The path to interesting profits through patience and a conservative approach

Many Forex traders believe that the more trades they execute in a relatively short period of time, the better their chances of success. In reality, however, this approach will only bring long-term success to a handful of traders. As we will show in today's series on successful traders, a long-term and disciplined approach may be a better choice for many traders.

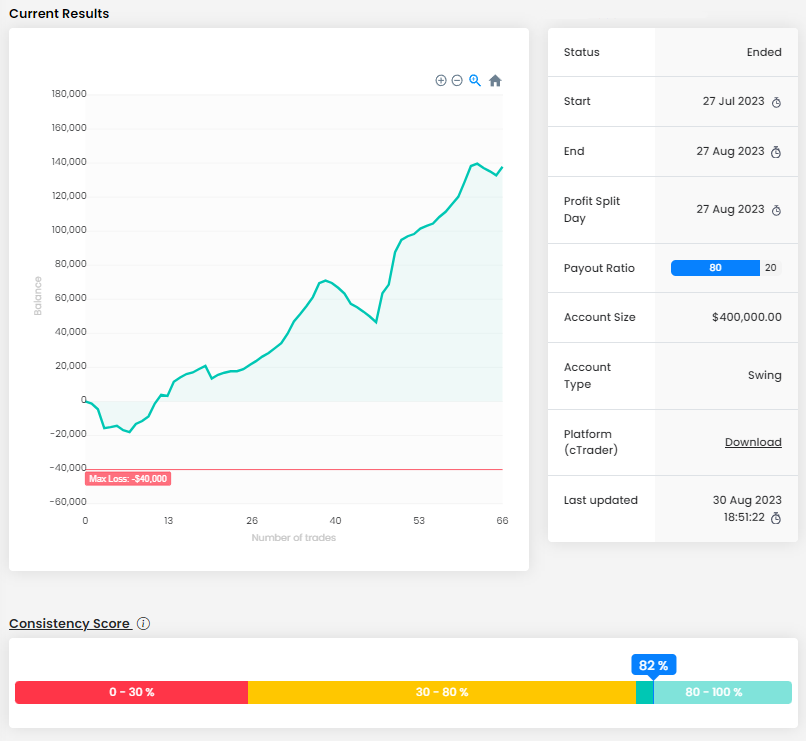

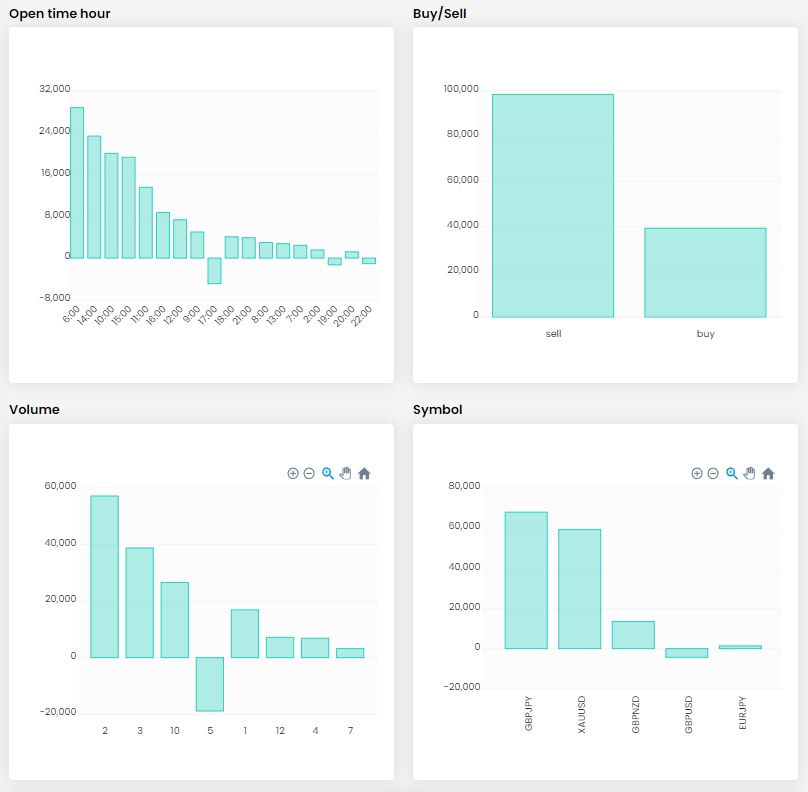

A bad start, but a good ending. I guess that's how you could describe the first trader's balance curve. Despite a misstep at the beginning that cost him nearly $17,000 and meant he was dangerously close to the Max Daily Loss limit, he managed to make very good money in the end. The initial slump was not the only time the trader failed, but in the end, we can say that history does not ask for it.

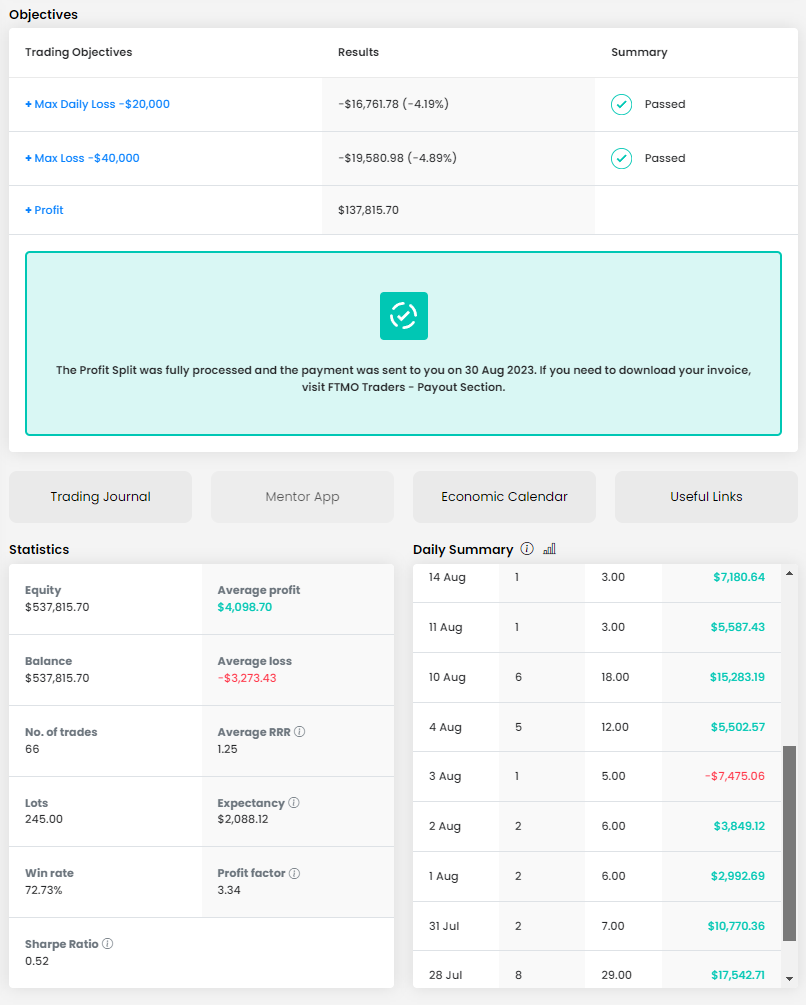

Making a cool profit of almost $140,000 on an account of $400,000 is not for everyone. It's not just the absolute amount, even the percentage is almost 35%, which in itself is very good. The average profit and average loss are not very different from each other, so the average RRR is "only" 1.25, but with a success rate of 72.73%, that's completely sufficient. The number of lots was 245 with 66 trades, which is 3.71 per trade, and the trader traded practically the whole month.

Although the trader reached the maximum possible allocation at FTMO, his positions were far from the highest. Even after opening multiple positions, the total position size on one instrument was rarely more than 15 lots, which is really fine for the size of the account. In the course of one day, the trader opened positions on a maximum of two instruments.

The problem we see with the trader is that he sometimes commits to adding to losing positions, so-called scaling in. With this approach, we repeatedly remind in these articles that it is not intended for beginners and inexperienced traders, nor for those who already have some trading experience, it is better to avoid this style of trading. In this case, it almost backfired for the trader, because thanks to these positions that he opened at a loss, he almost attacked the mentioned Max Daily Loss limit.

In the following days, he avoided such trades and instead used an approach where he increased his winning positions, known as pyramiding. In this approach, the trader uses the strength of the trend and gradually increases his potential profit by increasing his positions, while gradually reducing the potential risk of loss. However, it takes patience and often a longer period of time before the trader can exploit the entire trend.

However, it is not uncommon for this trader to hold positions for several days, for example, he closed trades on the last day of the trading period with a profit of over $40,000. Of course, the small disadvantage of such trades is the fact that they eat up a lot of money for the trader in the form of swap fees. On the other hand, the above-average return from a strong long-term trend will certainly offset these partial losses.

The trader opened similar numbers of long and short positions, but the result was much better on short positions, which earned him close to $100,000. While opening positions on five instruments, he opened the most positions on the GBPJPY currency pair and gold, where he was able to benefit from the downtrend. The trend lasted from late July til mid-August and it could have made a lot of money.

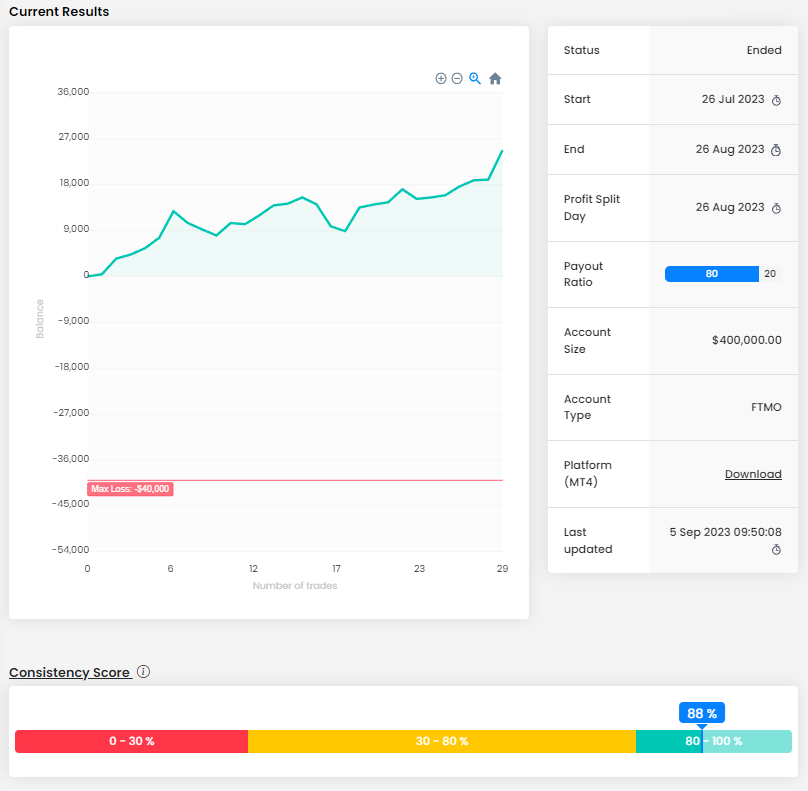

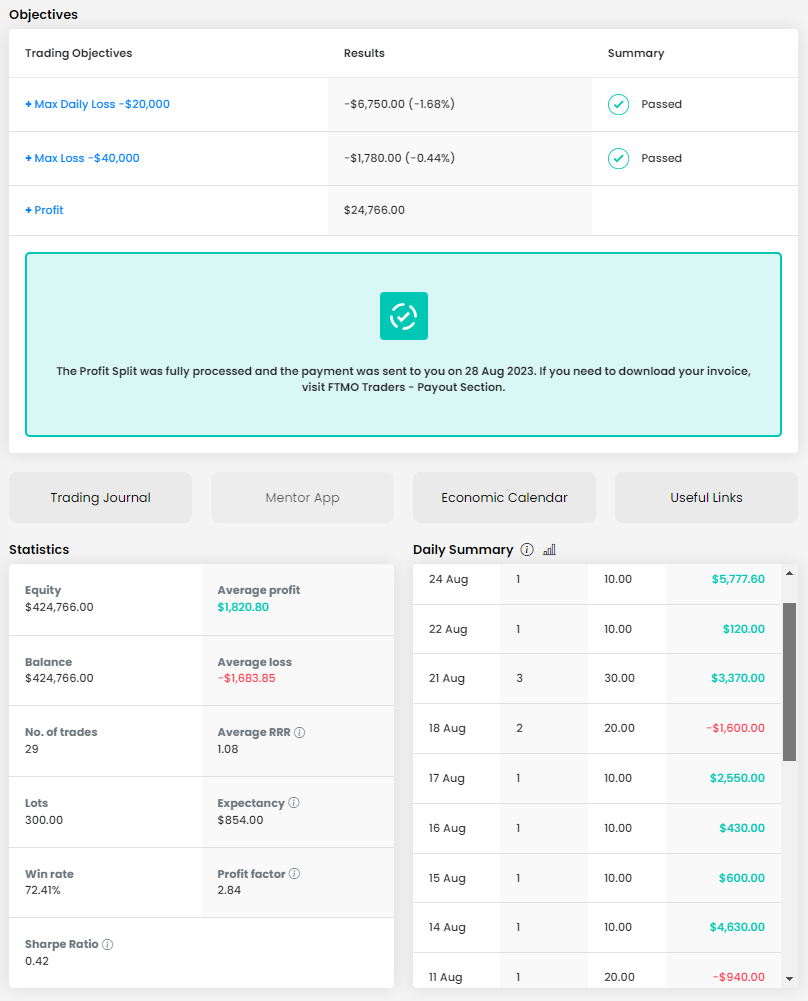

The balance curve of the second trader does not look so nice at first glance and the total return is also much lower. However, this does not change the fact that a patient and (if you can say that about Forex trading) conservative approach, complemented by high consistency, was also successful in this case.

The profit of almost 25,000 USD is not as great as in the previous case, but not small either. Furthermore, due to the more conservative approach, the trader had no problems and did not get close to the loss limits.

In the entire month, he only executed 29 trades with a total size of 300 lots. An average size of 10.3 lots per trade is really "small" with an account size of $400,000. Even though this trader did not achieve a very high average RRR (1.08), the high success rate (72.41%) guaranteed him an interesting profit in the end.

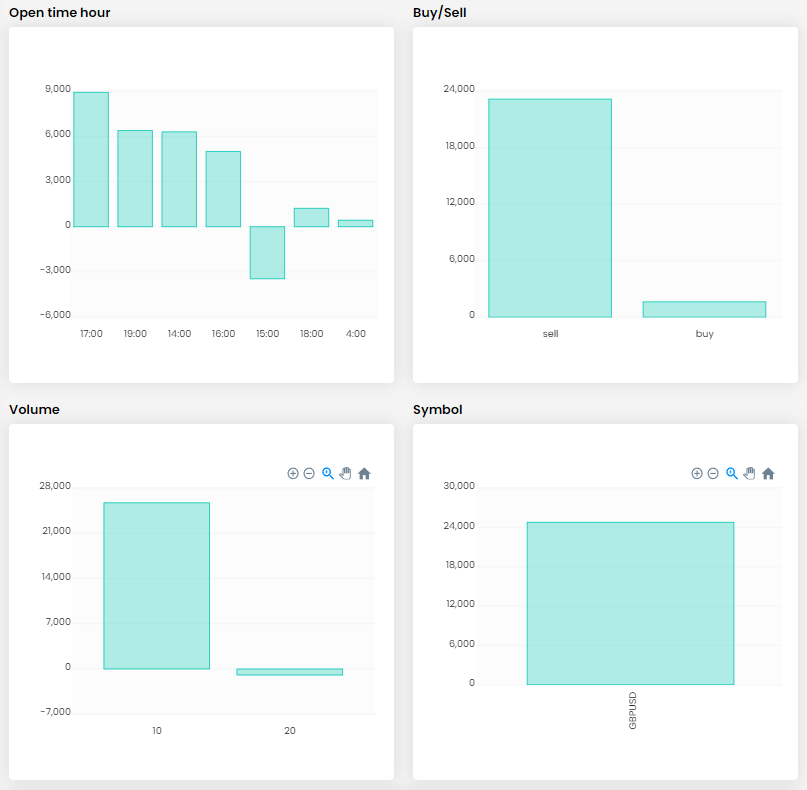

It is clear from the journal that the trader opened positions of 10 lots and opened a position of 20 lots only once. The trader rarely opened multiple positions, and he is a classic intraday trader who holds positions from tens of minutes to several hours and rarely holds positions overnight. Swaps do not pose a problem in this case and when the trader did hold the trade overnight, he had a positive swap.

Given the size of the positions, it is clear that the trader does not take extreme risks, only when his loss exceeded $4,000 and the profitable trades are similar. This trader is an example that we don't have to chase returns at all costs and that one relatively small trade per day is enough to make an interesting overall profit.

As with position sizing, the trader was fairly strict on instrument selection and only traded on one currency pair (GBPUSD). Although this is not a diversified path, in many cases it is the easiest way to refine your strategy and be successful in the long run. In this way, the trader does not have to spread his attention over several instruments but can focus on just one symbol and thereby not miss any interesting signals.

In today's section, we have shown that quality can win over quantity when it comes to Forex trading. A more moderate approach when opening positions, patience, and a very good level of consistency often means less stress and in this case led to above-average profits, which can also be sustainable in the long term. And that's what we all want.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.