“Treat the FTMO Challenge exactly like a real funded account from day one.”

For many FTMO Traders, success doesn’t come from chasing targets – it comes from discipline, emotional control, and treating the FTMO Challenge with the same seriousness as a real funded account. In this Q&A, Paul, Laielly, and Saswin share how structure, psychology, and consistency helped them progress through the FTMO Challenge and Verification.

Trader Paul Salvatore: “Even if you take losses, make sure you followed your plan 100%.”

How has passing the FTMO Challenge and Verification changed your life?

Passing the FTMO Challenge and Verification has truly been a game changer for me. It gave me the opportunity to turn my trading skills into real capital and opened doors in a way I never imagined.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a trading plan that fits perfectly with my strategy, and I do my best to follow it with discipline. I try to trade with as much emotional control as possible, avoiding impulsive decisions and sticking to my rules 100%.

How would you rate your experience with FTMO?

My experience with FTMO has been excellent. It’s actually the first company I ever bought a demo challenge from, and I’ve felt comfortable and confident with them since the beginning. Whenever I ask other traders, friends, or family members about funding companies, FTMO is always the first name they recommend. That trust and reputation are a big part of why I chose them.

What was the hardest obstacle on your trading journey?

The toughest obstacle for me has definitely been impulsiveness and managing my emotions while trading. I still have a lot to learn when it comes to emotional discipline and building more experience. But on the technical side, I’ve stayed strict with my plan, and that discipline helped me achieve funding with FTMO. I know there’s still room to grow, especially in emotional control, but I’m improving step by step.

Has your psychology ever affected your trading plan?

Absolutely. Psychology is one of the hardest parts of trading, and no trader can say they control their emotions 100%. Your mindset plays a huge role in your decisions and your results in the market. Just like everyone else, my psychology has affected my trading at times, but I’m constantly working on improving my emotional discipline.

One piece of advice for people starting the FTMO Challenge now.

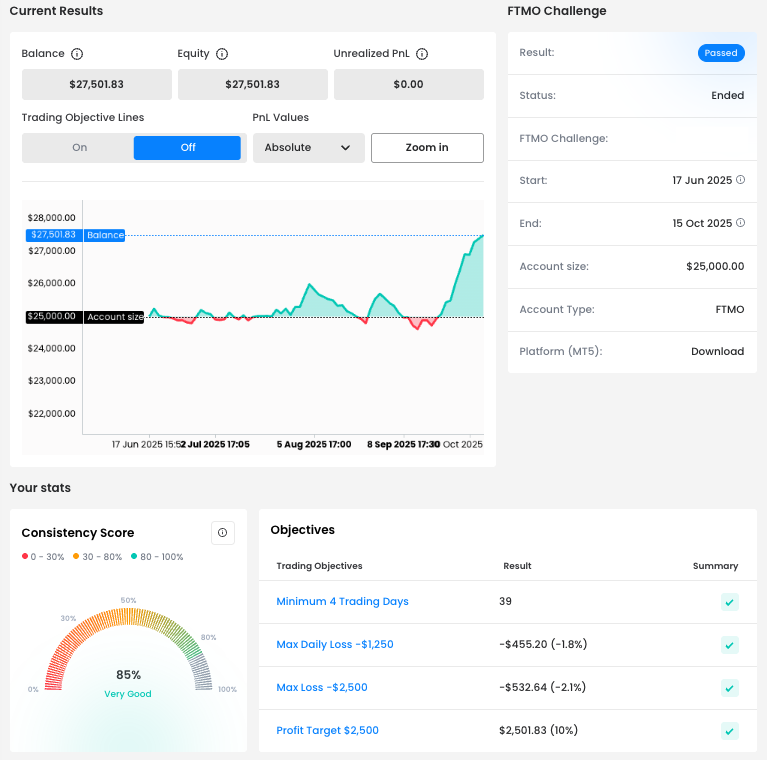

My biggest advice is to only buy the FTMO Challenge once you’ve built a solid trading plan and mastered the technical tools and confluences that your strategy relies on. Make sure you’ve practiced enough through backtesting and feel genuinely confident. When you’re ready, invest in a proper account — I’d recommend starting with at least a 25K one — and commit fully. Trade without fear, trust yourself, and even if you take losses, make sure you followed your plan 100%. And always put GOD FIRST; every time before I trade, I pray and am thankful for having the opportunity to hop on the markets.

Trader Laielly Jazmin: “Consistency and capital preservation will always beat speed.”

What do you think is the key for long-term success in trading?

Consistency, strict risk management, and continuous improvement. The ability to stick to a proven trading plan, respect Stop Losses and position sizing rules, and constantly review and adapt my strategy based on performance are the foundations of long-term profitability.

Where have you learnt about FTMO?

I first discovered FTMO through several well-known trading communities on YouTube, Discord, and Reddit (especially r/Forex and r/propfirms). Later, I did my own research on the official website, checked reviews, payout proofs, and compared it with other prop firms before deciding it was the best option for me.

How did you eliminate the factor of luck in your trading?

By developing and following a mechanical, rule-based trading strategy with a positive expectancy that has been backtested and forward-tested over hundreds of trades. I only take setups that meet all my checklist criteria, I always use fixed risk per trade (1% or less), and I maintain a large enough sample size so that results are driven by edge, not by luck or a few random winning streaks.

Describe your best trade.

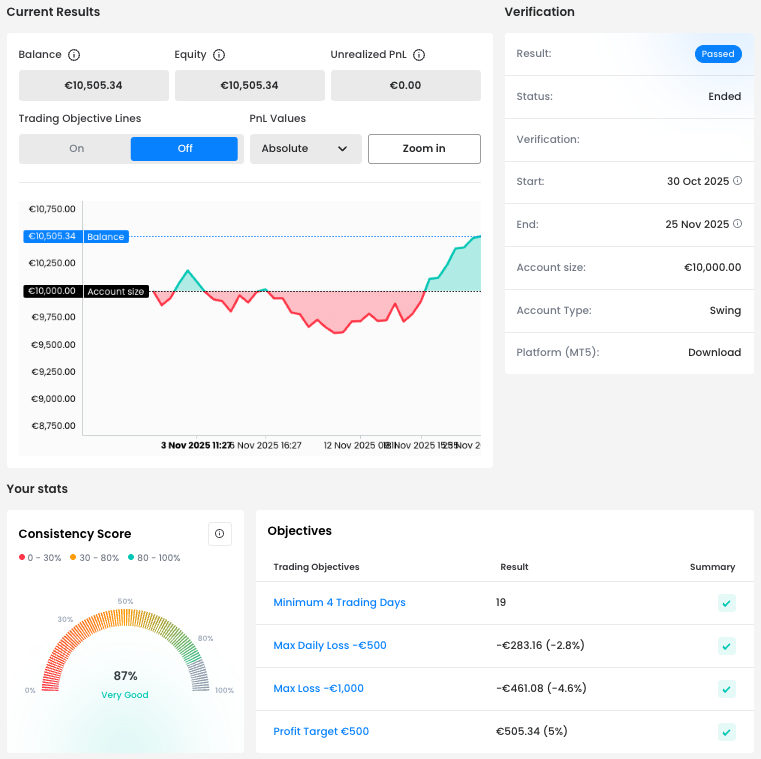

My best trade was a short on XAUUSD (gold) on November 7, 2024, right after a weaker-than-expected US NFP report and the Fed rate cut. Price strongly rejected the 2,720–2,725 zone (all-time high + weekly resistance + bearish order block). I entered short at 2,718, risked only 0.6% of the account with a Stop above 2,732, and scaled out in three parts: 50% at 2,685, 30% at 2,655, and let the final runner hit 2,610 with a trailing Stop Loss. The trade closed with a +5.2% total return and a 1:9.2 reward-to-risk ratio. It followed my trading plan perfectly, had almost no heat, and showed perfect confluence.

How would you rate your experience with FTMO?

10/10 without hesitation. The FTMO Challenge rules are clear and fair, trading conditions (spreads, execution, slippage) are excellent, the dashboard is very user-friendly, and support always replies quickly and professionally. It’s by far the most transparent and trader-friendly prop firm I’ve tried.

One piece of advice for people starting the FTMO Challenge now.

Treat the FTMO Challenge exactly like a real funded account from day one. Forget about the 10% profit target for a moment and focus 100% on protecting the Max Daily Loss and Max Loss. Trade only your proven edge with small, consistent risk (0.5–1%), avoid revenge trading at all costs, and aim for steady equity growth instead of rushing the target. Consistency and capital preservation will always beat speed.

Trader Saswin: “Trade with patience, respect the drawdown limits, and focus on clean setups, not the target.”

Describe your best trade.

My best trade was a clean higher timeframe liquidity sweep followed by an M15 structure break. I controlled risk, had a zero-drawdown entry, and took partials at key imbalances. It was my best trade because it followed my plan perfectly from confirmation to exit.

How did you eliminate the factor of luck in your trading?

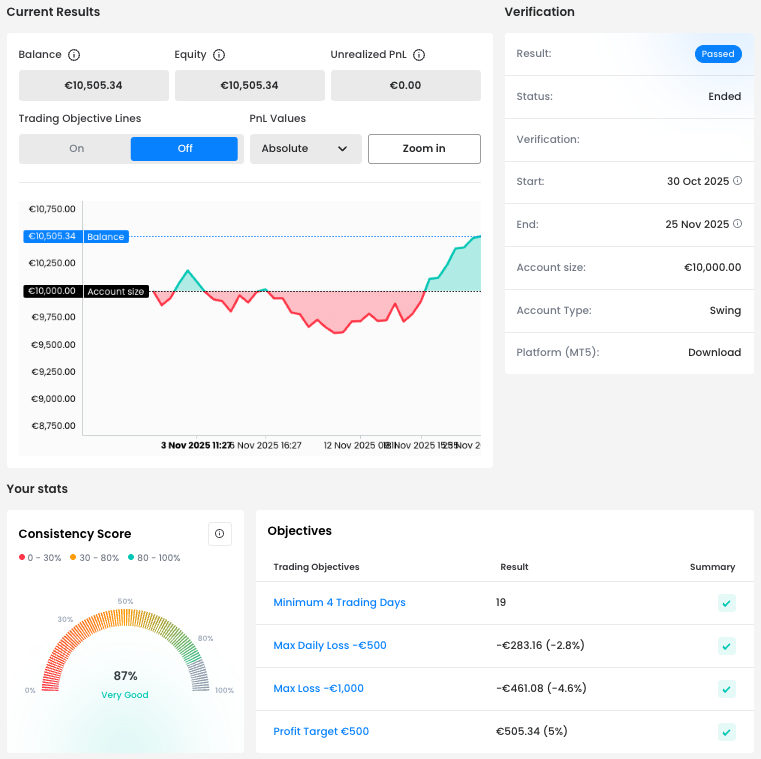

I removed luck by trading only rule-based setups. Every position must meet my checklist – higher timeframe bias, liquidity levels, structure shift, and fixed risk. If one condition is missing, I simply don't trade.

What was more difficult than expected during your FTMO Challenge or Verification?

Discipline. Respecting daily drawdown, avoiding revenge trades, and waiting for clean confirmations mattered more than the strategy itself. Following the plan consistently made the biggest difference.

What do you think is the key for long-term success in trading?

The key is consistency in risk management and emotional control. Strategies evolve, but discipline, patience, and protecting capital are what sustain long-term success.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I follow a structured plan with fixed risk, higher timeframe bias, liquidity levels, and confirmation rules. I don't take trades that fall outside my criteria, and I treat my plan like a rulebook, not a guideline.

What would you like to say to other traders attempting the FTMO Challenge?

Trade with patience, respect the drawdown limits, and focus on clean setups, not the target. The FTMO Challenge becomes easier when you follow a process instead of chasing profits.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.