Trading Week Ahead: US Jobless Claims, PMIs & Home Sales Ahead

This week’s economic calendar features high-impact US data that could shape market sentiment across major assets, from fresh labour market signals via unemployment claims to early snapshots of economic activity through Flash PMIs.

• Unemployment Claims

Thursday’s weekly jobless claims remain a key barometer of labour market conditions in the US. The previous figure stood at 229K, and even though no specific forecast is available, any significant surprise could trigger volatility across USD pairs and equity markets. Traders will monitor the data closely as it feeds into broader expectations around Fed policy and economic momentum.

• Flash PMI (Manufacturing & Services)

Preliminary S&P global flash PMI data for May (due Thursday) will provide early insight into the state of the US economy. Last month’s readings stood at 50.2 for manufacturing and 50.8 for services, barely above the expansion threshold. A drop below 50 could raise concerns about slowing growth, while any upside surprise could support USD strength and risk appetite.

• Existing Home Sales

Also set for release on Thursday, existing home sales offer a key look into the health of the US housing market amid persistently high interest rates. A continued decline in sales would indicate consumer strain and tightening financial conditions and potentially weigh on housing-related equities and dampen overall market sentiment.

| Date | Time | Instrument | Event |

|---|---|---|---|

| Monday, May. 19 | 11:00 AM |  EUR EUR |

CPI |

| Tuesday, May. 20 | 6:30 AM |  AUD AUD |

RBA Monetary Policy Statement |

| 8:00 AM |  EUR EUR |

German PPI | |

| 2:30 PM |  CAD CAD |

CPI | |

| Wednesday, May. 21 | 8:00 AM |  GBP GBP |

CPI |

| Thursday, May. 22 | 9:15 AM |  EUR EUR |

French Flash PMI |

| 9:30 AM |  EUR EUR |

German PMI | |

| 10:00 AM |  EUR EUR |

Flash PMI | |

| 10:30 AM |  GBP GBP |

Flash PMI | |

| 2:30 PM |  USD USD |

Unemployment Claims | |

| 3:45 PM |  USD USD |

Flash PMI | |

| 4:00 PM |  USD USD |

Existing Home Sales | |

| Friday, May. 23 | 8:00 AM |  GBP GBP |

Retail Sales |

EUR EUR |

German GDP | ||

| 2:30 PM |  CAD CAD |

Retail Sales | |

| 4:00 PM |  USD USD |

New Home Sales |

*All times in the table are in GMT+2

Technical Analysis with FVG Strategy

This trading approach leverages the 20 and 50-period Exponential Moving Averages (EMAs) to assess the prevailing market trend, while the Fair Value Gap (FVG) is used to pinpoint zones of price inefficiency. These gaps, formed during sharp price movements, often highlight optimal entry or exit levels. The strategy is suitable for instruments like EURUSD, GBPJPY, US30, and XAUUSD and offers insights into both last week’s market opportunities and the current one.

Last Week’s Opportunities

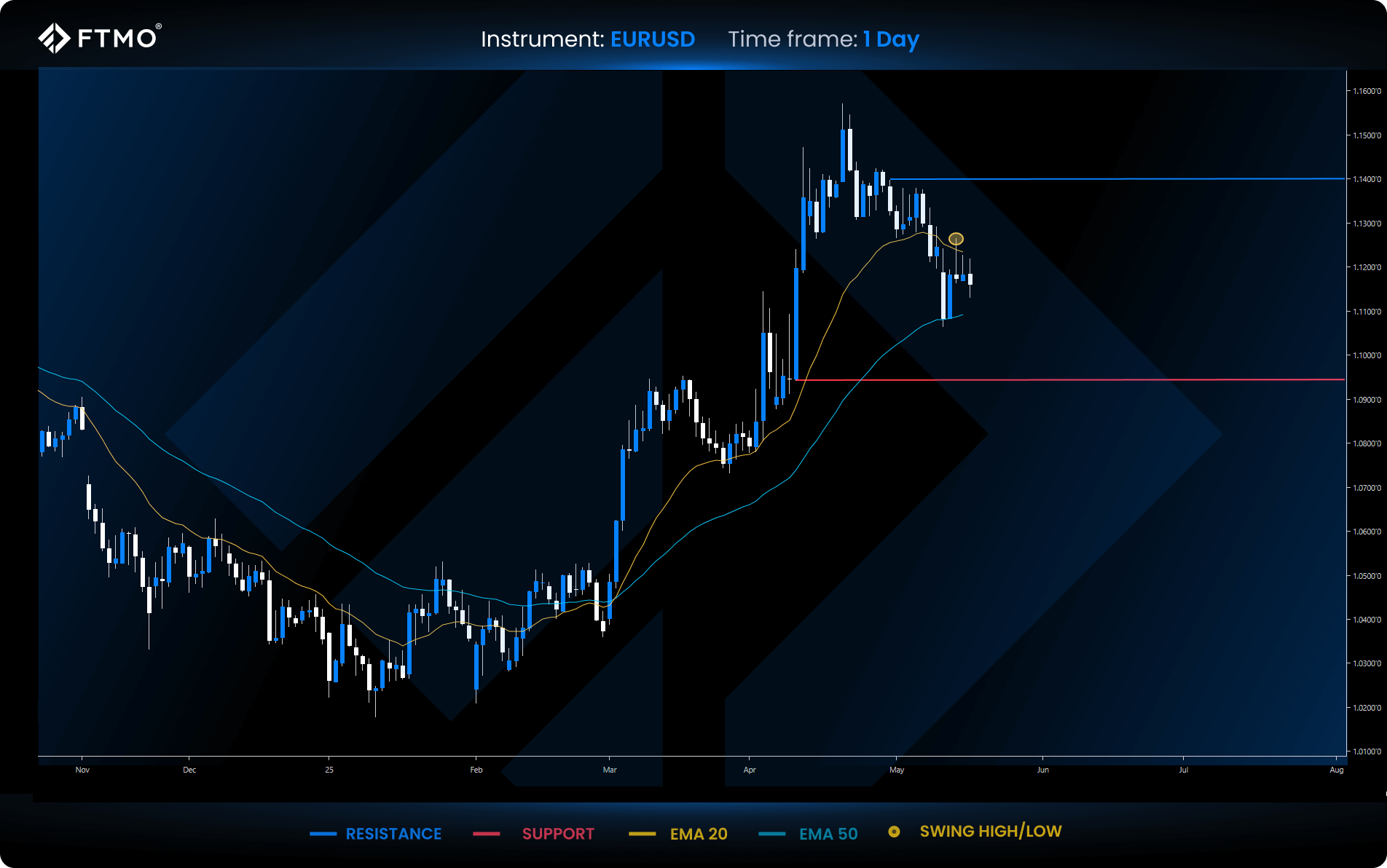

EURUSD

Market Context: EURUSD is trading below the 20 EMA, having recently tested the 50 EMA with a bullish reaction. Despite the bounce, the pair remains technically pressured, lacking momentum for a decisive move higher.

Bearish Scenario (Preferred): Price could reject current levels and retrace towards the nearest support, potentially sweeping recent lows.

Bullish Scenario (Alternative): A break above the recent swing high could trigger a move towards the next resistance zone.

Setup: No FVG setup formed this or last week. Market structure remains neutral to slightly bearish.

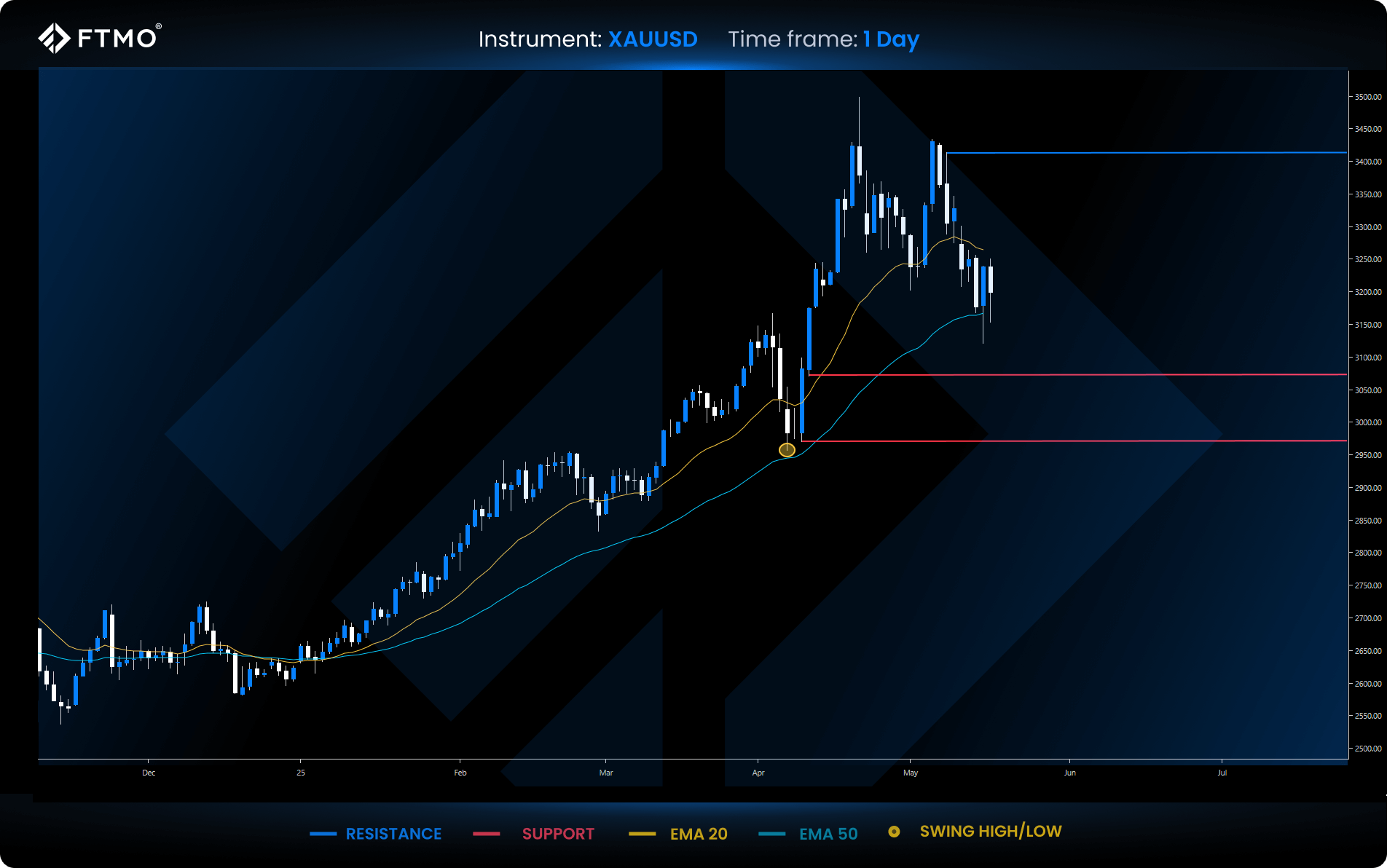

XAUUSD

Market Context: Gold continues its broader bearish correction after an extended rally. Price has broken below the 20 EMA and is currently testing the 50 EMA.

Bearish Scenario (Preferred): A breakdown below the 50 EMA could confirm a medium-term bearish trend, targeting support zones and swing low liquidity.

Bullish Scenario (Alternative): A recovery from the EMA 50 could trigger a bounce towards the nearest resistance, followed by potential continuation to the downside.

Setup: A short FVG setup formed last week but failed to trigger. No new FVG setup was identified this week.

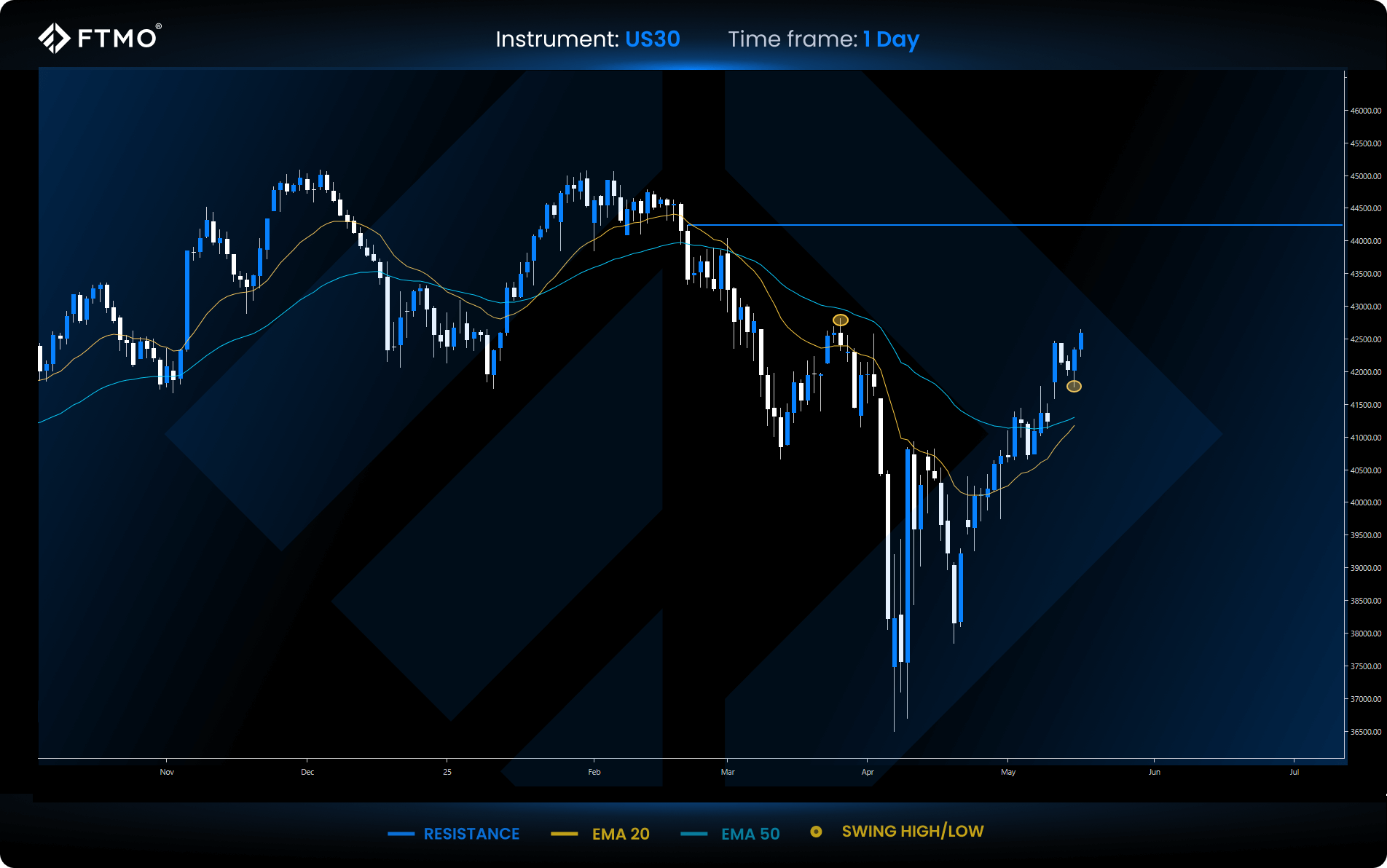

US30

Market Context: US30 remains in a strong bullish trend, trading significantly above both the 20 and 50 EMAs. Price action confirms sustained upward momentum.

Bullish Scenario (Preferred): Continued rally into the marked resistance zone remains the base case.

Bearish Scenario (Alternative): A pullback to the 20 EMA after a swing low sweep could offer a reactive long entry and continuation higher.

Setup: No FVG setup formed this or last week. Market conditions remain clean with low imbalance signals.

Opportunities to Watch This Week

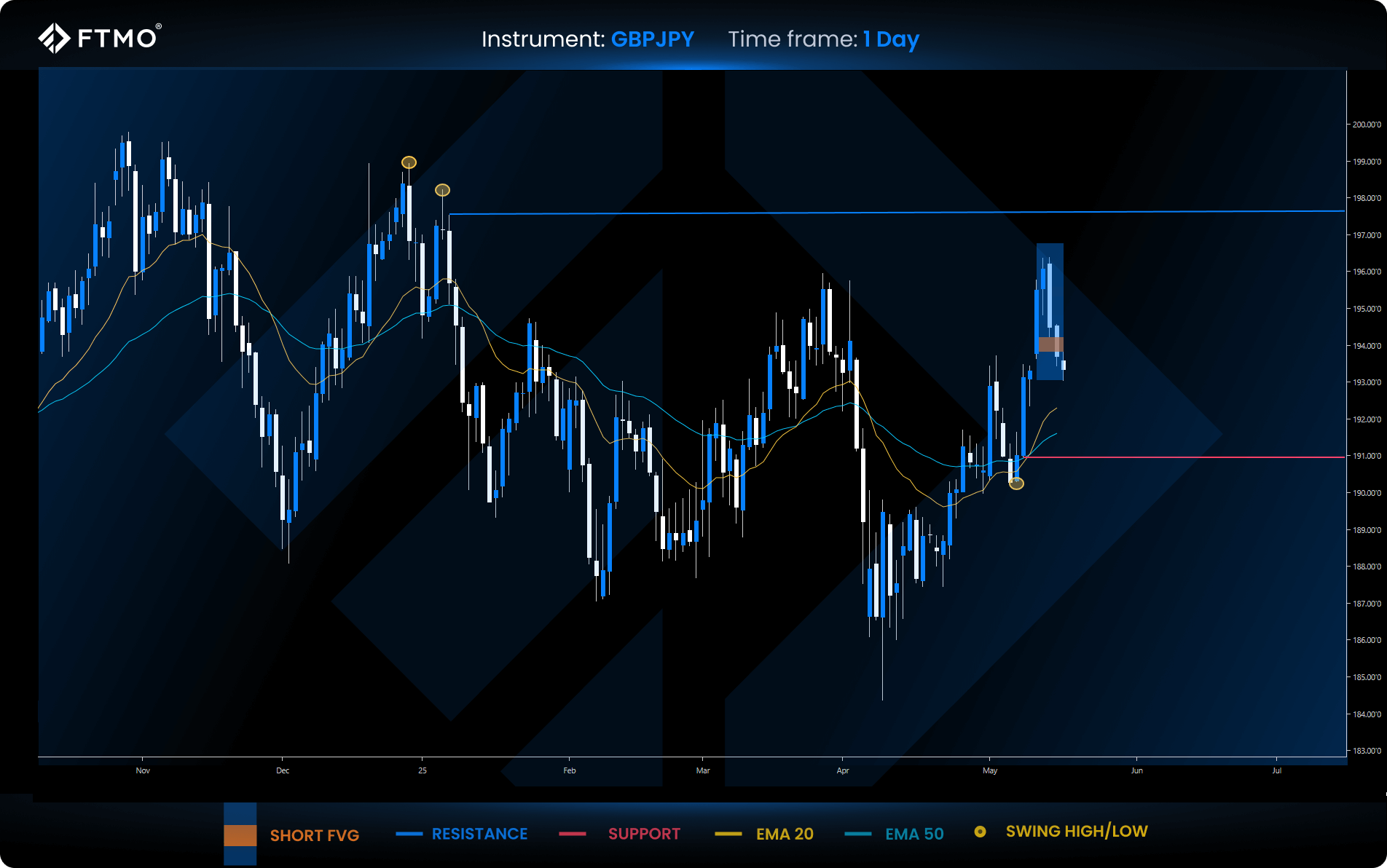

GBPJPY

Market Context: GBPJPY maintains bullish momentum, although recent swing high sweeps led to a short-term correction. A short FVG setup was identified during the dip.

Bearish Scenario (Preferred): Continuation lower into EMAs and key support zones, potentially targeting swing lows.

Bullish Scenario (Alternative): Breakout above resistance and FVG invalidation could renew bullish structure towards higher levels.

Setup: A short FVG setup was confirmed this week. Last week’s setup failed to trigger and is now invalid.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations. FTMO companies do not act as a broker and do not accept any deposits. The offered technical solution for the FTMO platforms and data feed is powered by liquidity providers.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.