Trading strategy using the Evening Star Pattern

The Evening Star pattern, like the Morning Star pattern, is popular among traders due to its ability to identify relatively reliably a change in sentiment from bearish to falling bullish. The "evening star" thus symbolises the end of the day (upward trend) and the arrival of the night (downward trend).

What does the Evening Star look like?

Evening Star is a formation consisting of three candles, which can be identified by the following rules:

- • The first candle is usually a long bullish (green) candle, indicating strong buying pressure.

- • The second candle is a candle with a small body, it can also be or doji candle, which often closes near the high of the first candle. This small candle signals weakening buying appetite and uncertainty in the market.

- • The third candle is a long bearish (red) candle that usually closes below the midpoint of the body of the first (green) candle. Here we see that the sellers have taken control and the price is starting to fall.

Together, this creates a reversal pattern, which can often be found at the end of an uptrend, where the market is in danger of not being able to handle another big rise and a decline may occur.

How to trade the strategy?

Identifying an uptrend

We can use moving averages (e.g. SMA50 and SMA100), trend lines, or we can just look at the chart (a series of higher lows and higher highs) to identify the trend. We usually look for the Evening Star at the end of such an uptrend.

Finding an Evening Star patterning at a strong resistance level

A pattern can form at an important price level:

- • the previous swing high,

- • an important psychological level (e.g. a round number),

- • Fibonacci retracement or a long-term trend resistance.

The formation of an Evening Star Pattern at such resistance is a strong signal of a potential reversal.

Trade entry

Entry (sell) usually takes place after the close of the third candle. A more conservative approach means waiting until the price gets below the low of the third (falling) candle. A more aggressive approach allows you to open a trade right after the close of the third candle.

Stop Loss (SL)

Stop Loss can be placed above the high of the second or third candle, i.e. the candle with the highest high of the whole formation. It is a good idea to enter the stop loss with a small margin (e.g. a few pips in forex, ideally according to the backtest results) so that market noise does not cause unnecessary exit from the position in case the SL is too tight.

Take Profit (TP)

We can set a target price according to different rules, for example:

- • at important support levels (e.g. the previous low).

- • based on the RRR ratio (e.g. RRR 2:1, where we risk $100 with the goal of earning $200).

As the price gets closer to the target, we can move the Stop Loss into profit (called a trailing stop) and thus protect the profit already made.

Example of a trade

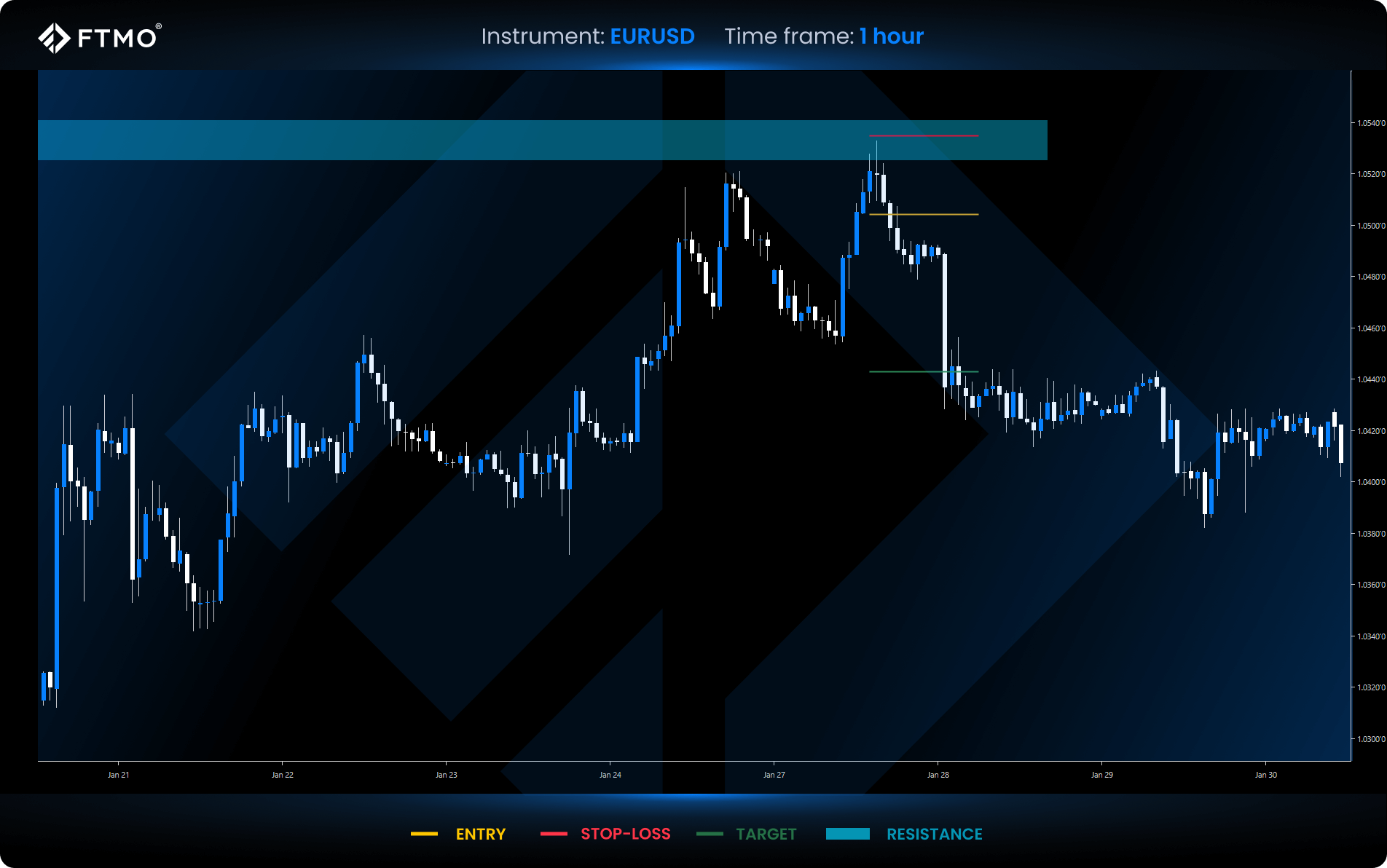

We found an example of a good entry based on the Evening Star pattern on the EURUSD pair at the end of January, when the euro strengthened significantly against the dollar since mid-January. By the end of January, however, speculators were running out of steam on the euro's rise. The price finally reached the resistance that had already formed on the pair in December of the previous year, and there was an exemplary bounce and trend reversal.

At the same time, a nice Evening star pattern formed, in which the middle candle has a small body but quite prominent wicks. However, this may not be a bad thing, the main two candles are before and after the given small candle in the middle of the pattern.

We opened the short below the third candle, at 1.05050. We set the Stop Loss above the high of the middle candle, at 1.05350, which is an acceptable 30 pips. Conservative traders can set the SL above the upper resistance level, i.e. at 1.05400, which would give an SL of 35 pips.

We could set the Take Profit somewhere around the low of the last down swing (i.e. at the 1.04540 level). This would give us a potential profit of 51 pips, which would give an RRR of less than 2:1. The other option was to set the TP at an RRR of 2:1, i.e. at 1.04450, or in the case of a conservative SL at 1.04350.

After the price bounced off the resistance, it saw a fairly quick move downwards and all our possible TPs were implemented, so we can consider the trade successful.

Common mistakes of beginners

- • Too early entry: traders after the formation of the second small candle immediately enter the position without confirming the downward trend reversal.

- • Ignoring the trend: sometimes traders try to trade the Evening Star in a sideways market without a clear previous uptrend. In such cases, however, the pattern may not be as strong and successful.

- • Inappropriately set Stop Loss: traders set the SL too "tight" and the market noise then easily throws them out of the position at a loss.

- • Lack of money management: traders risk too much of their capital in one trade, and one loss can then affect them psychologically very negatively.

Summary

- • The Evening Star is a reliable reversal pattern signalling the reversal of an uptrend.

- • Ideally, it forms at important resistance levels to increase the probability of success.

- • It is important to have a predetermined exit strategy, i.e. Stop Loss and Take Profit.

- • As with other similar patterns, even the best pattern is still no guarantee of 100% success. Part of any strategy is money management and a willingness to accept losses.

This strategy is simple and suitable for beginners who want to learn to recognise specific candlestick patterns and enter the market with reasonably defined risk.

All information provided on this site is intended solely for educational purposes related to trading on financial markets and does not serve in any way as a specific investment recommendation, business recommendation, investment opportunity analysis or similar general recommendation regarding the trading of investment instruments. FTMO only provides services of simulated trading and educational tools for traders. The information on this site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local laws or regulations. FTMO companies do not act as a broker and do not accept any deposits. The offered technical solution for the FTMO platforms and data feed is powered by liquidity providers.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.