Trading Week Ahead: Can Inflation Data Push the Fed Toward a Bigger Cut?

Markets enter a crucial week with traders watching the Fed's next move. The question is no longer whether the Fed will cut rates, but by how much. A 25-basis-point cut is already priced in by most participants, though speculation around a deeper 50-basis-point move is building. This week’s US inflation data will likely play a key role in shaping that decision.

• US PPI: First Look at Cost Pressures

The Producer Price Index will provide an early signal on inflation trends. Markets expect the monthly figure to drop from 0.9% to 0.3%, suggesting easing input costs. While not as impactful as CPI, a surprise to the upside could renew concerns about sticky inflation. That may prompt the Fed to lean toward a smaller 25 basis point cut instead of going deeper with 50. This outcome would likely support the dollar and weigh on risk sentiment.

• US CPI: Will Inflation Justify a Larger Cut?

Markets forecast a 0.3% month-on-month increase in August CPI, slightly up from July’s 0.2%. Although a rate cut is widely anticipated, this release could determine whether the Fed sticks with a quarter-point reduction or considers a more aggressive move. A stronger print would support a more cautious approach, likely boosting the dollar and yields. A weaker figure would strengthen calls for deeper easing and encourage risk-on positioning.

• ECB Rate Decision

The ECB is widely expected to hold rates steady, but the tone of Lagarde’s press conference will be critical. As eurozone growth continues to cool, any dovish hints or signals of future cuts could weaken the euro and lift European equities. A more balanced or hawkish message would likely keep the currency stable in the near term.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Wednesday, Sep. 10 | 2:30 PM |  USD USD |

PPI |

| Thursday, Sep. 11 | 2:15 PM |  EUR EUR |

ECB Interest Rate Decision |

| 2:30 PM |  USD USD |

CPI | |

| 2:45 PM |  EUR EUR |

ECB Press Conference | |

| Friday, Sep. 12 | 8:00 AM |  GBP GBP |

GDP |

EUR EUR |

German CPI | ||

| 4:00 PM |  USD USD |

Prelim UoM Consumer Sentiment, Inflation Expectations |

*All times in the table are in GMT+2

Technical Analysis with FVG Strategy

This trading strategy uses the EMA 20 and 50 to assess market trends and the Fair Value Gap (FVG) to identify areas of price imbalance. These imbalances, caused by rapid price movements, often indicate high-probability entry and exit points. This approach can be applied to currency pairs such as EURUSD and GBPJPY, as well as US30 and XAUUSD, and provides a review of recent price action and potential trading opportunities.

Last Week’s Opportunities

XAUUSD

Market Context: Gold continues its explosive rally, reaching new all-time highs. Momentum remains strongly bullish, with price structure respecting FVG levels.

Bullish Scenario (Preferred): As long as price respects the nearest FVG edge, trend continuation remains the likely path.

Bearish Scenario (Alternative): A corrective pullback may occur but isn't expected to break the overall bullish structure unless it pushes into deeper support.

FVG Setup: A valid FVG was formed last Wednesday and was cleanly tested on Thursday. The long trade remains active.

Weekly Market Outlook

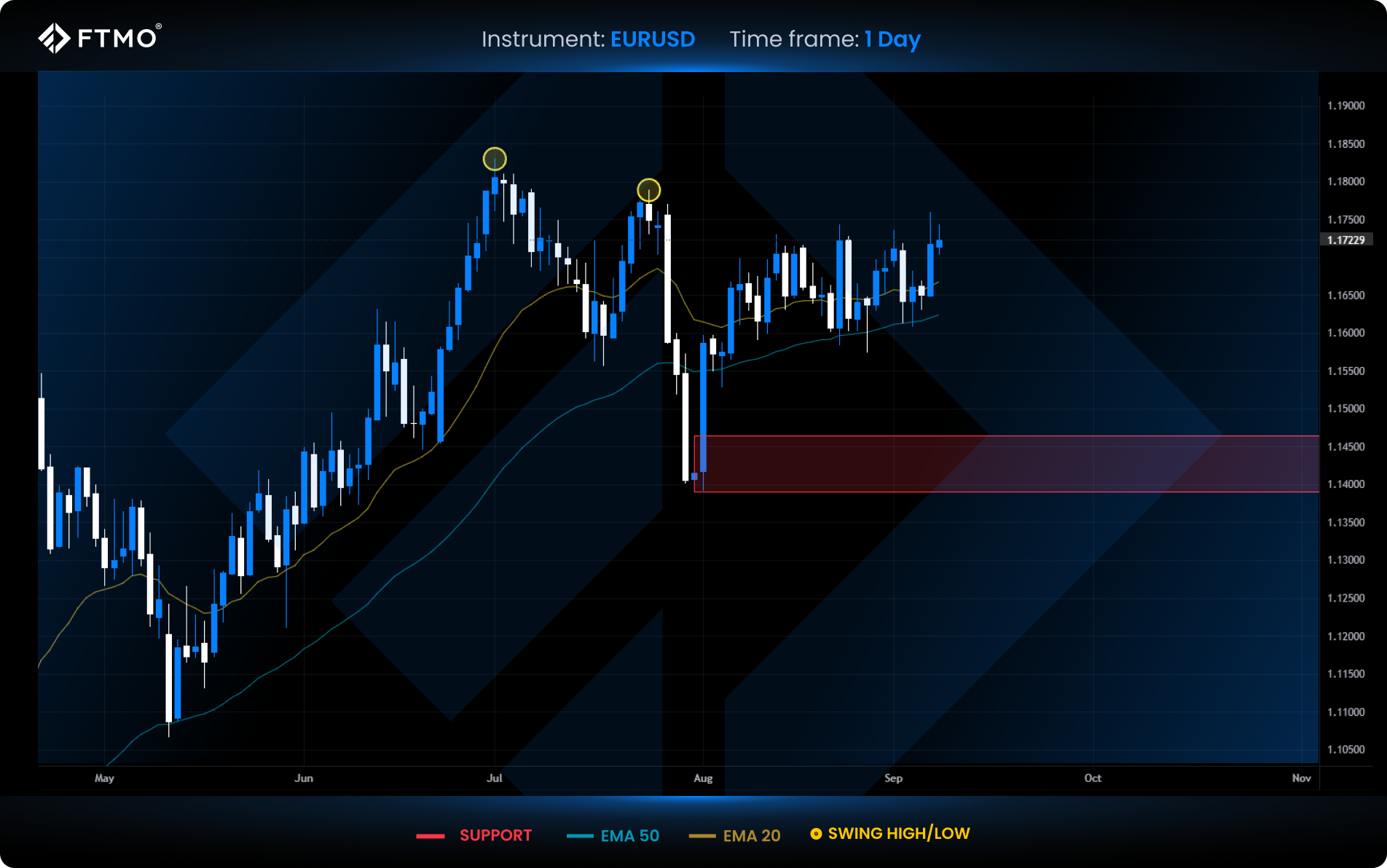

EURUSD

Market Context: After a month of sideways consolidation, EURUSD is beginning to show bullish momentum. Price trades above both EMAs, and the open supports further upside. Liquidity above the range remains an attractive target.

Bullish Scenario (Preferred): Further upside into the marked liquidity zone is likely, supported by structure and dynamic EMA alignment.

Bearish Scenario (Alternative): If the daily candle closes below the monthly range, which carries significant volume, the market could shift toward the next support zone marked on the chart.

FVG Setup: No valid FVG was formed this week. Last week’s bearish FVG setup was invalidated, reinforcing the bullish bias.

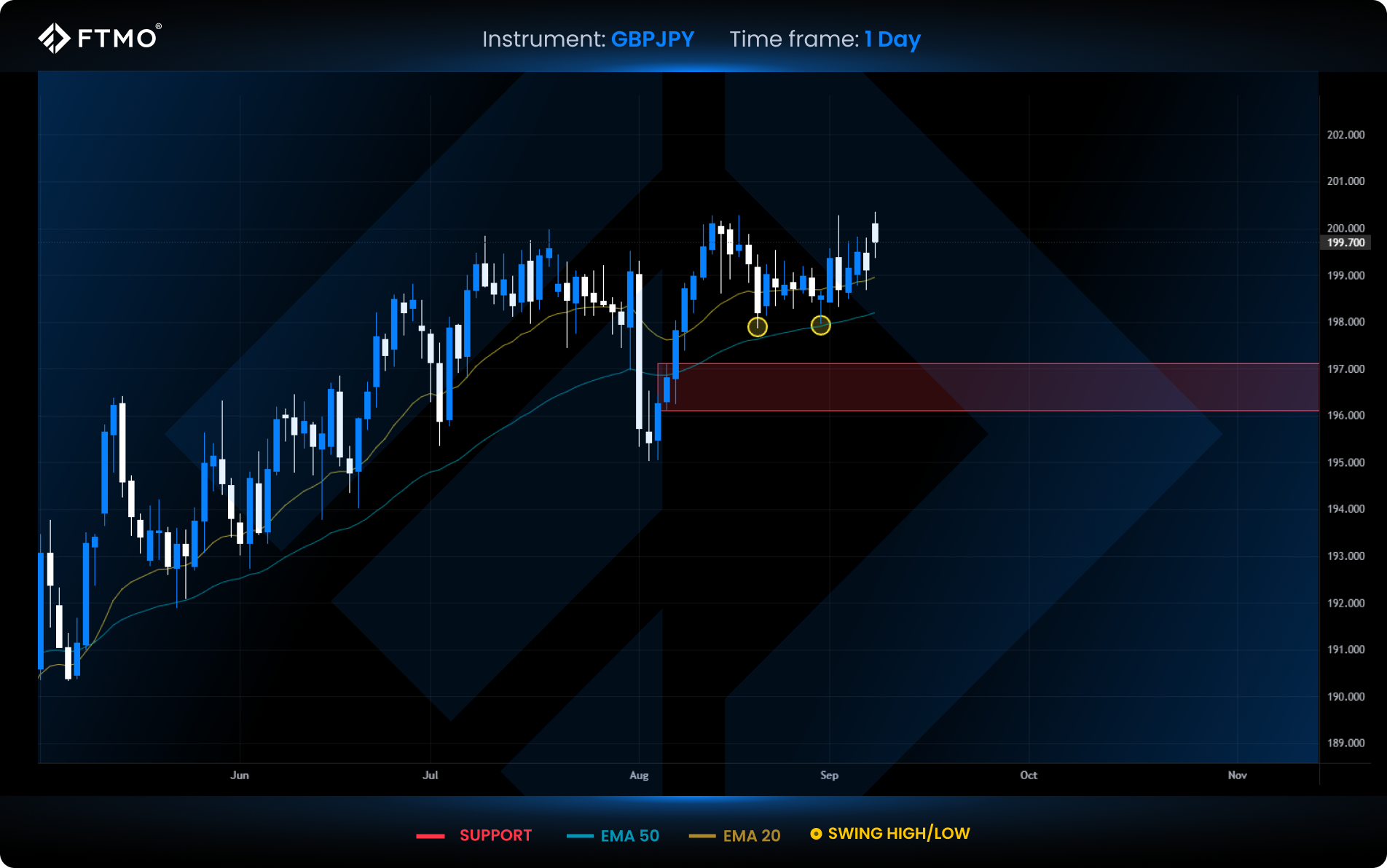

GBPJPY

Market Context: The pair opened the week with a strong move above range highs, sweeping liquidity and maintaining bullish structure above the 20 and 50 EMAs.

Bullish Scenario (Preferred): As long as the price holds above the breakout level and both EMAs, further upside toward higher liquidity remains likely.

Bearish Scenario (Alternative): A drop back below the range could open a move toward lower liquidity and support, where buyers may step back in.

FVG Setup: No FVG setups formed this or last week.

US30

Market Context: The Dow remains range-bound, consolidating beneath two equal swing highs, which suggest resting liquidity above.

Bullish Scenario (Preferred): A breakout above the equal highs could target the liquidity pool and open space for further upside.

Bearish Scenario (Alternative): Failure to break out may lead to a decline toward support, where buyers could react.

FVG Setup: No valid FVGs formed over the last two weeks due to continued consolidation.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis, or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.