Forex doesn't have to be just about short-term trades

Forex trading doesn't have to solely revolve around short-term speculation, where traders open large positions they hold for only a few minutes or hours at most. Significant profits can also be achieved by adopting a conservative, long-term approach, as demonstrated in today's two examples of successful FTMO Traders.

The first trader's balance curve looks almost ideal at first glance and has not gone into negative numbers for the entire period. This of course always has a very positive effect on the psyche, and more experienced traders can use this to their advantage. The key in such a case is not to fall into a false sense of perfection, still stick to your strategy and not enter trades just because "I can afford some losses".

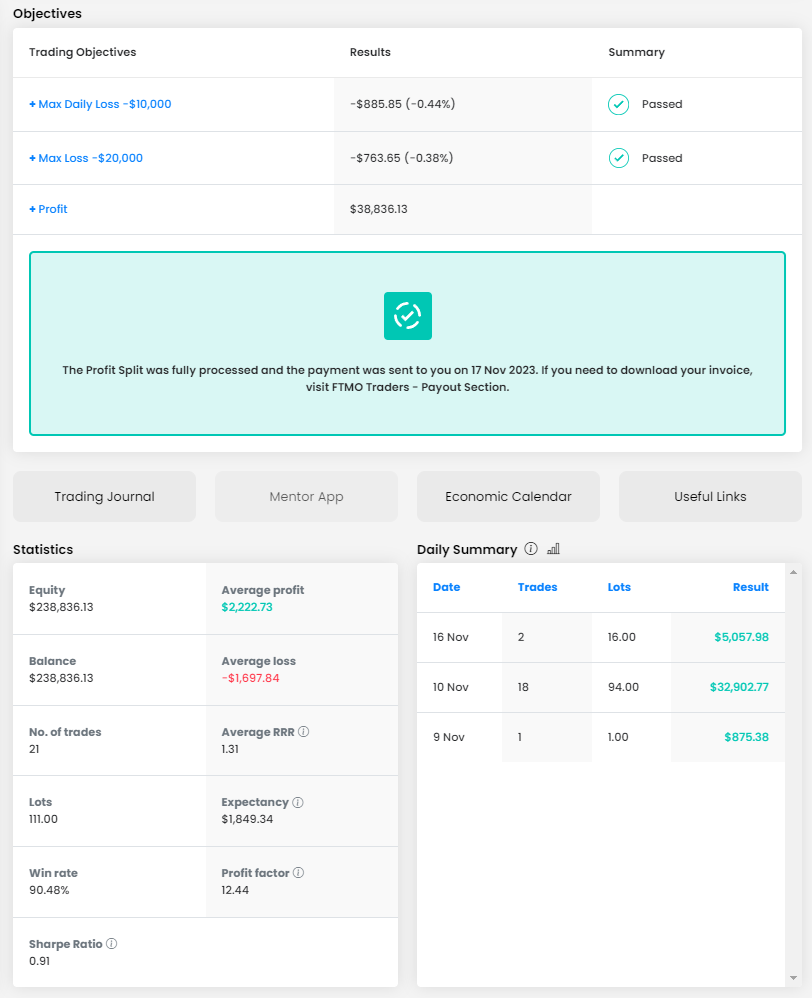

Thanks to the almost seamless development, this trader booked a profit of almost $39,000, which is obviously a great result. Even better is the data on Maximum Loss Limits, which the trader had no problem with at all.

The trader's average Risk-Reward Ratio (RRR) of 1.31 is notably strong, particularly when paired with the trades' high success rate of 90.48%. Across 21 executed trades with a cumulative size of 111 lots, the average position size stands at approximately 5.2 lots. This figure is notably conservative, considering the account size of $200,000. While the trader occasionally opened multiple positions, resulting in larger total sizes for certain instruments, this aligns well with the trader's strategy and poses no issue.

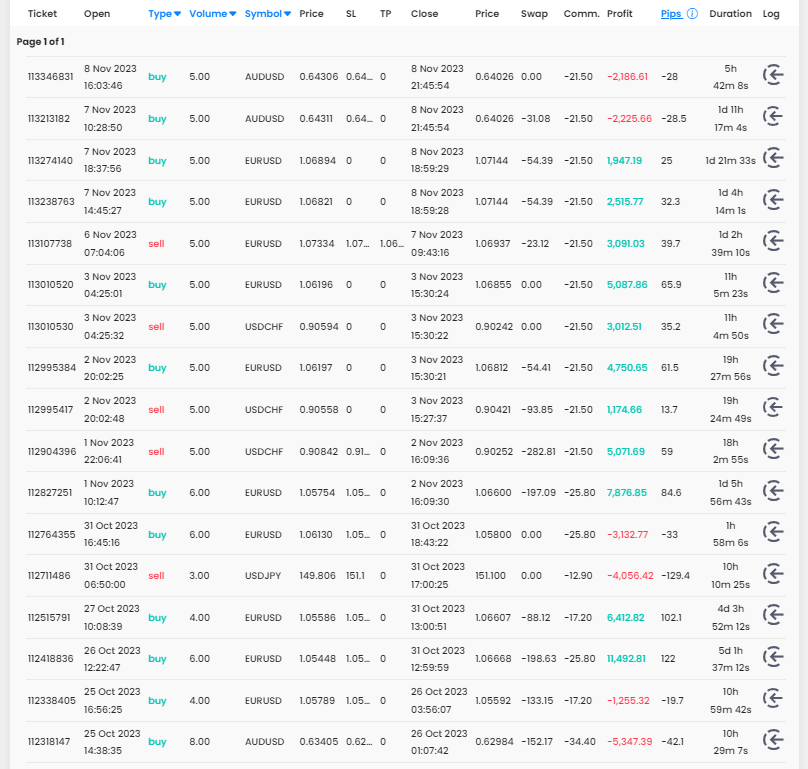

The trading journal shows that the trader is more of a swing trader, holding his positions for several days and in some cases opening an additional position when he felt he could make a higher profit on the instrument. His approach is characterised by the fact that he "builds" his positions throughout the week, but closed all his positions before the weekend.

That is why his most active day is Friday, November 10, when he closed all the positions he opened during the week (except for one, which he closed on Thursday, November 9). In the following week, he opened only two positions, which he closed on the same day with an impressive profit. On the negative side, the lack of Stop Losses can do a lot of damage to a trading account in case of sudden market movements, especially for traders who hold their positions for several days.

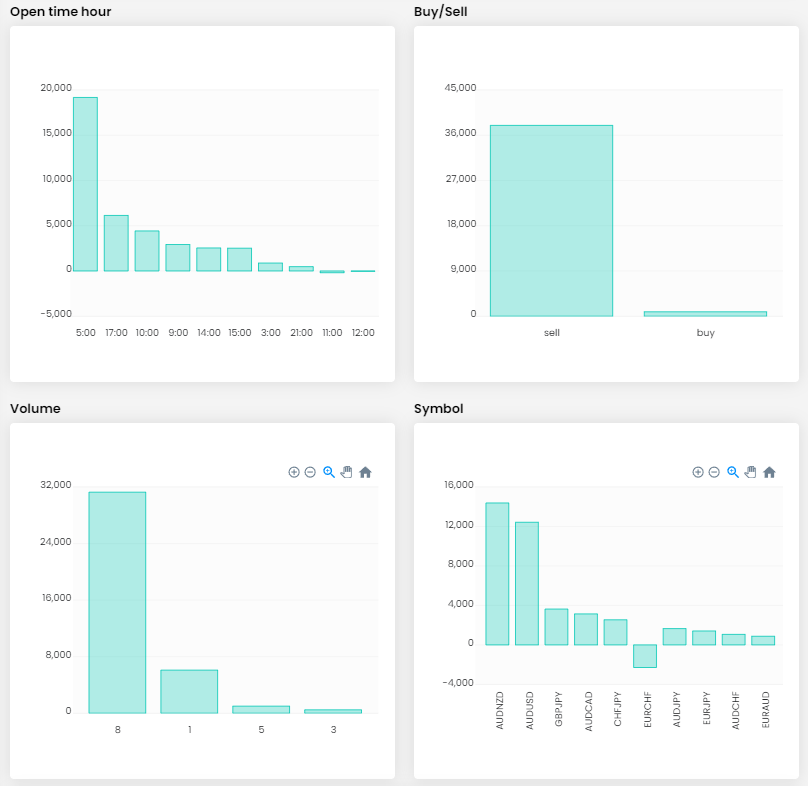

The trader has traded a few currency pairs, leaving out other types of instruments. At first glance, it may seem that this was a broad diversification, but a look at the list of instruments and the journal shows that he was practically speculating with his positions only on the strengthening of the Japanese yen and the weakening of the Australian dollar.

Interestingly, the vast majority of positions were short, but given the aforementioned focus on two currencies, this is probably a coincidence. In other accounts, the trader routinely opens long positions as well.

The balance curve of the second trader isn't as ideal as seen in the first case, yet the outcome remains intriguing. Initially facing a challenging start with three losing streaks during trading, the trader managed to navigate through and emerge unscathed by the end.

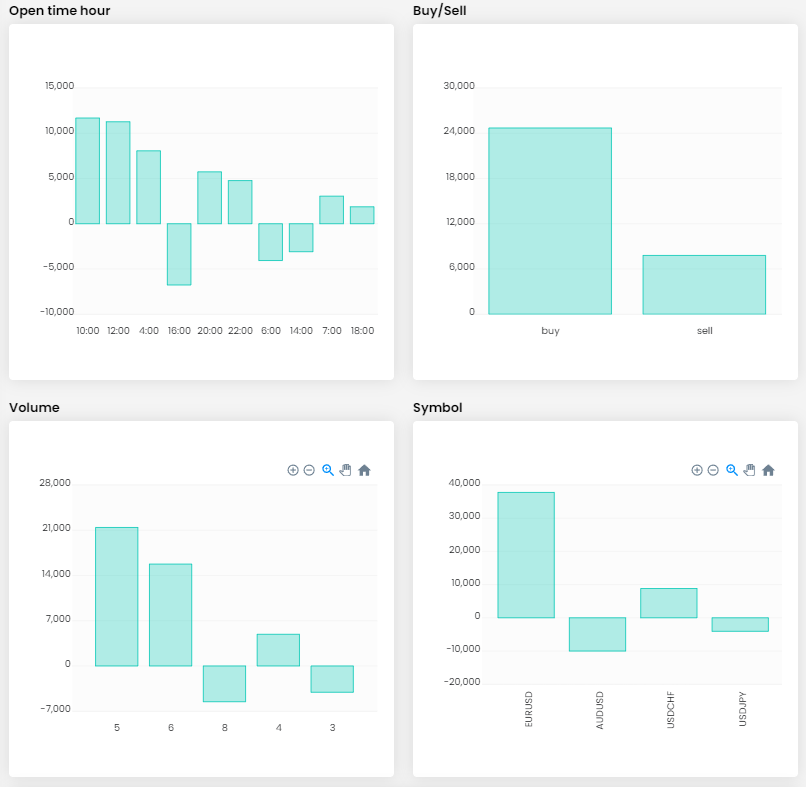

The total profit of AUD 32 492 on an account size of AUD 260 000 is also very good. The second trader was much closer to the loss limits than the first, but the margin was still there. The trader maintained a commendable Risk-Reward Ratio (RRR) of 1.5, coupled with a win rate of 64.71%. Similar to the first case, achieving substantial profit did not require an extensive number of trades. In total, 17 trades were executed with a cumulative size of 87 lots, averaging approximately 5.1 lots per trade. For the size of the account, this is a fairly conservative approach.

Both traders are proof that in the pursuit of big profits there is no need to take numerous trades and at the same time there is no need to open unnecessarily large positions, which ultimately represent a great mental burden for traders.

In contrast to the first trader in this scenario, it's evident that this trader typically implemented a Stop Loss, which is a positive indicator. Similar to the first case, this trader also held positions for several days, and this patient approach clearly paid off in this case as well. The trader only rarely opened multiple positions, and the fact that the biggest losses were only 2% of the account size is also very positive.

The trader dealt with four currency pairs with relatively low correlation, minimizing exposure to any single currency. Upon reviewing the logs, our suggestion would be for the trader to avoid trading the AUDUSD and USDJPY pairs. Notably, all four trades on these pairs resulted in losses, accounting for two-thirds of the trader's total losses.

In today's article, we have shown again that it is not necessary to trade too actively on Forex, nor to take risks with large positions in order to make impressive profits. Keep this in mind the next time you open an unnecessarily large position that can put your entire account at risk. Trade safely!

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.