“Discipline and patience. You need to wait for your best setups.”

In this Q&A, three FTMO Traders share what truly drives success in trading: patience, consistency, and emotional control. From building structure around Max Daily Loss limits to learning to think like funded traders, Paul-Andrei, Nadine, and Pablo explain how discipline shapes every part of their trading journey.

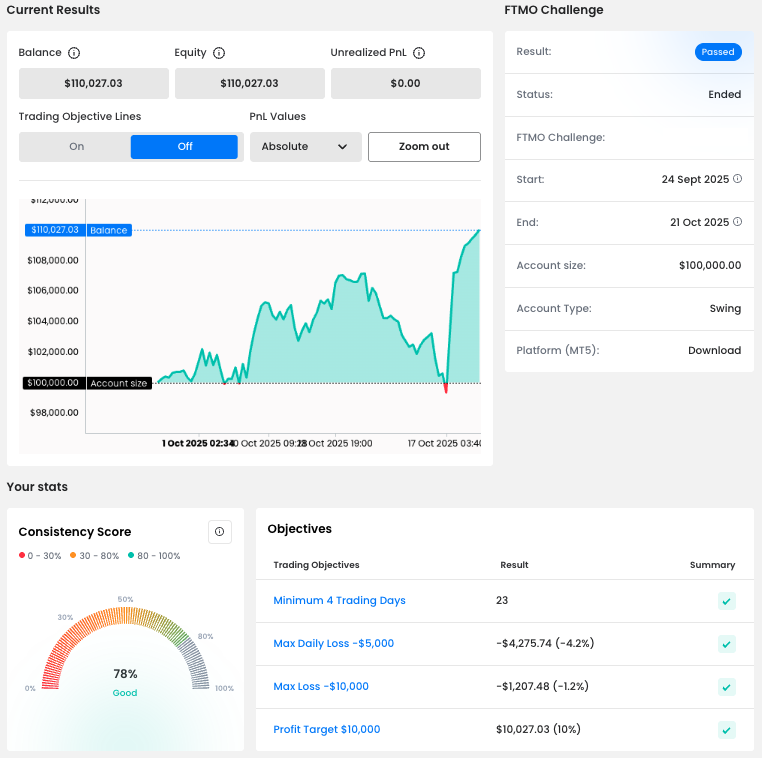

Trader Paul-Andrei: “Risk small and think like a funded trader from day one.”

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, my plan is to continue scaling my funded accounts step by step with discipline and risk management. The goal is to manage a larger capital in the future, always prioritizing consistency and psychological stability.

How has passing the FTMO Challenge and Verification changed your life?

It gave me confidence in my strategy and in myself as a trader. I feel that now I’m operating on a professional level, with transparency and clear rules, without stress. It showed me that with patience, risk control and discipline, it is possible to turn trading into a real career.

What do you think is the most important characteristic/attribute to become a profitable trader?

Discipline and patience. You need to wait for your best setups, focus on risk management and avoid emotional trading. Consistency in execution is more important than big wins.

What does your risk management plan look like?

I risk a small and fixed percentage per trade (0.25% – 0.50%-1%). I only take trades with clear confirmation and always with a Stop Loss. My main goal is capital protection. Profit is a consequence of managing risk correctly.

How did you eliminate the factor of luck in your trading?

By developing a strategy based on structure, volume, confirmations and rules. I only enter when the market shows a clear scenario. The less randomness in my decisions, the less luck is involved. My results now are the result of process, not hope.

One piece of advice for people starting the FTMO Challenge now.

Don’t rush. Focus on protecting your account and choose only the best trades. You don’t need many trades to pass the FTMO Challenge, you need smart decisions and discipline. Risk small and think like a funded trader from day one.

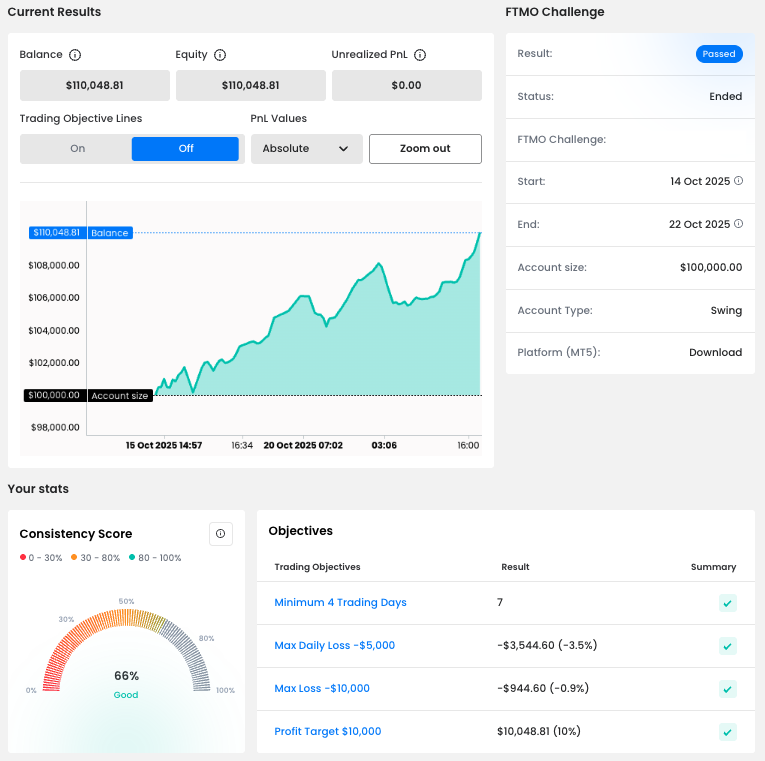

Trader Nadine: “Sometimes the best trade is no trade.”

How did Max Loss limits affect your trading style?

The Max Loss limits helped me become more structured and disciplined in my trading. They forced me to focus on protecting capital first and to remove emotional and impulsive decisions. Knowing that I have a defined risk boundary made me plan each trade more carefully and stick to my setup instead of chasing the market.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a clear trading plan based on structure and price action on the 15M timeframe. I risk a maximum of 1% per trade and always define my Stop Loss before execution. My plan helps me stay consistent, avoid overtrading, and prevents me from reacting emotionally to short-term price movements.

How did you eliminate the factor of luck in your trading?

I removed the factor of luck by focusing on probability and repeatability. Instead of relying on feelings or intuition, I trade only when my rules and technical confirmations are present. I execute the same approach every day, which allows results to come from consistency rather than randomness.

What do you think is the key for long term success in trading?

Long-term success comes from discipline, emotional control, and patience. The strategy itself is not the hardest part – the real key is having the mindset to wait for high-quality setups and manage risk correctly, even when the market tests your emotions.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

The most difficult part was staying patient and not forcing trades just to make progress. I overcame this by accepting that sometimes the best trade is no trade, and by trusting my system instead of trying to speed up the process.

What would you like to say to other traders that are attempting the FTMO Challenge?

Focus on risk management and emotional control more than on entries. If you treat the account like real capital from day one and stay patient, you will naturally pass the FTMO Challenge. Consistency beats excitement.

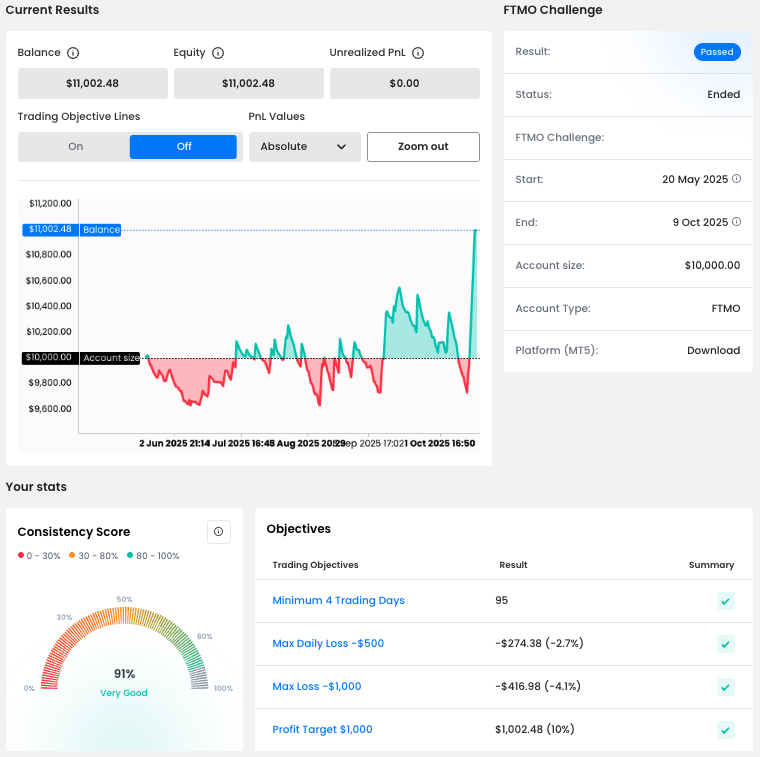

Trader Pablo: “Patience and strict risk management are the keys to long-term consistency.”

What do you think is the most important characteristic/attribute to become a profitable trader?

I believe the most important attribute to become a profitable trader is discipline. The ability to follow a plan, control emotions, and stay consistent even during drawdowns is what separates a professional trader from an impulsive one.

What was the hardest obstacle on your trading journey?

The hardest obstacle was learning to control my emotions after a losing streak. In the past, I used to overtrade or try to make back losses too quickly. Over time, I learned that patience and strict risk management are the keys to long-term consistency.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes, that’s definitely part of my plan. My goal is to scale up gradually as I continue improving my consistency and discipline. Managing bigger capital with the same level of focus and control is my next step.

What inspires you to pursue trading?

Trading inspires me because it represents freedom and self-mastery. It’s not just about money, but about personal growth, discipline, and the ability to build a lifestyle on my own terms.

Describe your best trade.

My best trade was on US30 during the New York session. Price made a manipulation above the previous day’s high, and I patiently waited for confirmation on the 1-minute chart. Once liquidity was grabbed and structure shifted, I entered short with a 1:2 reward-to-risk ratio. The move played out perfectly, reaching my target within minutes. It wasn’t just about profit, but about following my plan with discipline and precision.

One piece of advice for people starting the FTMO Challenge now.

Focus on consistency, not on passing quickly. Respect your plan, accept losses as part of the process, and protect your Max Daily Loss limit at all costs. Trading the FTMO Challenge is more about mindset than strategy – discipline will take you further than any setup.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.