Trading Week Ahead: FOMC & NFP Incoming

Markets face a pivotal week with three key US events in focus: FOMC minutes, Non-Farm Payrolls, and Flash PMIs. Sentiment has turned cautious as rate cut hopes fade, with Fed officials striking a more guarded tone. The recent data blackout from the government shutdown added to uncertainty, but that backlog begins to clear, setting the stage for renewed volatility.

• FOMC Meeting Minutes

The upcoming release of the Fed’s meeting minutes will be closely watched for policy signals. If the tone suggests growing openness to rate cuts, the dollar could weaken, yields may fall, and equities might rally. However, if the minutes confirm a more cautious outlook, market risk appetite could diminish and the greenback may gain strength.

• Non-Farm Payrolls (NFP)

The last jobs report before the government shutdown showed just 22,000 jobs added in August. With labour data delayed since then, this Thursday’s release is the first major update in weeks. A weak result may boost Fed cut expectations and pressure the dollar. A strong print could support the USD and weigh on risk assets.

• US Flash PMIs

November’s preliminary business activity data are expected to show a modest slowdown. Services PMI is forecast to decline from 54.8 to 54.6, and manufacturing from 52.5 to 52.0. These real-time indicators are particularly influential after recent data gaps. Surprises in either direction could shift the economic narrative and drive volatility in currency and equity markets.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Wednesday, Nov. 19 | 8:00 AM |  GBP GBP |

CPI |

| 11:00 AM |  EUR EUR |

CPI | |

| 8:00 PM |  USD USD |

FOMC Meeting Minutes | |

| Thursday, Nov. 20 | 2:30 PM |  USD USD |

Average Hourly Earnings |

USD USD |

Initial Jobless Claims | ||

USD USD |

Nonfarm Payrolls | ||

| 4:00 PM |  USD USD |

Existing Home Sales | |

| Friday, Nov. 21 | 8:00 AM |  GBP GBP |

Retail Sales |

| 10:00 AM |  EUR EUR |

Flash Manufacturing, Services PMI | |

| 10:30 AM |  GBP GBP |

Flash Manufacturing, Services PMI | |

| 3:45 PM |  USD USD |

Flash Manufacturing, Services PMI |

Technical Analysis with FVG Strategy

This trading approach leverages the 20- and 50-period Exponential Moving Averages (EMAs) to assess the prevailing market trend, while the Fair Value Gap (FVG) is used to pinpoint zones of price inefficiency. These gaps, formed during sharp price movements, often highlight optimal entry or exit levels. The strategy is suitable for instruments like EURUSD, GBPJPY, US30, and XAUUSD and provides insights into both last week’s market opportunities and the current one.

Opportunities to Watch This Week

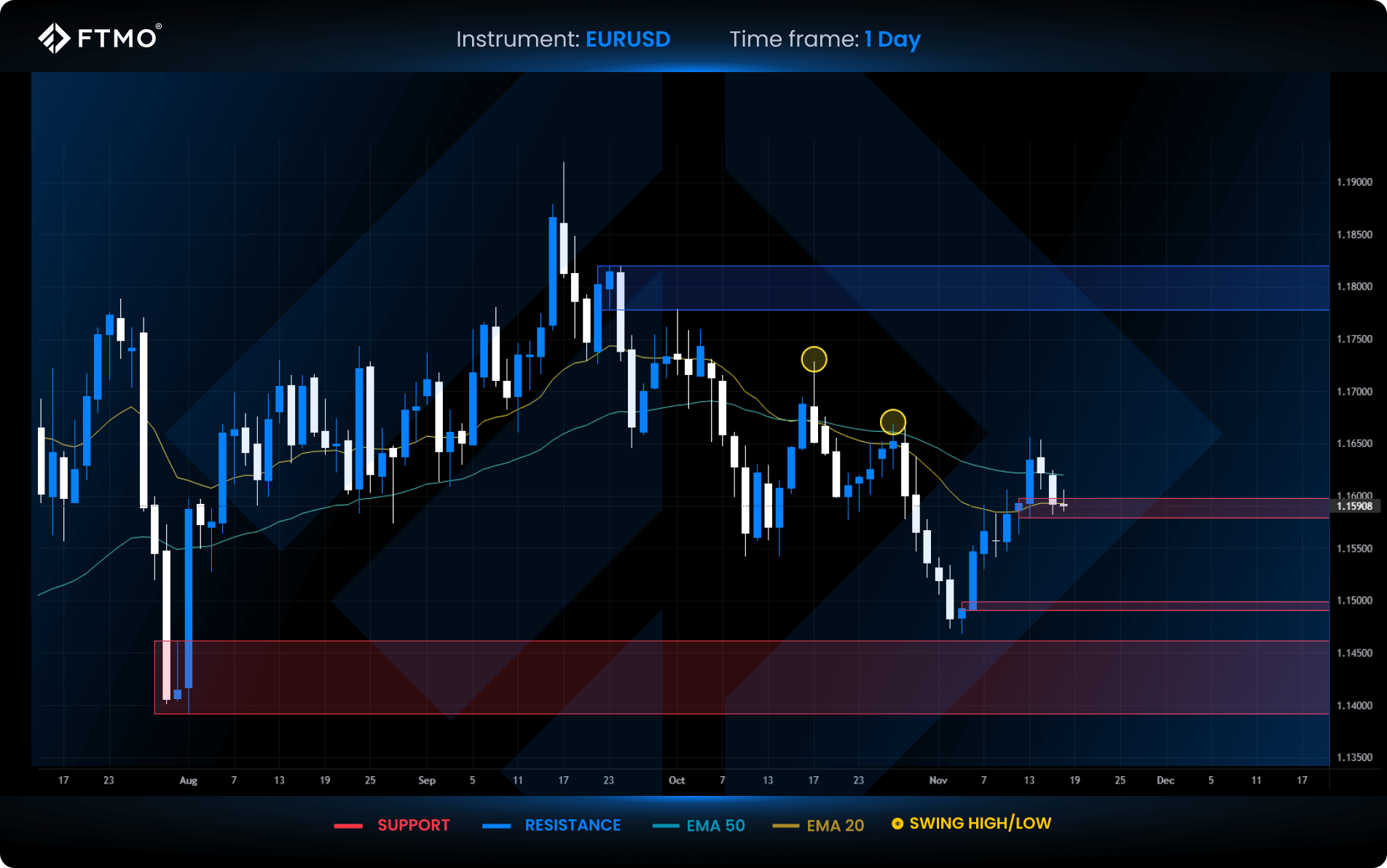

EURUSD

Market Context: The bullish sentiment on EURUSD remains intact. Price is currently sitting on support formed by a previous FVG and aligned with the 20 EMA, making this a key zone for potential continuation.

Bullish Scenario (Preferred): A bounce from current levels with continuation toward the marked swing high.

Bearish Scenario (Alternative): A close below the support zone would open the door for a move toward the next lower support area.

FVG Setup: No new FVG was formed this week.

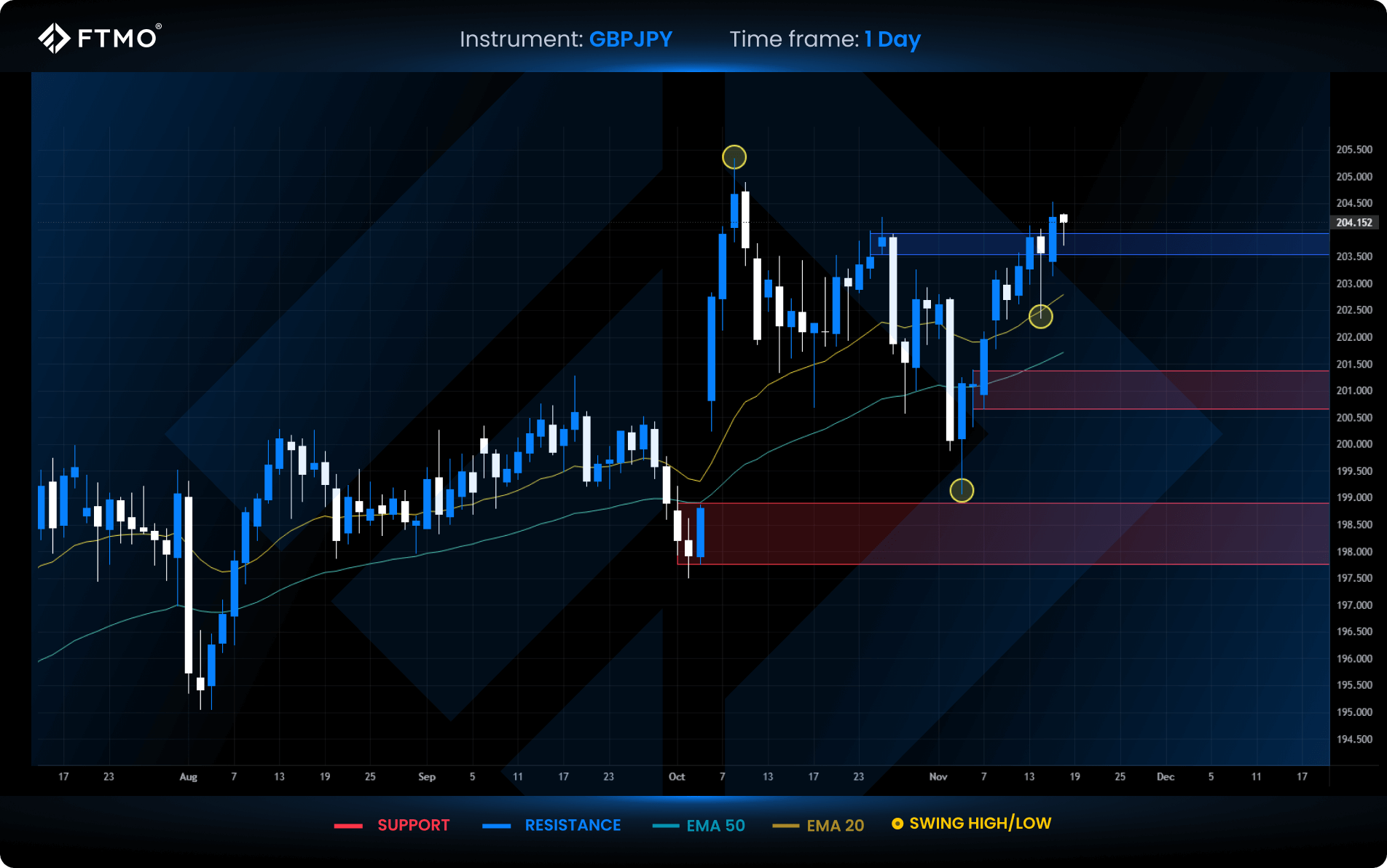

GBPJPY

Market Context: GBPJPY has continued its upward trend since the start of the month. The latest daily close above resistance confirms strong bullish market structure.

Bullish Scenario (Preferred): Further upside toward the swing high, where liquidity is likely to be targeted.

Bearish Scenario (Alternative): A pullback into support is possible, with a chance of sweeping the most recent swing low along the way.

FVG Setup: No FVG formed this week due to the steady, low-aggression trend.

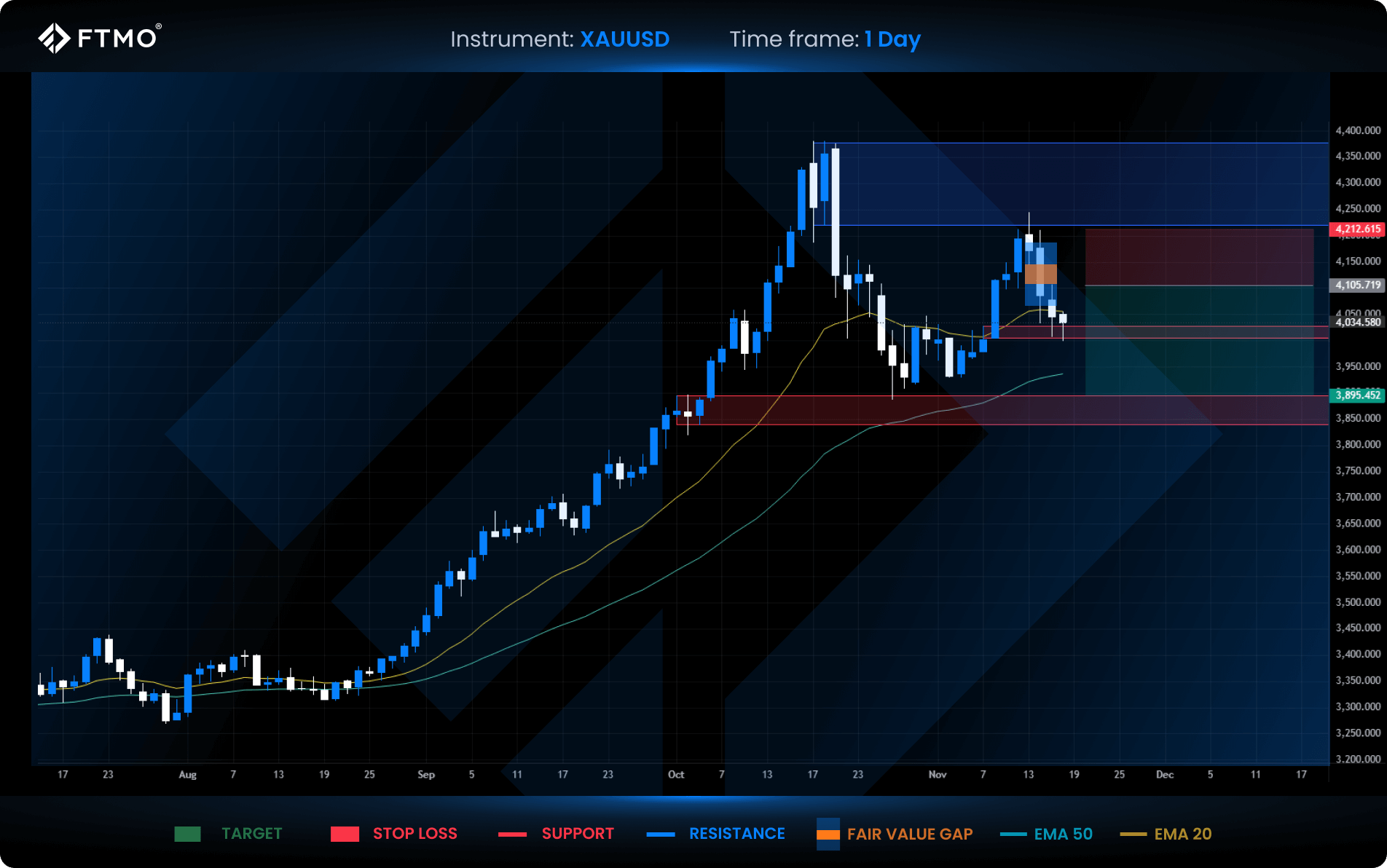

XAUUSD

Market Context: Gold broke above initial resistance but then faced a strong rejection at the next resistance zone. This aggressive move from sellers created a short FVG setup.

Bearish Scenario (Preferred): A short position aligned with the FVG setup, aiming for a break below current support and a move toward the next demand zone.

Bullish Scenario (Alternative): If current support holds, a retest of resistance may follow.

FVG Setup: A short FVG has formed and is active, offering a potential 2:1 RRR or a target at the support zone.

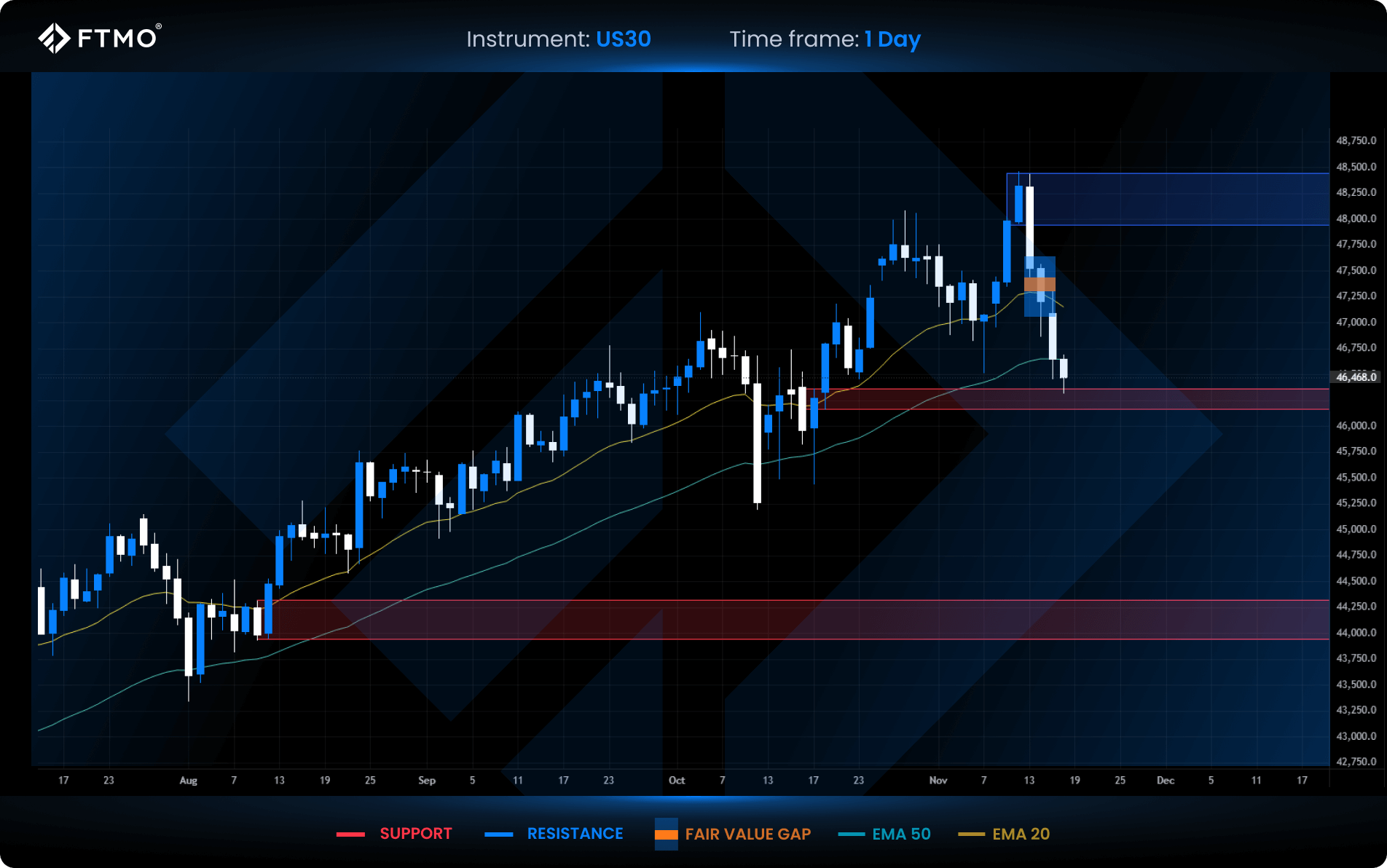

US30

Market Context: Since last Thursday, US30 has experienced a sharp decline. Price is now below both the 20 and 50 EMAs and sitting on a key support level where a buyer reaction is possible.

Bearish Scenario (Preferred): A continuation lower based on the active short FVG setup with a potential 2:1 risk-to-reward move.

Bullish Scenario (Alternative): A reaction from current support could trigger a short-term pullback.

FVG Setup: A short FVG formed and remains tradable under current conditions.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.