“Take the time to journal every trade, analyse your mistakes, and learn from them.”

Journaling is underestimated by many traders, which may be one of the reasons why the overall success rate of traders is so low. This is because a properly kept journal not only allows the trader to analyse backwards, but it helps him find errors and flaws in his trading process. What do our new FTMO Traders think about this?

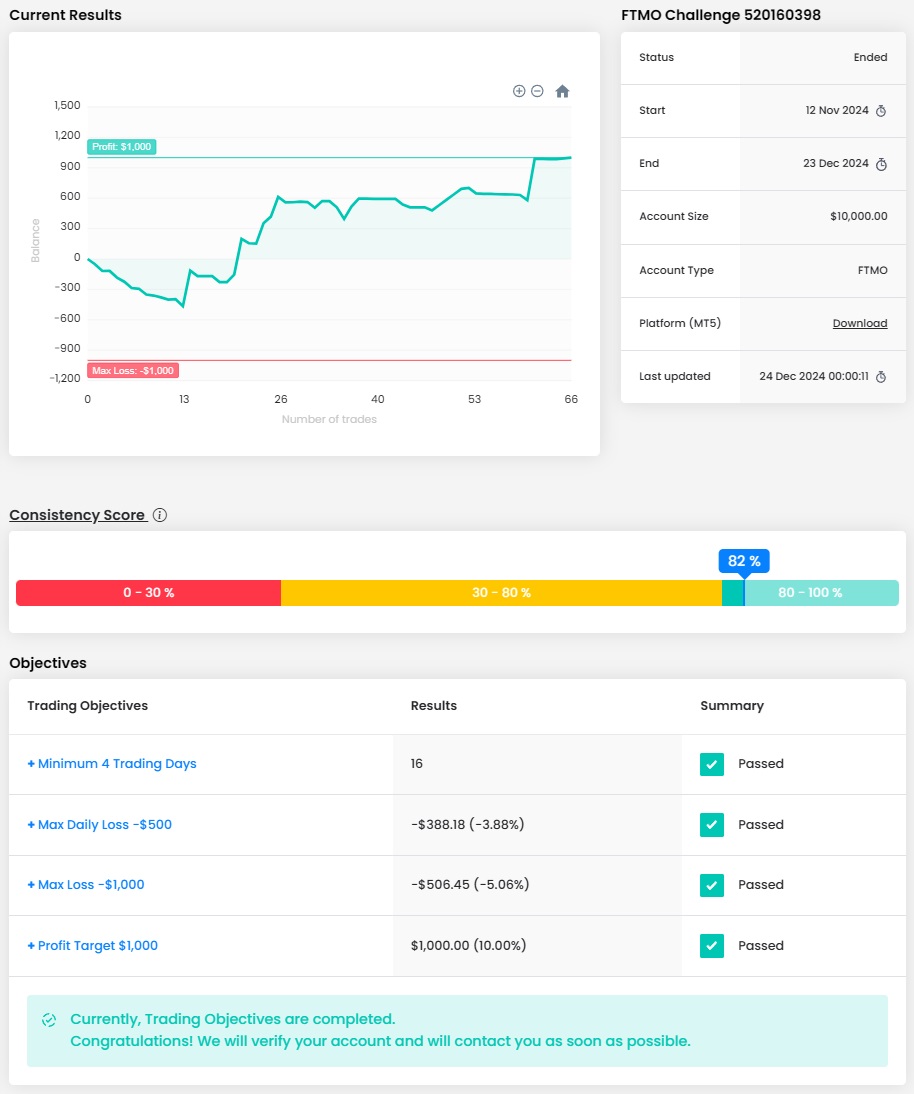

Trader Sanan Sirwan: “My hardest obstacle was my risk management.”

How would you rate your experience with FTMO?

Incredible experience, all the rules and regulations are made very clear and easy to understand. Overall, I enjoy being part of a great establishment.

Describe your best trade.

My best trade was in the first phase where I had placed a buy on US100 (NASDAQ). Price had reached a HTF demand zone, and waited for lower time frame confirmations and I entered based on those confluences. Price had upside potential as I aligned the lower time frame with the HTF narrative. My percentage gain on this was 4% and I believe that to have been my best trade.

How did loss limits affect your trading style?

It made me understand the importance of risk management. I understood how critical capital preservation is and that it’s unwise to risk recklessly when entering a position. It allowed me to follow a systemized plan with the correct risk management protocols.

Do you have a trading plan in place, and do you follow it strictly?

Yes, I have a fully systemized trading plan. I follow the plan very strictly.

What was the hardest obstacle on your trading journey?

I would say my hardest obstacle was my risk management and learning how to risk accordingly when it came to entering a trade. Over time, I learnt and reflected on this and have now overcome this hurdle.

What is the number one advice you would give to a new trader?

Understand that this isn’t a ‘get rich quick scheme’. Understand that this takes years to become diligent at and it isn’t something to expect overnight success in. It requires discipline, patience and an unwavering commitment to become successful in this endeavour.

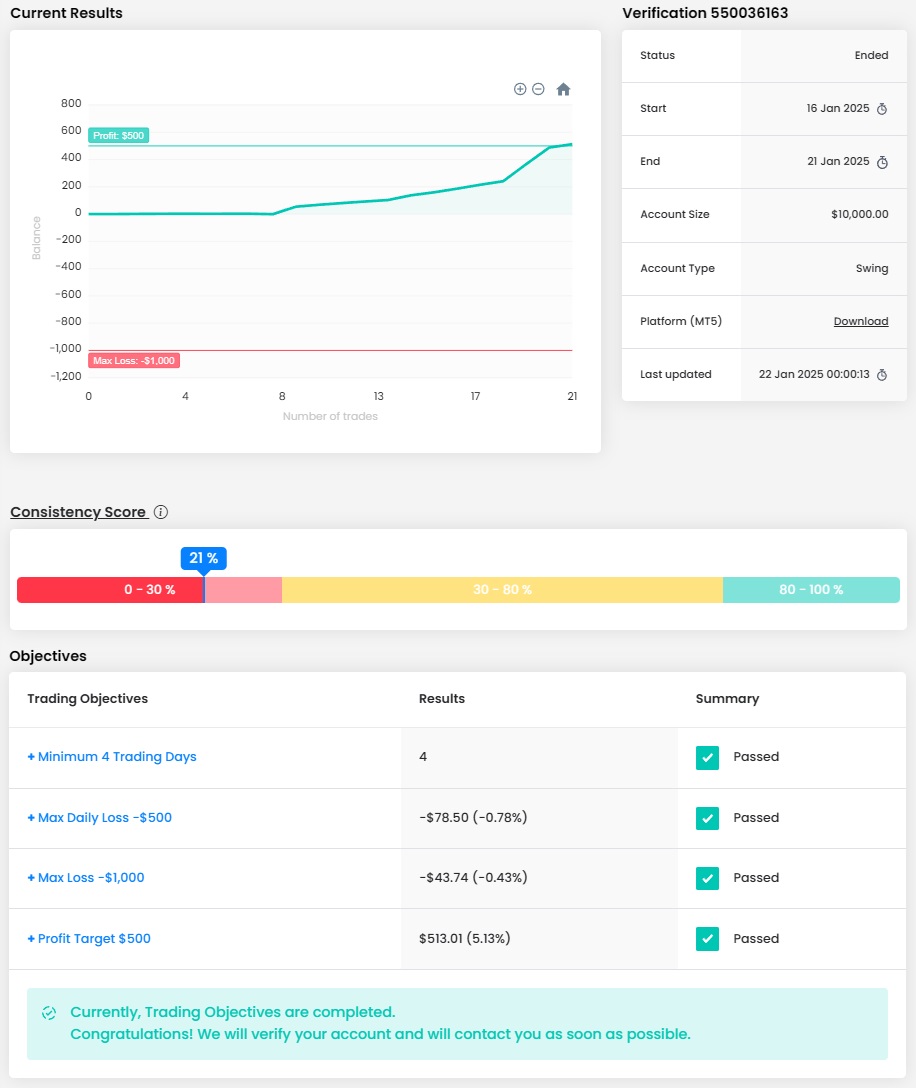

Trader Nuri Ghislain: “Focus on consistency over quick profits.”

What was easier than expected during the FTMO Challenge or Verification?

The risk management that I had, I think. I didn’t take big lots, so it helped also a lot.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

I think the mental part to want the finish the challenge so fast possible, but I managed well.

How did you manage your emotions when you were in a losing trade?

When I was in a losing trade, I focused on maintaining emotional discipline by reminding myself of my trading plan and sticking to it. I took a step back to evaluate the trade logically instead of reacting emotionally, ensuring that I didn’t overtrade or try to ‘chase’ losses. I also used techniques like deep breathing and keeping my risk management strategy in place to minimize the impact of the loss. Accepting that losses are part of the process helped me stay calm and make better decisions moving forward.

Describe your best trade.

My best trade was on XAUUSD. He was going straight to my TP, and I wasn’t truly on loss so this one was good in my eyes.

Do you have a trading plan in place, and do you follow it strictly?

I journal every trade that I take on my iPad. So, I can have an easier way to analyse myself and seeing why this trade are going and why these are going bad. I think personally journaling is a must it helps a lot to see your true self in the trading space and seeing if you are progressing or not.

What is the number one advice you would give to a new trader?

My number one advice for a new trader is to focus on consistency over quick profits. Start with a solid trading plan that includes risk management and always stick to it, no matter how tempting it is to deviate. Take the time to journal every trade, analyse your mistakes, and learn from them. Remember, trading is a marathon, not a sprint, so patience and discipline are key to long-term success.

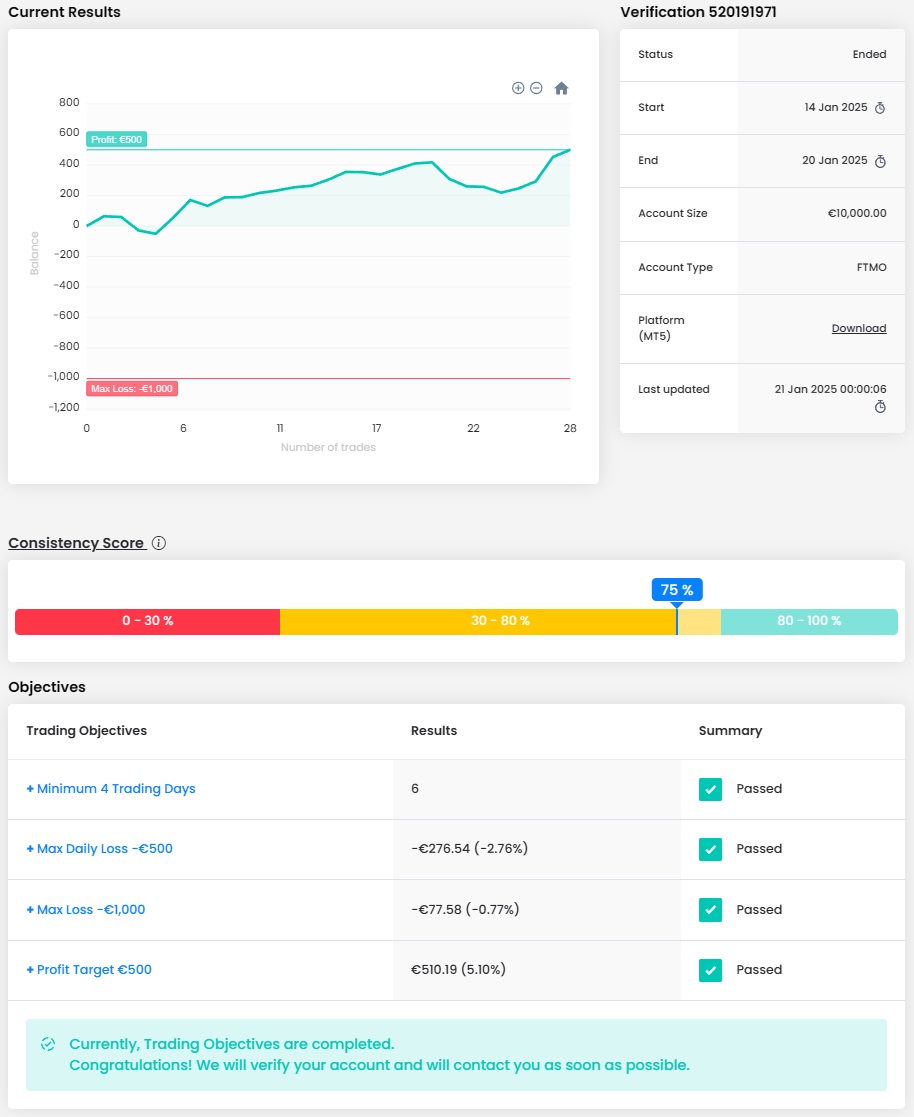

Trader Mihail: “Don't be greedy and don't be in a hurry.”

What was more difficult than expected during your FTMO Challenge or Verification?

Being patient, this trait wasn't one of my strongest for the past few years but at the end I'm managing to control myself better.

Has your psychology ever affected your trading plan?

Yes, especially at the start, I got too excited because I was doing very well so I tried to use excessive exposure and over-traded, that’s how I got from +4% to -6% with the challenge.

What was easier than expected during the FTMO Challenge or Verification?

Market structure analysis.

Do you plan to take another FTMO Challenge to manage even bigger capital?

Yes.

What was the most difficult during your FTMO Challenge or Verification and how did you overcome it?

I over-traded and overleveraged at the start, when I got 6% drawdown, I was angry with myself. I got too greedy, so I walked away from the market for a few days and got back to my plan that was working pretty well. I learned the lesson and after that I went perfectly with my rules.

One piece of advice for people starting the FTMO Challenge now.

Don't be greedy and don't be in a hurry, trading is 20% analysis and 80% patience.

Trader James Byron: “Do not believe 99% of social media traders.”

What was easier than expected during the FTMO Challenge or Verification?

I can’t think of an insightful answer right now.

How would you rate your experience with FTMO?

Very good. The app is very easy to navigate and has a great user interface.

How did you eliminate the factor of luck in your trading?

I use a system which is easy to replicate. Short term results do not mean much, it’s about your performance over 30 trades.

What do you think is the most important characteristic/attribute to become a profitable trader?

Belief and accountability. You get out of life what you out in. You need to learn from mistakes too.

What do you think is the key for long term success in trading?

A system which has an edge that you can replicate each trade. Also journaling and belief. The ability to solely focus on yourself whilst ignoring other traders’ biases and results. The subconscious mind is very powerful, and you need to utilise this.

One piece of advice for people starting the FTMO Challenge now.

Accountability. Do not believe 99% of social media traders.

About FTMO

FTMO developed a 2-step Evaluation Process to find trading talents. Upon successful completion you can get an FTMO Account with a balance of up to $200,000. How does it work?.