Moderation and discipline are the basis for success

In today's Successful Traders series, we'll look at an example of how even with a relatively small number of trades and low trading volumes compared to the size of your account, you can make a very impressive return.

There is simply no need to open positions of tens of lots and execute hundreds of trades in a month. And there is even no need to combine dozens of instruments, which could only distract many traders and ultimately lead to erroneous trades. The important thing is simply good risk management, discipline and patience, and then you're good to go.

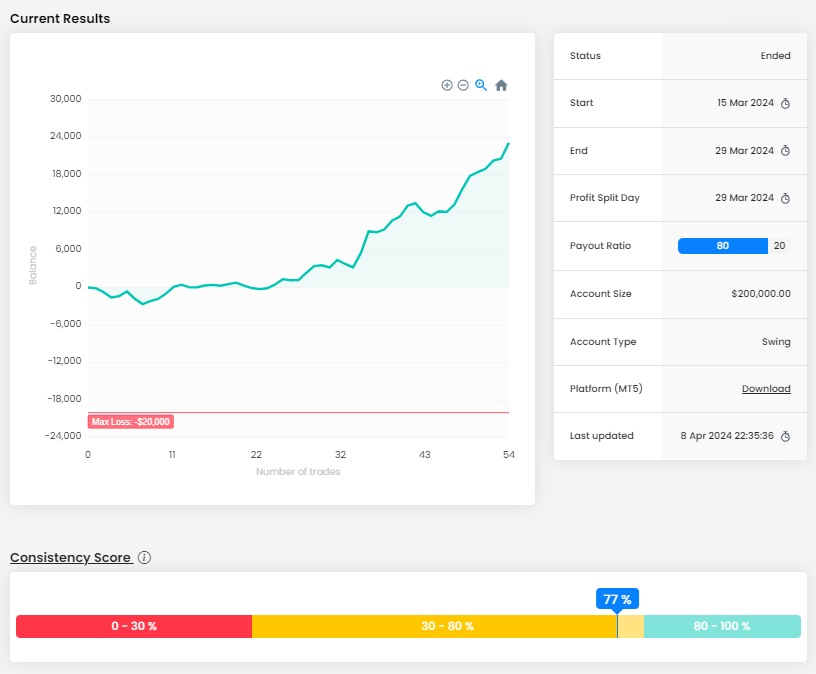

The trader did not start well at all and the first three trades ended in the red. For many traders, such a start can be a disaster, when they either mentally collapse, or get tempted by overtrading, or start increasing their positions. In our case, this scenario fortunately did not happen and the trader was able to keep his nerves in check and with a dose of luck get into the green numbers fairly quickly.

It is clear from the balance curve that he has managed to gradually increase his profits, without the need to increase the size of the position. Of course, it was not possible without losses, but the losing streaks never amounted to more than two trades, which certainly contributed to the trader's mental well-being. Thus, with a very good consistency score, he made an awesome profit of $23,156.

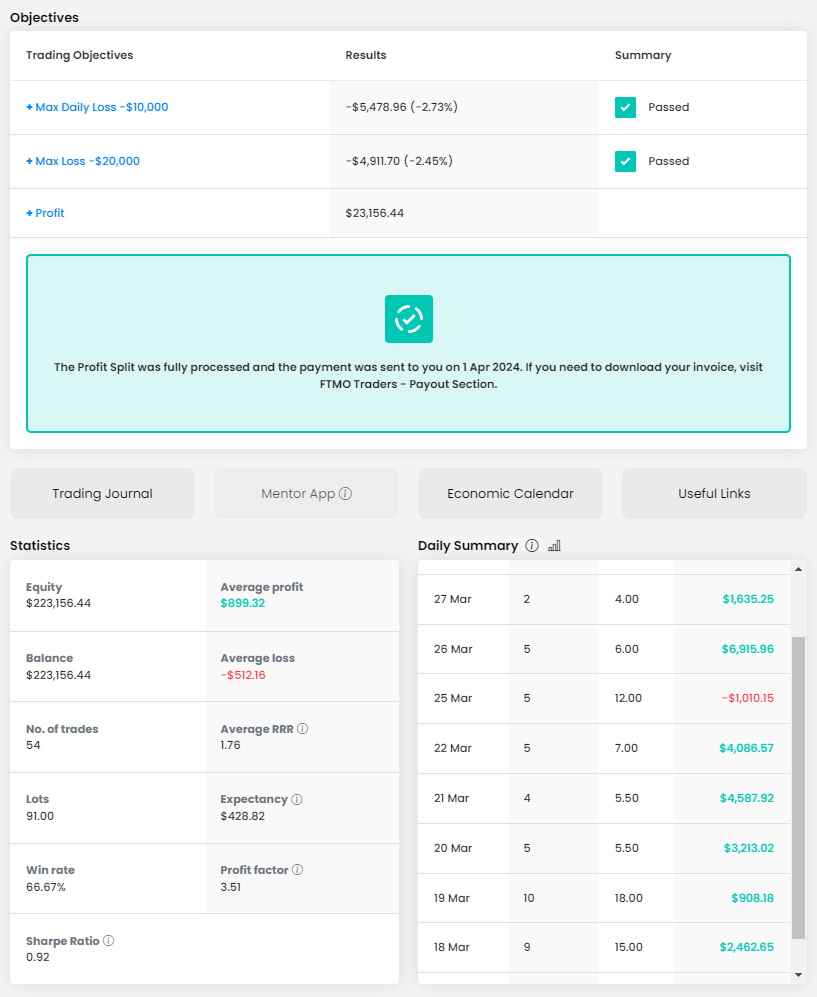

Neither the Maximum Daily Loss nor the Maximum Loss limits were a problem for the trader, a loss of around 2.5% is perfectly fine. The trader traded for two weeks and during this time he opened 54 trades with a total size of 91 lots. This is an average of something around 1.6 lots per trade, but the largest position was 3 lots. The trader also opened multiple positions, so the maximum position was around 8 lots, but this is still okay with an account size of $200,000.

The trader's average RRR was 1.76, which combined with a good success rate (66.67%) is a very good result. With a well set risk management, this is a very good assumption for profitable trading.

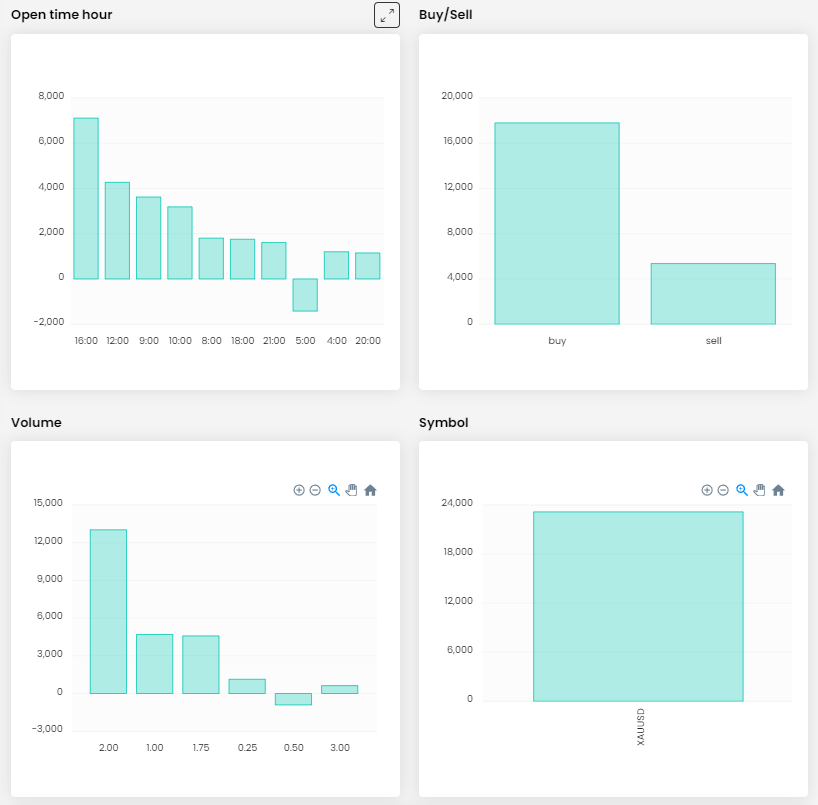

In the trading journal, we can see that this is a classic intraday trader who opens several positions in the course of one day and collects profits within a few hours. In only four cases did the trader keep his position open overnight and in only one case did the trade last more than two days.

We positively evaluate the setting of Stop Losses for practically all open positions, it shows a disciplined approach. The trader moved the Stop Loss in most of the profitable trades, which insured his returns, but in some cases he moved the SL level too aggressively, which cost him better returns.

The trader was only trading on gold, which is still one of the most popular instruments amongst FTMO Traders. On the one hand, this deprives him of possible diversification, but on the other hand, he can better focus on the chosen instrument, which he has experience with and understands. Even though gold is in a long-term uptrend and has been breaking one historical record after another in recent weeks, the trader has been able to make money even on short positions.

In the picture below, we see three trades of the trader. The first trade is a very successful consolidation entry at the support level. Like the entry, the exit looks very good, although from a longer view the trader could have held the trade longer. However, the placement of the TP at the last local resistance level is certainly fine, the trader was clearly not chasing high returns at any cost.

The second entry doesn't look so good at first glance, but the third buy order makes more sense, given the creation of a new higher low. In both cases, the TP was set at the level of the last swing a few days back, which formed a resistance level. However, the trader did not close both positions at this level, but left a smaller portion of the position open in both cases. Thus, on the one hand, he realised most of his profit at a level that made sense to him and realised additional profits on top of that, while the open positions could not reduce his gains much.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.