“Learn, then earn. Pay the price of learning first.”

For these FTMO Traders, trading isn’t just a job – it’s a test of mindset, patience, and discipline. Julien, Gilbert, and Aleksandr share their unique approaches to trading, risk management, and psychology that helped them succeed in the FTMO Challenge and Verification.

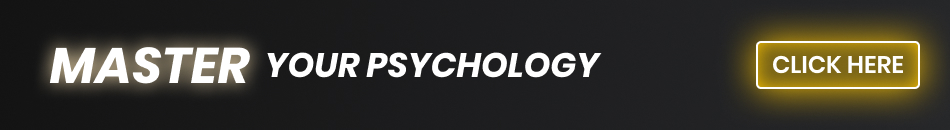

Trader Aleksandr: “The goal is not to pass the Challenge, but to become the trader who deserves to pass it.”

What do you think is the key for long-term success in trading?

Consistency, discipline, and emotional control. Long-term success in trading comes from following a proven strategy, managing risk properly, and keeping emotions out of decision-making. I believe it’s better to focus on process and risk control rather than short-term profits.

What was more difficult than expected during your FTMO Challenge or Verification?

The most difficult part was staying patient and not overtrading during slow market periods. Sometimes it’s tempting to open extra trades just to stay active, but I learned that discipline and patience are more profitable in the long run.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a detailed trading plan that defines my entry conditions, risk limits, and daily goals. I follow it strictly, and if I break any rule, I stop trading for the day to review my mistakes and prevent emotional decisions.

What does your risk management plan look like?

As an intraday gold scalper, my trading is based on strict risk management and discipline. I risk around 2% per trade, depending on market structure and volatility, and I set a Max Daily Loss limit of 4%. Every position is protected by a Stop Loss, and I never move it against the trade or add to losing positions. My goal is to catch precise, high-probability moves during active sessions, usually with a minimum 2:1 reward-to-risk ratio. I don’t hold trades overnight, and I focus on capital protection – consistent execution and emotional control are the foundation of my trading.

What do you think is the most important characteristic or attribute to become a profitable trader?

Emotional discipline. The ability to stay calm and follow your plan even when the market is moving fast or against you is what separates consistent traders from losing ones. Anyone can learn a strategy, but only disciplined traders can execute it under pressure.

One piece of advice for people starting the FTMO Challenge now.

Don’t rush. Focus on following your plan, not on reaching the target fast. Trade as if you already manage an FTMO Account – control your emotions, respect your Max Daily Loss limit, and let consistency build your profit. The goal is not to pass the FTMO Challenge, but to become the trader who deserves to pass it.

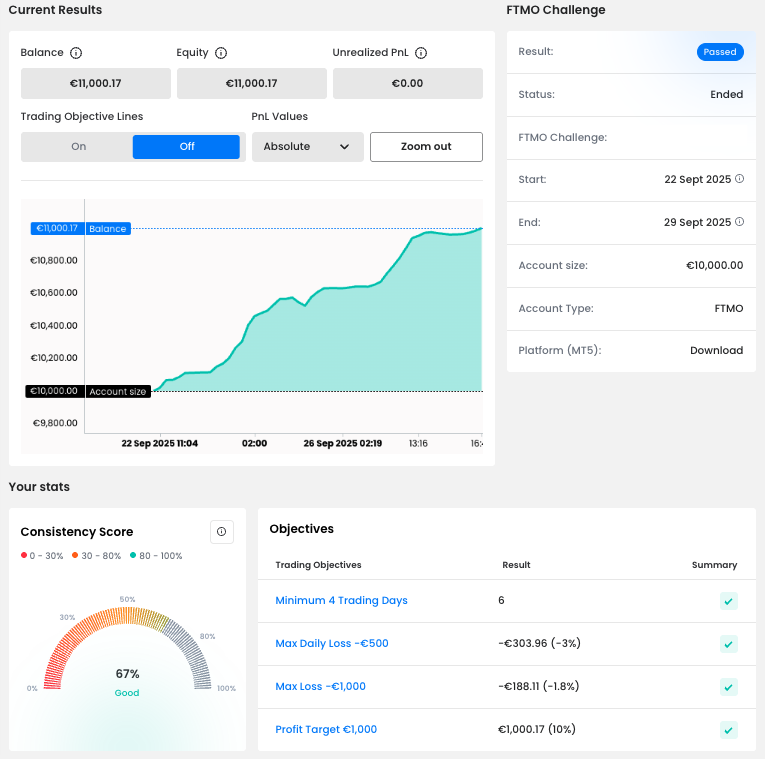

Trader Gilbert: “Trading is a career – it should be done as a business with accountability and not as a gamble.”

How would you rate your experience with FTMO?

Great! I've learned so much so far, and I'm looking forward to growing in an environment that has been and continues to be supportive.

How has passing the FTMO Challenge and Verification changed your life?

Through the FTMO Challenge and Verification process, I've learned the importance of sticking to a strategy and observing rules that ultimately protect a trader’s career – something a person may not do when trading in a retail or personal account environment.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do.

Where have you learnt about FTMO?

Online, through people’s testimonials and YouTube videos.

How did you eliminate the factor of luck in your trading?

Through experience. When I started my trading journey, I thought it was about luck, but over time – through practice, losses, and wins – I learned that it’s about strategy, discipline, and consistency.

What is the number one advice you would give to a new trader?

Learn, then earn. Pay the price of learning first. Trading is a career – it should be done as a business with accountability and not as a gamble. Trading is not a get-rich-quick scheme!

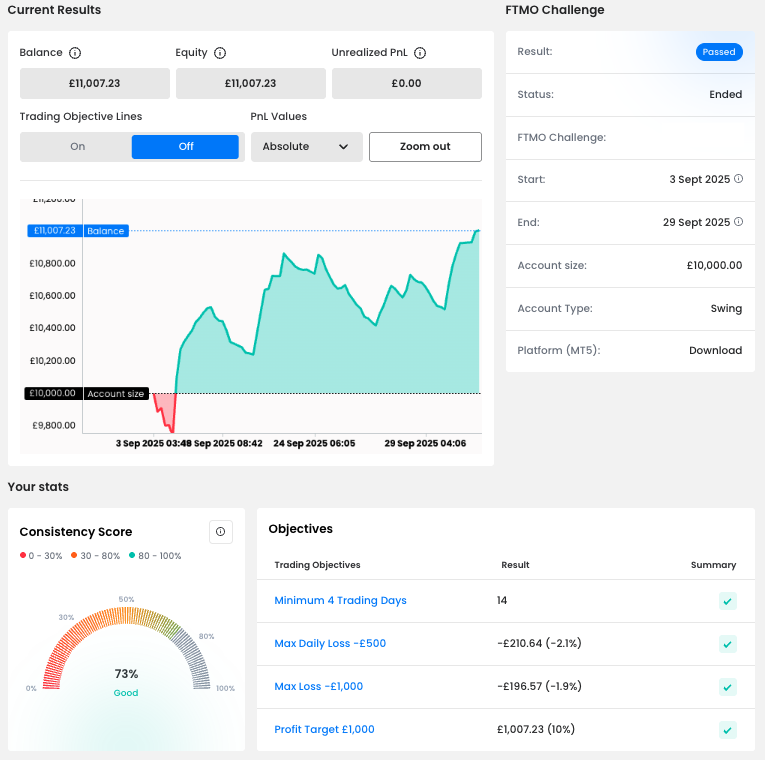

Trader Julien: “Stick to the plan, whatever it is. The simpler, the better.”

Do you have a trading plan in place, and do you follow it strictly?

Yes, I do. I passed the first FTMO Challenge and got my first timid payout, barely gambling my way out. Eventually, I noticed that something was missing from my plan and started becoming more mechanical than I used to be. Now I have rules for everything – literally everything. I even have rules for when to break rules and let my creativity work. It’s like a cheat meal when you’re on a strict diet: it doesn’t boost weight loss but keeps you on track six days out of seven.

How did you manage your emotions when you were in a losing trade?

I manage trades, not emotions. If I get emotional, that means I’m pushing too hard (in my life) or trading too big, and I need to slow down. I stop trading until I’m restored or trade half my usual size.

What do you think is the key for long-term success in trading?

Stick to the plan, whatever it is. The simpler, the better. Keep in mind that if you blindly open 1:1 trades, your Win Rate will be 50%. If you randomly open 1:2, it’ll be 33%. 1:4? 20%. 1:0.5? 66%. In my opinion, it’s easier to survive with a Win Rate of at least 40%, even if it means a lower RRR. If you desperately want a 25 RRR, go buy a lottery ticket – you’ll be better off.

What does your risk management plan look like?

Fixed risk whether I’m in profit or drawdown. If I’m right, I scale in. If it starts moving the other way, I start scaling out.

What inspires you to pursue trading?

It’s a mental game. I freakin’ love mental games.

What is the number one advice you would give to a new trader?

Study. Wanna play chess? It’ll take you thousands of hours in the game to start getting a sense. The same if you want to be a surgeon. The same if you want to be a trader. The more you study, the more you learn. You have to learn all the silly indicators YouTube recommends in order to understand how useless they are and start reducing and reducing until you’re back to naked charts – and, magically, profitable.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.