Fear should not limit your profits

Most traders tend to increase their positions and take more risk after making a certain profit because they feel they can afford to do so. In today's part of the series on successful traders, we will describe the opposite case, where a trader, in an attempt to preserve his profits (perhaps a bit unnecessarily), closed his trades with lower profits than he could have.

It is natural that sometimes a trader feels that since he has made enough money, he can try a riskier trade, or, in short, he sets a higher RRR and allows himself to wait for a larger profit than he would normally realise. In short, he does not need to close the trade at all costs with some profit, but he will wait longer in the trade, which may lead to a better profit. In short, the existing profits will allow him to achieve even better results because he is no longer stressed.

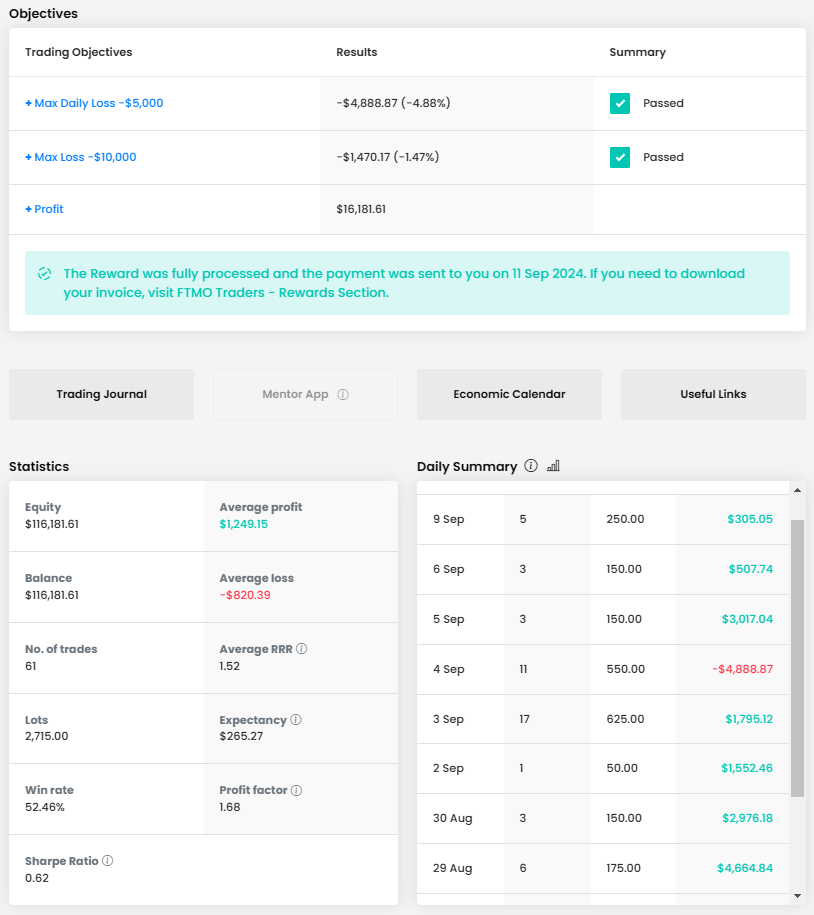

But today we have a trader who behaved the opposite at the end of his trading period. Despite this minor complaint, which we will discuss at the end of the article, the trader managed to stay in the green numbers from the beginning to the end of the trading period and his balance curve looks like everyone would like to have it. Including a high consistency score.

Thanks to his relatively conservative approach and consistent results, the trader had no problem at all with loss limits, which he didn't even come close to. A profit of over $41,000 is truly impressive and with an account size of $200,000, it represents a growth of just over 20%. The average RRR is also great and together with a 50% win rate should guarantee long term returns.

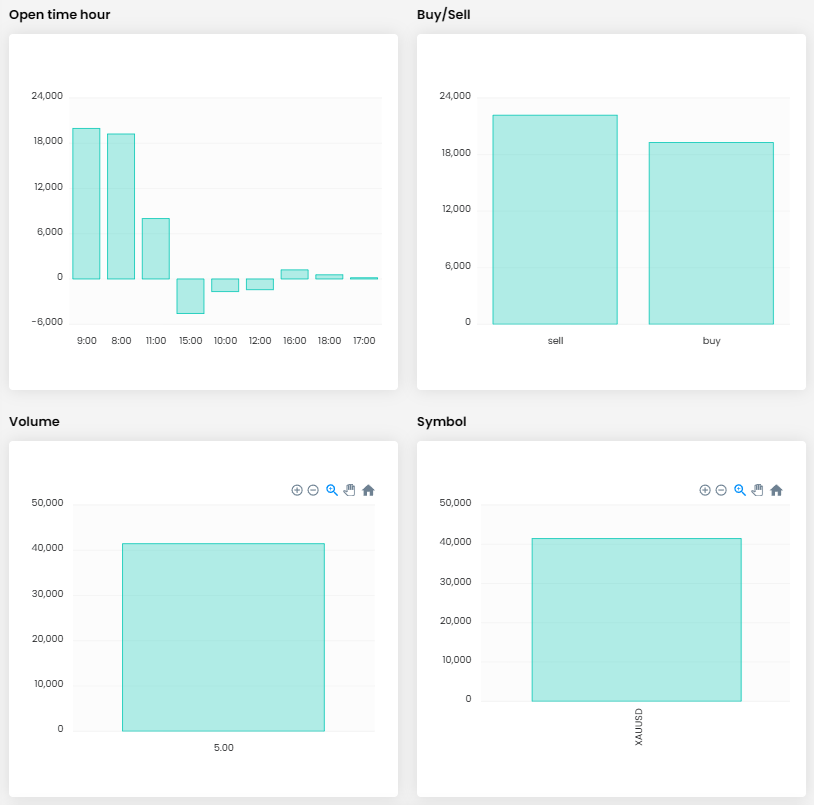

The trader traded for eleven trading days and within this period executed 18 trades with a total size of 90 lots. This gives 5 lots per position, which is also the actual size of all the trader's positions.

In most cases, the trader opened only one trade per day, but when the opportunity appeared, he opened two or three positions, but never at the same time. He is therefore a very conservative trader. He is a typical intraday trader who does not keep positions open overnight. In all of his trades, he set a Stop Loss and in most cases he also set a Take Profit, which we commend.

The results for Buy and Sell positions are rarely balanced and as you can see, he usually opened the first position early in the morning, which was also reflected in the overall results. The only instrument the trader traded on was gold, which has long been one of the most popular instruments.

We will also look at the most profitable trades. Both of them succeeded in close succession, within two days in a row, which is a great psychological boost for any trader. In both cases, he probably took advantage of the fact that the gold price was moving sideways in a particular range or a slightly declining channel during this period, so all he had to do was enter trades around the limits of support and resistance.

In the first case, he made a slightly risky entry when the support level was broken, and the price bounced back to a long position. He set a stop loss below the recent low and aimed for a take profit with a risk-reward ratio (RRR) of 7:1. After ten hours of trading, the price reached the take profit level, coinciding almost perfectly with the price reversal. This trade resulted in a substantial profit of over $14,000, making it a very successful trade.

The very next day, the trader opened a short position in the morning after a bounce from resistance. During the trade, he probably moved the SL to a lower level, but the trade again ended at TP with an RRR around 5:1. Exit again at TP, profit "only" slightly above $10,000, but also a great trade, we can only congratulate.

Interestingly, at the end of the trading period, when the trader had "made his money", he became perhaps a little too cautious. This is not a criticism, as maintaining profits should be one of the main goals of consistently profitable traders, but in this case the concerns were a bit overblown. Even the balance curve shows that the gains from successful trades are not as significant as they were at the beginning, and you can see in the charts below why we allowed ourselves to be critical.

In the case of the second to last trade, our criticism is a bit harsh because the trader realised a profit where he set his Take Profit. So there is nothing to blame him, the mentioned TP was not even set explicitly wrong, as it was placed above the last low, but after such results, perhaps the trader could have afforded a "braver" exit from the market, as he was already entering the market against the trend. Rather, we could criticise the placement of the SL, which probably should have been above the local high. Overall, however, we can evaluate the trade as good, the RRR was around 3.6:1.

The last trade can take a bit more criticism because it is a wasted opportunity. The trader entered quite risky half an hour after the US inflation, which significantly swung prices across the whole spectrum of instruments, including gold. If this had been an entry at the resistance level, as indicated on the chart, it would have been a potentially good, though still risky, entry point. The original SL was probably higher, the trader then moved it to a new lower high to limit losses, which is fine.

The problem lies more with the exit from the market. The trader hit the price drop after a rapid rise caused by surprising inflation and set the TP at RRR around 7.5. So far, so good. He didn't close the first swing to the downside because he didn't reach the TP, which is also fine. But he eventually closed the trade manually, at a time when the price started to fall again, which is really a pity. So the total profit from the trade was much less than it could have been in the end. At the same time, maybe it was enough to just move the SL above the new local high again, or to Break Even, and wait for further developments. In the end, however, even a small profit is better than a loss, so let's not overdo the criticism.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO has developed a two-step evaluation process to find trading talents. Upon successful completion, you may be eligible for an FTMO Rewards Account with a balance of up to $200,000 in simulated funds. How does it work?