“Don’t fall into the trap of greediness”

FTMO Traders know that the key to long-term success isn’t luck, but discipline, patience, and strong psychology. In this Q&A, four traders share how avoiding greed, trusting their process, and mastering their emotions helped them succeed in the Evaluation Process.

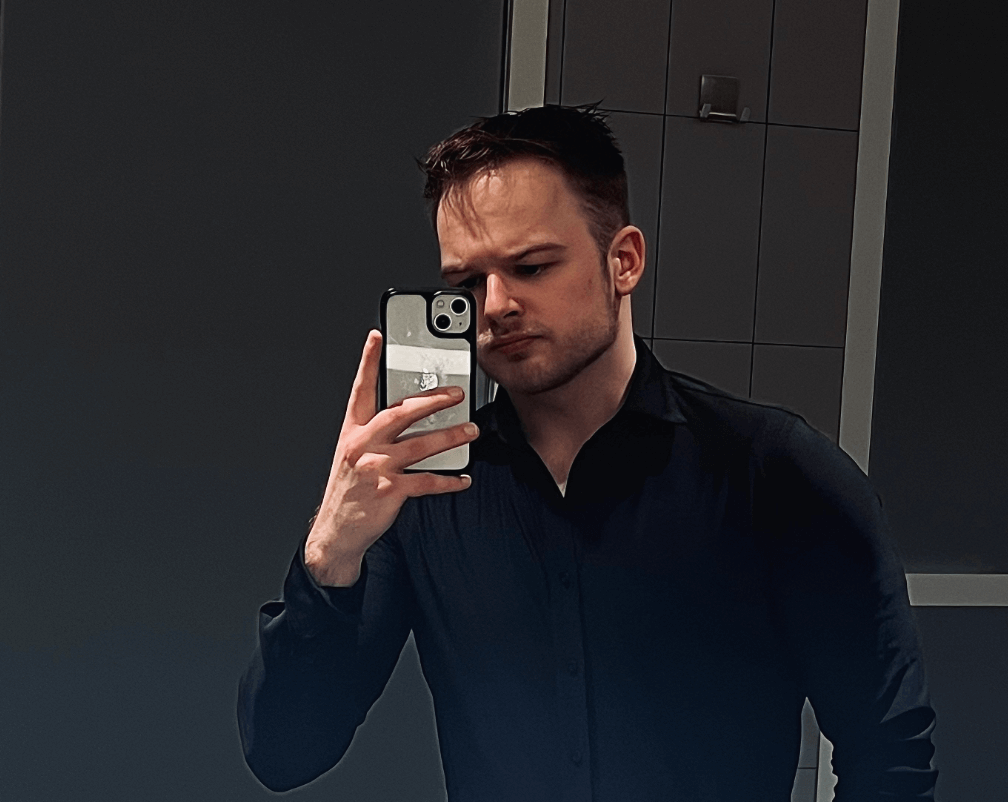

Trader Eldert: “Stay human and don’t get too greedy.”

How did loss limits affect your trading style?

I was thoughtful about my actions and knew what I could risk and what not.

What do you think is the most important characteristic/attribute to become a profitable trader?

Discipline and self-control.

Has your psychology ever affected your trading plan?

It was steady. But once you start going well you have to stay human and don’t get too greedy.

Describe your best trade.

My best trade was a bundle of 3 where I saw the volume go up and up and entered sales where in a short period of time the TP’s were fulfilled and could call it a day.

How did you eliminate the factor of luck in your trading?

By following my trading rules and counting in the confluences. Which makes me able to predict the market most of the time.

What would you like to say to other traders that are attempting the FTMO Challenge?

Don’t fall into the trap of greediness or temptation to trade more/over trade. Take the time to reset and climb even higher instead of sinking lower.

Trader Ulrich: “Consistency and discipline are the keys to long-term success.”

What was easier than expected during the FTMO Challenge or Verification?

Managing my emotions and staying disciplined was easier than expected once I trusted my trading plan.

What does your risk management plan look like?

I risk 0.25-1% per trade with a fixed stop-loss and aim for at least a 2:1 reward-to-risk ratio.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I follow my trading plan and take setups that meet all my criteria.

What do you think is the key for long term success in trading?

Consistency and discipline are the keys to long-term success in trading.

What do you think is the most important characteristic/attribute to become a profitable trader?

Patience; waiting for high-probability setups and not forcing trades.

What would you like to say to other traders that are attempting the FTMO Challenge?

Trust your process, stay disciplined, and don’t let emotions control your trading.

Trader Sami: “With patience, you can cross the sea.”

How did you eliminate the factor of luck in your trading?

I have eliminated the luck factor through discipline, consistency, and a clear strategy without taking excessive risks. By applying fundamental analysis, relying on clear statistics, and reevaluating through backtesting. Everything depends on how each person observes the chart. For example, I am a good analyst, thank God, and I can identify and prevent incidents that may lead to overtrading.

Do you have a trading plan in place, and do you follow it strictly?

Of course, I have a trading plan and I try to push my limits so that I don’t remain in the retail mindset, but think like a cautious strategist. And it really works, only that it requires a lot of perseverance and sacrifice: time, energy, and willpower.

What does your risk management plan look like?

The Reward:Risk plan must always be 2:1. This is the foundation. Over time, it can be advanced to 3:1 or even 3.5/4:1, depending on how calculated you are with the order placed and whether you have your fundamental analysis prepared in advance.

What do you think is the most important characteristic/attribute to become a profitable trader?

Patience is the key. I remember a saying from one of my grandfather’s old friends: ‘With patience, you can cross the sea.’ Without too much attachment to losses and with a lot of consistency and perseverance.

Describe your best trade.

I can’t say that I have a favorite trade. I haven’t excelled to the point where I could consider having one. However, if you believe in yourself and don’t doubt what you’re doing, knowing that you’re doing it right, you will manage to make all trades good — even the less profitable ones or even the losing ones. From every trading day, every week, and every month of the year, there is always something new to learn, regardless of success or failure.

What would you like to say to other traders that are attempting the FTMO Challenge?

I would tell them that once they start, they shouldn’t quit, because FTMO provides basic analytical support, and this helps a lot in shaping traders by giving them the foundation for achievement and success. Perseverance is the key. They should not give up and should remember that they are doing it with a purpose: to push their limits and reach their goal!! All according to God’s Will!!

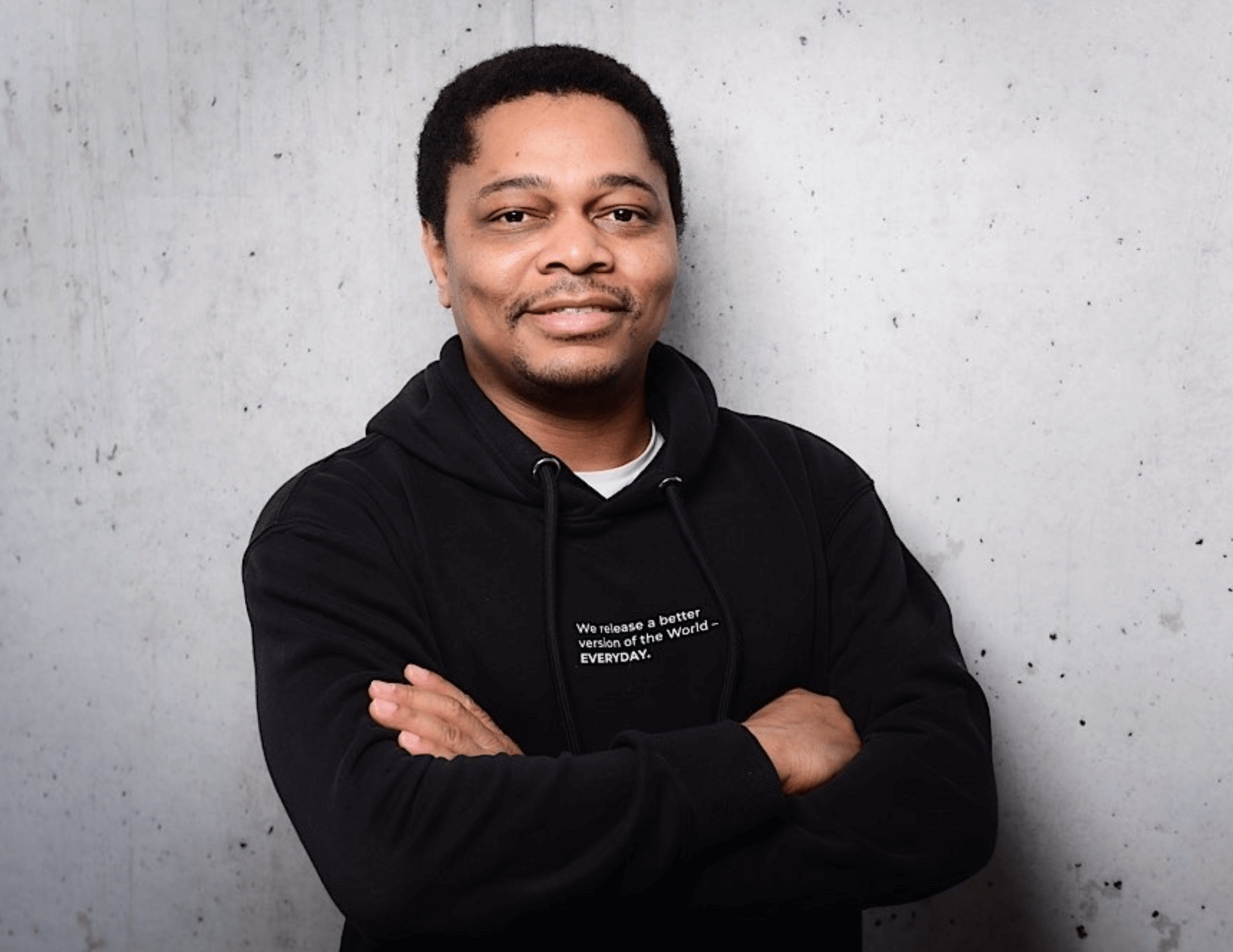

Trader Brandon Joe: “Psychology is the key to success.”

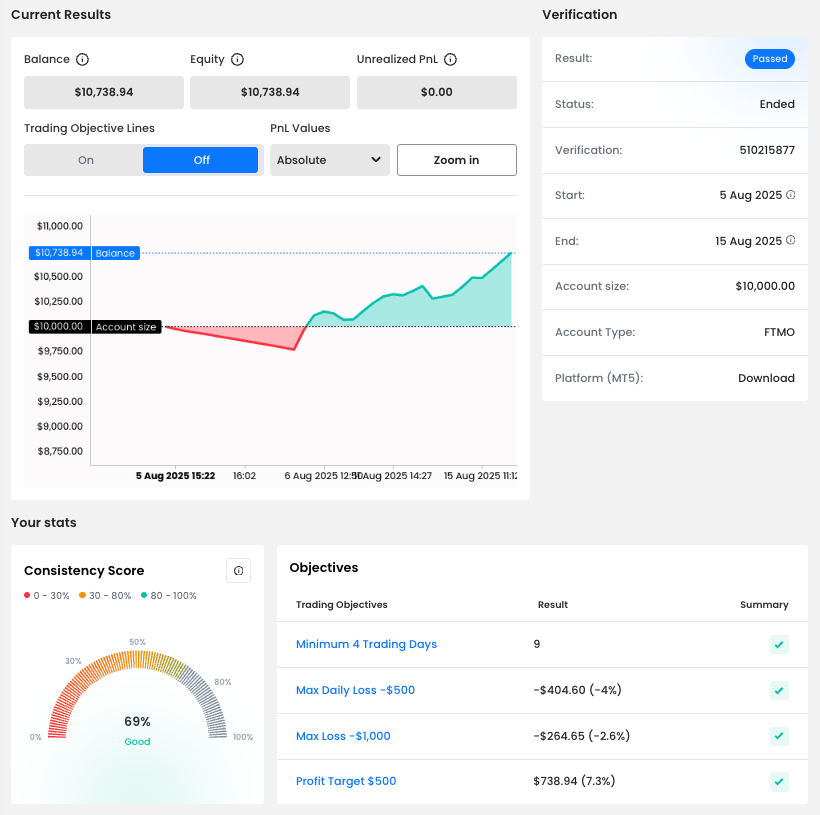

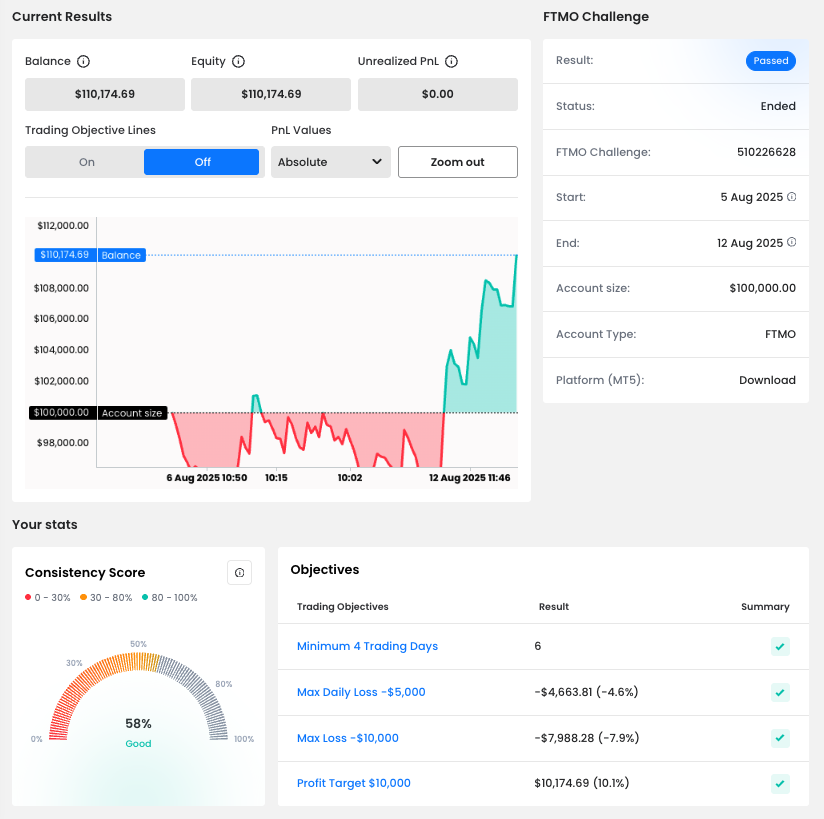

What was easier than expected during the FTMO Challenge or Verification?

The FTMO Challenge. Due to a lower required profit target.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The pressure of being close to funding during the verification stage, but ensure I stay within all of my risk parameters

What does your risk management plan look like?

I roughly trade a 3:1, never risking more than 1% per trade and no more than 2 trades per day. If a second trade is placed I won’t risk more than 0.5%. If I look to leverage a position, my original entry has to be at break even and I still target my original TP unless the market structure is highly in my favor.

How did you manage your emotions when you were in a losing trade?

I now have a system in place where my trading apps are locked if there are no set ups or I have reached my max trades for the day. Using an app called Brick which is a little device that locks me out of selected apps. This provides assistance in managing my emotions by reminding me no more trading is to be done. I now journal absolutely everything per trade and carry out weekly analysis to ensure I have stuck to my plan.

What do you think is the most important characteristic/attribute to become a profitable trader?

Psychology. A strong mental framework is the key to success which I have aided through the likes of meditation. It is very easy to place “1 more trade” or “risk a little more” which just leads to over-trading and eventually losing money.

One piece of advice for people starting the FTMO Challenge now.

Don’t rush and think it’s a get rich quick scheme. Ignore all the flash bits online, as trading is not something that can be overcome quickly, the key to success with any strategy is through solid risk management and a strong mental frame.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.