Don't be afraid of the drawdown

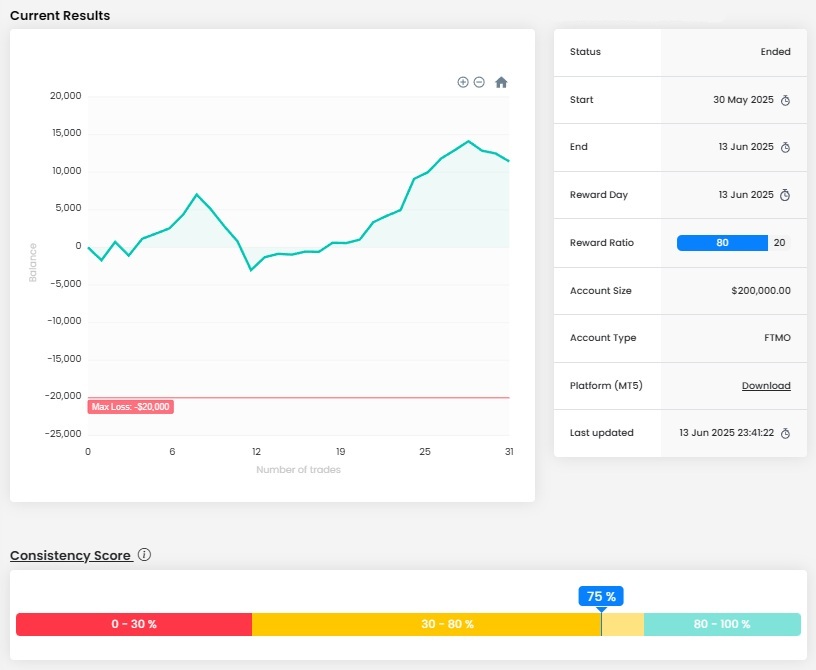

In the next part of our series on successful FTMO Traders, we take a look at a trader who had a very strong start but had to deal with a significant drawdown during the trading period - one that even pushed him into the red.

Not every trader can recover from a drawdown that turns a profitable trade into a losing one. Some begin to panic and change their strategy, others open unnecessarily large positions in an attempt to 'take revenge on the market' and return to profit as quickly as possible, and some traders become completely paralyzed by the situation.

The moment a trader experiences a series of losses, they need to be mentally resilient - something that should be supported by confidence in their own strategy. A well-tested strategy that a trader can rely on for long-term success, combined with disciplined adherence to a trading plan, are the key factors that separate successful traders from those still trying to succeed. Proper risk management is also essential and should be an integral part of both the strategy and the trading plan.

Our trader clearly managed to achieve both. As seen in the balance curve, after the first few trading days, he was up more than three percent and appeared to be on track for a very strong result. However, a series of unsuccessful trades followed, which pushed him into the red for two days.

Fortunately, the trader didn’t panic. He began opening smaller positions, where he likely felt more comfortable, and gradually returned to a growth trajectory. After making some profit, he allowed himself to open larger positions again and ended the period with a solid profit, thanks to his consistent approach. The final stretch was not ideal, but he managed to close his trading period before encountering further trouble.

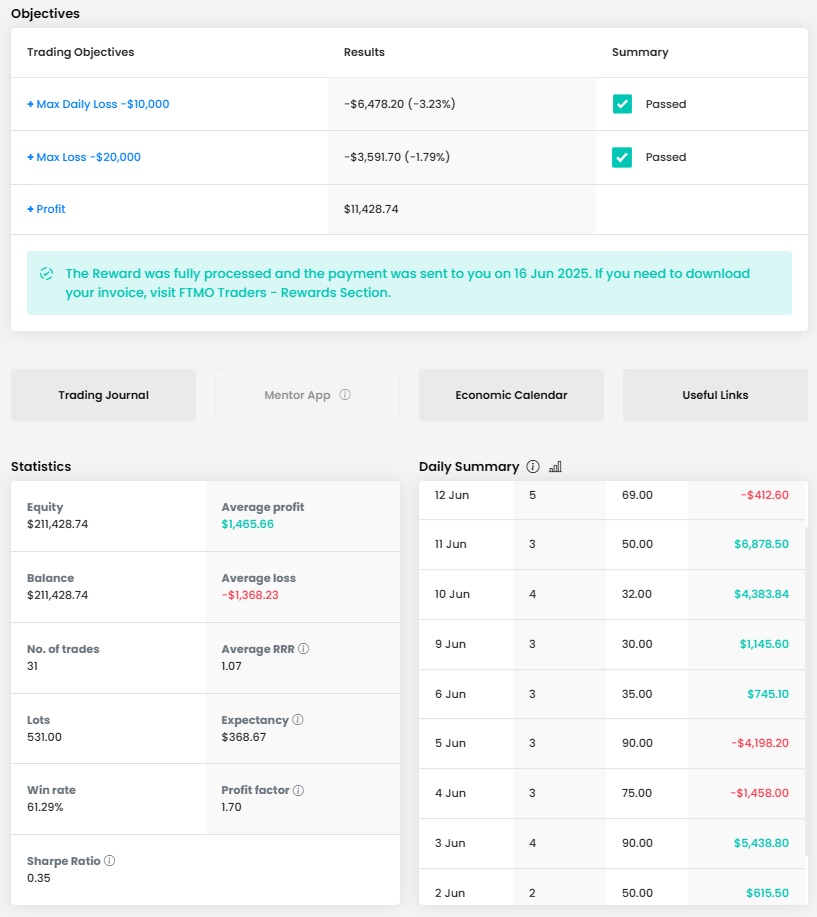

The total profit of over $11,000 is impressive. Although it represents less than 6% on an account size of $200,000, the trader can certainly be satisfied with his performance. Similarly, despite the drawdown mentioned earlier, his maximum loss remained below 2%, staying well within our limits.

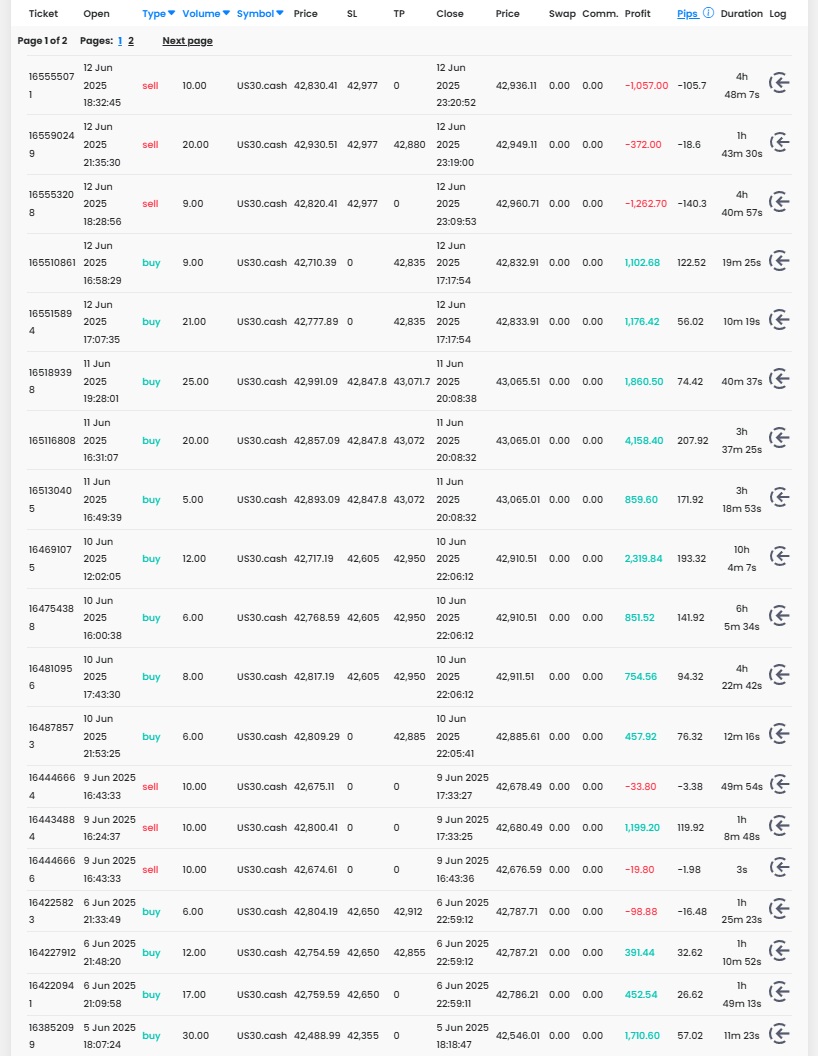

Over the course of ten trading days, the trader opened 31 positions with a total volume of 531 lots. That’s an average of about 17 lots per position, and he occasionally added to his positions. This may seem like a lot, but for the US30.cash instrument and an account size of $200,000, it is quite reasonable. The risk-reward ratio (RRR) was slightly above 1 (1.07), which is not high, but with a success rate of 61.29%, it was enough to produce a strong overall profit.

According to data from the journal, he is an intraday trader who never holds positions overnight. In most cases, his trades lasted several hours, but some were as short as 10 minutes, which could be considered scalping. Generally, the trader did enter Stop Loss (SL) and Take Profit (TP) orders, although a few trades lacked them. This is not ideal, as a significant price movement—which is not uncommon in US stocks today—could prevent the trader from closing a potentially losing position in time, risking an unnecessarily large loss. On the positive side, the trader kept losses within reasonable limits, and only in one instance did the loss exceed one percent of the account size.

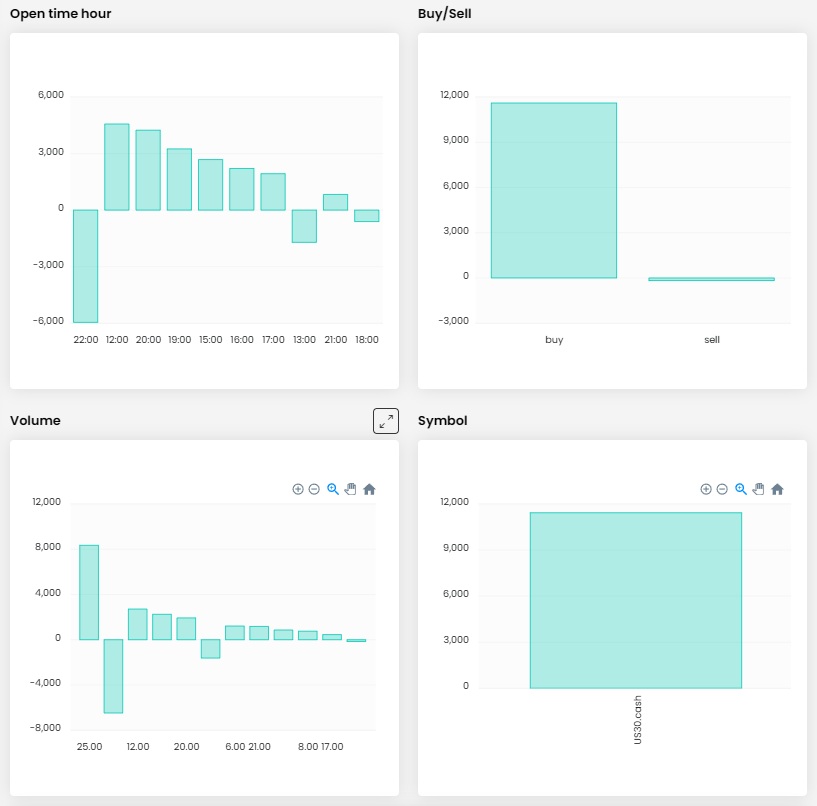

The trader focused on a single instrument—the well-known US index DJIA (US30.cash). Concentrating on a single instrument can be advantageous in short-term trading, as it allows for deeper focus without the distraction of switching between different charts. Although he did not trade during a strongly bullish trend (even though the DJIA was up 2% during his trading period), the difference in success rates between long and short positions was surprisingly significant.

In most cases, the times when the trader opened his positions coincided with the opening hours of the US stock markets. This is quite expected given the choice of investment instrument, although the US30.cash can be traded—with a short break—almost continuously throughout the day. Interestingly, the success rate of trades varied depending on the time of entry, with the trader clearly experiencing the worst results when opening positions in the hour after the markets had closed. He would probably do well to avoid this time in the future.

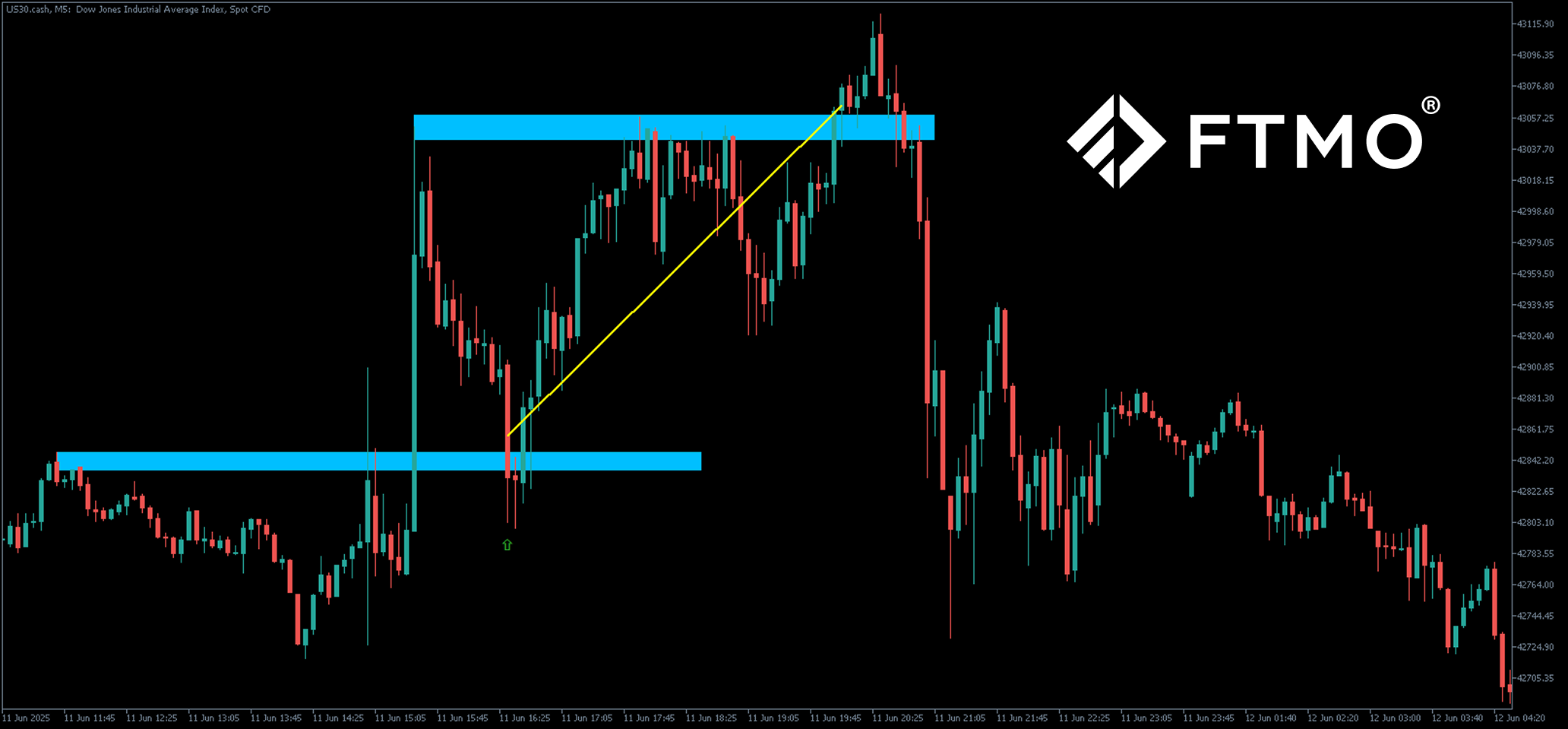

As always, we will also look at some of the trader's successful trades. First, we'll discuss a long position from the first half of June. The trader entered the position when the price approached a level that had served as short-term resistance and turned into support after a breakout and the US market open. The entry appears somewhat hasty (though we don't actually know the trader’s strategy, so it's difficult to judge), but the market eventually moved in the right direction.

The trader didn’t wait for his Take Profit (TP) to be hit and closed the trade when the price reached a new resistance level. In the end, closing the order turned out to be a smart decision, as traders speculating on further upside could have been caught in a bull trap. A profit of $4,158 was the reward for the right decision—and a bit of luck.

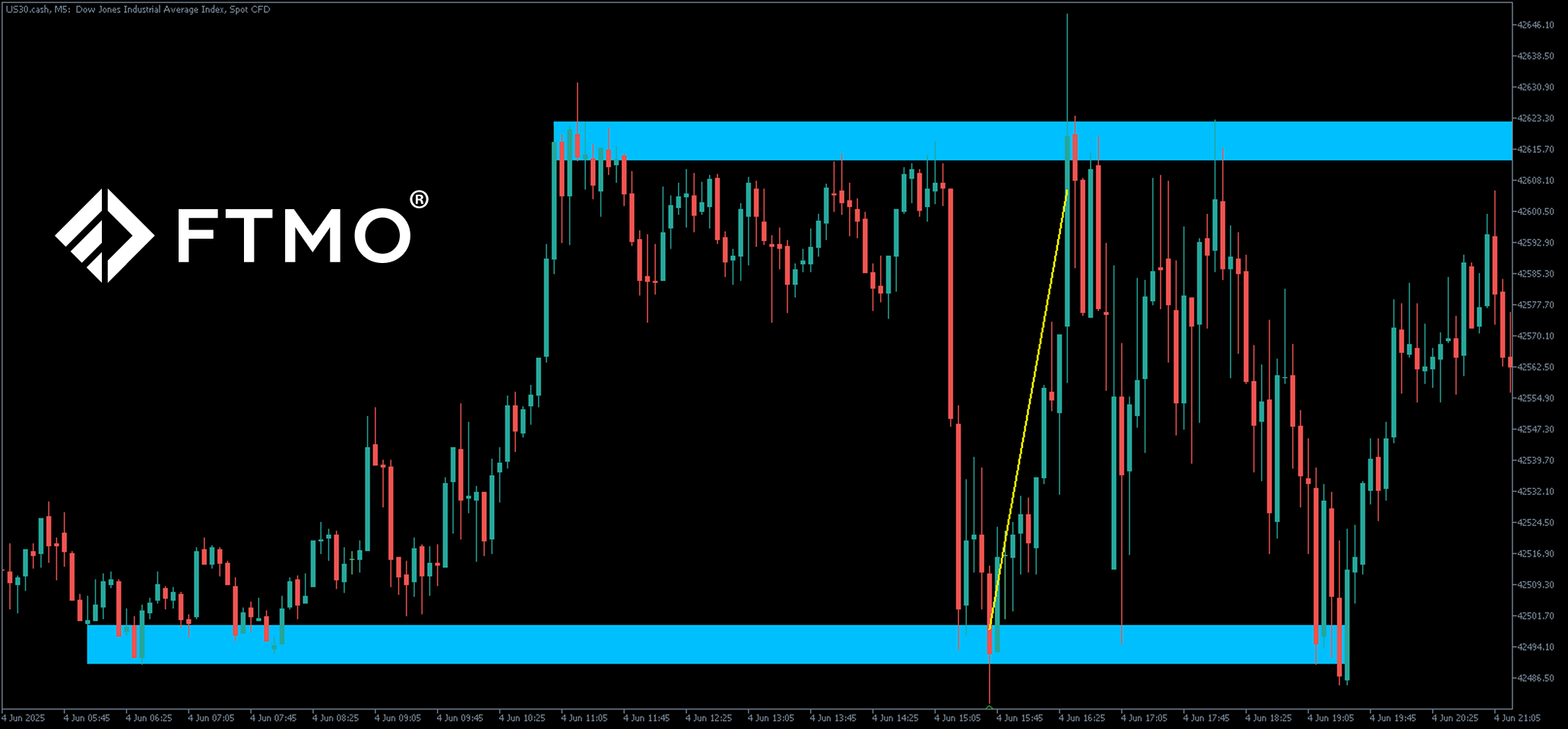

In the second trade as well, the trader speculated on a rise in the DJIA index and again relied on a bounce from a support level. This is a good example of scalping, taking advantage of price movement within a range and volatility shortly after the stock market opened. The trade lasted only a few dozen minutes, and the $2,680 profit was certainly worth it. Once again, the trader may have been slightly lucky with the entry and could have been more patient, but as the saying goes, fortune favors the prepared.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.