Tips for completing the FTMO Challenge & how to avoid mistakes

Sometimes traders tend to make unnecessary mistakes during the FTMO Challenge that are easy to avoid. Minimizing mistakes during the FTMO Challenge will definitely increase your chances of success and can generally benefit your trading. Achieving short-term profit is one thing, but at FTMO it is important to be disciplined in long-term and to follow the risk management rules, which are essential for your account longevity and trading success. With these tips, we would like to help you avoid the common mistakes that traders often encounter.

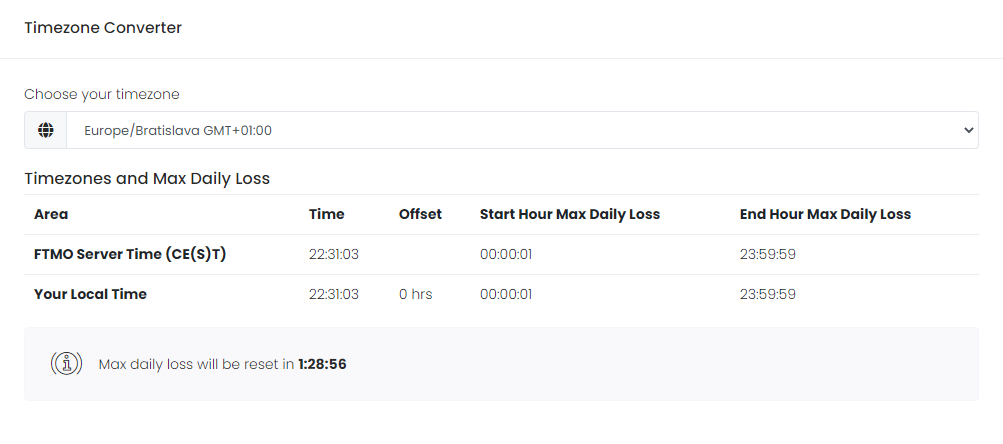

It is important to realize in which time zone you are

In our FTMO Challenge, the business day is defined according to Central European Time - CE(S)T - [Central European (Summer) Time]. This time may not always be the same as the server settings and therefore the time you see in the platform. Compliance with the rules is always monitored according to the time zone CE(S)T.

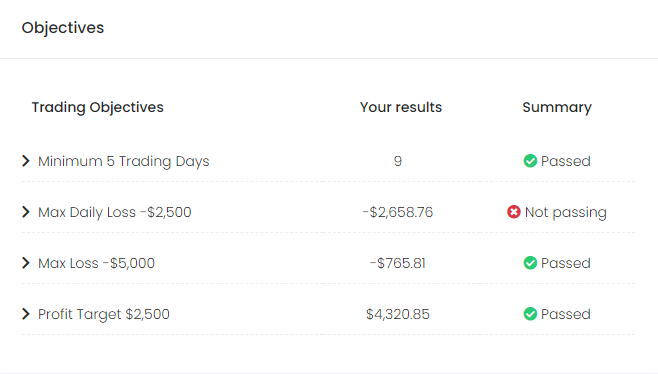

Avoid violating the maximum daily loss

Suppose a trader chooses the $50,000 FTMO Challenge with a maximum daily loss of -$2,500. For example, a businessman travelled on a vacation to a different time zone. Let's say his current daily result is -$2,000, so he can afford an additional loss of -$500 for the rest of the trading day. Let us rephrase again that the results are measured in the CE(S)T (GMT+1/+2) time zone.

This trader automatically counts the time at 00:00 on his watch as midnight and the start of a new day, but to measure the rules you still need 23:00 according to CE(S)T. A trader with a realized loss of -$2,000 will now open a new position that goes into a loss higher than -$500, thus violating the Maximum Daily Loss limit. The trader assumes that this loss was recorded on a new day, but according to our rules, it took place on the same day according to the CE(S)T time zone.

You can find a time zone converter on our website with additional information about the renewal specifics of the Max Daily Loss original 5% value.

If he exceeds the limit for Maximum Daily Loss, it is considered a breach of a basic FTMO Challenge rule, and the FTMO Challenge will be deemed unsuccessful.

Using a Stop Loss can avoid violating the loss limits

Many unexpected events can happen during the FTMO Challenge. Many traders believe they have their trades under control, but one never knows when the volatility picks up or unexpected market moves occur. It is always better if your Stop Loss is placed with some buffer before the loss limit could even trigger the violation of your FTMO Challenge.

You need to know where your limit is

Let's take the example where we have -$2,000 in closed positions for the trading day. So, our allowed loss for the rest of the day is -$500. When we decide to open another trade, we must keep in mind that this new trade must not go into a loss (open or closed) higher than -$500. In this case, we set the Stop Loss so that we never exceed this. Bear in mind that you have to take the commission, swap and possible slippage into account.

Our Metrix application and Mentor app will provide you with very useful information regarding the allowable loss. You also need to check the trading platform to see the real-time equity of your account.

In the 'Current Results' table, you'll see how much more you can afford to lose for the rest of the day and for the rest of the trading period. We hope this information helps you improve your risk management.

Please keep in mind that your losses also take into account open positions.

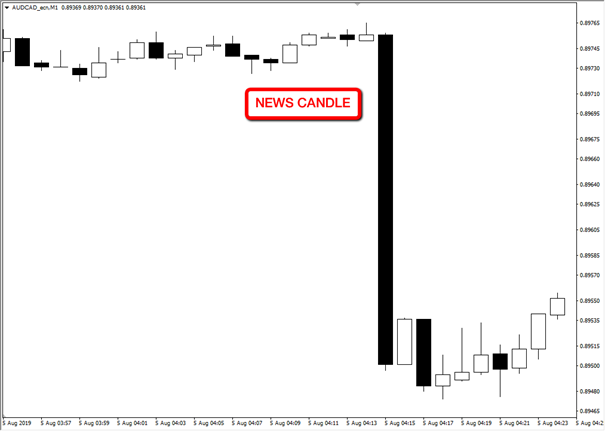

Watch out for major economic news releases

During the FTMO Challenge & Verification, you can ignore the rule of not trading in the window of 2 mins before to 2 minutes after the specific releases. We don't enforce it as we want to make it easier for you to pass the evaluation process. However, we want you to observe the selected news releases once you trade your FTMO Account as that is the stage when real money is involved. We recommend that you always use our economic calendar. This will make you ready for any event.

Every serious trader knows how the macroeconomic news influence price movements across the board. If you do not have an overview of these releases, you might be unknowingly jeopardizing your trading account. Markets are very volatile during this period and therefore we recommend trading very carefully.

Don't get too close to your limits

Sometimes you are very close to your limits and then can occur a small accident to cause them to break.

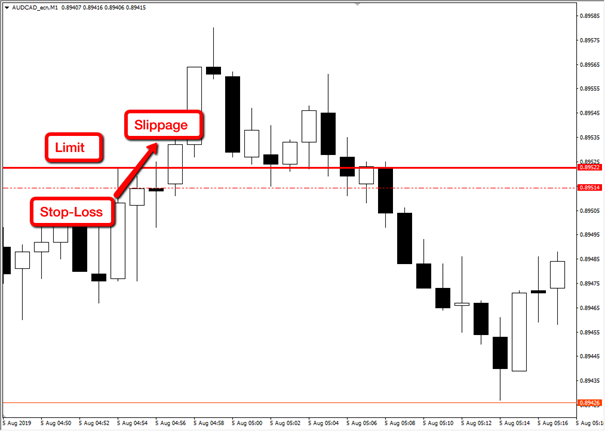

Slippage

If you set your Stop Loss exactly at the level of your loss limit, then we have bad news for you. Stop Losses do not guarantee the execution of the order at the predefined price level. You have to take into account possible slippage and changes in the spread. Be aware that Stop Losses are pending orders that trigger market orders when a specified market level is reached. Market orders try to get the best price at the moment. However, if there is insufficient liquidity in the market at that time, the order can be executed at a worse price, and this may cause the loss limit to be breached. Slippages can be either negative or positive.

Commissions & Swaps

When we calculate losses in the MetaTrader4 environment, the platform calculates trading results, commissions & swaps separately. When you buy 5 lots on EURUSD, you pay $15 to the turnover commission. If your maximum daily loss is -$500, then your EURUSD trade shouldn't have a Stop Loss set to -$500. You still have to account the -$15 commission. If you set your Stop Loss to -$500 and it gets hit in this case, then your total loss would be -$515 (trading result + commission), andthis will violate your limit.

Illustration example

Of course, we always recommend leaving more room for the loss limit. When you stop trading when you reach a 4% daily loss (the limit is 5%), it would be a very responsible decision from your point of view.

Hedging won't provide full protection

Although your position is hedged, your P/L is still subject to changes due to floating spreads. Keep in mind that you are buying at an Ask price and selling at a Bid price. The difference between them is a spread. For this reason, each of your trades immediately opens at a slight loss at the time of opening, precisely because of the initial payment for the spread. The spread fluctuates based on current liquidity in the markets.

Especially during the time of publishing the main economic news, market liquidity tends to be very weak, which results in a substantial widening of spreads. This widening of spreads causes a temporary loss, which in rare cases can lead to a violation of the loss limit. If you get close to your loss limits, we recommend closing your positions instead of hedging them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.