Grow & Monetize

Why People Choose FTMO

Choose Your

FTMO Challenge

Complete FTMO’s Trading Objectives to become eligible to gain your demo FTMO Account.

Trusted by Millions of Traders

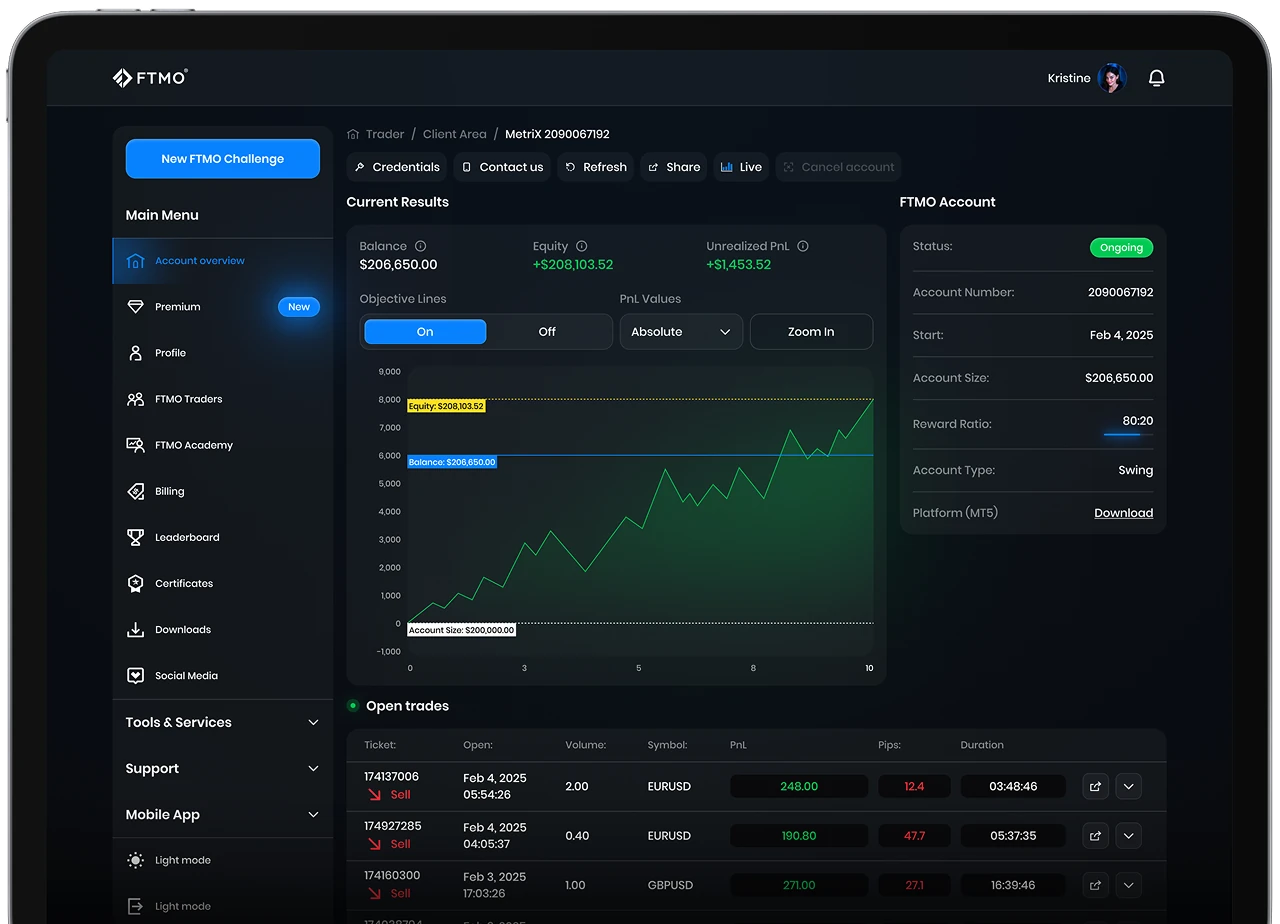

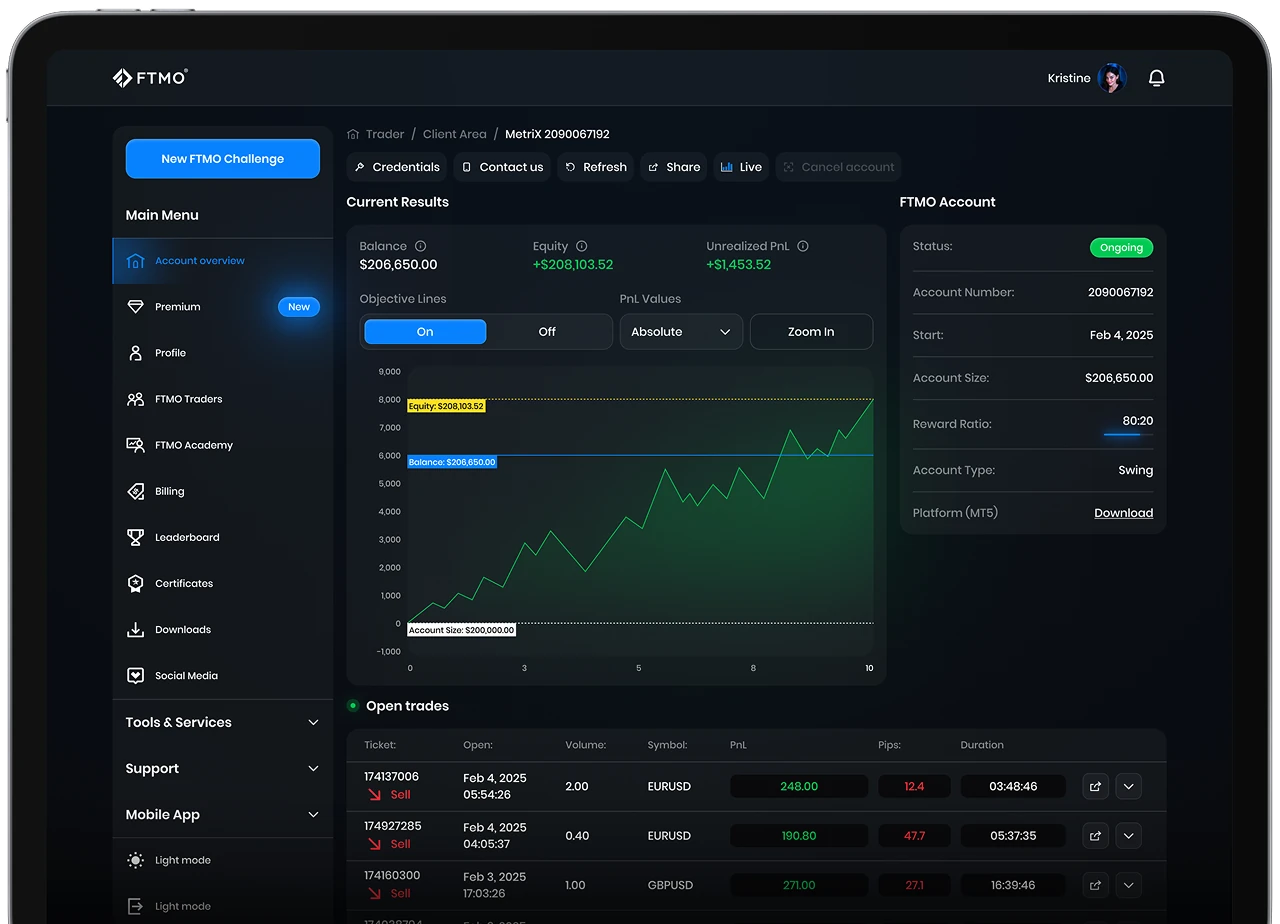

Trader Name

How It Works

Prove your skills

Prove your skills in a 1‑Step FTMO Challenge or 2‑Step Evaluation Process and gain your FTMO Account.

Earn real-money rewards

Trade in a simulated environment and earn performance-based rewards.

Achieve More.

Gain More.

Access exclusive benefits with Premium Programme and Quantlane by FTMO. Learn more

We Support Major Platforms

At FTMO, we want to give you options. That’s why we offer the flexibility to tailor your experience and choose between MT4, MT5, DXtrade and cTrader. Pick the professional trading platform that suits you best.

Elevate Your Trading with FTMO

Learn with FTMO Academy, gain inspiration from our YouTube channel and connect with thousands of traders on Discord. Join our trading community!

Expand Your Trading Knowledge With FTMO Academy

Enhance your knowledge and learn to understand your ups and downs with our Psychology Course.

- Expand your trading knowledge

- Perfect for beginners and intermediate traders

- Includes the Trading Psychology Course

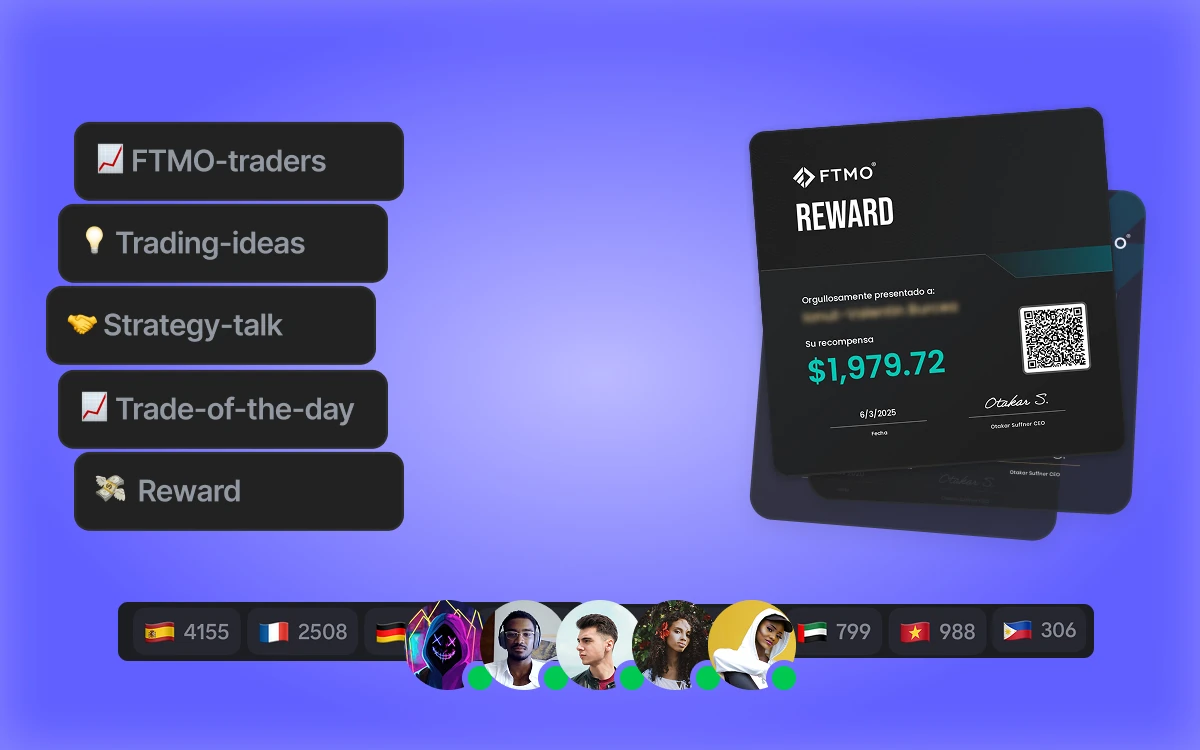

Join Our FTMO Discord. Trade Smarter. Together.

Share in our trading community and get inspired.

Watch. Learn. Trade

Get inspired by the stories of successful traders. Learn about trading psychology and stay connected for more trading content!

FTMO on Youtube

60+

CustomerTeam Members

20

LanguagesSpoken

Customer Support

Our dedicated in-house customer support team is available 24/7. We provide assistance in 20 languages. We ensure fast and reliable support to help you whenever you need it.

Frequently Asked Questions

Find your answers here!

Before you decide to start an FTMO Challenge, we want to make sure that you understand how the process works and what is expected from you.

After you sign up, you can either start the FTMO Challenge: 1‑Step or the FTMO Challenge: 2‑Stepright away, or— as we usually recommend — begin with our Free Trial. The Free Trial is a free, simplified version of the FTMO Challenge experience designed for pra... Read more

To become an FTMO Trader, you must successfully meet the conditions of one of our two products: FTMO Challenge: 1‑Step or FTMO Challenge: 2‑Step. Each product follows a different structure, which is outlined below.

FTMO Challenge: 2‑Step

The FTMO Challenge: 2‑Step consists of a two-step process.

Phase 1: FTMO Challenge

A demo account with fictitious capital where you trade according to our Read more

What happens next depends on whether you are participating in the FTMO Challenge: 1‑Step or the FTMO Challenge: 2‑Step, as each product follows a different structure.

FTMO Challenge: 2‑Step

After you pass all the Trading Objectivesin your FTMO Challenge: 2‑Step, you will see a notification in your Account MetriX informing you about your success. At this point, you no longer need to tr... Read more

FTMO Challenge: 1‑Step is a simplified evaluation product that consists of a single evaluation phase. Unlike FTMO Challenge: 2‑Step, it does not include a separate Verification phase.

From the perspective of Trading Objectives, the two products are structured differently. More detailed information about the specific Trading Objectives is available on the Trading Objectives page.

The evaluat... Read more

Rules for trading during macroeconomic news releases differ depending on whether you are participating in the FTMO Challenge: 1‑Step, the FTMO Challenge: 2‑Step, or already trading on an FTMO Account.

Within the FTMO Challenge: 1‑Step, you may trade freely during all macroeconomic news releases without any restrictions. After successfully meeting the conditions of the FTMO Challenge: 1‑Step and tran... Read more

Overnight and weekend position restrictions apply only to the Standard account type. The Swing account type does not have any restrictions on holding positions overnight over the weekend, or during news releases.

For Standard accounts, these restrictions apply only once you start trading on an FTMO Account. They do not apply during the Evaluation phase.

Evaluation phase (Standard account)... Read more

- As many Free Trials as you need

- Up to $200,000 FTMO Account

- Performance-based rewards

Worldwide Reviews