“Random trades generate random results”

Anyone who wants to take trading seriously and be consistently profitable must have a clearly defined trading plan and a strategy, which he can trust. Random trades without clearly defined rules cannot work in the long run. Here's what our new traders Denys, Jorge Miguel, Halil, and Mostapha think about it.

Trader Denys: “I've learned to prioritize trade quality over quantity.”

How did you eliminate the factor of luck in your trading?

To significantly reduce the factor of luck in trading, I prioritized education and continuous learning to deepen my understanding of market dynamics. I have created a clear trading plan that includes risk management and tracking my progress. By being disciplined and patient, and testing different strategies, I make decisions based on data rather than luck. This helps me to consistently perform well over time.

How did loss limits affect your trading style?

Implementing maximum loss limits has impacted my trading style, leading me towards a more disciplined and risk-aware approach. I've learned to prioritize trade quality over quantity. This limitation has compelled me to enhance my analysis and selectivity, ensuring that each trade aligns with my trading plan and has a favorable reward to risk ratio. Consequently, this strategy has not only protected my capital from significant drawdowns but has also fostered a more methodical and less emotionally driven trading practice.

What was easier than expected during the FTMO Challenge or Verification?

I found the initial Challenge stage of the FTMO process to be easier than I expected, especially in terms of the psychological aspects. Although I was anxious about the high stakes, my focus on building a strong mental framework and trading discipline paid off. I was able to manage my fear and greed, stay focused, and stick to my trading plan with ease. This allowed me to make well-considered decisions that were crucial for passing the Challenge stage.

Do you have a trading plan in place, and do you follow it strictly?

Having a trading plan is essential to my approach, and I stick to it with strong discipline. My strategy prioritizes managing risk by allocating only 0.5 to 1% of my capital per trade. This way, I minimize exposure and protect my portfolio. My trading decisions are based on objective criteria, which eliminates emotions from the process. Each trade is executed with predetermined Take Profit (TP) and Stop Loss (SL) levels to ensure that potential gains are captured, and losses are contained. I seldom adjust the SL once it's set, as I believe in maintaining my initial risk assessment and avoiding emotional responses to market fluctuations. This disciplined approach not only helps manage risk but also fosters consistency and predictability in my trading outcomes.

Do you plan to take another FTMO Challenge to manage even bigger capital?

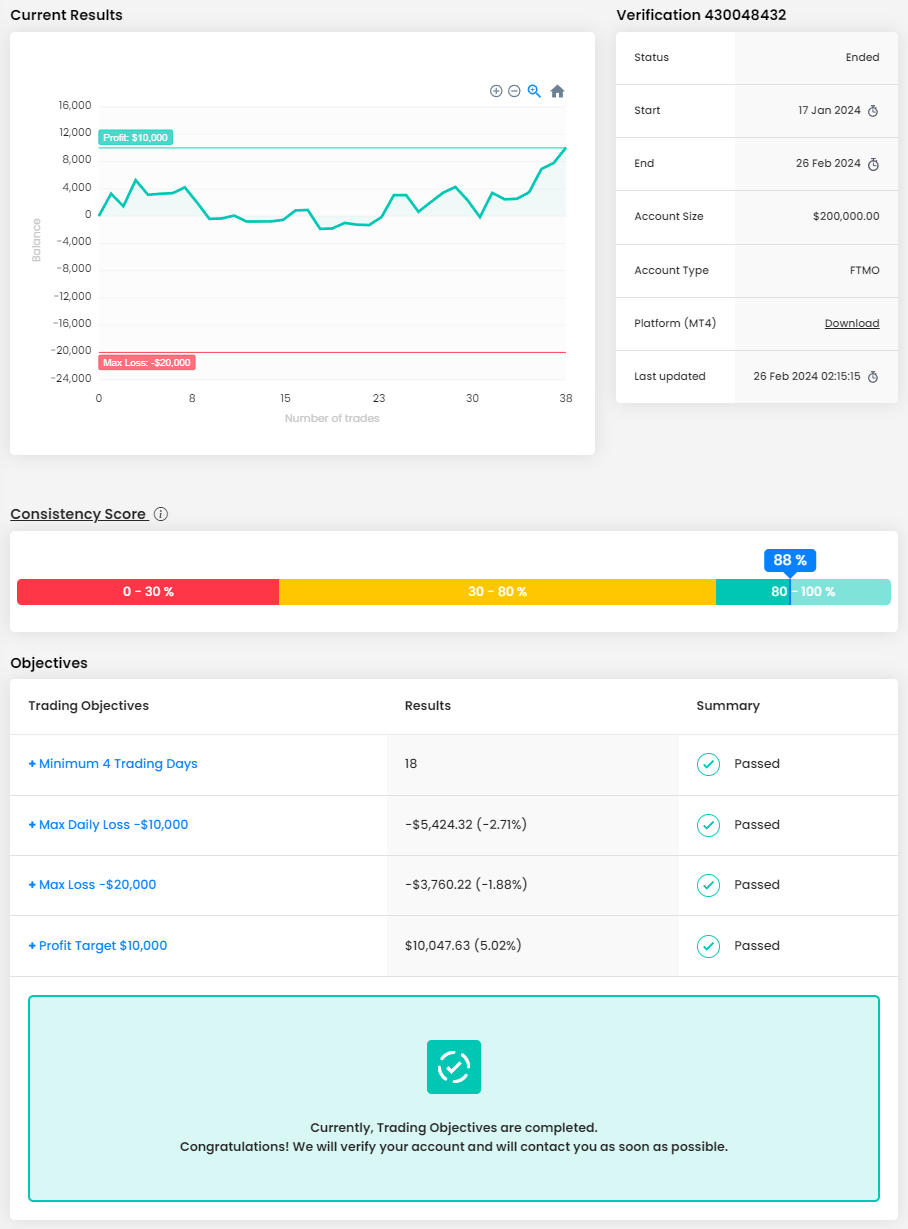

I aim to complete a $200k challenge and merge it into a $400k account. Eventually, I would like to receive the maximum allocation possible.

What is the number one piece of advice you would give to a new trader?

Start with a solid educational foundation and always adhere to strict risk management rules.

Trader Jorge Miguel: “Trading must be approached in a cold, rigid and very calculated way.”

Where have you learnt about FTMO?

It was in 2019 that I decided to learn more about this industry and chose to look for more people with the same ambition and even the possibility of having a mentor, someone with whom I could exchange ideas, clarify doubts, and learn together. It was then through this group that I heard about FTMO for the first time.

Describe your best trade.

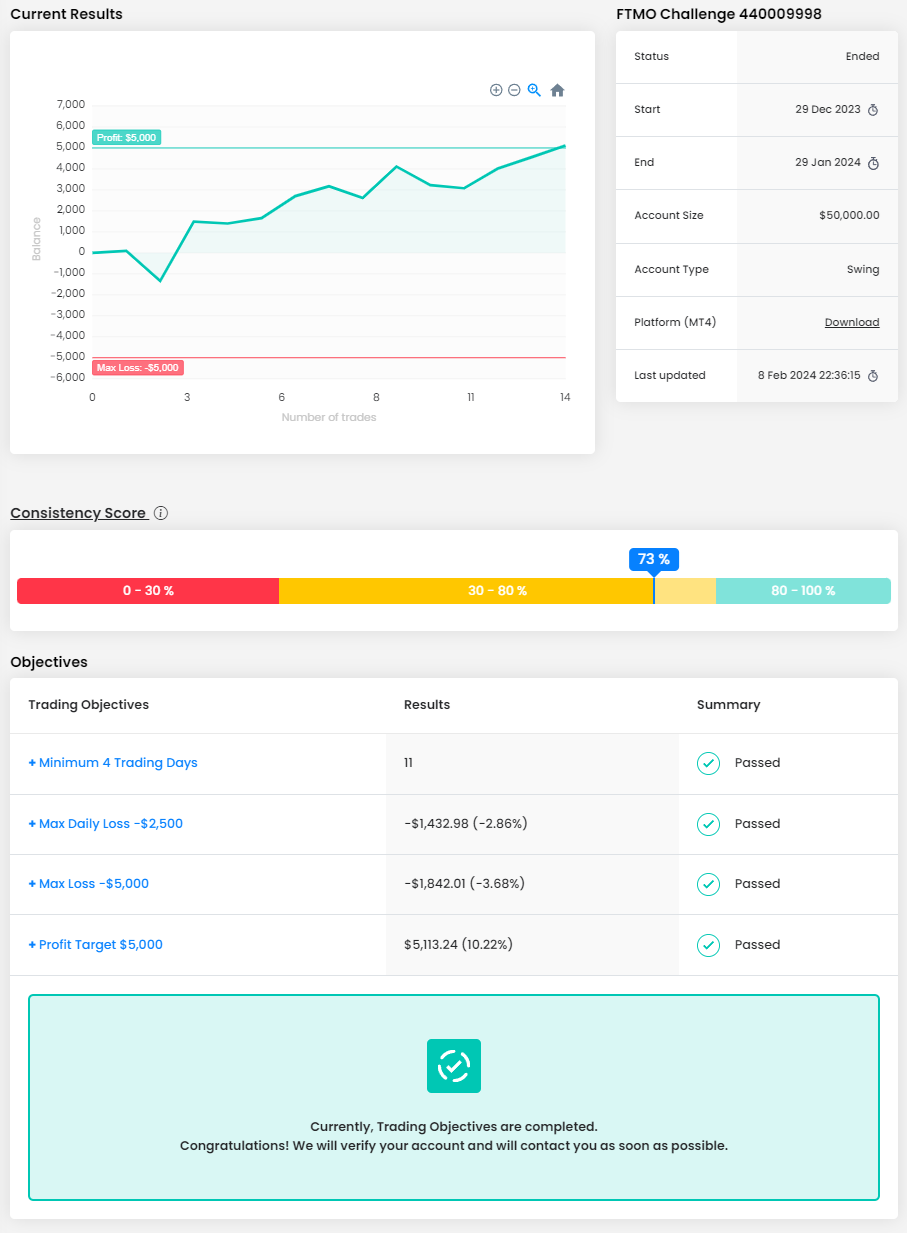

Interestingly, what I consider to be my best trade was carried out in this same verification process to obtain the FTMO Account. In addition to being one of the trades that had the most meaning in my career as a trader so far, it was a trade where I obtained approximately 7% in about 15/20 min.

Do you have a trading plan in place, and do you follow it strictly?

Yes, this is perhaps the rule that I consider number one for being a successful trader. It is extremely important to be consistent in decision-making and increasingly refine the rules of your personal trading plan. Random trades generate random results!

What inspires you to pursue trading?

Trading is an incredible industry, very specific when it comes to its target audience and very difficult to master. What inspires and motivates me most is without a doubt the potential return and the freedom that this can offer us.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Obviously yes, trading is a game with no limits that regardless of capital, it is always played in the same way, if you can make one euro, you can make a million in exactly the same way. One step at a time, but always with the aim of improving and growing more and more financially.

What is the number one advice you would give to a new trader?

The number one piece of advice is to create a trading plan and adjust it whenever necessary. Trading must be approached in a cold, rigid and very calculated way. As I said above, random negotiations generate random results!

Trader Halil: “Don’t look 24/7 on the chart.”

What was easier than expected during the FTMO Challenge or Verification?

The waiting periods between finishing a phase and getting new account information for phase 2 and so on. It went pretty smooth and fast. I used similar services before, but FTMO is very fast in transmitting data, which surprised me very.

What does your risk management plan look like?

I usually go for a 5:1 reward-risk-ratio (in some cases only 3:1) and always risk between 0,5% -1% per trade and never exceed a daily draw down of 4%.

What inspires you to pursue trading?

I always loved trading in online games as a kid and imagined myself in a medieval time where I sold my gold to the people and stuff like that. Now I have the opportunity to live my kids dream as a real trader in a newer setting, but the system is the same old buy low and sell high. I found myself happy again to make something I am familiar with since I am like 6ish years old.

Describe your best trade.

My best trade is not the highest amount of cash I made in on sitting, it is how much I could resist my greed and my fear. controlling my emotion in 1 trade where it nearly crashed into SL but eventually, it hit my TP in the end, and I was very proud of my self-resisting the strong emotions.

How did you manage your emotions when you were in a losing trade?

Don’t look 24/7 on the chart. Set your start, your rock bottom, and your finish line. Your eyes can’t change how the market is moving, they can only trick your brain into weird thoughts. The best way is to write down your emotions and keep an eye on your behavior instead of the market. Slowly but steadily you will lose money, but also gain more control of yourself and in the long run you will start being more profitable when you trust in your strategy and yourself.

One piece of advice for people starting the FTMO Challenge now.

Always analyse yourself. Write down your emotions in a failed trade and a winning trade. Look at your behavior how you feel when the trade is moving towards Stop Loss and Take Profit, what’s going on in your head. How do you feel and what do you think. You are your own biggest enemy when you start to let your emotions control you. So, focus on your strategy and let your trade move freely, otherwise you’re sabotaging yourself!

Trader Mostapha: “Remember, trading involves risks.”

How did you eliminate the factor of luck in your trading?

By building a bulletproof trading plan with proper risk management rules and always expecting the unexpected.

Describe your best trade.

One of my most memorable trades occurred when I identified a clear uptrend in a particular stock after conducting a thorough fundamental and technical analysis. I entered the trade at an opportune moment, just as the stock broke out of a key resistance level with strong momentum. Throughout the trade, I diligently monitored the price action and market conditions, adjusting my Stop Loss and Take Profit levels accordingly to manage risk and capture profits. As the trade progressed, the stock continued its upward trajectory, surpassing my initial profit targets. Ultimately, I decided to close the trade when the stock reached a significant resistance zone, locking in a substantial profit. This trade not only resulted in a handsome financial gain but also reinforced the importance of patience, discipline, and sound decision-making in successful trading endeavors.

How has passing the FTMO Challenge and Verification changed your life?

Passing the FTMO Challenge and Verification has been a significant milestone in my trading journey and has positively impacted my life in several ways. Firstly, it has provided me with a sense of validation and confidence in my trading abilities. Successfully completing the challenge and verification process demonstrates that I have the discipline, skill, and risk management techniques necessary to trade profitably in the financial markets. Moreover, passing the FTMO Challenge and Verification has opened new opportunities for me as a trader. It has enabled me to access additional capital and trade larger positions.

Where have you learnt about FTMO?

Internet: Google - Instagram (ads), some friends.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do have a trading plan in place, and I make a concerted effort to follow it strictly. My trading plan outlines my entry and exit strategies, risk management techniques, and criteria for selecting assets to trade. Following a trading plan helps me stay disciplined and focused on my long-term objectives, while also mitigating emotional decision-making. However, I also recognize the importance of flexibility and adaptability in response to changing market conditions.

One piece of advice for people starting the FTMO Challenge now.

Remember, trading involves risks, and it's essential to conduct thorough research and practice prudent risk management techniques to enhance the likelihood of success.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.