Disciplined Scalping: Profits From US Indices Despite a Mid-Cycle Drawdown

In the next part of our series on successful FTMO Traders, we take a look at a trader who showed that scalping doesn’t have to mean reckless trading. With discipline, focus on just one asset class, and controlled risk, he managed to grow his $200,000 account steadily – even despite a sharp mid-cycle drawdown.

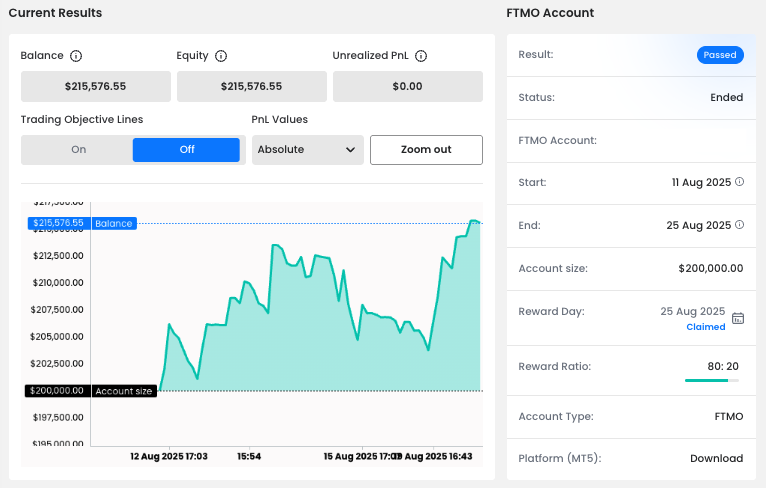

A Balance Curve With Ups and Downs

The equity curve tells a clear story: strong early gains, followed by a sharp $10,000 dip across four days, before recovering to finish with a profit of $15,576.55 (7.7%). While not the largest return we’ve seen in this series, the ability to bounce back from a sizeable drawdown without losing control is what sets serious traders apart.

This conservative performance also demonstrates the trader’s risk awareness. By keeping losses under control and focusing on consistent setups, he avoided the all-too-common trap of “revenge trading” after setbacks.

Risk Well Under Control

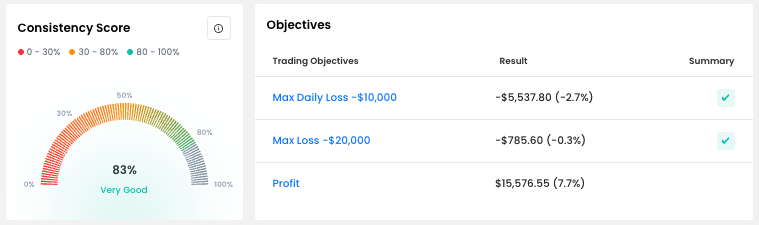

The trader’s Consistency Score of 83% confirms that his results were not random. He respected both his Max Daily Loss (-$5,537.80, or -2.7%) and Max Loss (-$785.60, or -0.3%) limits, proving that risk management was central to his plan.

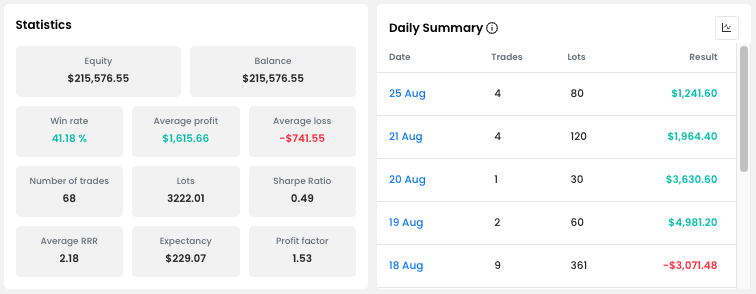

Numbers That Support the Style

The win rate may appear modest, but combined with a reward-to-risk ratio above 2:1, it provided a profitable edge. His average profit trade was $1,615.66, more than double his average loss of –$741.55.

Focused Approach: Just US Indices

Unlike other traders we’ve featured who spread their trades across forex pairs, gold, and crypto, this trader stayed laser-focused on US indices – primarily the US30.cash (Dow Jones) and US100.cash (Nasdaq).

Both long and short trades were taken in nearly equal measure, showing flexibility in reading market conditions rather than sticking to a bias. This single-asset focus gave him an edge: knowing the behavior of one instrument deeply, instead of chasing opportunities across multiple markets.

A Small Criticism: Stop Loss Usage

Reviewing the trade list reveals that Stop Losses were not always placed immediately when opening positions. While this is not uncommon among scalpers, it does carry risk, especially in volatile markets.

The positive note is that he never left trades running overnight without protection, which shows discipline in managing exposure. Still, consistently setting Stop Losses at entry would strengthen the approach further.

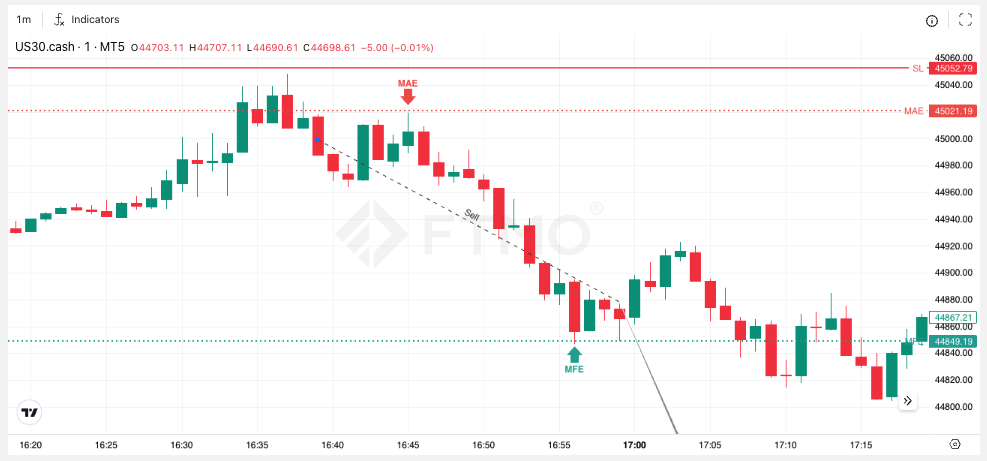

Case Study: A Well-Timed Dow Jones Short

On 20 August, the trader opened a short on US30.cash (30 lots) right after the index rejected the 45,000 zone. The chart shows a long upper wick followed by several red candles – a classic sign of fading momentum.

Unlike in some of his faster scalps, he placed a Stop Loss just above resistance (45,052.79), which protected the position against sudden spikes. The market then trended lower with a steady sequence of bearish candles, and within 20 minutes the trade closed for a profit of $3,630.60.

While a bit more patience could have captured an even larger move, this trade was a strong example of his disciplined scalping: a clear setup, defined risk, and confident execution.

Conclusion

While this trader’s final return of 7.7% may seem modest compared to others in this series, it’s a powerful example of conservative scalping on a large account. Staying focused on one market, keeping risk in check, and bouncing back after a $10,000 drawdown all point to a structured, disciplined approach.

It once again proves that consistency, patience, and respect for risk limits are the real keys to long-term success.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.