Do not underestimate Account Analysis

Every trader who completes FTMO Challenge, Verification or finishes a cycle on an FTMO Account will receive an Account Analysis as a bonus from our company at the end of the trading period. For traders who are serious about trading and want to improve, this can be a fine detail that will help them in achieving better and more consistent results.

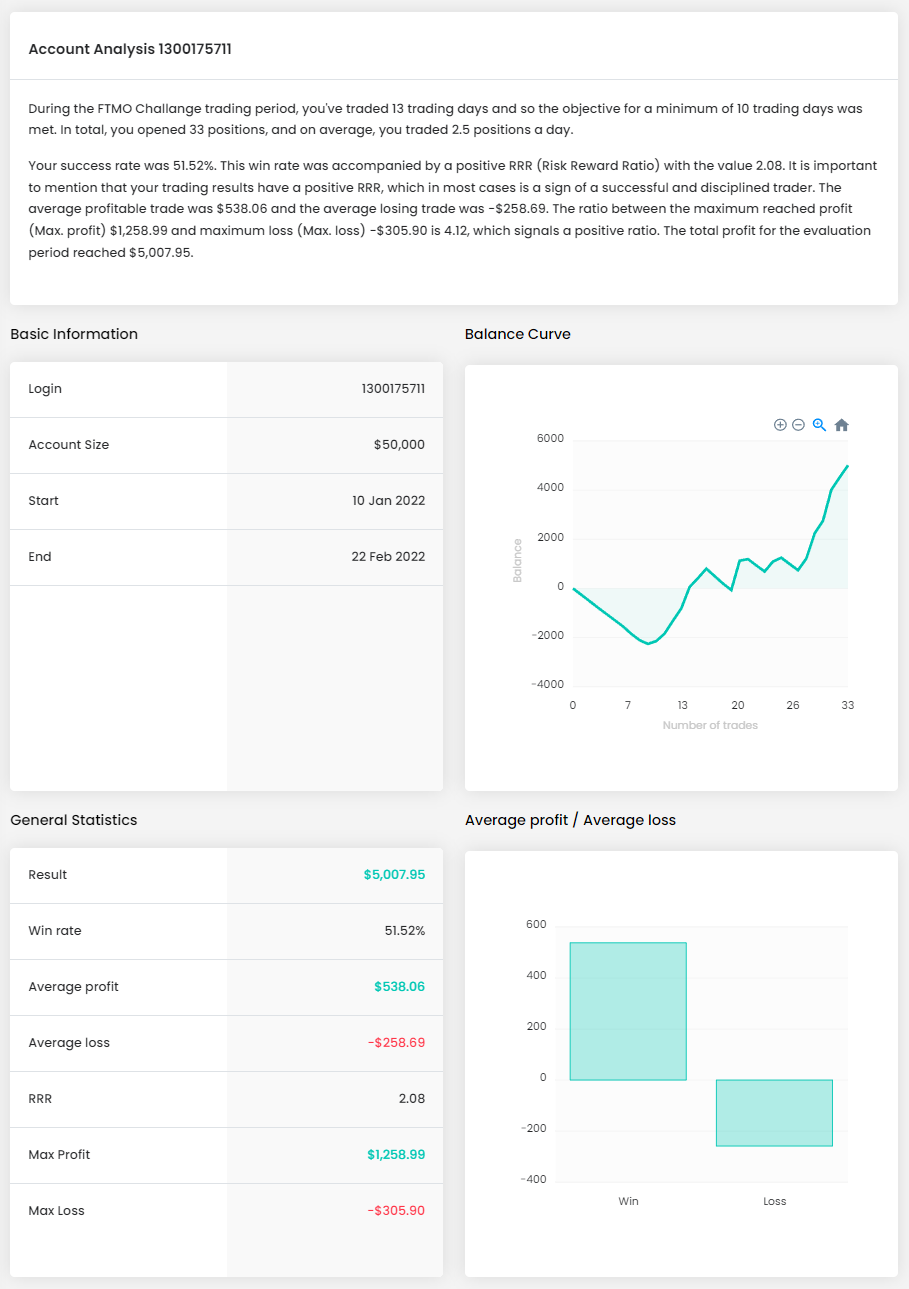

An Account Analysis will be given to every trader who starts trading with FTMO. Those who try the Free Trial will receive the evaluation in a simplified form, which includes mostly basic statistics and a graph showing average profits and losses.

FTMO clients who finish their trading period (whether it is on their FTMO Challenge, Verification, or FTMO Account) are provided with the Account Analysis. Combined with the MetriX app, this is a potent and valuable tool that can significantly assist traders in achieving consistent results over the long term.

Addition of the Account MetriX app

Some statistics appear in both the Account MetriX app and Account Analysis, but the two tools complement each other perfectly. For example, Account MetriX displays charts in their absolute value; in Account Analysis, we have balance charts sorted by days or hours. While everyone may look for something slightly different while analysing their performance, the important thing is the actual information about what is happening in the market with our trades.

Unlike our Account MetriX app, which has more of a statistical and progress-tracking function, the Account Analysis also includes a verbal assessment, which is then elaborated by the individual numbers and charts below. In the Account Analysis, we have first the balance curve, general statistics, and a graph showing the average profit or loss. Account MetriX app on the other hand supplies also the daily summary to these statistics.

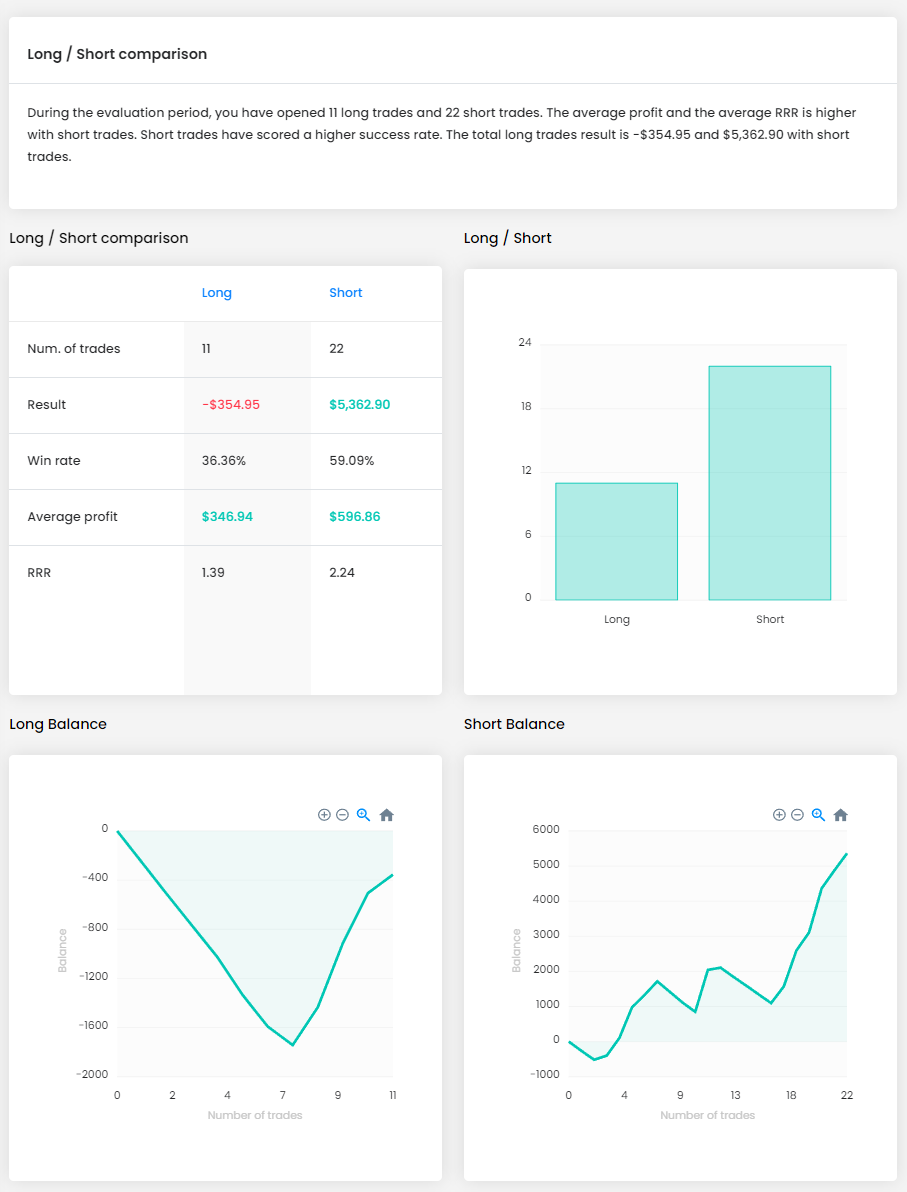

Long vs. short

The next part is a comparison of long and short positions. Here we will find out how many long and short trades we have taken and how successful they were. In the longer term, this statistic can show, for example, the tendency of a trader to open predominantly long positions, which could be a sign of a psychological barrier or a fear of opening positions where we speculate on the downside (although this is relative for currency pairs).

In the example above, we see that the trader opened multiple short positions with a much higher success rate. Thus, the trader is not afraid of opening short positions and has taken advantage of the downtrend in that month on his favourite instrument (which we will see below).

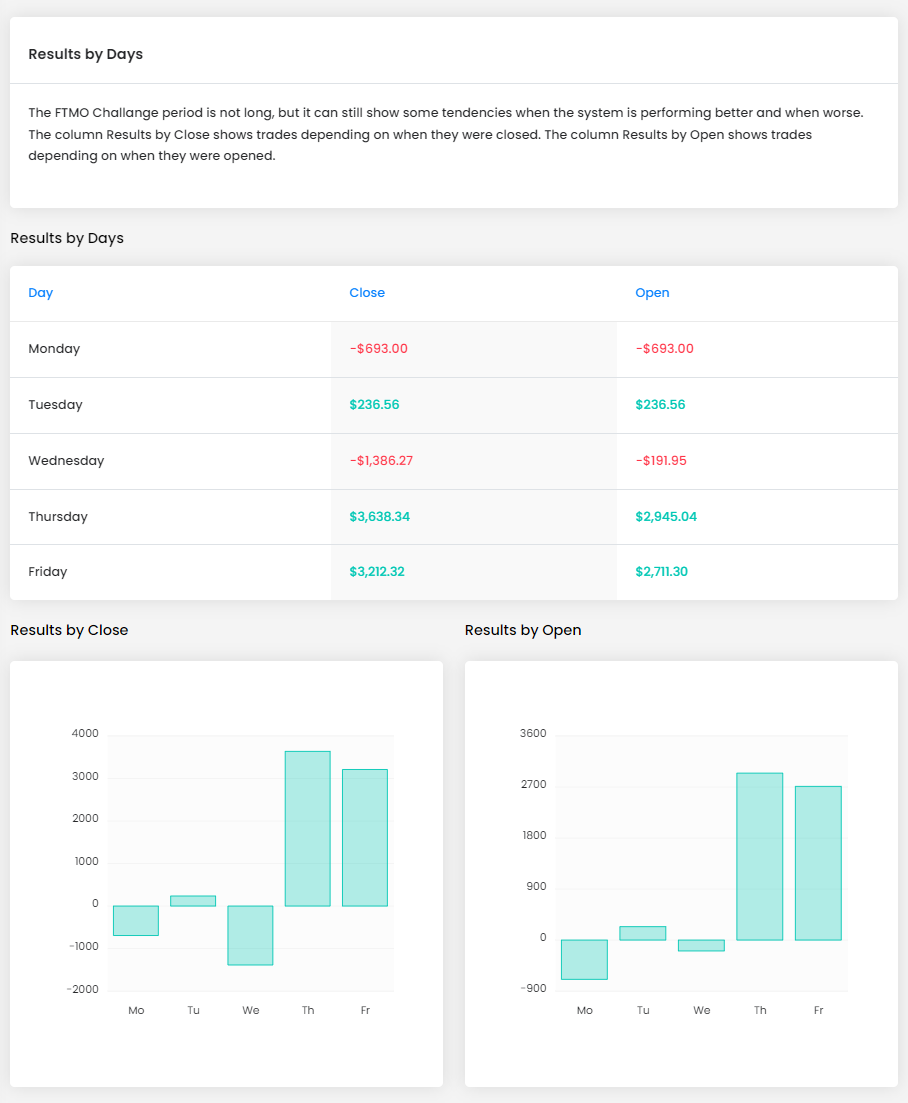

Choosing the appropriate day

The following are statistics by day of the week. This statistic can also be exciting for a trader in the long run because it gives him information about which days of the week are more successful for him and which ones are less successful. He can then adjust his strategy accordingly and not trade at all or open more minor positions on the less successful days. This can have a very positive effect on the long-term success.

Interestingly, in our case, the trader was particularly successful on the last two days of the week and opened more losing trades at the beginning of the week.

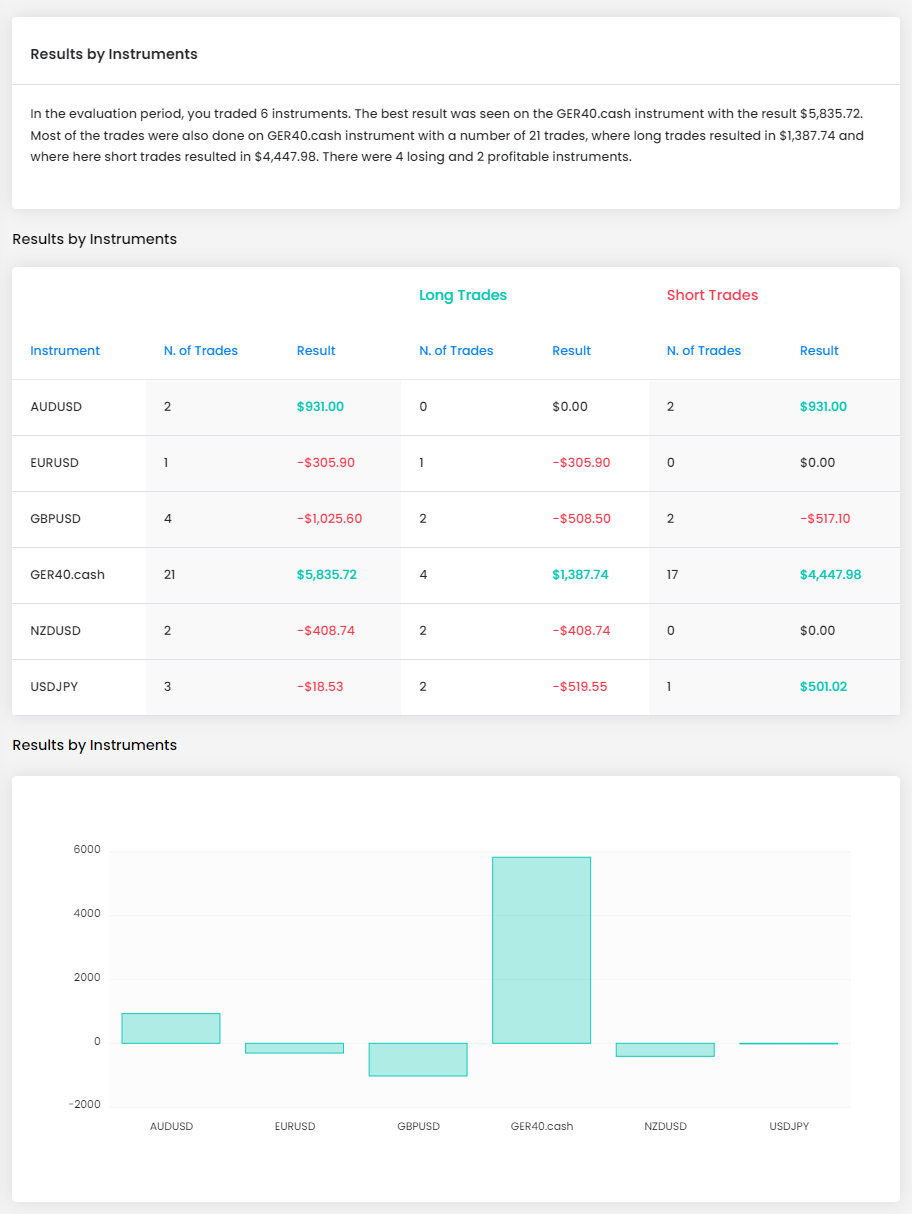

Which instrument is the best?

In the next section, we have a comparison by instrument. This is also important for traders who want to improve their success and consistency because in the long run, this comparison can show them which instrument they should exclude from their strategy and which one they should focus more on.

In our example, it is evident that the trader should focus his attention on the German DAX index (symbol GER40.cash), which clearly provides him with the best results. Comparisons do not always have to be so clear-cut and it is good to have a longer time series and more data (as with other statistics) for better results. However, this case is an example of how the Trading Account Evaluation can help a trader in choosing the appropriate investment instrument.

Profits vs. losses

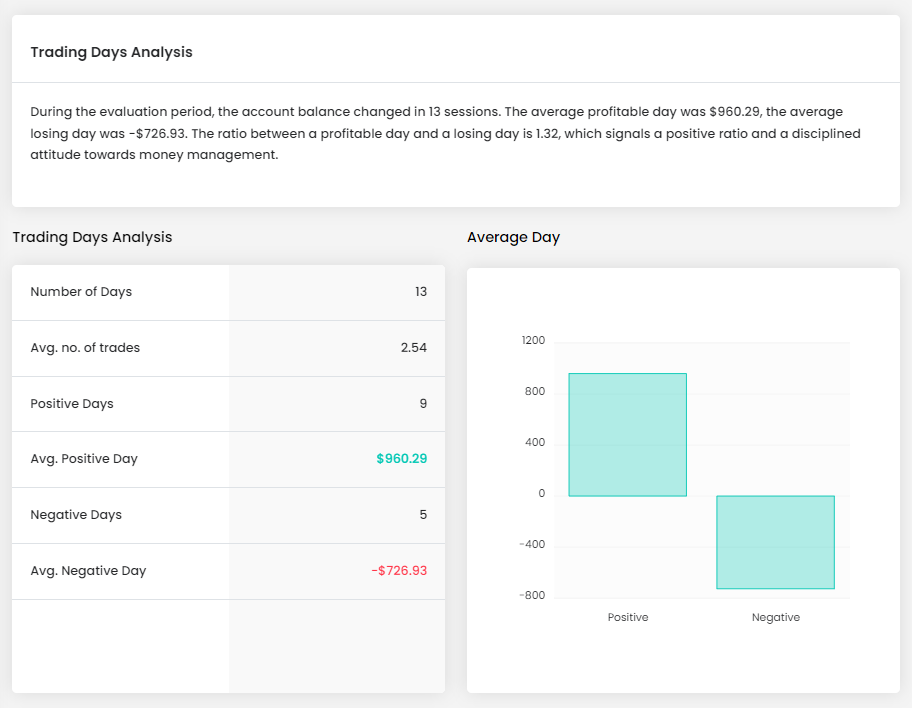

The following section shows the trading days analysis, which shows us the number of trading days and the ratio of profitable and losing days. The average number of trades per session is also essential information that can indicate if a trader is making (depending on his strategy) too many trades per day. Overtrading is a vice that leads to unnecessary losses for many traders.

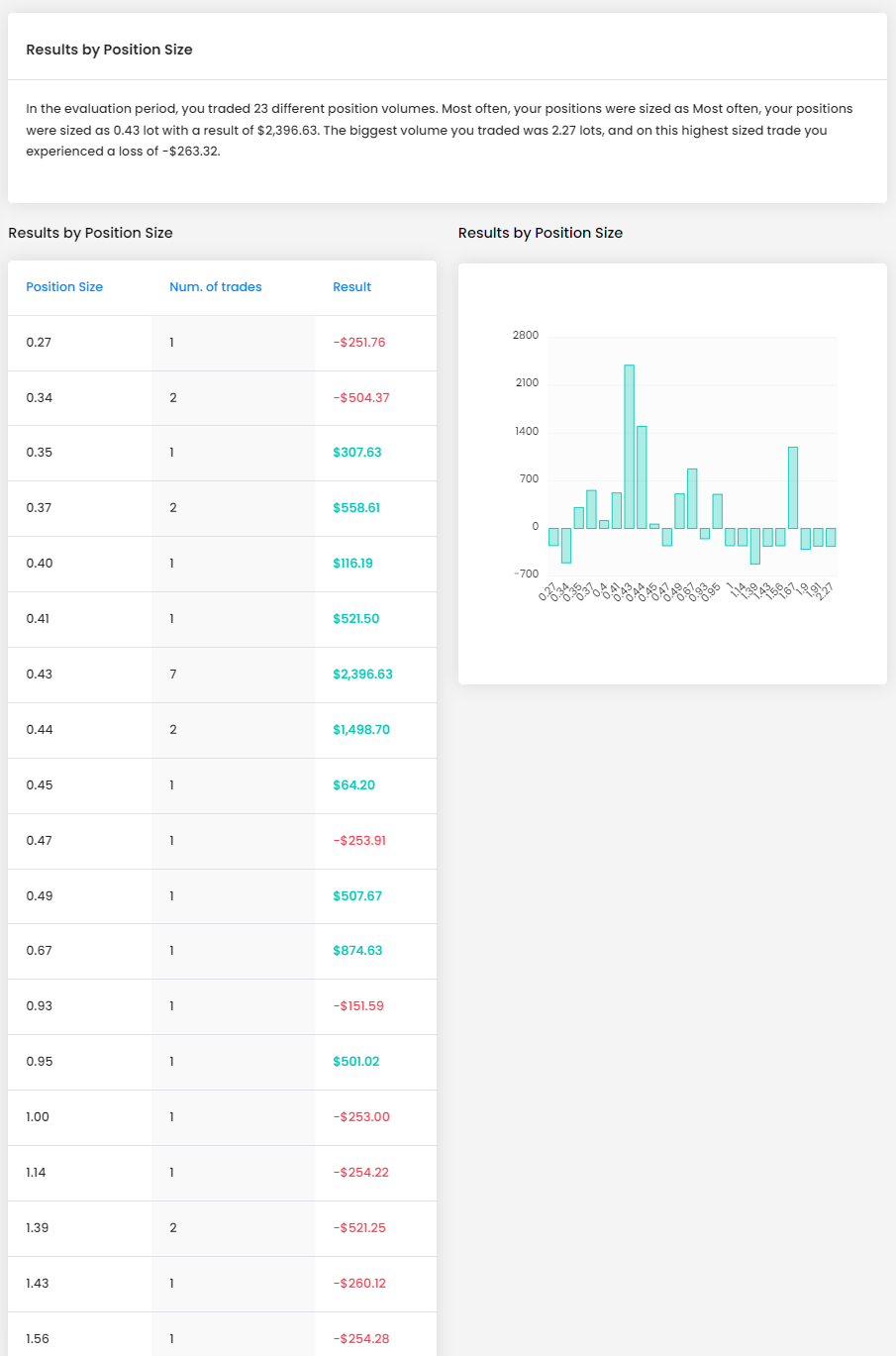

Appropriate size and duration

The results by position size show us how large positions we opened. The variance was quite large in our case because the trader always tried to risk 0.5 to 1% of the account size, and his Stop Loss kept changing in points. Still, it is pretty clear that opening too large positions (and thus very tight SLs) is not suitable for his strategy.

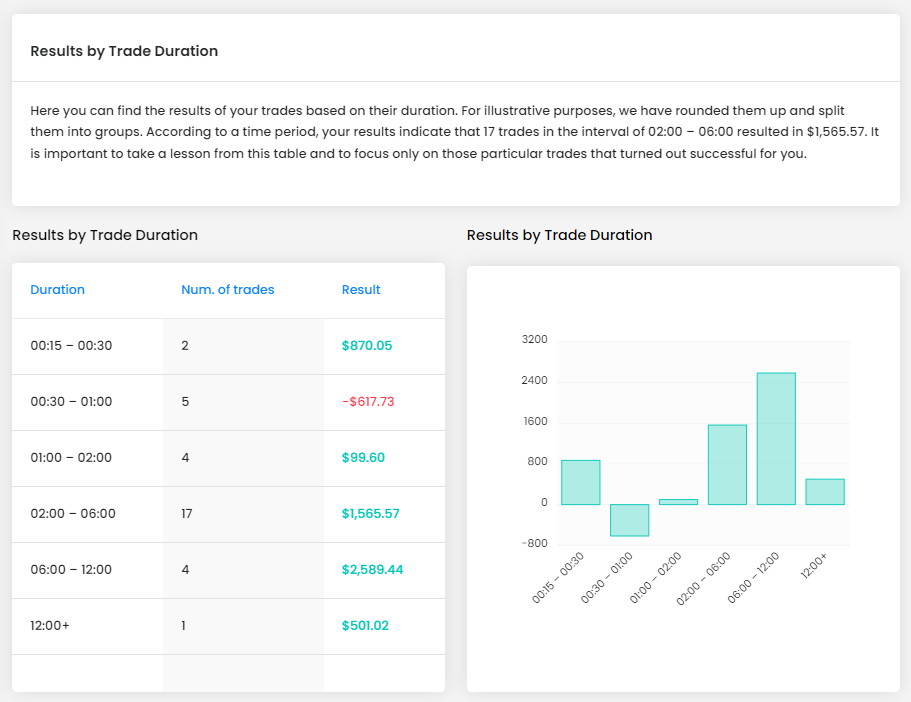

The results by trade duration are related to position size because the tighter the SL, the sooner the trader can profit or lose. In our case, holding positions between two and twelve hours (which is already quite a lot for an intraday trader) was the most advantageous.

Opening hours are important

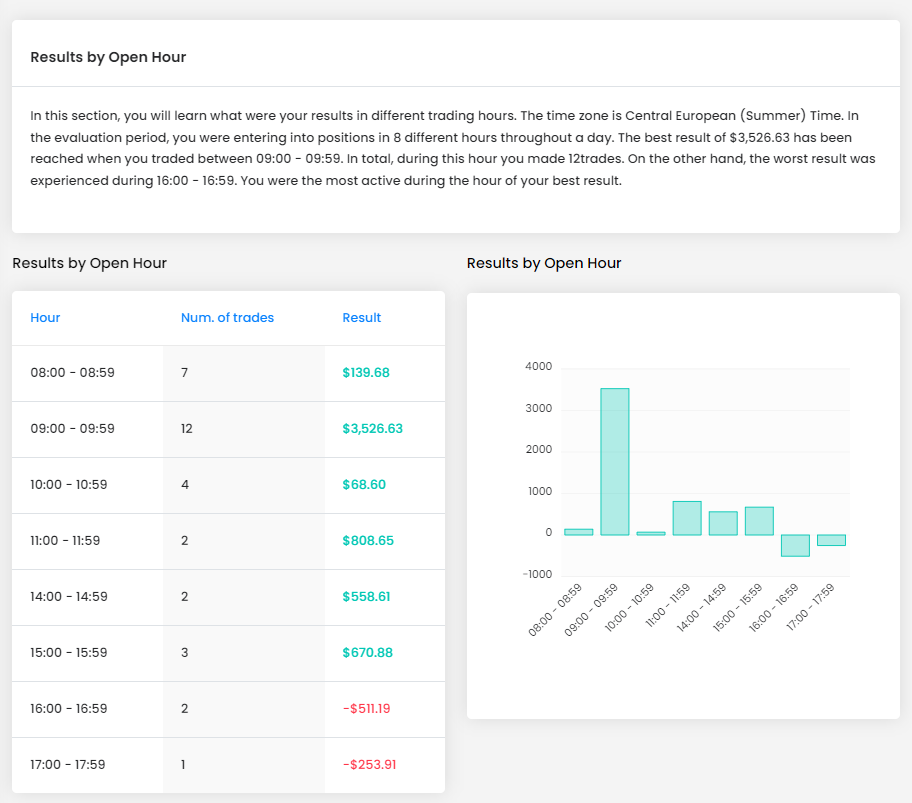

Another often necessary statistic when creating or adjusting a strategy is the results by the open hour. According to our example, it is clear that entering trades after 4 PM is not worthwhile for a trader, and he should focus more on looking for signals between 9 and 10 AM when the stock exchanges in Europe open. Many long-term successful traders only trade at selected hours because they know that they get the best results at that time, which helps their consistency.

Looking at the Account Analysis, some traders may wonder if such statistics are actually any good for them. However, when they study our analysis properly, they may find that it provides exciting and valuable information that will help them achieve long-term profitability.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.