FTMO Traders Analysis: focused on consistency

In the next part of our irregular series, in which we evaluate successful FTMO Traders, we will take a look at two traders who managed to achieve great profits thanks to their consistent approach.

The first trader earned a very nice 8.3% profit for the month, but did not avoid a rather long period when his account was in loss. However, thanks to the great consistency score of 86%, he managed to overcome this period and finished the trading period with a great profit on his account.

Over €13,000 of profit achieved in one month is a very good result. Although the trader "attacked" the Maximum Daily Loss limit during the trading period, he managed to get out of the drawdown quite successfully. As far as the maximum loss limit is concerned, he still had enough margin there.

We are of the positive opinion of the RRR (Reward-Risk-Ratio) of 1.58, which would normally indicate that the trader’s strategy should be profitable in the long run. Thus, the success rate of trades below 50% (46.81%) does not bother us either. The trader opened 94 positions in 20 trading days, which is almost 5 positions per day. What is interesting is that the two days when he opened the most positions were his worst losing days. The total size of 440.13 lots means a little over 4.5 lots per position, which is a rather conservative approach for an account size of €160,000.

The Trading Journal shows that in most cases the trader opens positions with Stop Losses and Take Profits set, which is obviously a good approach to limit unnecessarily large losses during unforeseen market movements. The loss per trade only exceeded 2% in one case, usually it is around 0.5 - 1% , which also shows a consistent approach and well set risk management rules. The trader rarely holds trades overnight and the longest trades last a few hours, so this is a classic case of an intraday trader and the trader does not lose swap fees unnecessarily as a result.

The trader uses a relatively large group of instruments in his trading, but only one asset class is used, which is the currency pairs. Of course, there is nothing wrong with this, quite the opposite. Being able to follow the developments on almost 20 currency pairs can sometimes be difficult and trying to diversify can be rather counterproductive in such cases. For pairs that are long-term losers, the trader might then consider whether they are actually suitable for the chosen strategy. The ratio of buy and sell orders is also rarely balanced, so there is nothing wrong in this respect either.

The second trader also did not avoid a losing period and his curve has a much more volatile course at first glance. However, thanks to his consistent approach (score of 81%), he was able to overcome even relatively large fluctuations and made a high profit. The final result is clearly better than the result of the first trader in terms of percentage and the profit amount.

This trader also came dangerously close to the Maximum Daily Loss and Maximum Loss limits during the course of trading, which we cannot view positively. While a trader can set his Stop Loss so that he does not exceed the limit, an unexpected significant move after a surprising result of macroeconomic news may mean that even the SL will not protect his account in the end. In any case, a profit of over $28,000 on a $100,000 account is a very good result.

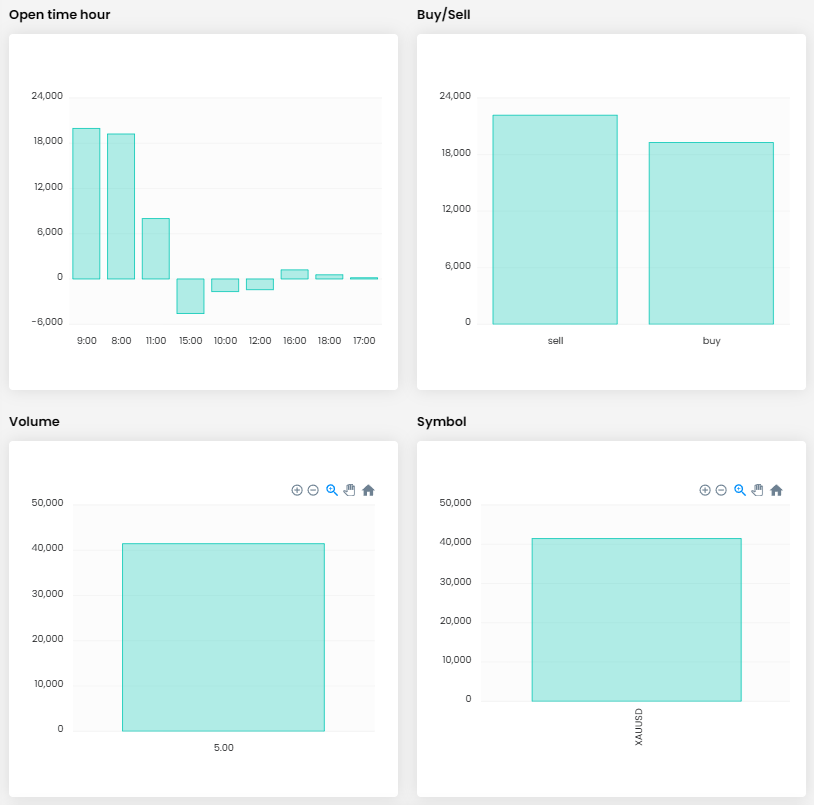

The trader managed to maintain a positive risk/reward ratio of 1.2 in 15 trading days. Combined with a trading success rate of 52.14%, his strategy can be successful in the long term. The trader opened 2,092 lots in 140 positions, which represents more than 9 positions per day and nearly 15 lots per position. So he is a fairly active trader, but the position size is fine given the size of the account. Interestingly, the trader had more losing days than profitable ones, and still managed to make very decent profits. It shows a good mental setup where even more losing days does not have to mean a disaster.

The trader's trading diary shows that he often opens multiple positions or opens additional positions on one instrument. Although it is a Swing account, the trader does not hold trades overnight. We evaluate the Stop Loss and Take Profit settings positively. From our point of view, the biggest problem is the fact that the trader uses the scaling in method, where he opens additional positions at the time when the original position is at a loss.

While this strategy may be profitable for some traders, we cannot recommend it to most traders (you can read more about its advantages and disadvantages in our article). For this trader, these trades have mostly worked out, but sometimes this approach has led to more significant losing periods, which even led to approaching the aforementioned Maximum Loss and Maximum Daily Loss limits.

The trader traded five instruments in four different asset classes. This is not a very high number, but given their relatively low correlation, we can talk about good diversification. He opened the most trades on the BTCUSD instrument, where he took full advantage of the opportunity to trade over the weekend. This option is tempting for many traders, but it is necessary to take into account that market movements can be significantly affected by low volumes and increased volatility.

Interesting is the relatively large difference in the results of buy and sell positions, although in terms of numbers they are almost the same. Sometimes it may have a psychological reason and the trader simply cannot work well with short positions. In this case, he should think whether it is worth opening short positions at all.

In today's article, we looked at two traders who took different approaches to trading which ultimately resulted in different balance curves. However, both of them managed to make some very interesting profits in the end thanks to their relatively consistent approach. There is not always an easy path to profits, but if a trader can keep his nerves in check and overcome the periods when he is not doing well, he can celebrate success even after a series of losses.

This article is for informational purposes only, and some information may not reflect the current service offering or product features. Please always verify the latest terms on the official product pages.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?