How to follow big players in Forex Trading- Commitment of Traders Report

Forex trading is a zero-sum game, for every winner, there has to be a loser. If you could take a guess who is more likely to be profitable? Retail traders or Big Banks and Hedge Funds?

Well if you guessed that Banks, you are right. Retail traders are in a disadvantage with the amount of information we have in the markets, luckily for us, there is a way to follow what the big players are doing.

In this article, we are going to take a look at the Commitment of Traders Report and how it can help with your trading.

Commitment of Traders Report

What is the Commitment of Traders Report?

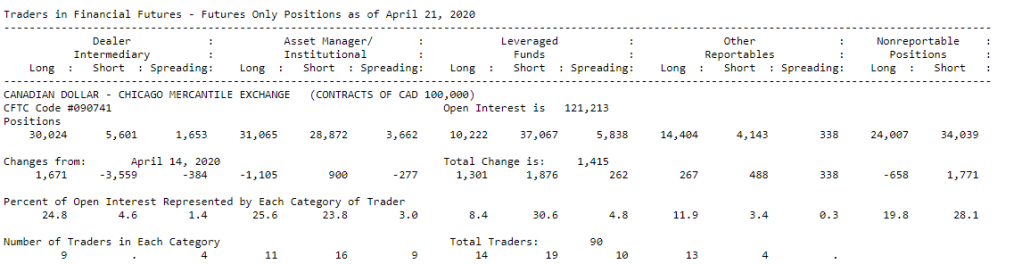

Commitments of Trader Report (COT) is published every week by the Commodity Futures Trading Commission (CFTC).

What subjects you can find in the Commitment of Traders Report?

Where is the Commitment of Traders Report published?

The original version of the COT Report can be found at the CFTC website.

There are also more interactive versions to display data such as barchart.com or freecotdata.com

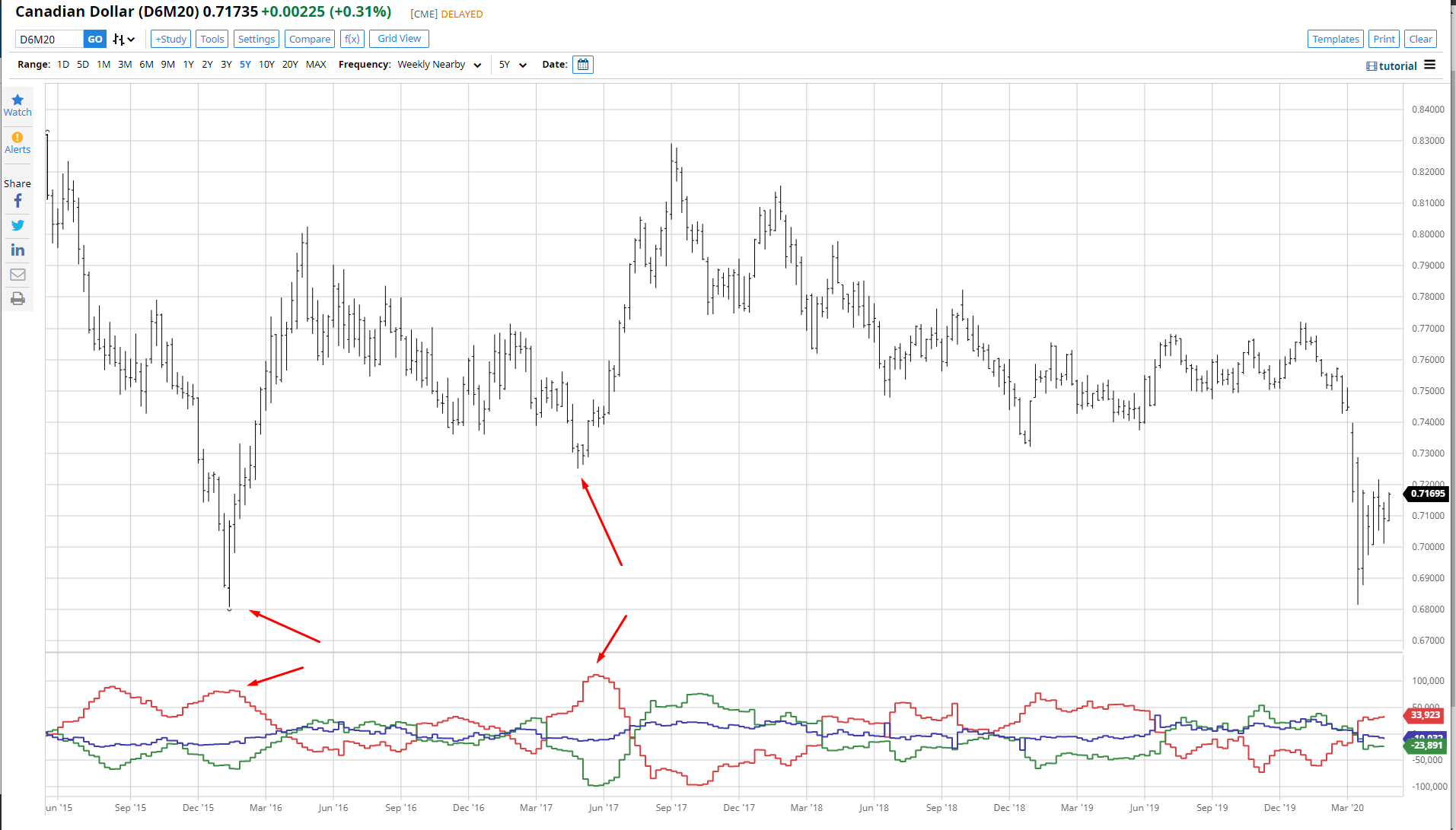

As you can notice on the above chart of Canadian futures. Commercial participants (red line) were heavy long in both early 2016 and mid-2017, both of this informations signalled big trend moves in the market for the following months ahead.

As this showed us the strength of the Canadian dollar, we could use this as a trend move of USD/CAD short.

In Conclusion

The Commitment of Traders is a great tool to help you understand the market sentiment, but this report itself should serve you only as a benefiting advantage to your analysis and there should be a discretion exercised while using it.

When you are watching a report, it is generally perceived not to look at low timeframes, but to rather stick with a daily/weekly timeframes and look for big extremes where you can find a big difference between commercial and small speculators positioning.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.