FTMO Traders Analysis: watch out for loss of concentration

It happens quite often that after a period of substantial returns on their FTMO Account, our traders experience a series of losses and they simply do not do well during a certain period of time. Such cases are not unusual in Forex. It is important not to panic in such situations and pay attention to the loss limits, exceeding which can lead to unnecessary losses and, in the worst case scenario, to a loss of the FTMO Account.

The first trader we are reviewing in today's analysis had a great couple of weeks, however, even then he was not able to avoid negative periods, but despite all that his final result is very impressive. His balance curve has been in the green for virtually the entire trading period and a gain of over $56,000 on a $200,000 account means an appreciation on his trading account of over 28%. The consistency score doesn't look bad either, a value of around 75% may not be in the green area, but it's still a pretty good result.

Although the balance curve looks quite good at first glance, it is evident that the trader had a hard time maintaining the established trend at the end of the trading period. This is not unusual, losing periods are not uncommon in Forex. The important thing in such situation is to have confidence in the strategy to handle such a period of time without any significant drawdowns.

Thus, in this case, there was no problem with the total loss limit, however,just before the end of the trading period, the trader had a hard time when he approached the Maximum Daily Loss limit. Therefore, on the penultimate and final trading day, he experienced two sets of losing trades, which in the worst case scenario could have cost him his account.

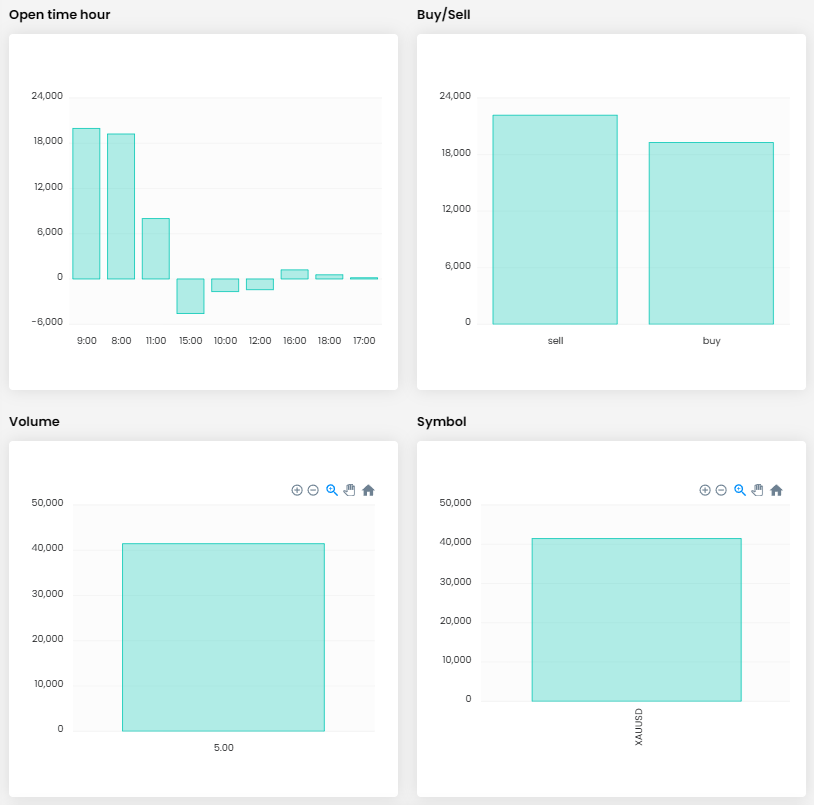

The average RRR for this trader is at 1.27, which is not a staggeringly high value, but with a 61.06% success rate, even such value was sufficient in the end to achieve a great result. Over a period of ten trading days, the trader executed over 330 positions, which is more than 30 positions per day, so he is a very active trader. The total size of 347.9 lots means an average position size of over one lot, which is not much for an account size of $200,000, but the trader often opened multiple positions. However, even with this method of opening positions, the total position size on one instrument did not exceed 8 lots, which is fine.

On a positive note, we appreciate the fact that this trader had Stop Losses set on all his positions, which, of course, can protect him from unnecessarily large losses and may have even saved his account at the end of the trading period when he had a series of losses. He wasn't as precise with the Take Profits, but then, again, that's not that big of a deal. That being said, the trader didn't open unnecessarily large positions and the loss per trade (when adding up multiple positions) didn't exceed $4,000, which is 2% of the account. At first glance this looks fine, however, given the number of trades per day, this can be quite risky behaviour and in the event of a bad development for all open positions, such trading style can lead to a violation of the Maximum Daily Loss rule.

The trader opened positions on a wide range of currency pairs, but the most successful instrument was clearly gold, where he was successful in most cases. It might be worth trying to concentrate on just this one instrument. We understand the need to diversify, but following such a large number of instruments (more than 20 currency pairs is indeed a lot) can sometimes be counterproductive, especially when none of them stand out for their performance.

Interestingly, the disproportion between buy and sell orders is significant in favour of buy orders, which comprise almost 90% of all his trades. This is also true for gold itself, we should note that the trader executed the few sell orders at the time when gold was experiencing a price spike in early May and was approaching its all-time high. In short, the trader made counter-trend bets that require a fairly precise timing and this approach doesn't work for everyone.

The second trader chose a diametrically different approach in his trading and the result, or the path to achieving the result, is also significantly different. In this case, the balance curve is also in the green from the beginning of the trading period, however, the periods of losses are much less pronounced. The gain of nearly USD 22,500 is lower, in percentage terms (+5.6%), for an account size of $400,000, but it is still a very good result. Since there is no need to achieve a 10% return on an FTMO Account, a more conservative approach is certainly in order. The consistency score for this account is only 60%, but this is due to a very successful last trading day where the trader recorded a profit of almost $9,000.

Considering the shape of the balance curve, it is clear that the trader had no problem with the loss limits during the trading period and did not even come close to them. The RRR of 1.47 is a pretty good value and combined with the 82.35% trade success rate, it is a clear path to profitable trading. The trader opened 34 positions over a period of 13 trading days, which is just over 2.5 positions per day. A total size of 86 lots means an average of 2.5 lots per position, which is a really conservative approach for an account size of $400,000.

One of the few negative aspects about this account is that we don't see any Stop Losses recorded in the Trading Journal, which could lead to an increased risk in the event of unpredictable market events. Given the very conservative concept of the position sizes, we could forgive the trader for this.

This is a classic intraday trader who holds positions for a few hours at most, and in only one case has held a position overnight. The conservative approach is evidenced by the profit made per position, which, even after accounting for multiple positions, is less than 1% (less than 0.5% for losses). The only exception was on the last trading day when the trader opened a long trade on gold just after the US inflation data was published. The perfect execution of the trade is proven by the fact that a few minutes after closing the position the market direction reversed and the trader closed his trade almost at the top of the trend.

Unlike the first trader, this trader trades only three instruments, opening the vast majority of trades on gold and only in two cases opening a position on another instrument. As in the first case, we see a strong bias towards long (buy) positions, which, with only a few exceptions, are the vast majority of his trades. When it works well for a trader, there is nothing to worry about.

As you can see in today's examples, traders can generate profits on their accounts through different approaches, however, without discipline and well-set risk management and money management it is very unlikely to achieve good results.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?