Trading Week Ahead: Central Banks & CPI in the Spotlight

Markets face a pivotal week as central bank decisions and inflation data collide. The Fed is widely expected to deliver a second rate cut, but it’s Powell’s forward guidance that will dictate the broader market tone. Across the Atlantic, the ECB holds steady, yet any dovish shift from Lagarde could rattle the euro. Meanwhile, Friday’s Eurozone CPI will serve as a critical gauge for future policy moves, with volatility likely to surge across all markets.

• Fed Rate Decision

The Fed is widely expected to cut rates from 4.25% to 4.00% this Wednesday, marking its second straight easing move. However, the key market driver will be the forward guidance accompanying the decision. If Chair Powell signals openness to further cuts amid weakening macro data, the USD could face renewed pressure, yields may fall, and equities could find support. Conversely, a more cautious or hawkish tone could stabilise the greenback and spark profit-taking across risk assets.

• ECB Rate Decision

The ECB is set to hold rates steady at 2.15%, but traders will be laser-focused on the language and tone of the Monetary Policy Statement. Should President Lagarde adopt a dovish stance, indicating possible future cuts amid stagnating growth and soft inflation, EUR pairs may slide. Alternatively, a more hawkish or data-dependent message could support the euro and temper rate cut bets.

• Eurozone CPI

Friday’s Eurozone CPI release will test whether inflation is easing in line with ECB projections. A stronger-than-expected print may delay any hopes for monetary easing, potentially lifting EUR and pushing bond yields higher. A soft inflation figure, however, would likely intensify rate cut expectations and weaken the euro, creating space for upside in European equities and bonds.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Tuesday, Oct. 28 | 3:00 PM |  USD USD |

CB Consumer Confidence (tentative) |

| Wednesday, Oct. 29 | 2:45 PM |  CAD CAD |

BOC Rate Statement |

| 7:00 PM |  USD USD |

Federal Funds Rate | |

| 7:30 PM |  USD USD |

FOMC Press Conference | |

| Thursday, Oct. 30 | 10:00 AM |  EUR EUR |

German GDP |

| 1:30 PM |  USD USD |

GDP (tentative) | |

| 2:00 PM |  EUR EUR |

German CPI | |

| 2:15 PM |  EUR EUR |

Monetary Policy Statement | |

| 2:45 PM |  EUR EUR |

ECB Press Conference | |

| Friday, Oct. 31 | 11:00 AM |  EUR EUR |

CPI |

| 1:30 PM |  CAD CAD |

GDP | |

USD USD |

Core PCE Price Index (tentative) |

*All times in the table are in GMT+2

*US government data may be impacted by the shutdown. (Tentative) events are subject to delay, revision, or cancellation.

Technical Analysis with FVG Strategy

This trading strategy uses the EMA 20 and 50 to assess market trends and the Fair Value Gap (FVG) to identify areas of price imbalance. These imbalances, caused by rapid price movements, often indicate high-probability entry and exit points. This approach can be applied to currency pairs such as EURUSD and GBPJPY, as well as US30 and XAUUSD, and provides a review of recent price action and potential trading opportunities.

Opportunities to Watch This Week

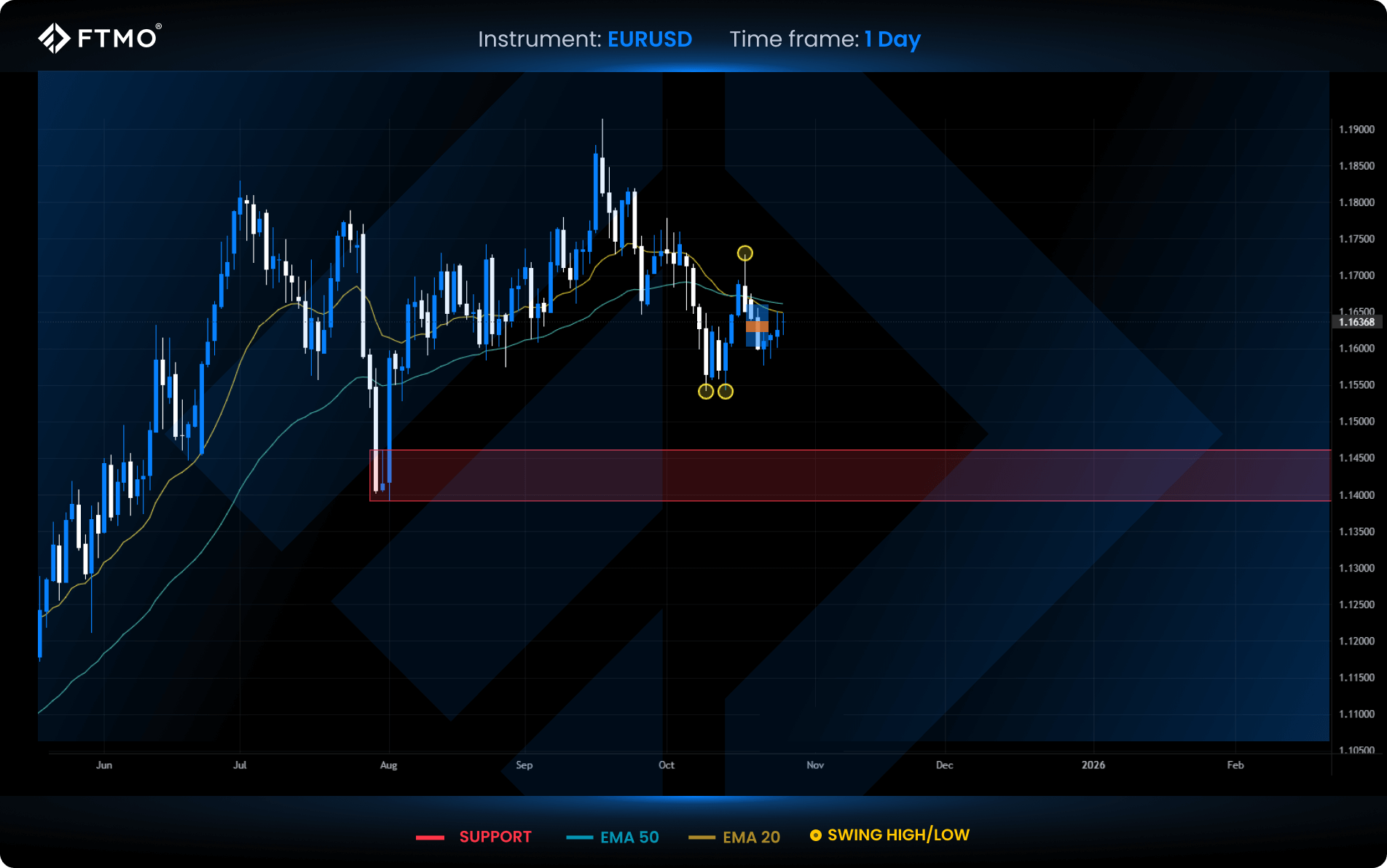

EURUSD

Market Context: After testing the upper range, EURUSD printed a swing high and resumed its move lower. A newly formed SHORT FVG supports the prevailing bearish market structure, suggesting continued downside pressure.

Bearish Scenario (Preferred): The outlook remains bearish, with price likely targeting marked swing lows or the next major support zone. The presence of a valid SHORT FVG reinforces this directional bias.

Bullish Scenario (Alternative): A sustained move above the SHORT FVG would invalidate the bearish setup and shift focus to a liquidity grab above recent swing high.

FVG Setup: A SHORT FVG has formed this week and is currently active as part of the bearish continuation thesis.

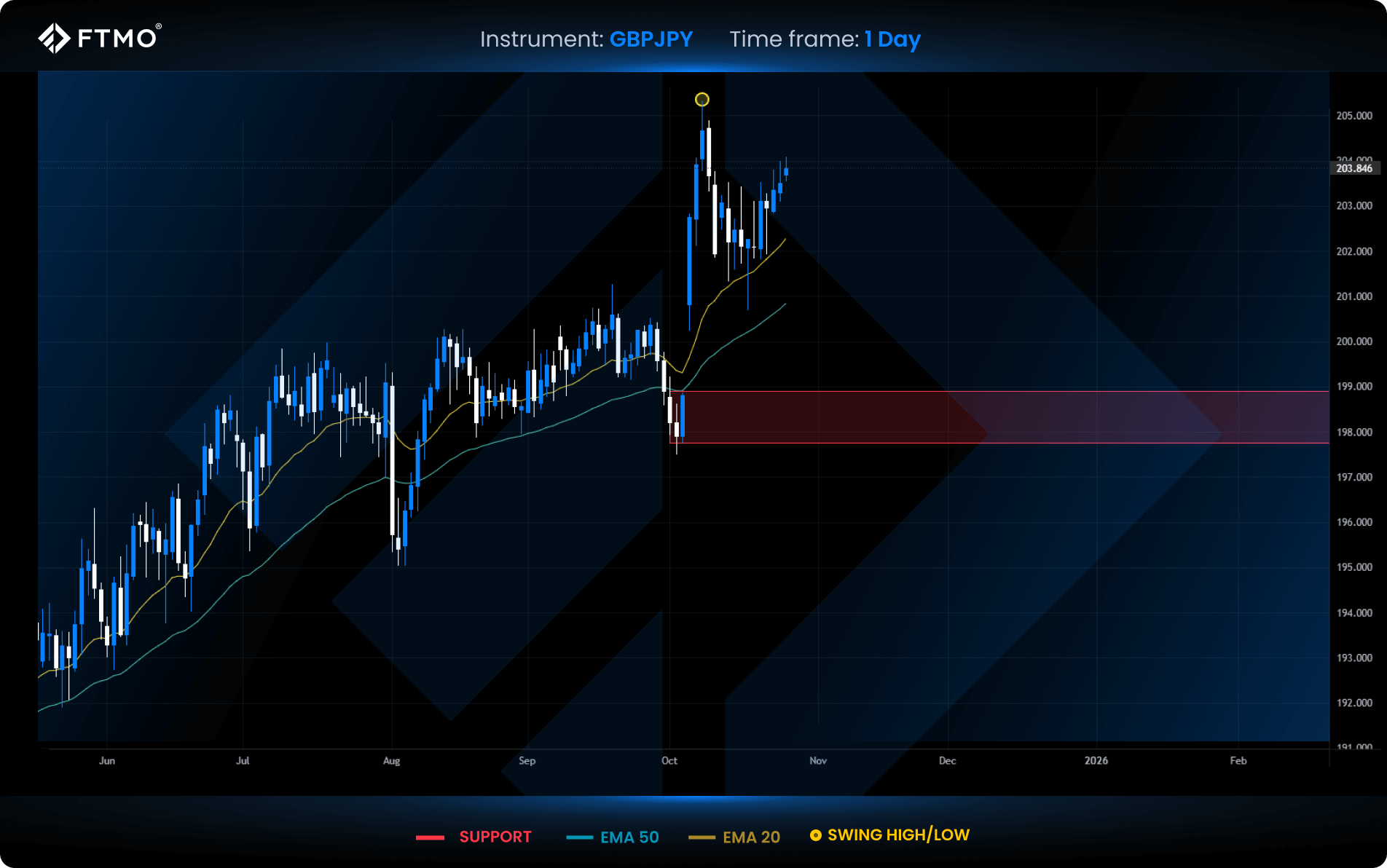

GBPJPY

Market Context: GBPJPY is showing signs of a mild uptrend while resisting a full retracement of the overnight gap. The market is currently advancing toward a swing high, maintaining bullish pressure in the short term.

Bullish Scenario (Preferred): Continuation toward the swing high remains the primary scenario as the price structure holds above key moving averages.

Bearish Scenario (Alternative): A close below the 20 EMA would indicate a potential short-term trend reversal and may prompt a move to fill the overnight gap.

FVG Setup: No FVG formed this week, reflecting a lack of strong momentum or aggressive market behaviour.

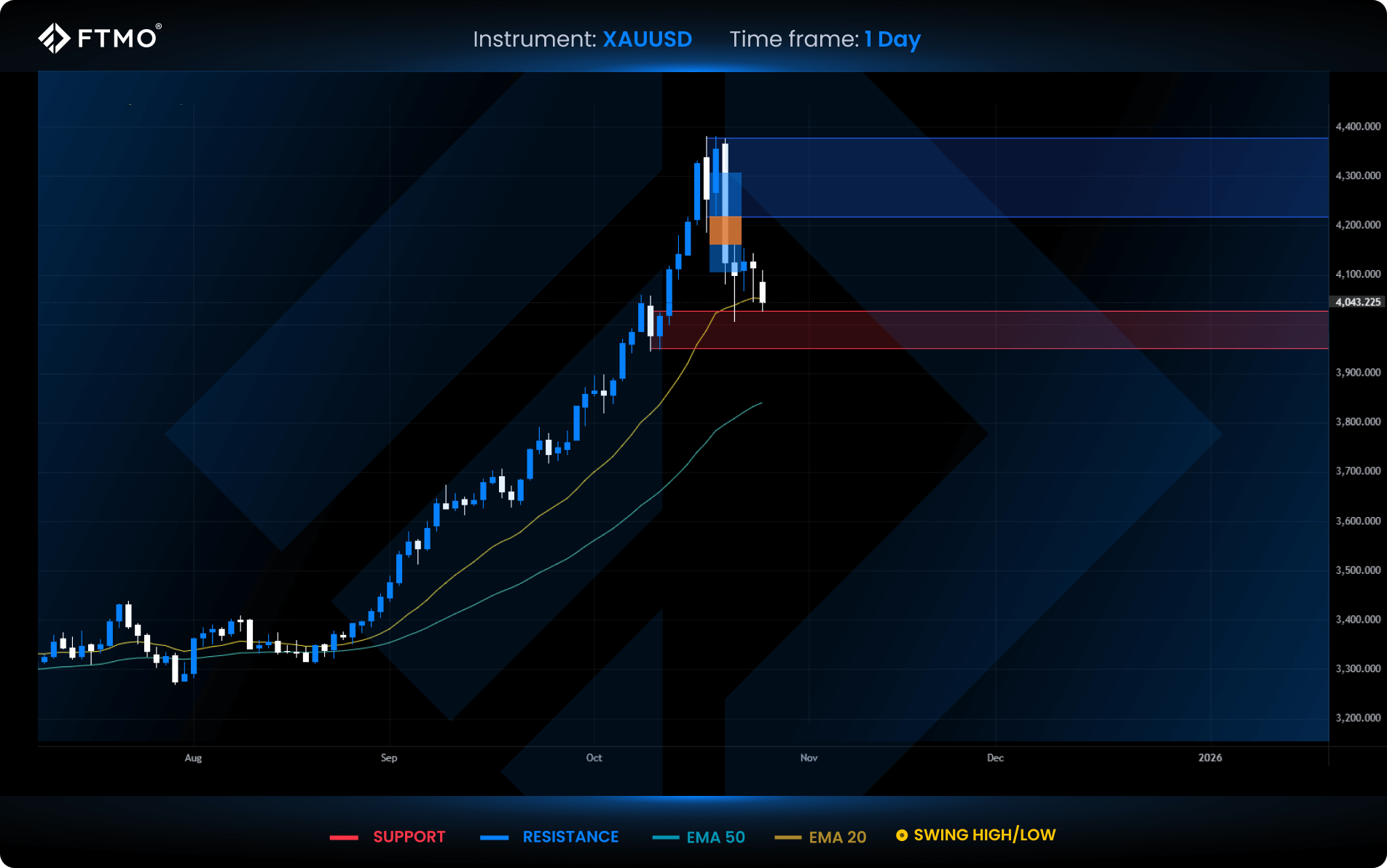

XAUUSD

Market Context: Gold corrected into the nearest support zone, where accumulation is now underway. The broader trend remains bullish, and this pullback appears to be a pause within the ongoing rally.

Bullish Scenario (Preferred): A continuation higher toward the resistance zone remains the base case. This area could trigger renewed selling interest, but the trend bias remains upward until proven otherwise.

Bearish Scenario (Alternative): A close below the support zone would shift market structure to bearish and validate the SHORT FVG as a tradable setup.

FVG Setup: A SHORT FVG has formed, though confirmation of a bearish shift is required before acting on the setup.

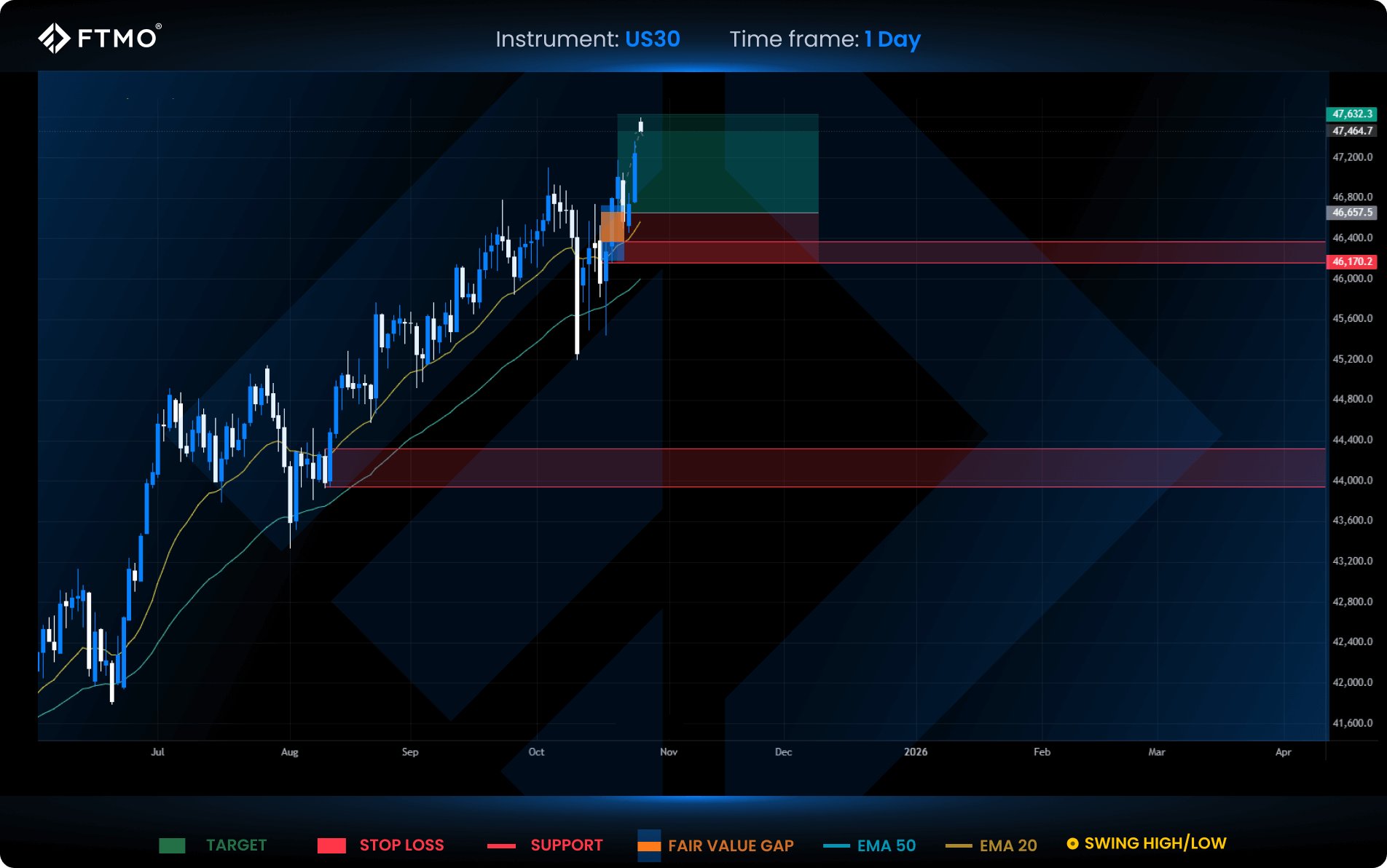

US30

Market Overview: US30 is currently trading at all-time highs, but last Friday’s price action left an untested closing level, suggesting the market may still return to fill that gap. While the overall trend remains bullish, traders should stay alert to the possibility of a short-term pullback.

Preferred Scenario (Bullish): The most likely outcome is a minor retracement back to Friday’s close, followed by a continuation of the broader uptrend. This would align with the prevailing bullish momentum.

Alternative Scenario (Bearish): If the index breaks below the current support zone, it could trigger a deeper correction toward the next strong support area, where buyers are expected to step in again.

FVG Setup: A LONG fair value gap formed last week and remains valid. The setup is active, targeting a potential 2:1 RRR to the upside.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis, or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.