FTMO Traders Analysis: losses are part of profitable trading

In this article we will continue with the next part of the series in which we will evaluate successful FTMO Traders and their results. Today, we will take a look at three traders who managed to achieve interesting profits during the month and at how they got there.

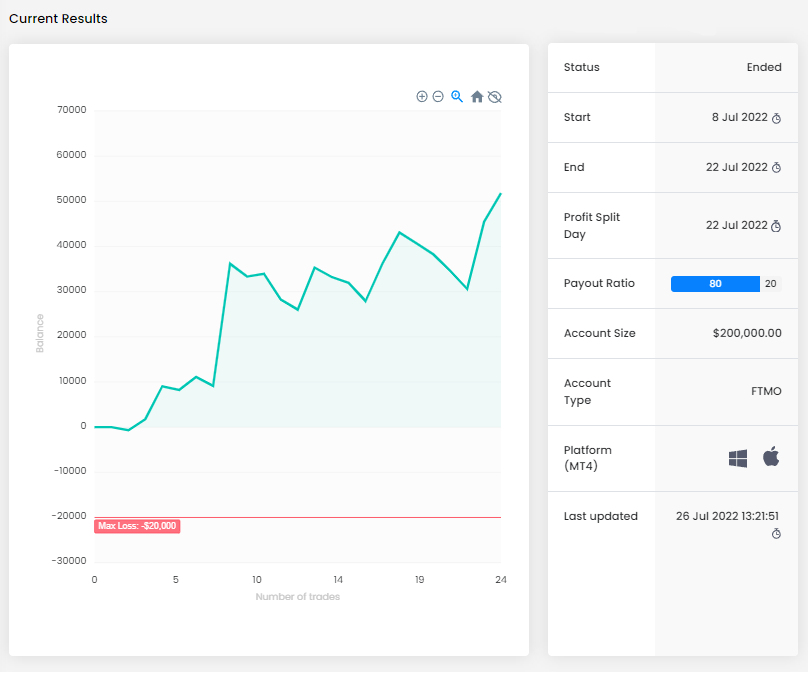

The first trader did not have an easy path to a successful monthly result, but he still recorded a very interesting return. The balance curve has a steadily rising direction, but the trader did not avoid a series of losing trades after a good start. This in itself is not a problem, because every trader has to realize that you cannot trade without losses and it is all about how you deal with them and whether you are able to keep the losses to a reasonable level.

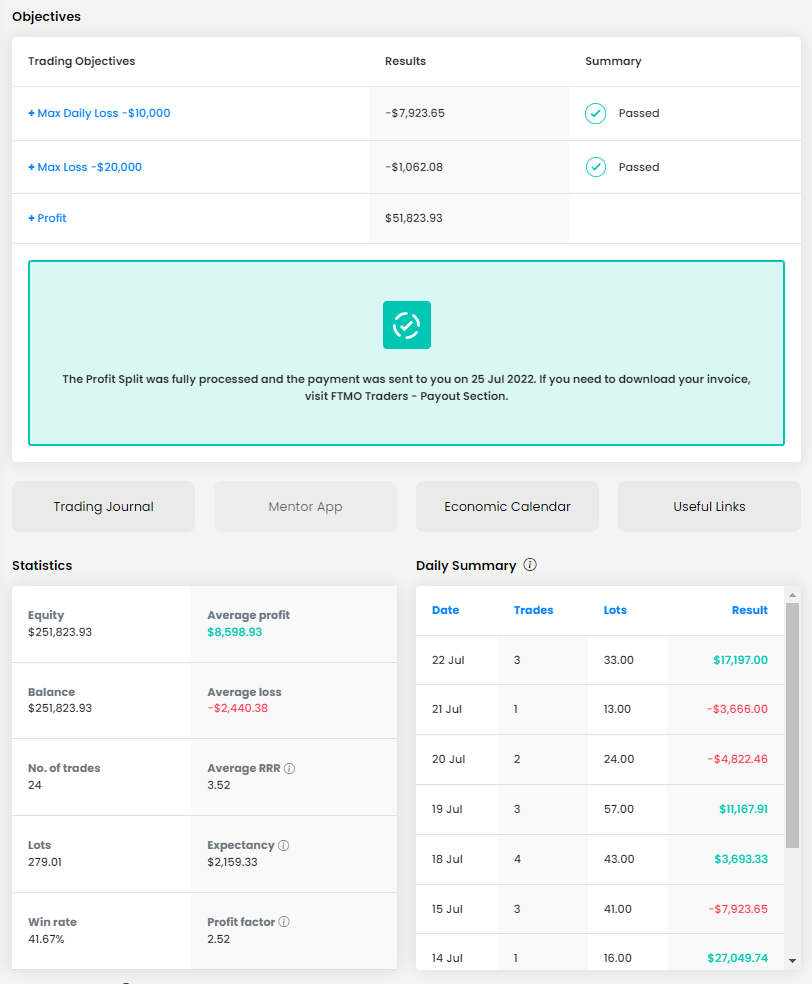

His total profit is over $51,000, which is a great result for an account size of $200,000. As you can see, the trader did not avoid a bad day when he was close to the Maximum Daily Loss limit, but even here he still had a fairly good margin. The Maximum Loss was no problem for him and he was only in a slight negative at the beginning of the trading period.

Looking at the trading statistics, it can be seen that not all days ended in profit, but overall the number of profitable days is higher than the losing ones. This is helped by a high reward to-risk ratio (RRR) of 3.52, so even with a relatively low success rate (41.67%) the trader was able to make a very good profit. The trader achieved the profit with 24 trades, he traded 279 lots, which is just over 10 lots per position. This is not low, but given the size of his account it is not extreme.

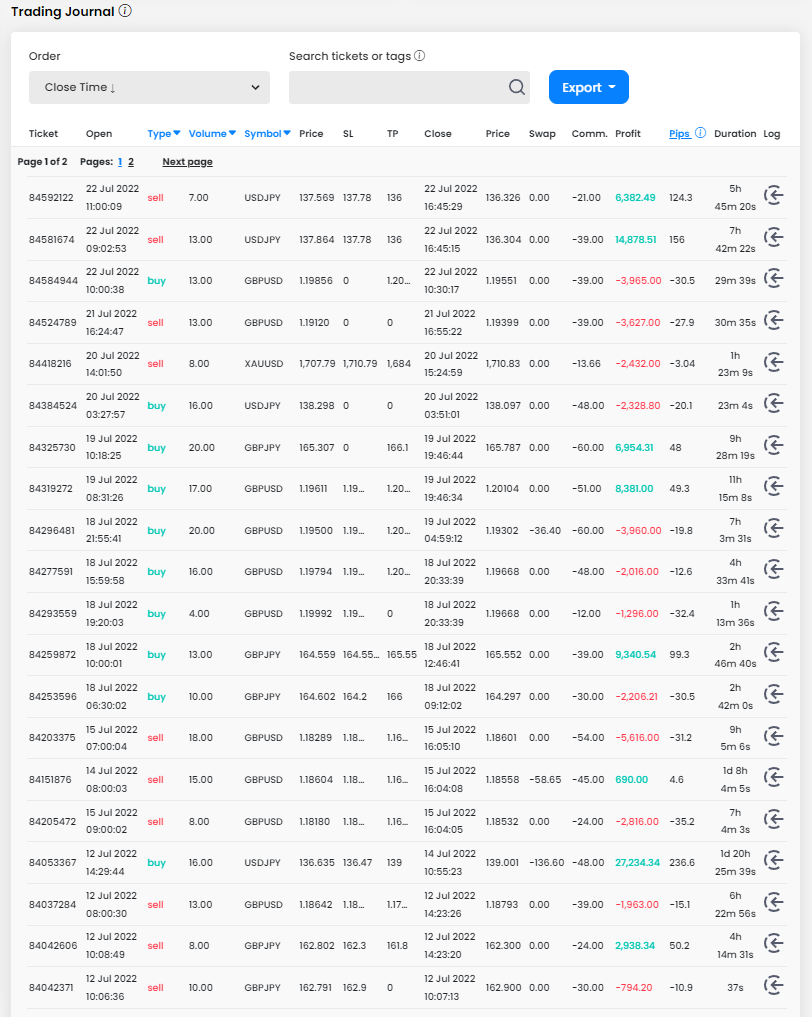

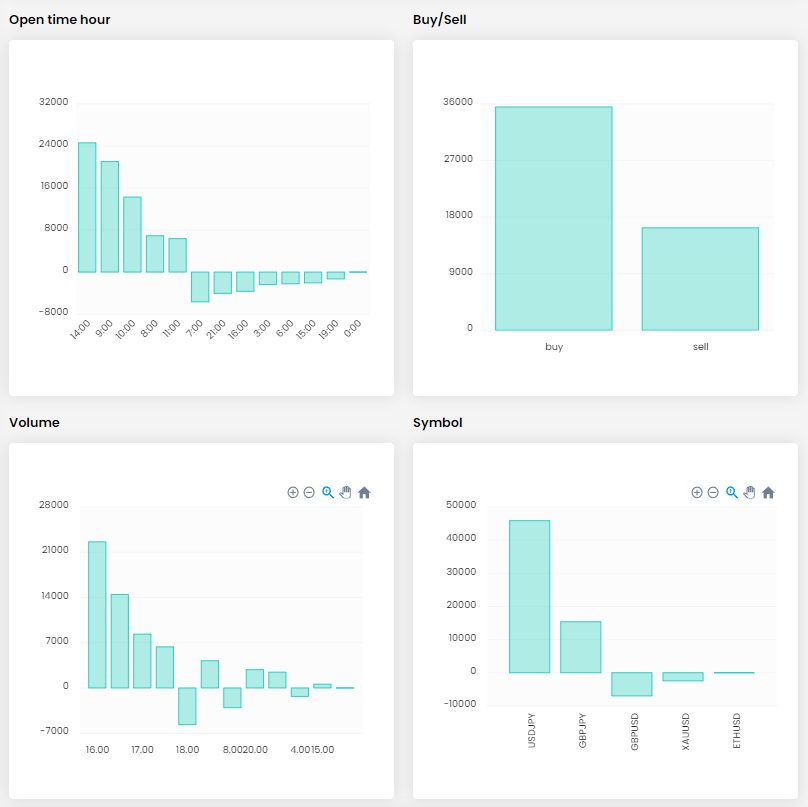

According to the Trading Journal, the trader opened positions of different sizes and when the market moved in his direction he had no problem with scaling in and entering other positions in the direction of his trade (this is an example of the last trade in the Journal). He used SLs and TPs for most of his trades, but this does not apply to all trades, which we do not rate positively. On rare occasions he held trades overnight, but otherwise he is a typical intraday trader who closes his positions within the day.

The trader traded a total of five different instruments and, as we can see, he was most successful with the currency pairs involving the Japanese yen, while he was less successful with the other pairs. He made better profits with long positions than with short positions, but overall he was successful in both directions.

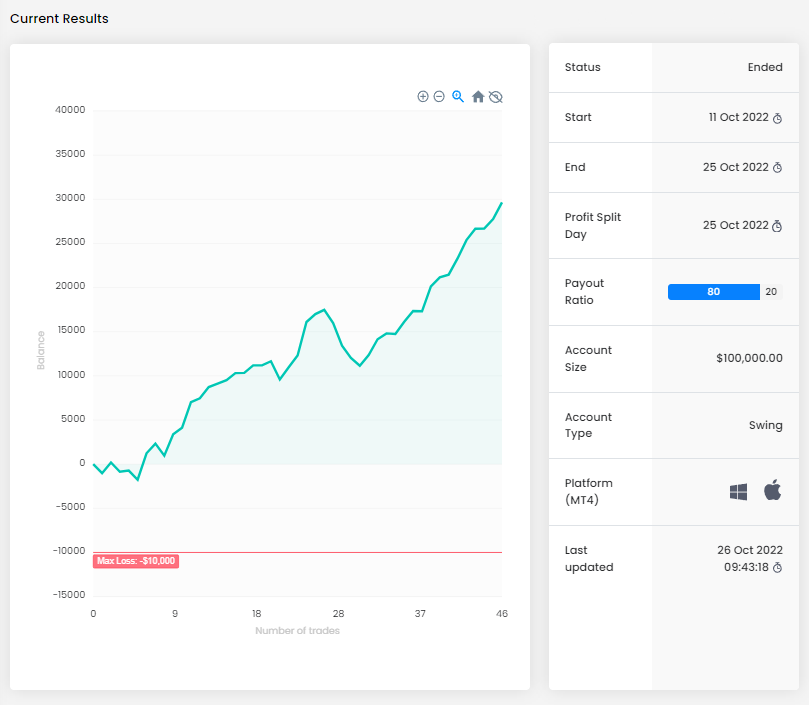

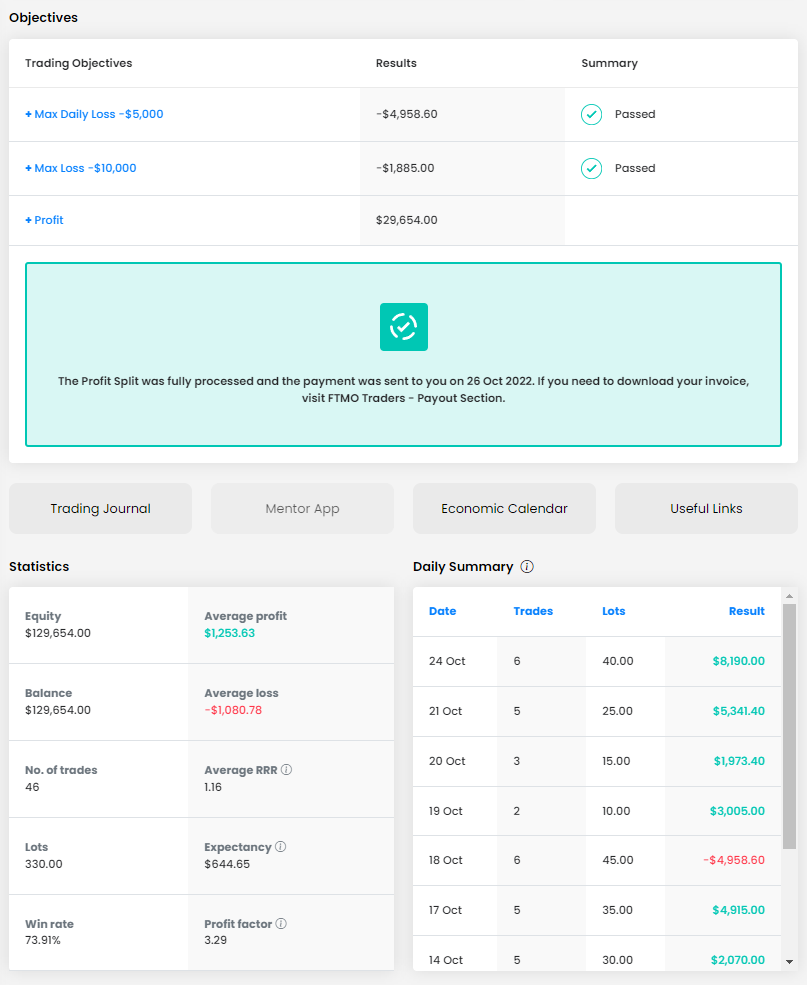

The second trader had a clearer path to making the profit at first glance, but even he did not avoid a period when he recorded several losing trades in a row. He coped well, however, and after 46 trades, he notched up his profit tonearly $30,000. With an account size of $100,000, his results in terms of the percentage are even better than the results of the first trader.

Although the total profit is great and the total loss is not high either, the trader really struggled when he almost exceeded the Maximum Daily Loss that would have meant losing his account in the middle of the trading period. In the end, he managed to follow this important Trading Objective and was consistently in profit again in the following days. By limiting the amount of trades during the next trading day and especially by having a very high success rate (73.91%) he managed to achieve good profits, so the relatively low RRR of 1.16 (which is still better than being below 1) did not have a negative effect on his performance.

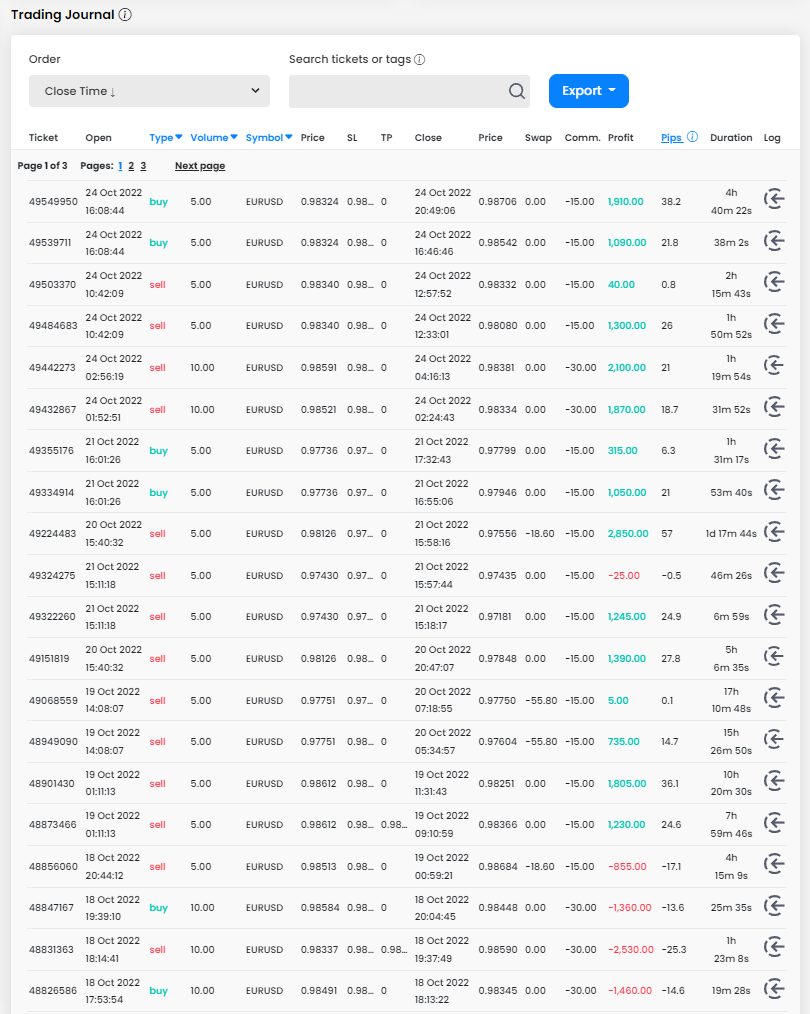

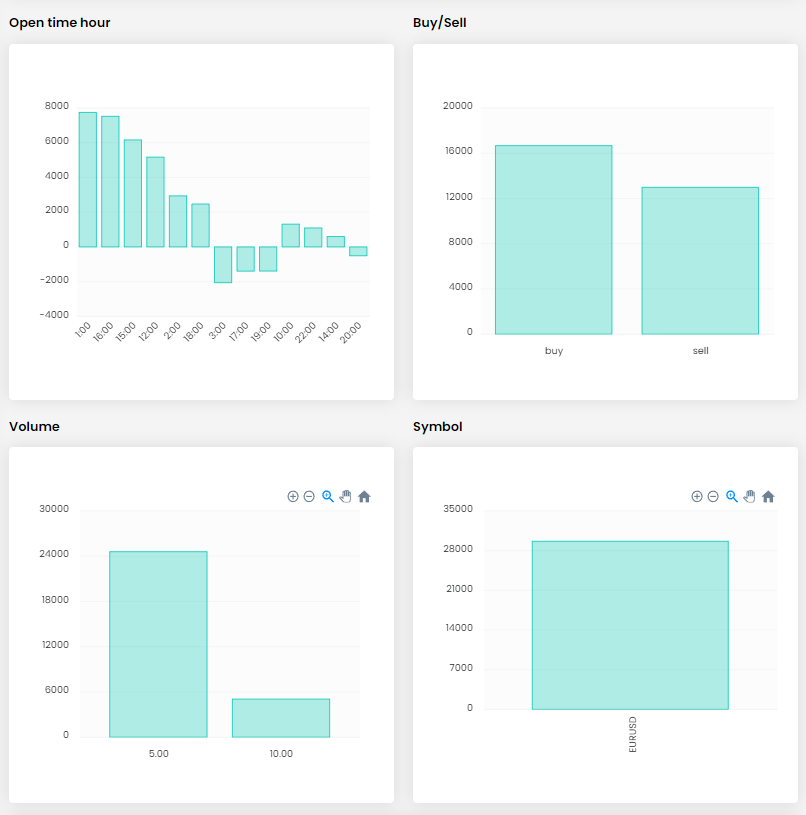

During the trading period, this trader executed 46 trades with a total volume of 330 lots, which is an average of around 7 lots per trade. The trader did not experience any significant fluctuations in volume from day to day, which only underlined the consistency.

This was also confirmed by the Trading Journal, which clearly shows that the trader opened positions of 5 or 10 lots. All of his trades had t SLs, which we evaluate positively, but he did not set TP, which shows an active approach to trading. Most of the trades were closed within one day, so he is mostly an intraday trader and only on rare occasions the trader held trades open overnight.

He only traded the EURUSD pair, the most liquid currency pair. While this way of trading limits the possibility of diversification, the liquidity on this pair allows the trader to open positions throughout the day, which he did. Both buy and sell positions were profitable and, interestingly, the most profitable positions were opened by the trader between 1:00 a.m. and 2:00 a.m. CET.

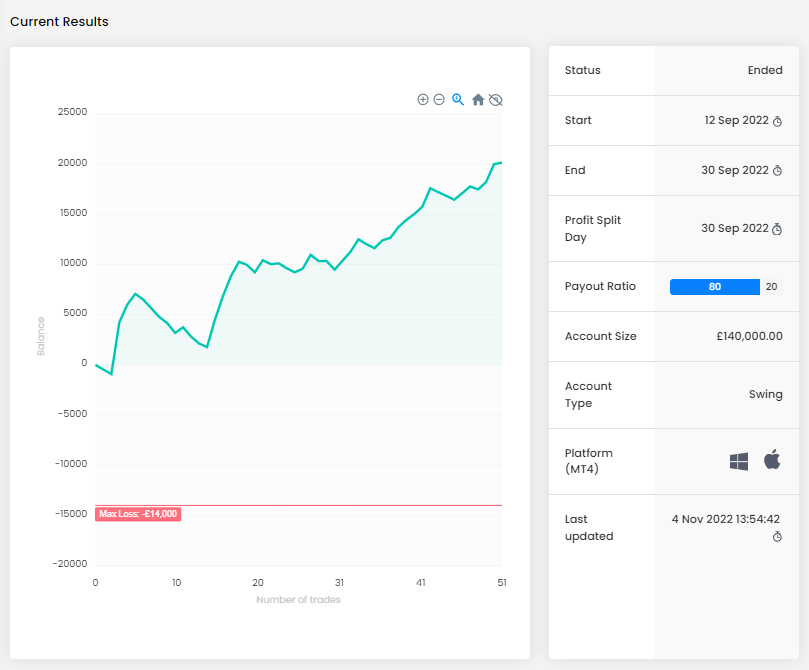

The third trader also didn’t avoid a losing streak, and, unlike with the previous trader, it happened in the beginning of the trading period, which can be mentally challenging. However, in the end he made it through and made a profit of over £20,000, which is a very good result for an account size of £140,000.

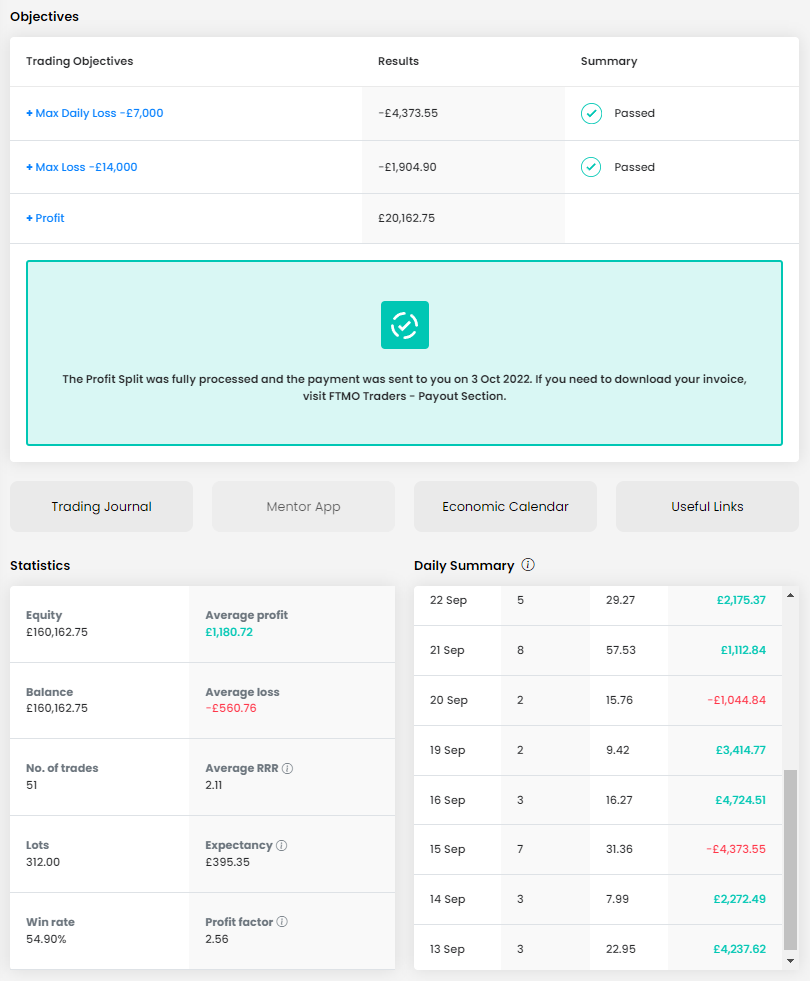

The trader did not have a problem with the Maximum Loss or the Maximum Daily Loss limits, he had two losing days during the trading period and with a few exceptions he was consistent in terms of the number of trades during one day. Overall, he opened 51 trades with a total volume of 312 lots, with a good RRR of 2.11 and a success rate of 54.90%, which is a very good combination.

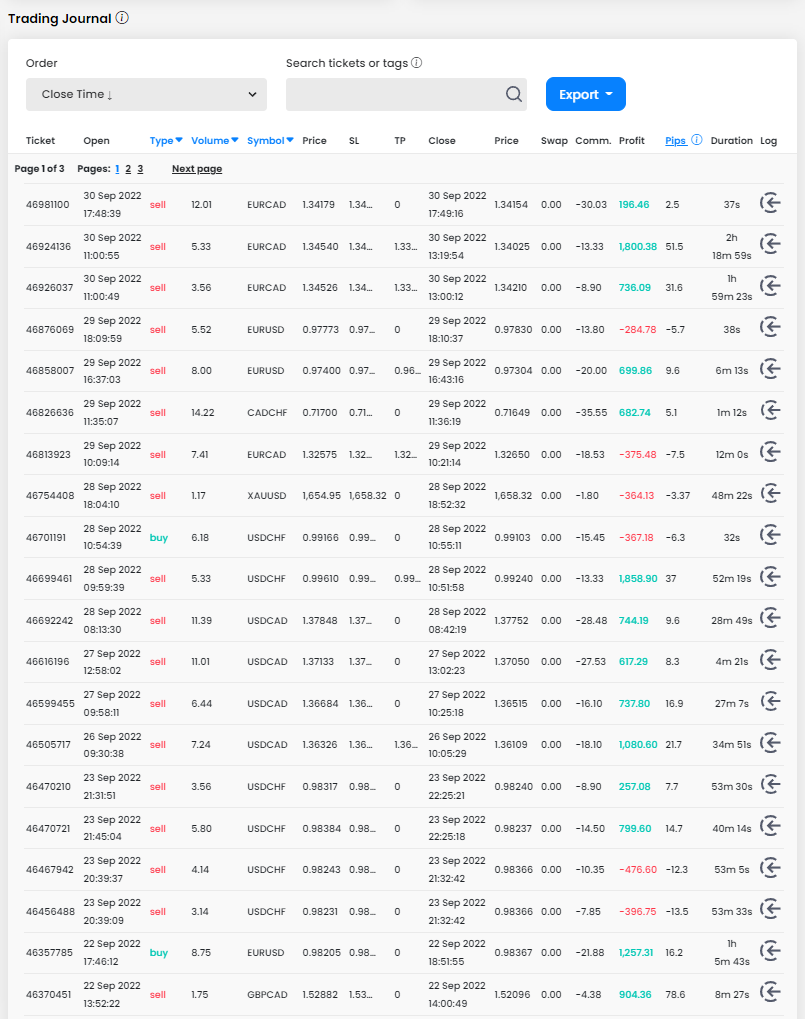

Position sizes in the Trading Journal vary, but the trader never held positions overnight, his trades often lasted only a few minutes. However, the trader cannot be considered a typical scalper. We positively rate the SL entries for all his positions but, as in the previous case, profitable trades were manually closed.

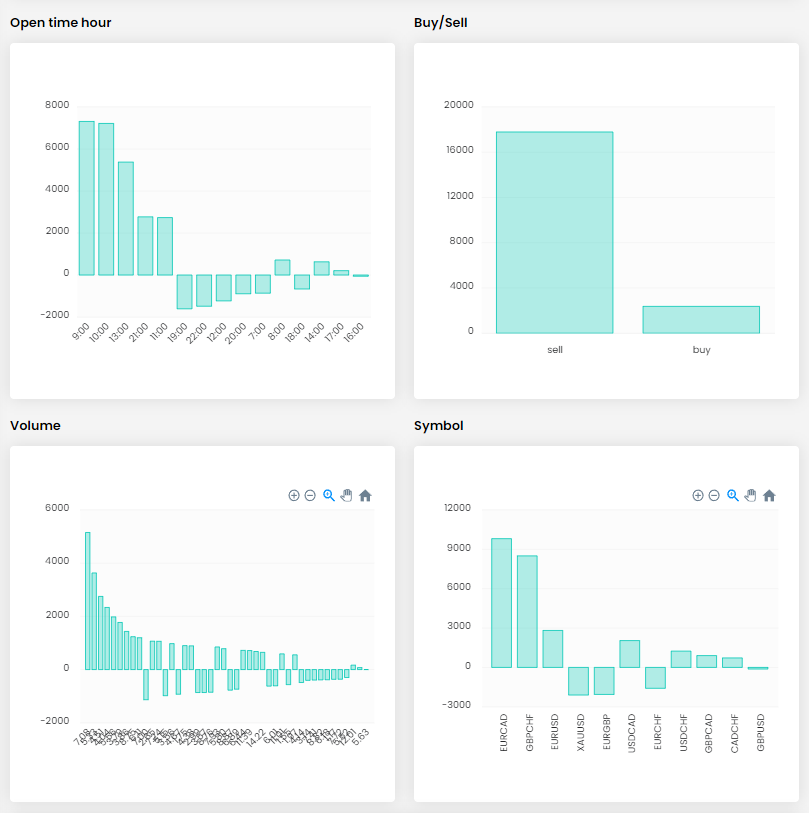

It is interesting to see that the trader mostly opened sell positions, which is unusual. Some traders may have a psychological problem with this, but this is clearly not the case for this trader. The trader traded several currency pairs from the majors and the crosses group and attempted to trade gold as well. However, judging by the result, he should have avoided it. He was most successful with the EURCAD pair and generally did well with the Canadian dollar pairs.

As you can see, profitable trading is not just about the pros, but is also about how traders are able to cope with a losing streak. As long as a trader does not mentally collapse after a few losing trades and can continue to stick to his strategy, in the end the losing streak does not always have a negative effect on his results.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.