Trading Week Ahead: Major Earnings and CPI Data

Markets face a pivotal week as key macro data and geopolitical risks collide. The spotlight will be on the October US CPI and Flash PMIs from both the Eurozone and the US, offering early signals on inflation and growth. At the same time, traders remain alert to US-China tensions, a prolonged US government shutdown, and a heavy earnings calendar featuring companies like Tesla and Goldman Sachs.

👉 How can traders position for the volatility ahead? Let’s break it down.

• US CPI

The October Consumer Price Index is the week’s headline release and could set the tone for risk appetite. Core CPI is forecast at 0.3%, matching the previous month. A hotter print may prompt the market to push back expectations for Fed rate cuts, supporting the US dollar and yields. A cooler number, however, could trigger a dovish shift in sentiment and boost equities, gold, and other risk assets.

• US Flash PMIs

US Flash PMIs will offer an early read on how the economy is performing in October. Expectations are slightly lower across the board, with Manufacturing PMI forecast at 51.9 (down from 52.0) and Services PMI at 53.5 (down from 54.2). These readings will help confirm whether the US economy is continuing to slow in a controlled manner or if cracks are starting to widen. Any sharp surprise could spark moves in USD pairs and equity indices.

• Eurozone Flash PMIs

The Eurozone will also release its preliminary October PMIs, with markets looking for signs of either further weakness or unexpected stability. Persistent underperformance, particularly in manufacturing, could reinforce concerns that the region is sliding closer to recession. In such a scenario, the euro may come under renewed pressure, especially if the divergence with US data widens further.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Tuesday, Oct. 21 | 2:30 PM |  CAD CAD |

CPI |

| Wednesday, Oct. 22 | 8:00 AM |  GBP GBP |

CPI |

| Thursday, Oct. 23 | 2:30 PM |  CAD CAD |

Retail Sales |

| 4:00 PM |  USD USD |

Existing Home Sales | |

| Friday, Oct. 24 | 8:00 AM |  GBP GBP |

Retail Sales |

| 10:00 AM |  EUR EUR |

Flash Manufacturing, Services PMI | |

| 10:30 AM |  GBP GBP |

Flash Manufacturing, Services PMI | |

| 2:30 PM |  USD USD |

CPI | |

| 3:45 PM |  USD USD |

Flash Manufacturing, Services PMI |

*All times in the table are in GMT+2

Technical Analysis with FVG Strategy

This trading approach leverages the 20- and 50-period Exponential Moving Averages (EMAs) to assess the prevailing market trend, while the Fair Value Gap (FVG) is used to pinpoint zones of price inefficiency. These gaps, formed during sharp price movements, often highlight optimal entry or exit levels. The strategy is suitable for instruments like EURUSD, GBPJPY, US30, and XAUUSD and provides insights into both last week’s market opportunities and the current one.

Opportunities to Watch This Week

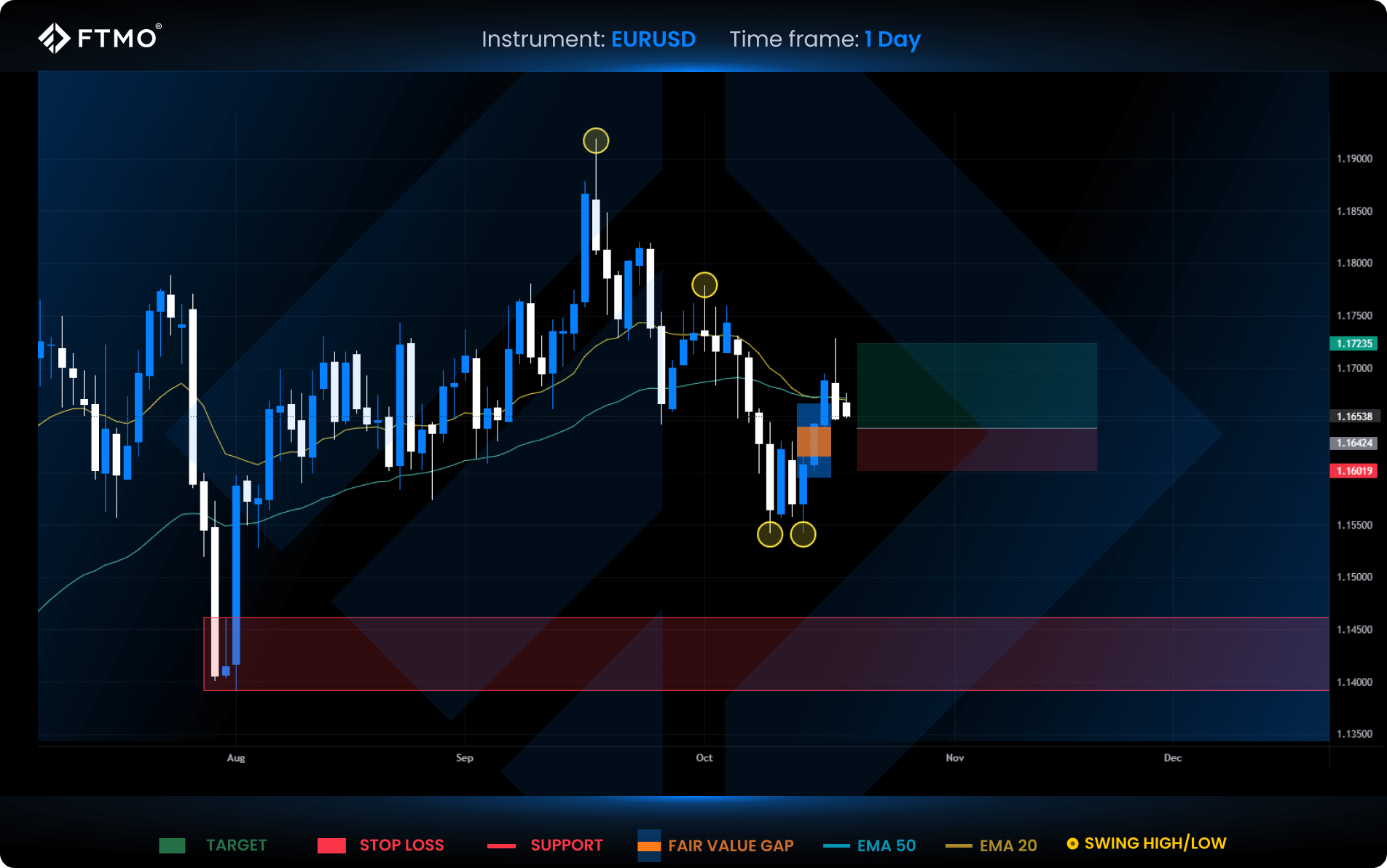

EURUSD

Market Context: Despite trading within a broader monthly downtrend, EURUSD staged a notable recovery last week, pushing into the EMA 20 and 50. Price action around these moving averages will be pivotal in determining the next directional move. A recent bullish impulse also left behind a visible LONG FVG, now acting as a major support zone.

Bullish Scenario (Preferred): A retest of the LONG FVG followed by a continuation of the bullish leg is the preferred outlook. Price could aim for a 2:1 RRR target or even extend toward the recent range swing high if momentum builds.

Bearish Scenario (Alternative): If the pair fails to hold above the EMAs and prints a bearish rejection, downside continuation is on the table, targeting the lower support zone in alignment with the prevailing downtrend.

Setup: A LONG FVG was formed this week and currently serves as a valid trade setup for continuation to the upside.

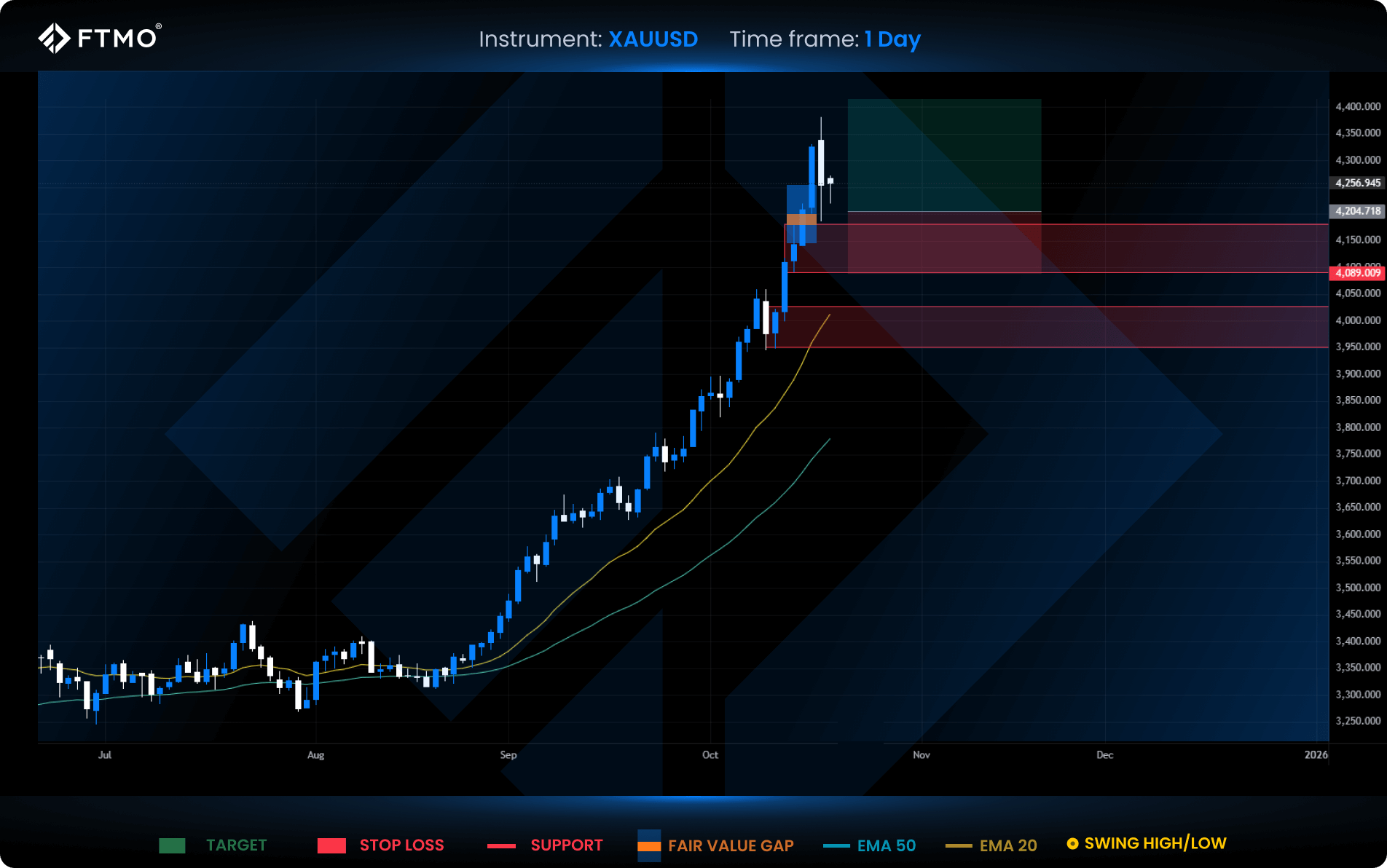

XAUUSD

Market Context: Gold remains in a strong bullish trend, with Friday's negative candle testing the upper boundary of a LONG FVG. The close suggests a shallow correction within the broader uptrend rather than a trend reversal.

Bullish Scenario (Preferred): The market is expected to continue higher, with the 2:1 RRR target from the LONG FVG in play. An extended rally could even push toward the 2500 psychological level, a key area where profit-taking may occur.

Bearish Scenario (Alternative): A deeper correction into the support zone is possible. As long as the price stays above this zone, the bullish structure remains valid.

Setup: No new FVG was formed this week. However, the previous week's LONG FVG was tested on Friday and remains an active long setup with a 2:1 RRR target.

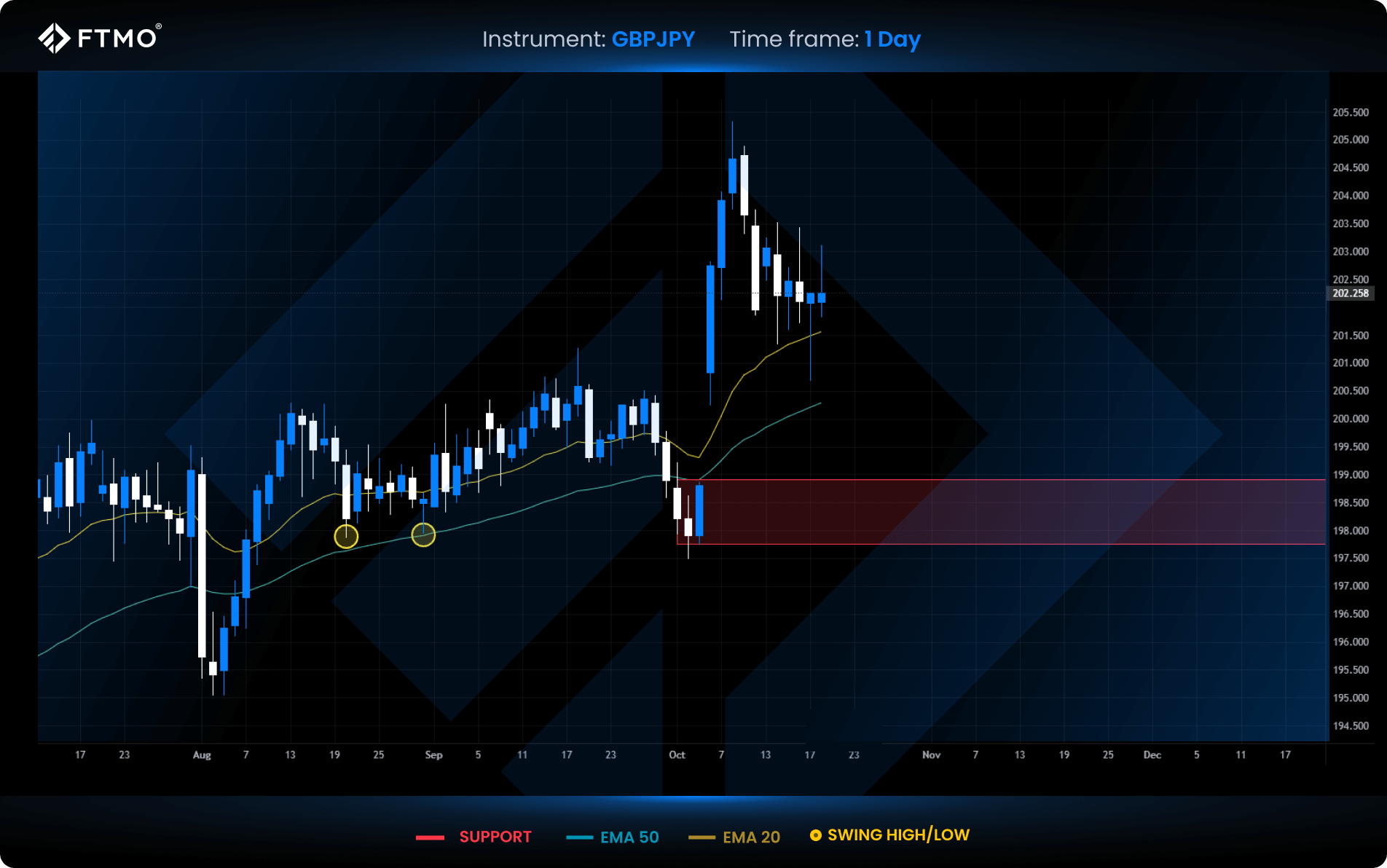

GBPJPY

Market Context: GBPJPY has remained range-bound with little directional conviction since last week. The key focus remains on whether the weekend gap will be filled. On lower timeframes, the structure continues to favour sellers, reinforcing the short-term bearish narrative.

Bearish Scenario (Preferred): As long as the bearish structure holds on intraday charts, a move toward closing the weekend gap is expected. This remains the primary scenario.

Bullish Scenario (Alternative): A structural bullish shift on lower timeframes could open the door for further upside and invalidate the gap fill.

Setup: No new FVGs formed this or last week due to reduced market aggressiveness. However, potential setups may emerge on lower timeframes targeting the weekend gap.

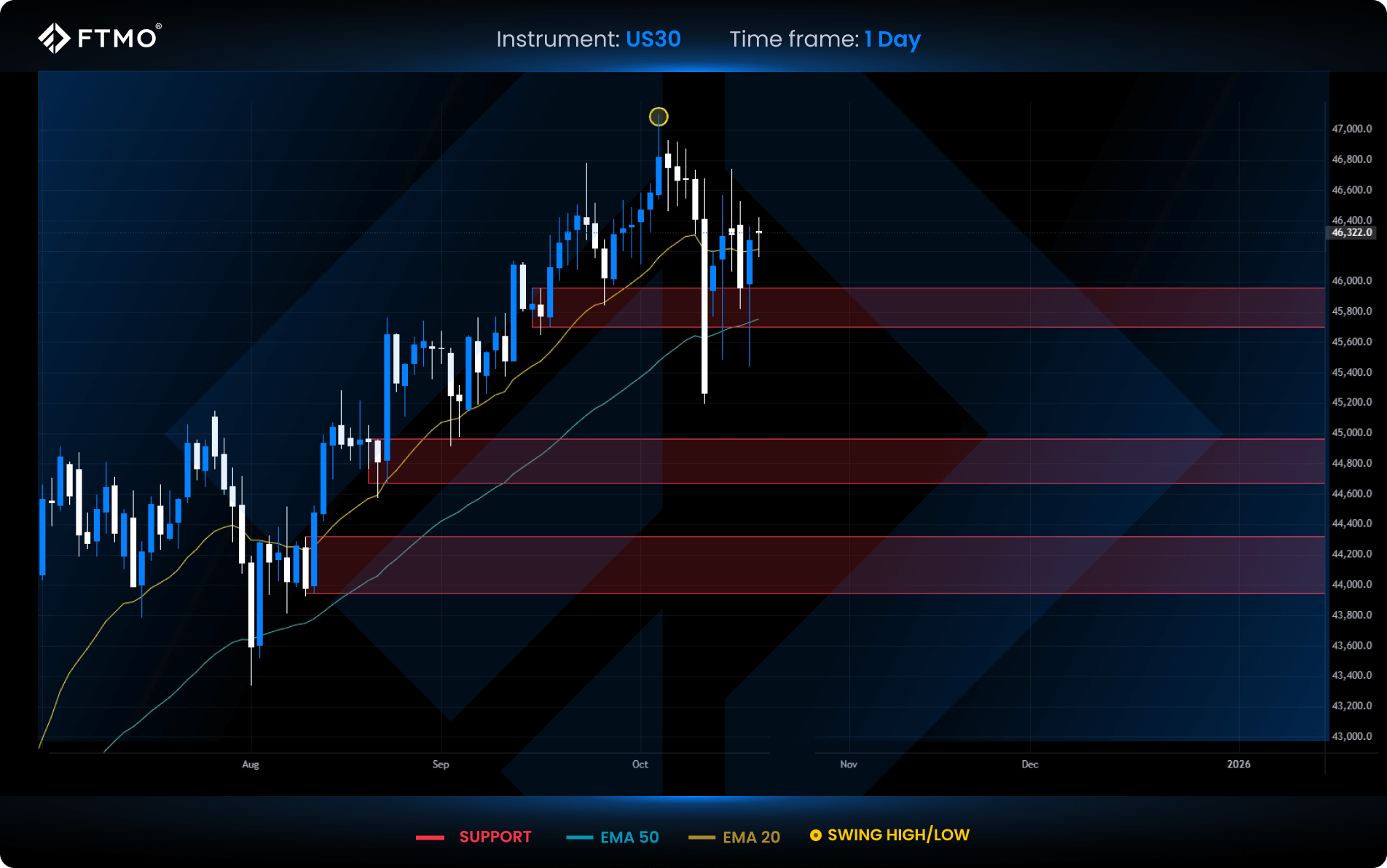

US30

Market Context: After last week’s sharp sell-off, US30 has entered an accumulation phase, with price now stabilising above the 20 EMA. Friday’s candle swept Tuesday’s low, hinting at possible accumulation ahead of a bullish move.

Bullish Scenario (Preferred): If support holds and bullish momentum builds, a continuation of the long-term uptrend is expected. This scenario is favoured unless the structure breaks to the downside.

Bearish Scenario (Alternative): A drop below the key support zone would validate further downside toward the next major support level.

Setup: No FVG formed this week due to consolidation following last week's aggressive sell-off.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis, or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.