Reasonable diversification can increase the chances of a good profit

In the next part of our series on successful FTMO Traders, we will have a look at a trader who bet on a fairly wide diversification into different asset classes, thanks to which he managed to achieve a great return.

Although diversification into different asset classes is mainly recommended for long-term investors who can reduce the risk of their portfolio through correlation, this approach can also work for short-term traders. For scalpers, who only keep their positions open for a few minutes and may see several suitable opportunities on any instrument within a day, this approach does not really make sense. On the contrary, it is definitely more beneficial for scalpers to focus on as few instruments as possible so that they can concentrate on them and not get unnecessarily distracted by the large number of charts they have to follow.

The situation is slightly different for traders who execute only a few trades a day, which they keep open for hours or even days. In that case, a larger number of traded instruments can offer them more quality trading opportunities and thus have a positive effect on the overall results. This is without traders increasing their risk unnecessarily.

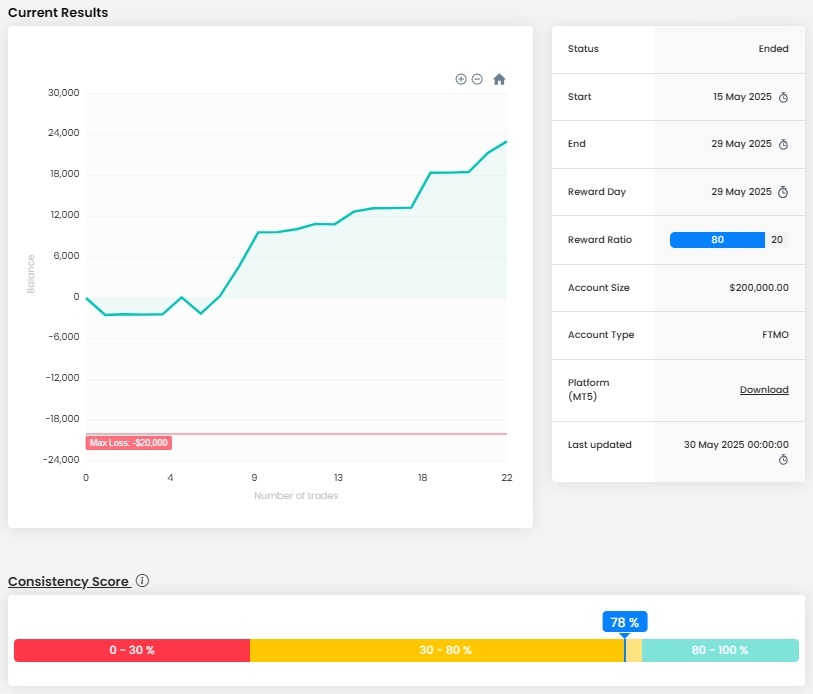

This was also the case for our trader who opened trades on up to 15 instruments. And although he was not successful from the first trading day, his balance curve looks very nice in the end. It also has an upward trend for almost the entire trading period thanks to a very good consistency score and the final profit is very good.

A profit of over $50,000 on an account size of $200,000 is truly awesome and a dream for most traders. The trader also had no problem with the loss limits, so his result is not that much of a surprise.

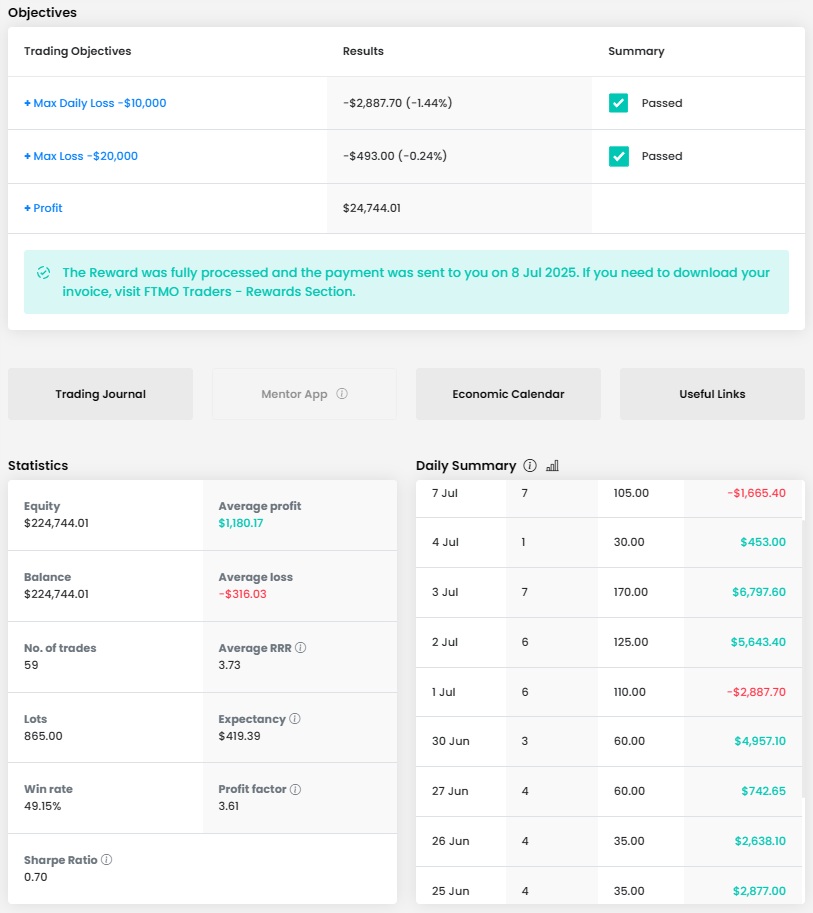

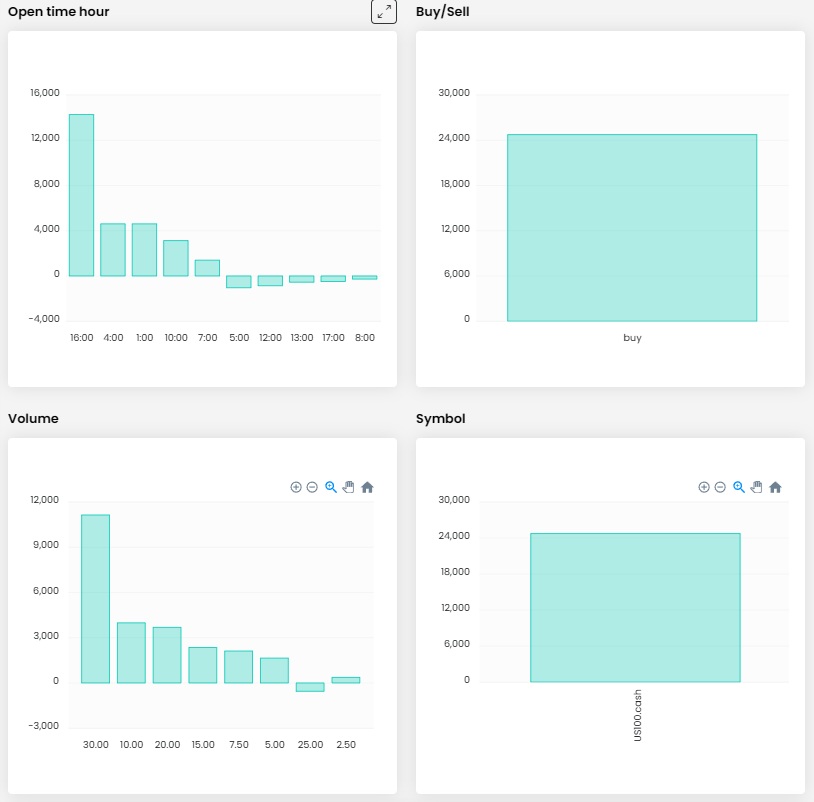

The trader opened 33 positions over the course of twelve trading days for a total size of 877 lots, which is 26.5 lots per position. It seems like a lot, but then again, for some instruments (for example, USOil.cash) it is possible to open a position of 100 lots without any problems if the Stop Loss is set correctly. This does not necessarily mean that the trader is somehow violating the risk management rules.

The average RRR was 2.82, which is not bad at all, and with adherence to risk management and money management it can be almost a certainty of profit. Then when you add in a win rate of 63.64%, it is clear why the trader made a profit of over 25% of the account size.

Looking at the journal, we can see that this is not a scalper, as we have had several here recently, but rather a trader who trades intraday but holds his positions for hours and in some cases overnight. So it can be described as a kind of short-term swing style that can be very effective in forex. We appreciate the entry of Stop Loss on all positions, which is a sign of good risk management. This is also evidenced by the losses, which practically did not exceed 1% of the account size, which is very good.

As mentioned, the trader opened positions on up to 15 instruments, including 10 currency pairs (five of which were with the Japanese yen), plus gold (XAUUSD), the S&P 500 index (US500.cash), WTI crude oil (USOil.cash) and two cryptocurrencies (BTCUSD and ETHUSD). So a trader could have had many opportunities to choose from indeed.

This was evident both in the large variance in position sizes, but also in the relatively large interval when the trader opened and closed positions. The trader clearly has no problem with which direction he speculates in his trades, but as can be seen, he fared better on long positions.

And the trader also speculated in the long direction on the most successful positions we look at. In the first case, the trader opened the trade after the GBPJPY pair bounced off short-term support and subsequently made two higher lows, which could have indicated an emerging uptrend. He entered the position after a subsequent shorter consolidation and closed it manually after more than six hours. Admittedly, with a more patient approach he could have made a better return and was far from his take profit, but the profit was over 100 pips and amounted to a handsome $7,345, which we cannot criticize.

In the second sample trade, the trader again bet on the uptrend on the AUDCHF pair, entering the position after a bounce from the trend line and a short consolidation. Although he closed the trade prematurely again and after a much shorter time, the profit was still a very nice $5,190 as the position size was double.

Diversification between asset classes in forex and CFD trading makes sense, but the trader needs to know what he is doing. Sometimes trading too many instruments can be counterproductive, because the trader practically cannot focus on any one instrument properly. Therefore, it is a good idea to adapt the strategy to this and try not to add unnecessary additional instruments that can complicate the situation unnecessarily. Trade safely!

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?