Don't be discouraged by losses

Life is not a walk in the park and this is even more true for traders. Most of you will have to go through a series of losses and failed attempts before becoming a successful trader. This is not uncommon and a good trader treats failures as training that is not in vain. Today's traders, who eventually established themselves as successful traders, feel the same way.

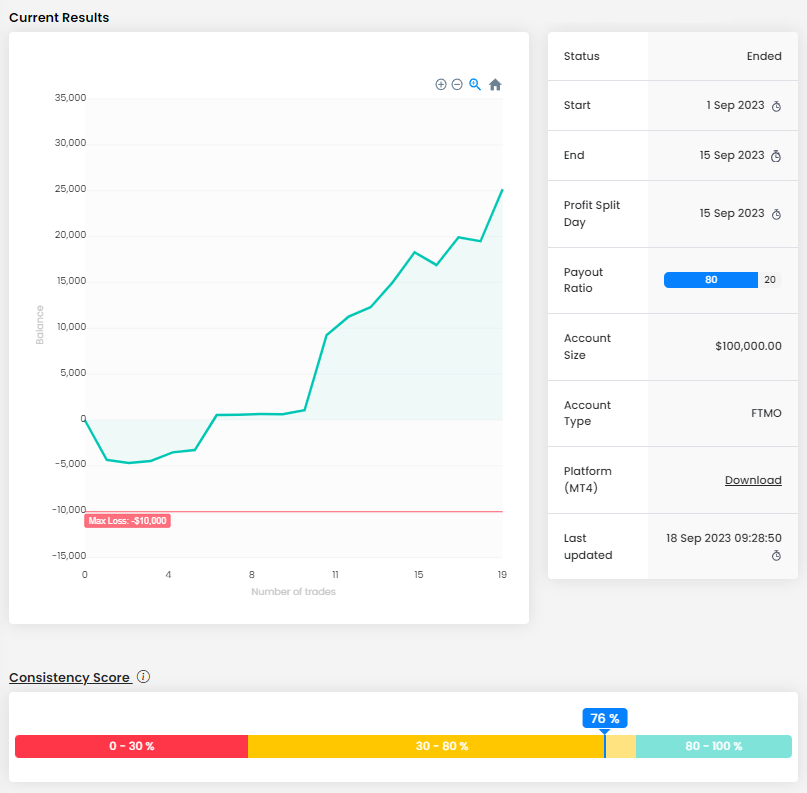

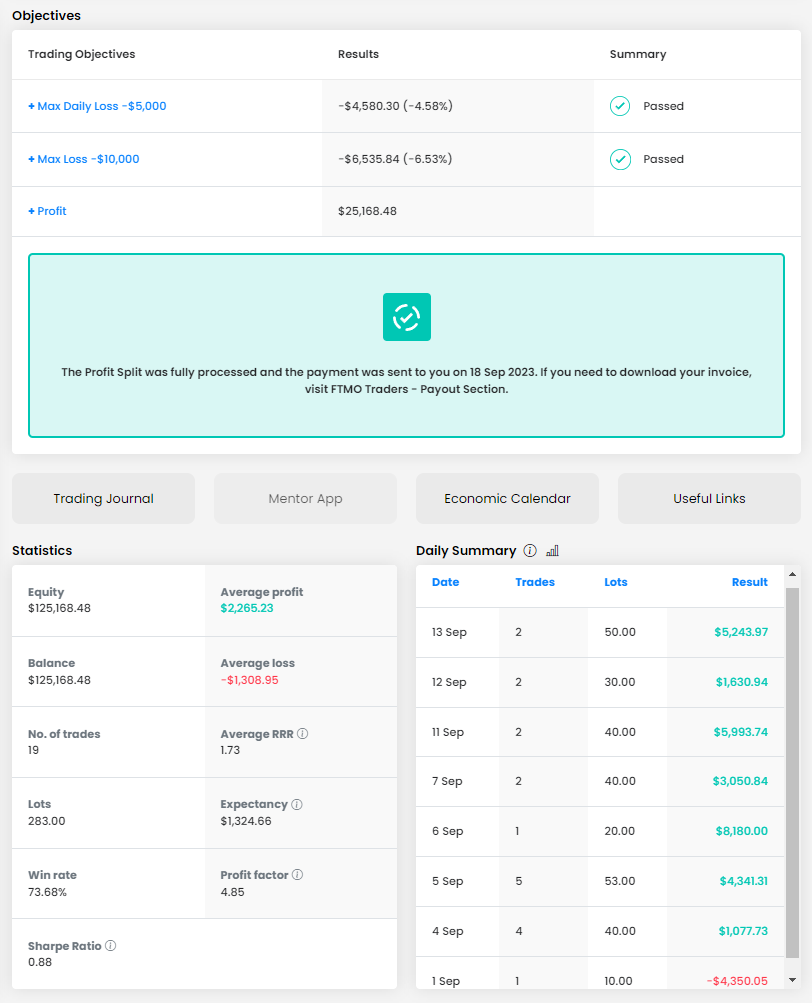

The first trader didn't start his successful trading phase particularly well, but didn't give up and in the end achieved a very nice result and an almost perfect balance curve (we had something similar here two weeks ago). Maybe he was lucky that the first trading day, when he recorded the biggest loss, was followed by a weekend, so he had time to pull himself together. His biggest mistake was also starting trading on a Friday, which many traders deliberately skip due to volatile results. Interestingly, he didn't trade the following Friday and probably did the right thing.

The trader's first stumble almost cost him the account as the Maximum Daily Loss limit was almost reached (-4.58%) and affected the trader's Maximum Loss, but after that everything was fine. A total profit of over $25,000 is great with an account size of $100,000. It was underwritten by good consistency, but also by a good RRR (1.73) combined with a high success rate (73.68%).

The trader opened 19 trades with a total of 283 lots over the course of eight days. That's nearly 15 lots per position, which is not too much for an account size of $100,000. Apart from the first day, when he recorded the big loss mentioned above, he has already closed the other days in profit.

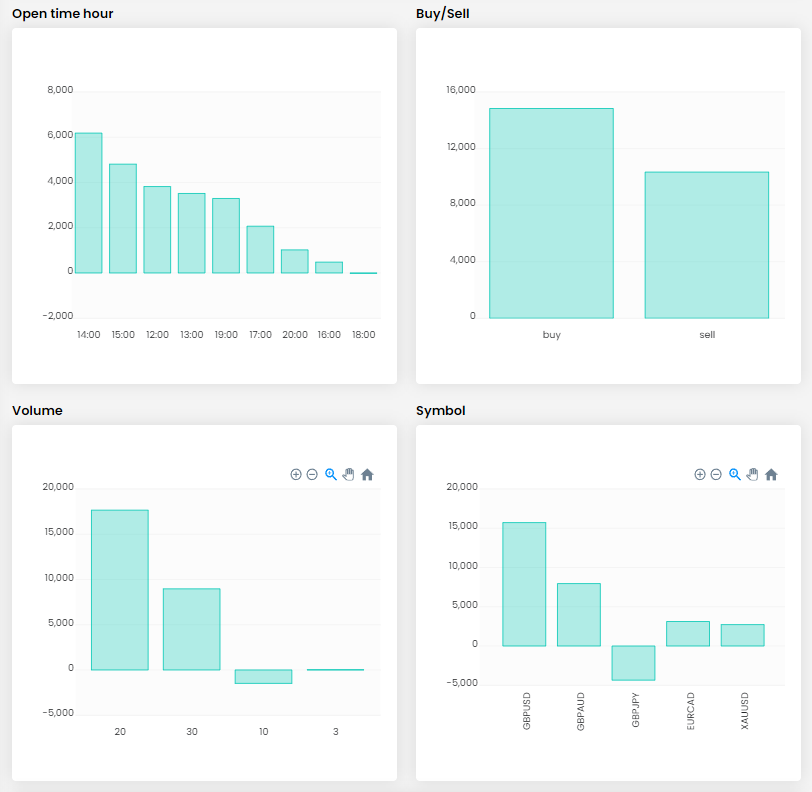

The trader rarely opened multiple positions and even in the two cases when he did, the position size on one instrument did not exceed 20 lots, which is still within a reasonable risk tolerance. On the other hand, we can fault him for not setting Stop Losses on many trades, which significantly increases the risk level of the trades in the event of a sudden market event.

Fortunately, he didn't keep his positions open overnight, as he is a typical intraday trader who keeps his positions open for a few hours at most. He also did not open too many trades in one day and chose his positions carefully, which probably led him to believe that he did not need to set Stop Losses, but we still do not recommend this approach to traders.

The success rate of long and short positions is similar due to the low number of losing trades. The trader opened positions on five instruments, with tmost trades opened on the GBPAUD currency pair, but the most profitable was the GBPUSD currency pair. Interestingly, he only opened one position on the GBPJPY pair, but it was the above trade executed on the first trading day that ended with the biggest loss. This may have been the reason why the trader chose to avoid it later.

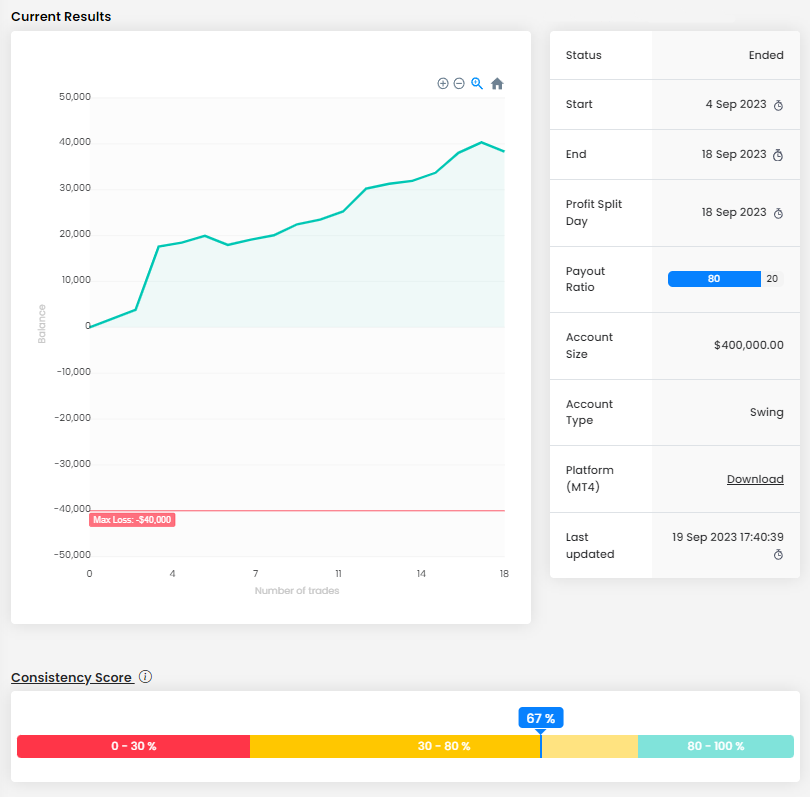

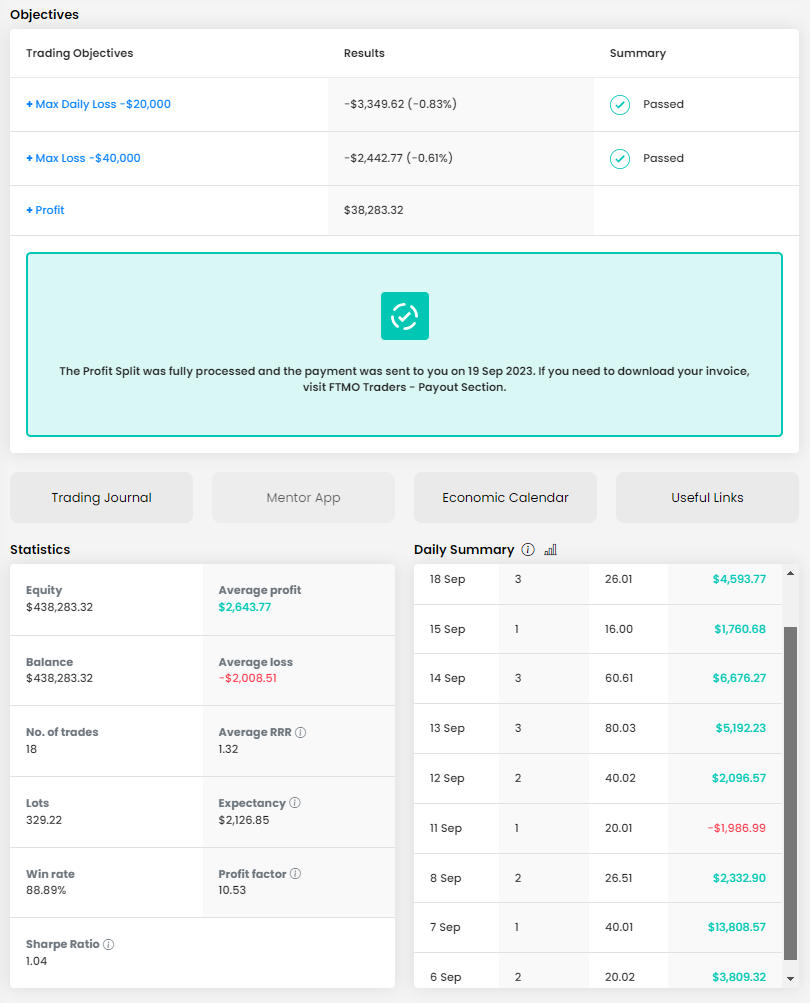

The balance curve of the second trader looks even better than that of the first trader and the overall return is also very nice. The trader was in the green practically from the beginning of the trading period. His consistency score was below 70%, but even that was enough to make a profit of almost $40,000 on a $400,000 account.

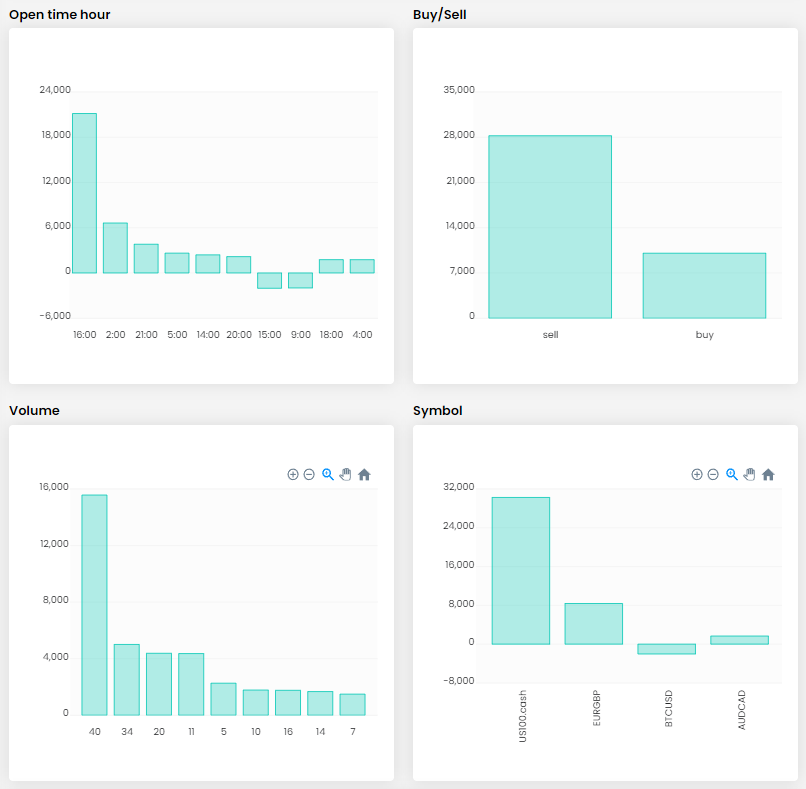

Unlike the first trader, in this case there was no problem with the loss limits, neither the Maximum Loss nor the Maximum Daily Loss. This trader was also able to rely on a strong combination of a good RRR (1.32) and a very high success rate (88.89%). The trader traded for nine days, opening 18 positions with a total size of 329.22 lots. Again, the average position size (18.29 lots) is perfectly acceptable for the size of the account.

However, unlike the first case, this trader opened multiple positions, so the maximum position size in some cases reached up to 80 lots, which is really a large amount and a relatively large exposure to one investment instrument. This is forgivable given the size of the account, but traders are strongly discouraged from opening positions that are too large on one instrument.

Fortunately, the trader set Stop Loss and Take Profit for all open positions. since some of the positions were held for practically the entire trading period, this is a necessity. Only two positions with this trader ended in the red, and in both cases the loss was only 0.5% of the account, so some of the shortcomings in position size are probably forgivable. The key is to maintain the maximum loss per position rule going forward.

In this case, it was clear that the trader's balance of short and long trades would be without problems, but given the market developments, his short positions prevailed. In total, he traded four investment instruments across three asset classes, making it the first time in a long time that we have a trader who also traded Bitcoin. Unfortunately, Bitcoin was the instrument where the trader recorded the biggest loss.

In today's part of the series on successful traders, we have once again seen that it is not necessary to trade a large number of trades to be a successful trader, and that it is not even necessary to trade a large number of instruments. Furthermore, in both cases, it was true that traders needed time to reach the level they are at today. However, their patience and belief in their own abilities ultimately meant that they were now able to trade accounts with very interesting balances, which is also reflected in their overall profiles.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.