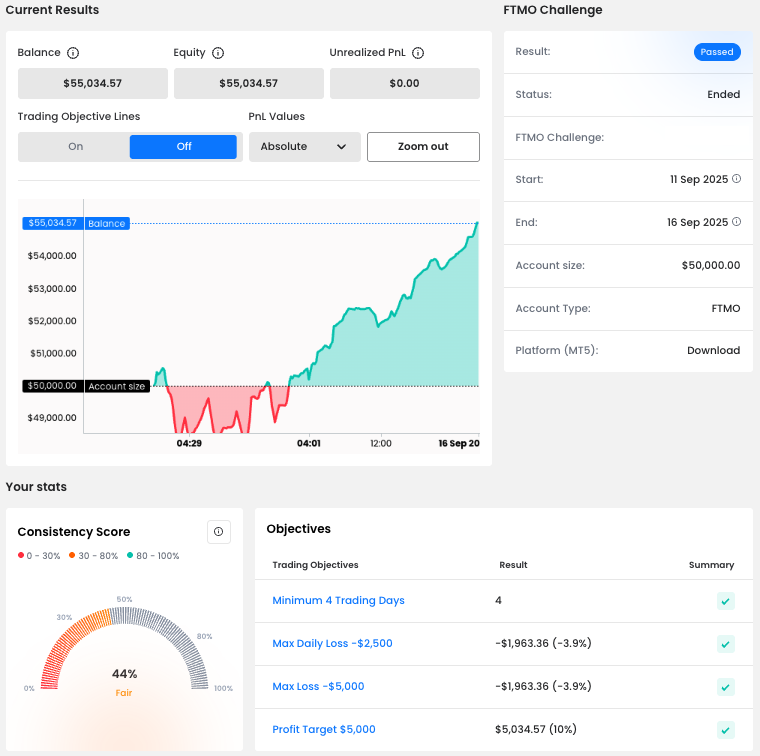

Trader Tze Yong: “You may feel like giving up but don't. It's worth it.”

How did you manage your emotions when you were in a losing trade?

I go for a walk, motorcycle ride to clear my head, when I am back I review my mistakes and talk to my friends discussing what I could have done better.

Describe your best trade.

I don’t think I have one best trade, all my trades are equal. But I occasionally make mistakes and let my emotions get the better of me.

What have you learnt thanks to FTMO?

I learned to better manage my risk. The statistics provided through the FTMO app really helped me understand my trading patterns and style.

How did Maximum Loss limits affect your trading style?

They helped me limit my risk and manage it better. Reaching the Max Loss forced me to stop and take a break.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The daily drawdown. I overcame it by trading smaller positions and setting proper Stop Losses.

One piece of advice for people starting the FTMO Challenge now.

It's going to get difficult. You may feel like giving up but don’t. It's worth it.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.