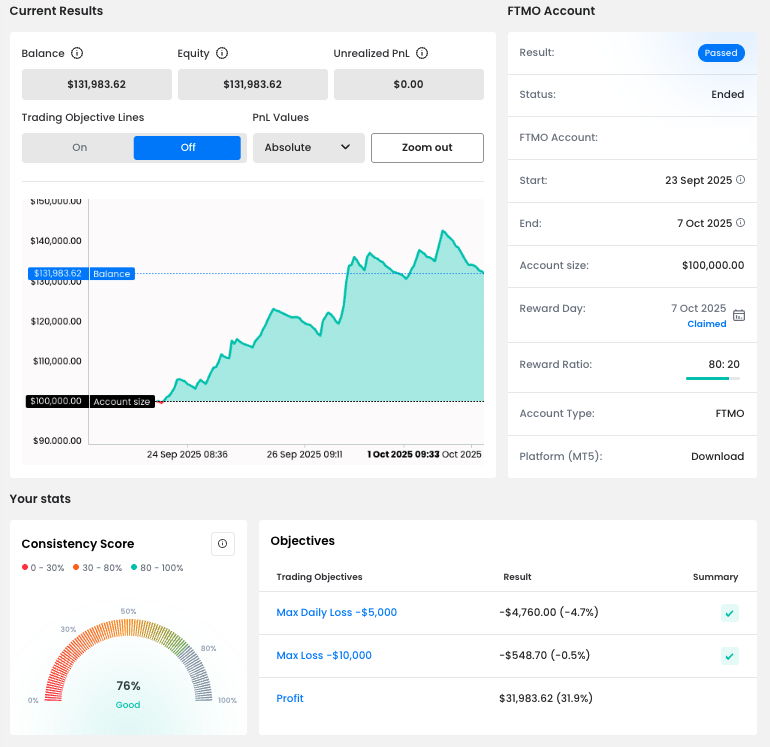

Respecting the Trading Objectives at Hard Times Led to a 31.9% Profit

In this part of our Successful Trader Stories, we take a look at a trader who proved that respecting the FTMO Trading Objectives and staying consistent with risk management can lead to remarkable results. With a 31.9% profit on his $100,000 demo FTMO Account, he closed the trading period successfully and walked away with a well-deserved Reward. Find out how!

Smooth Growth Through Focus and Control

The balance curve reflects confident and well-managed growth. Instead of chasing every opportunity, this trader focused on structured setups and steady execution. His disciplined approach helped him reach a final balance of $131,983.62, translating into a profit of $31,983.62 within just two weeks.

His Consistency Score of 76% shows that his trades were not random but guided by a well-defined plan.

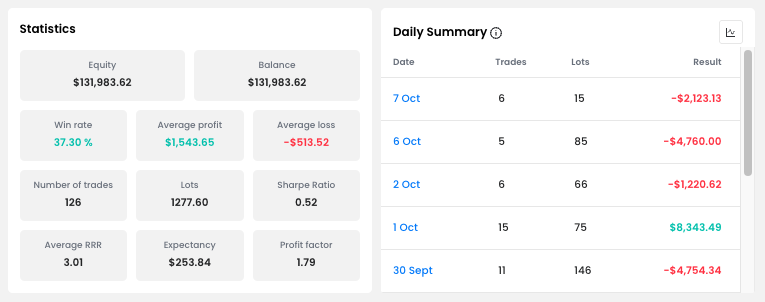

Numbers That Tell the Story

The numbers behind his performance are clear. With a Win Rate of 37.3%, statistically less than four out of ten trades were profitable, but his reward-to-risk ratio of 3.01 was more than enough to make the difference.

His average winning trade brought in $1,543.65, while average losses were limited to $513.52. This balance created a Profit Factor of 1.79, proving that even with a lower win rate, strong risk-to-reward discipline can deliver consistent profitability.

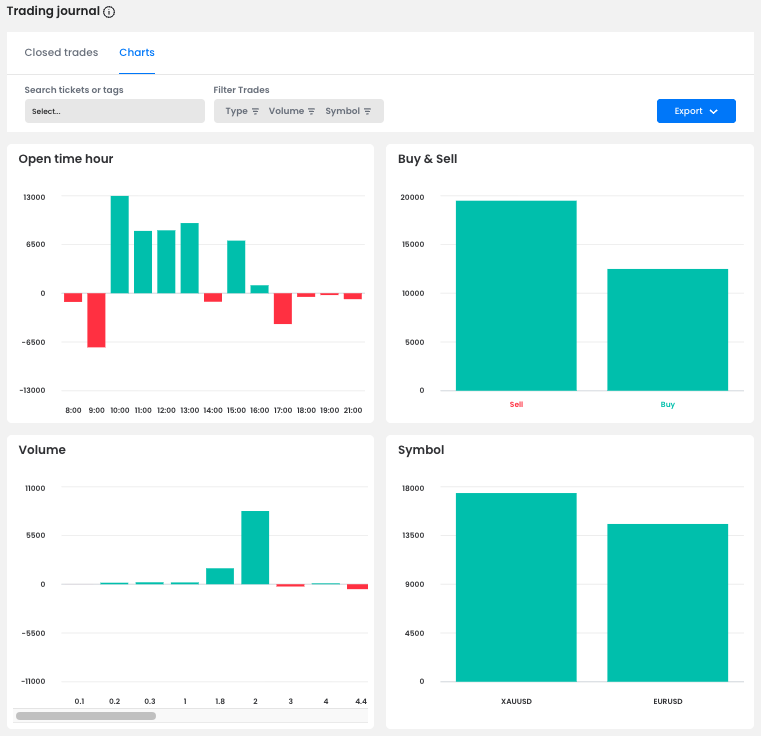

Focused Approach to Markets

This trader built his success around two favorite instruments: EURUSD and XAUUSD (Gold). Despite their differences, both provided enough liquidity and volatility for his strategy to work efficiently.

Interestingly, he opened more short positions than longs, showing that he wasn’t biased toward one direction. His flexibility allowed him to react to changing conditions while still respecting his Trading Objectives and Max Loss limits.

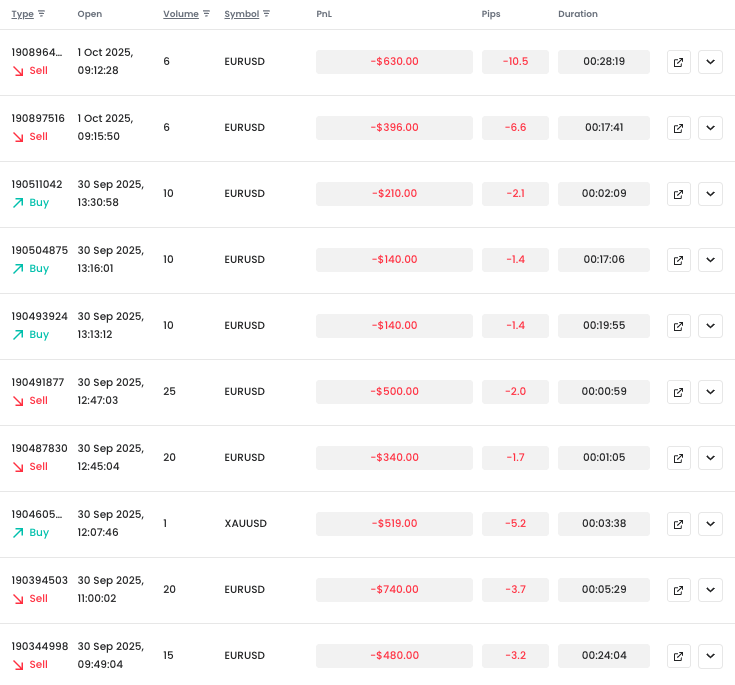

Staying Composed During a Losing Streak

Every trader faces difficult days, and this one was no exception. The toughest period came around 30 September, when he recorded 13 consecutive losing trades and hit a Daily Loss of –$4,754.34.

Despite this challenging streak, he stayed calm, respected his Max Daily Loss limit of $5,000, and avoided emotional decision-making. His ability to step back and maintain discipline was crucial — and just a few days later, he made a strong comeback.

Case Study: A Well-Timed EURUSD Short

Although he traded gold more frequently, his best performance came from a different market – EURUSD. On 26 September, he opened a short position that lasted just over two hours and secured an impressive $6,156 profit.

The setup was clean and disciplined: he had a Stop Loss in place and managed it dynamically throughout the trade. We can see that he closed the position above his originally set Take Profit, even though the move continued in his favor. With a bit more patience, the trade could have reached his TP level perfectly — but the decision to secure profits early was still a solid one.

📌 Fundamental context: Around that time, EURUSD might have reversed lower as risk sentiment probably improved and investors shifted back toward the U.S. dollar. Concerns about a potential U.S. government shutdown were starting to ease, and further rate cuts might not have come as quickly as previously expected. This combination could have strengthened the USD and supported the trader’s short position.

Conclusion

This trader’s performance proves that success isn’t about trading more — it’s about trading smarter. By respecting the Trading Objectives, focusing on EURUSD and AUXUSD, and maintaining emotional control even during tough periods, he achieved a 31.9% profit on his account.

His approach shows that even with a modest Win Rate, disciplined risk management and patience can lead to outstanding results. Once again, this story reminds us that consistency, risk awareness, and emotional balance are the true cornerstones of profitable trading.

Note: Since we cannot clearly define the exact trader's strategy from the chart, this is only the private opinion of the author of this article. FTMO Traders are free to choose their strategy and as long as they do not explicitly violate our Terms and Conditions and follow our risk management rules, the choice of strategy and execution of individual trades is up to them.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.